Read More Leer más Join the discussion Participa en la discusión

Paul Krugman addressed the question of whether the decline in manufacturing employment can be attributed to the trade deficit. He rightly points out that most of the decline is due to productivity growth, but notes the trade deficit has been a contributing factor. It is worth adding a bit more to the discussion.

The manufacturing share of employment has been declining for more than half a century. The story is that productivity growth is generally faster in manufacturing than the rest of the economy. If, as a first approximation, our demand for manufactured goods increases at the same pace as our demand for all goods and services, then this means we will see a declining share of employment in manufacturing over time.

However, a trade deficit adds to this loss by having a substantial share of manufactured output produced elsewhere. This means that in addition to needing fewer workers to produce the manufactured goods we consume as a result of productivity growth, we also need fewer workers in the United States since a portion of our manufactured goods are being provided by workers in other countries.

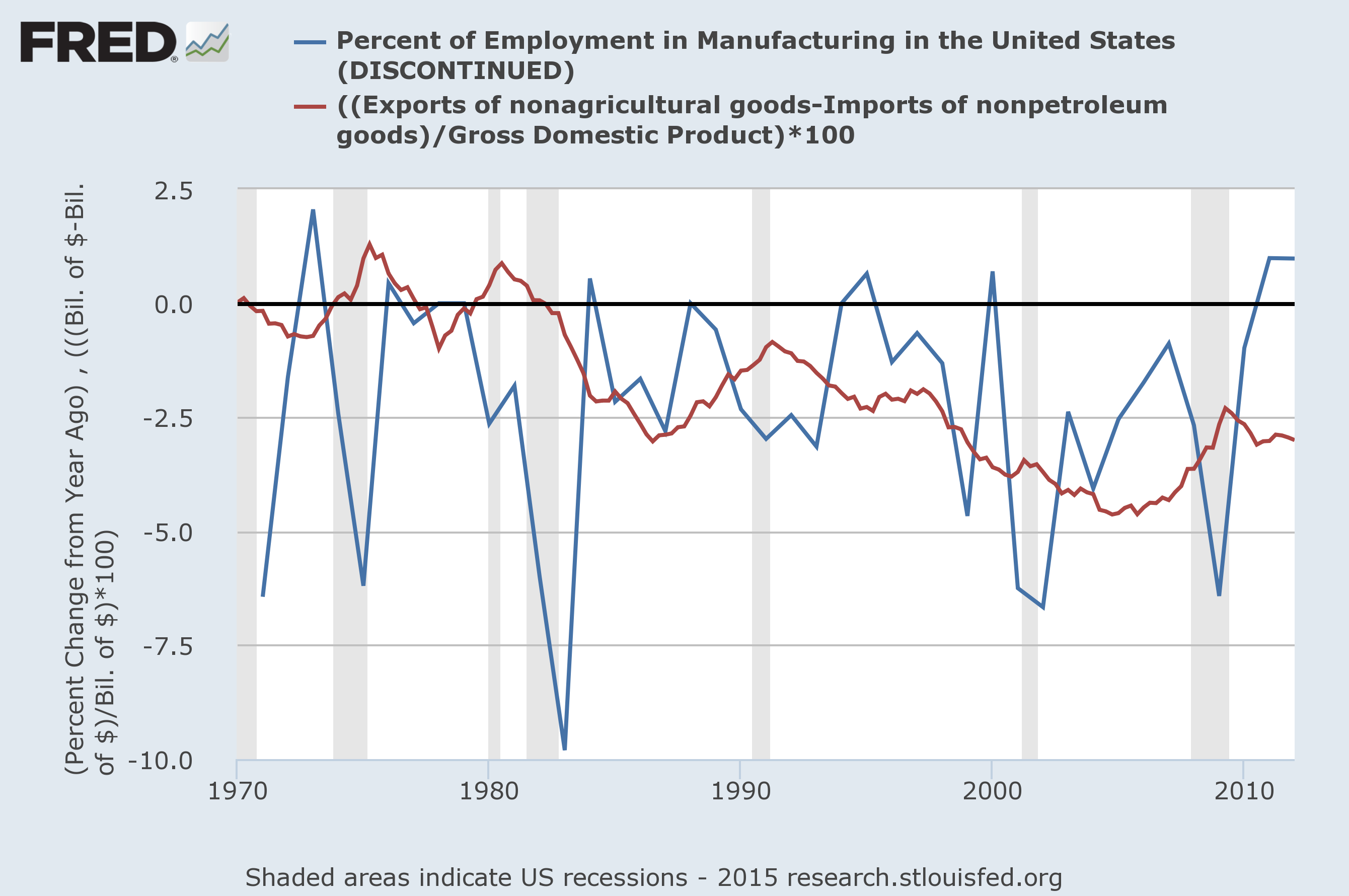

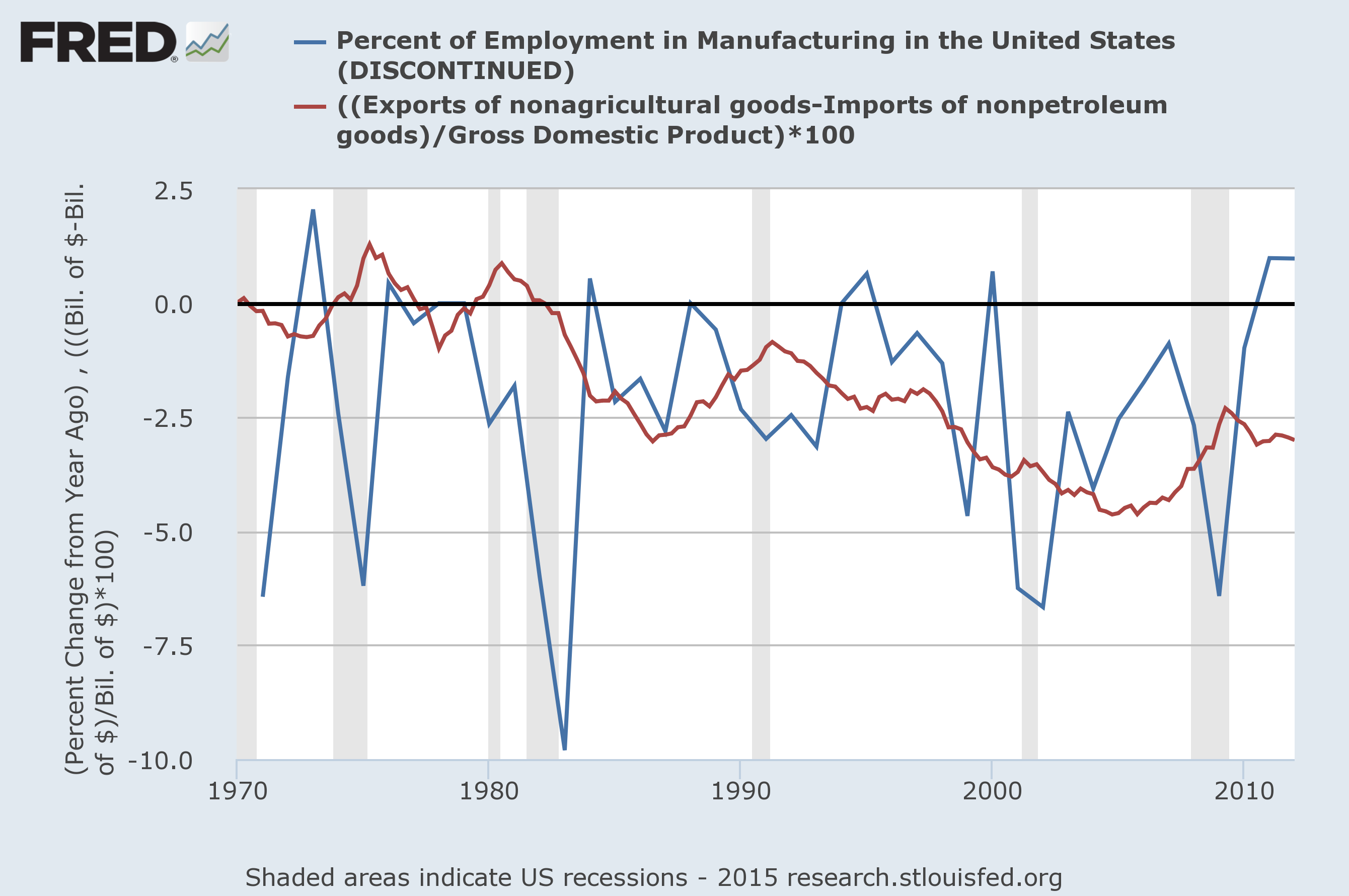

This not very pretty graph shows the percent change in the share of manufacturing employment compared to the non-oil, non-agricultural deficit in goods trade as a share of GDP. Note the sharp in decline in shares in the 2000s when the trade deficit was increasing rapidly. In 1997, when the trade deficit in goods was 2.0 percent of GDP, manufacturing accounted for 17.2 percent of total employment. When the deficit peaks at 4.6 percent of GDP in the first quarter of 2005, manufacturing employment was down to 11.5 percent of total employment. This is a decline in share of almost one-third in the span of just eight years. That was not due to productivity growth.

It is incredibly dishonest for proponents of TPP to try to pretend that imports don’t displace manufacturing jobs. They do. This doesn’t necessarily mean that TPP is a bad pact, it is just one of the factors that has to be considered in assessing the deal. If the TPP proponents don’t think they can acknowledge this simple fact and still sell their trade pact, then they must not think they have cut a very good deal for the country.

Paul Krugman addressed the question of whether the decline in manufacturing employment can be attributed to the trade deficit. He rightly points out that most of the decline is due to productivity growth, but notes the trade deficit has been a contributing factor. It is worth adding a bit more to the discussion.

The manufacturing share of employment has been declining for more than half a century. The story is that productivity growth is generally faster in manufacturing than the rest of the economy. If, as a first approximation, our demand for manufactured goods increases at the same pace as our demand for all goods and services, then this means we will see a declining share of employment in manufacturing over time.

However, a trade deficit adds to this loss by having a substantial share of manufactured output produced elsewhere. This means that in addition to needing fewer workers to produce the manufactured goods we consume as a result of productivity growth, we also need fewer workers in the United States since a portion of our manufactured goods are being provided by workers in other countries.

This not very pretty graph shows the percent change in the share of manufacturing employment compared to the non-oil, non-agricultural deficit in goods trade as a share of GDP. Note the sharp in decline in shares in the 2000s when the trade deficit was increasing rapidly. In 1997, when the trade deficit in goods was 2.0 percent of GDP, manufacturing accounted for 17.2 percent of total employment. When the deficit peaks at 4.6 percent of GDP in the first quarter of 2005, manufacturing employment was down to 11.5 percent of total employment. This is a decline in share of almost one-third in the span of just eight years. That was not due to productivity growth.

It is incredibly dishonest for proponents of TPP to try to pretend that imports don’t displace manufacturing jobs. They do. This doesn’t necessarily mean that TPP is a bad pact, it is just one of the factors that has to be considered in assessing the deal. If the TPP proponents don’t think they can acknowledge this simple fact and still sell their trade pact, then they must not think they have cut a very good deal for the country.

Read More Leer más Join the discussion Participa en la discusión

There is much that is wrong with former Clinton and Obama aide (and J.P. Morgan executive) Bill Daley’s NYT column arguing for the Trans-Pacific Partnership (TPP). First, there is the obvious that he is equating the TPP and past trade deals with “free trade.”

Of course they are not the same, these deals have been about putting manufacturing workers in competition with low-paid workers in the developing world, while protecting doctors and other highly paid professionals from the same sort of competition. They also impose a business friendly regulatory structure. And, they increase protectionism in the form of stronger and longer copyright and patent protection.

But this is not new. What stands out in Daley’s piece is the ungodly silly assertion that:

“today, of the 40 largest economies, the United States ranks 39th in the share of our gross domestic product that comes from exports. This is because our products face very high barriers to entry overseas in the form of tariffs, quotas and outright discrimination.”

Can you see the problem with this one? Think about how much the U.S. might export compared to a country like France. How much would it export compared to a country like Belgium or Luxembourg?

Yes, smaller countries are likely to have a larger share of their economy go to exports because they are smaller. To take advantage of economies of scale, countries like Luxembourg, Belgium, and even France have to integrate their economies with other countries. Because the much larger size of the United States, many economies of scale can be captured entirely by serving the domestic market. That is the main reason that we rank 39th out of Daley’s 40 countries in the export share of GDP, not barriers to our products.

You have to wonder if these folks don’t ever get tired of these sorts of cheap tricks. Do they really think the TPP is such a bad deal that they can’t sell it with honest arguments?

Note: Spelling of “aide” was corrected.

There is much that is wrong with former Clinton and Obama aide (and J.P. Morgan executive) Bill Daley’s NYT column arguing for the Trans-Pacific Partnership (TPP). First, there is the obvious that he is equating the TPP and past trade deals with “free trade.”

Of course they are not the same, these deals have been about putting manufacturing workers in competition with low-paid workers in the developing world, while protecting doctors and other highly paid professionals from the same sort of competition. They also impose a business friendly regulatory structure. And, they increase protectionism in the form of stronger and longer copyright and patent protection.

But this is not new. What stands out in Daley’s piece is the ungodly silly assertion that:

“today, of the 40 largest economies, the United States ranks 39th in the share of our gross domestic product that comes from exports. This is because our products face very high barriers to entry overseas in the form of tariffs, quotas and outright discrimination.”

Can you see the problem with this one? Think about how much the U.S. might export compared to a country like France. How much would it export compared to a country like Belgium or Luxembourg?

Yes, smaller countries are likely to have a larger share of their economy go to exports because they are smaller. To take advantage of economies of scale, countries like Luxembourg, Belgium, and even France have to integrate their economies with other countries. Because the much larger size of the United States, many economies of scale can be captured entirely by serving the domestic market. That is the main reason that we rank 39th out of Daley’s 40 countries in the export share of GDP, not barriers to our products.

You have to wonder if these folks don’t ever get tired of these sorts of cheap tricks. Do they really think the TPP is such a bad deal that they can’t sell it with honest arguments?

Note: Spelling of “aide” was corrected.

Read More Leer más Join the discussion Participa en la discusión

Mr. Arithmetic was wondering after seeing an article in the Chicago Sun Times that analyzed the distribution of pensions among former employees of the City of Chicago and the State of Illinois. The article began by telling readers:

“One of every four retired workers from the state of Illinois, the city of Chicago and the Chicago Public Schools is getting a pension of more than $60,000 a year.

“That’s 80,365 people in all.”

It then went on to say that 13,240 of these workers had pensions of more than $100,000 a year and 20,004 had pensions between $80,000 and $100,000.

So this group of retirees seems to be doing reasonably well, but what prompted Mr. Arithmetic’s interest was the statement:

“In all, the state’s five pension funds, Chicago’s four pension funds and the Chicago teachers pension fund are paying a total of $12.7 billion a year to more than 310,000 people.”

Here’s the problem. We apparently have total payments of $12,700 million. If this was just divided evenly among all 310,000 beneficiaries it would come to a bit less than $41,000 a head, but we know that many retirees get much more than this figure, so the rest must get much less. We can try to figure out how much less by doing some arithmetic and making some assumptions.

We’ll assume conservatively that the average pension for people who get more than $100k a year is $105k, the average pension for people who get between $80k and $100k is $85k, and the average pension for people who get more than $60k and less than $80k is $65k. That gets us:

13,240 * $105k = $1,390 million

20,004 * $85k = $1,700 million

47,121 * $65k = $3,063 million

Taken together this gives us $6,153 million going to these retirees. If we subtract that from $12,700 million being paid out in total, that leaves $6,547 million going to the remaining 229,635 retirees. That comes to an average pension for this group of $28,500 a year. This doesn’t seem too high, especially since most of these workers are not covered by Social Security so this will be the bulk of their retirement income.

As far as who pulls in these higher pensions, many of them are police and firefighters. The city reports that the average pension for 2,900 retired firefighters is $67,000. The average pension for 9,200 police officers is $59,000. Obviously there are others who fall into the Sun Times high pension group, but that’s a significant part of the story.

Note: My mother is one of these pension beneficiaries, although she is not among the Sun Times’ high income group.

Mr. Arithmetic was wondering after seeing an article in the Chicago Sun Times that analyzed the distribution of pensions among former employees of the City of Chicago and the State of Illinois. The article began by telling readers:

“One of every four retired workers from the state of Illinois, the city of Chicago and the Chicago Public Schools is getting a pension of more than $60,000 a year.

“That’s 80,365 people in all.”

It then went on to say that 13,240 of these workers had pensions of more than $100,000 a year and 20,004 had pensions between $80,000 and $100,000.

So this group of retirees seems to be doing reasonably well, but what prompted Mr. Arithmetic’s interest was the statement:

“In all, the state’s five pension funds, Chicago’s four pension funds and the Chicago teachers pension fund are paying a total of $12.7 billion a year to more than 310,000 people.”

Here’s the problem. We apparently have total payments of $12,700 million. If this was just divided evenly among all 310,000 beneficiaries it would come to a bit less than $41,000 a head, but we know that many retirees get much more than this figure, so the rest must get much less. We can try to figure out how much less by doing some arithmetic and making some assumptions.

We’ll assume conservatively that the average pension for people who get more than $100k a year is $105k, the average pension for people who get between $80k and $100k is $85k, and the average pension for people who get more than $60k and less than $80k is $65k. That gets us:

13,240 * $105k = $1,390 million

20,004 * $85k = $1,700 million

47,121 * $65k = $3,063 million

Taken together this gives us $6,153 million going to these retirees. If we subtract that from $12,700 million being paid out in total, that leaves $6,547 million going to the remaining 229,635 retirees. That comes to an average pension for this group of $28,500 a year. This doesn’t seem too high, especially since most of these workers are not covered by Social Security so this will be the bulk of their retirement income.

As far as who pulls in these higher pensions, many of them are police and firefighters. The city reports that the average pension for 2,900 retired firefighters is $67,000. The average pension for 9,200 police officers is $59,000. Obviously there are others who fall into the Sun Times high pension group, but that’s a significant part of the story.

Note: My mother is one of these pension beneficiaries, although she is not among the Sun Times’ high income group.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

For some reason major news outlets like the NYT and WaPo chose not to report on the Federal Reserve Board’s release of data on industrial output for April. This release showed that manufacturing output was flat in April leaving output roughly half a percentage point below the November level. Meanwhile capacity utilization, which is often a forerunner of investment in new plant and equipment, dropped to 77.2 percent, 0.9 percentage points below its November level.

The weakness is manufacturing is not surprising given the sharp rise in the trade deficit in the quarter and especially in March. The rise in the deficit is presumably the result of the run-up in the value of the dollar in the second half of 2014. The new data should have warranted at least a short article in these papers.

For some reason major news outlets like the NYT and WaPo chose not to report on the Federal Reserve Board’s release of data on industrial output for April. This release showed that manufacturing output was flat in April leaving output roughly half a percentage point below the November level. Meanwhile capacity utilization, which is often a forerunner of investment in new plant and equipment, dropped to 77.2 percent, 0.9 percentage points below its November level.

The weakness is manufacturing is not surprising given the sharp rise in the trade deficit in the quarter and especially in March. The rise in the deficit is presumably the result of the run-up in the value of the dollar in the second half of 2014. The new data should have warranted at least a short article in these papers.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The Washington Post told readers that China’s government is no longer acting to keep the value of the dollar up against its currency:

“Economists say that over the past several years, China’s currency has risen to a fair value, no longer providing Chinese exporters with a leg up on U.S. businesses.”

After citing several economists who support the claim that the currency is at or near a market value, it then reports that it’s trade surplus is within a normal range.

“Nick Lardy, a Peterson economist specializing in China, says that in 2014 China’s trade surplus dropped to 2.2 percent of gross domestic product, a level considered an indicator of fair exchange rates. At their peak in 2007, China’s exports amounted to 10 percent of GDP, he said.”

There are several points worth noting. First, while it appears that China has largely stopped its large-scale purchases of foreign exchange (mostly dollars), its central bank now holds close to $4 trillion in foreign exchange. This is at least twice what would be expected for a country with an economy of China’s size.

It is widely believed by economists that the Fed’s holding of $3 trillion of assets is holding interest rates down in the United States. The idea is that by holding this stock of government bonds and mortgage backed securities, it is keeping their prices higher than they would be if investors had to hold this stock of assets. (Higher bond prices mean lower interest rates.) If we accept the view that holding a large stock of bonds affects their price, then it must follow that the decision of China’s bank to hold a large stock of foreign reserves raises their price relative to a situation where investors held them. This would mean that China’s central bank is continuing to prop up the value of the dollar against its currency, even if it is not actively buying dollars.

The point about a trade surplus of 2.2 percent of GDP being normal is also misleading. This would be a reasonable figure for a slow growing rich country like the United States. Economists usually expect fast growing developing countries like China to be running trade deficits. The idea is that capital earns a better return in a fast growing country. This pushes up the value of its currency.

Remember the billions of stories in the media last fall about how the dollar was rising because the U.S. economy was so strong? (It was growing at a bit more than a 2.0 percent annual rate.) That should be happening with China, given the huge difference between its growth rate and the growth rates in the U.S., Europe, and Japan. The rise in the value of China’s currency would make its goods and services less competitive internationally, shifting its trade surplus to a deficit. The fact that this is not happening is explained by the actions of China’s central bank to keep its currency from rising.

The Washington Post told readers that China’s government is no longer acting to keep the value of the dollar up against its currency:

“Economists say that over the past several years, China’s currency has risen to a fair value, no longer providing Chinese exporters with a leg up on U.S. businesses.”

After citing several economists who support the claim that the currency is at or near a market value, it then reports that it’s trade surplus is within a normal range.

“Nick Lardy, a Peterson economist specializing in China, says that in 2014 China’s trade surplus dropped to 2.2 percent of gross domestic product, a level considered an indicator of fair exchange rates. At their peak in 2007, China’s exports amounted to 10 percent of GDP, he said.”

There are several points worth noting. First, while it appears that China has largely stopped its large-scale purchases of foreign exchange (mostly dollars), its central bank now holds close to $4 trillion in foreign exchange. This is at least twice what would be expected for a country with an economy of China’s size.

It is widely believed by economists that the Fed’s holding of $3 trillion of assets is holding interest rates down in the United States. The idea is that by holding this stock of government bonds and mortgage backed securities, it is keeping their prices higher than they would be if investors had to hold this stock of assets. (Higher bond prices mean lower interest rates.) If we accept the view that holding a large stock of bonds affects their price, then it must follow that the decision of China’s bank to hold a large stock of foreign reserves raises their price relative to a situation where investors held them. This would mean that China’s central bank is continuing to prop up the value of the dollar against its currency, even if it is not actively buying dollars.

The point about a trade surplus of 2.2 percent of GDP being normal is also misleading. This would be a reasonable figure for a slow growing rich country like the United States. Economists usually expect fast growing developing countries like China to be running trade deficits. The idea is that capital earns a better return in a fast growing country. This pushes up the value of its currency.

Remember the billions of stories in the media last fall about how the dollar was rising because the U.S. economy was so strong? (It was growing at a bit more than a 2.0 percent annual rate.) That should be happening with China, given the huge difference between its growth rate and the growth rates in the U.S., Europe, and Japan. The rise in the value of China’s currency would make its goods and services less competitive internationally, shifting its trade surplus to a deficit. The fact that this is not happening is explained by the actions of China’s central bank to keep its currency from rising.

Read More Leer más Join the discussion Participa en la discusión