October 20, 2013

Steven Pearlstein reviewed Alan Greenspan’s new book in the Washington Post today. He is far too generous to the former Maestro.

Pearlstein tells readers:

“Like Fred Astaire on the dance floor, Greenspan glides through the list without the slightest sign he might have had something to do with those developments. What he does remember is that during his watch, the markets and the economy quickly recovered after asset bubbles burst — in 1987 (junk bonds) and again in 2001 (dot-com). Based on those happy outcomes, Greenspan confidently reprises his now widely discredited view that, in the long run, the economy is better off if the government restricts itself to cleaning up after bubbles rather than trying to prevent them from growing too large.”

It is more than a bit silly to compare the bursting of the stock bubble (not dot-com, the market in general was hugely over-valued) and the housing bubble to the 1987 crash. The market had gained a great deal of value in the year of 1987. After the crash in October it quickly began to make back lost ground and by the end of the year the market was at virtually the same level as the beginning of the year. No one thinks that the economy is affected in any significant way by short-terms movements in the market, so there was really nothing to clean up in this story.

The picture was very different following the 2001 crash which resulted in the elimination of roughly $10 trillion in stock bubble wealth, an amount approximately to the economy’s GDP. The economy did not recovery quickly following this crash. While the recession was officially short and mild, ending in 2001, the economy did not begin to create jobs again until the fall of 2003, almost two years after the recession was over. It did not get back the jobs lost in the recession until January of 2005. At the time, this was the longest period without job growth since the Great Depression.

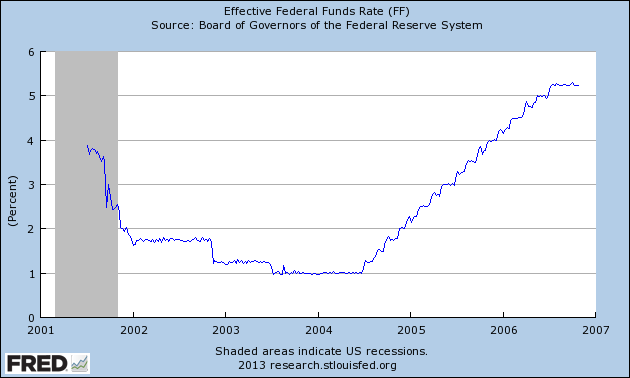

The Fed seemed to take notice of the weakness of the economy keeping the federal funds rate at just 1.0 percent until the summer of 2004. This can be seen as effectively the zero lower bound. No one thinks that there is any great stimulatory effect from dropping the rate from 1.0 percent to zero, which is why people routinely talked about the European Central Bank as being at its zero lower bound even when its overnight interest rate was 1.0 percent.

Of course even when the economy did finally bounce back it was on the back of the housing bubble, which was not a very stable course. In other words, if Greenspan thinks he can point to evidence that the economy recovers quickly from the collapse of asset bubbles it is only because he is very confused about basic economic facts.

Comments