April 26, 2013

April 26, 2013 (GDP Byte)

By Dean Baker

Final demand grew just 1.5 percent, which will be close to the growth rate for the rest of 2013.

GDP grew at just a 2.5 percent annual rate in the first quarter, a bit faster than the 2.2-2.4 percent range needed to keep the unemployment rate from rising. Even this growth only came with a large boost from inventories. Final demand grew at just a 1.5 percent annual rate.

The government sector continues to be a major drag on growth. Cutbacks in government spending, primarily on the military side, subtracted 0.8 percentage points from the growth rate for the quarter. However domestic federal spending also contracted, as did state and local spending, falling at a 1.2 percent annual rate.

Trade was also a big negative for the quarter, subtracting 0.5 percentage points from growth. This goes along with the jump in inventories, which are largely imported. Investment was weak in the quarter, growing at just a 2.1 percent annual rate following growth of 13.2 percent in the fourth quarter of last year. Equipment and software investment grew at a 3.0 percent rate while non-residential structures actually fell by 0.3 percent.

Residential construction had its third consecutive double-digit increase, growing at a 12.6 percent annual rate and adding 0.31 percentage points to growth. This growth is likely to continue through 2013 and 2014.

Another bright spot is health care. Spending increased at just a 4.2 percent nominal rate for the quarter and is up just 3.4 percent over the last year. That is less than the growth in GDP over this period. As the period of slow health care cost growth persists, it is becoming increasingly hard to dismiss the slowdown as simply the result of the recession. As the Congressional Budget Office (CBO) incorporates more of this slowdown in its projections, the long-term deficit picture will improve substantially.

Consumption grew at a 2.2 percent annual rate in the quarter, its fastest rate of growth since the fourth quarter of 2010. However, much of the uptick can be explained by a surge in utility usage and housing that added 0.53 percentage points to growth in the quarter, reversing an almost identical decline from the prior quarter. This just reflects erratic weather-related factors.

Consumption growth in the quarter was probably also boosted somewhat by the large dividend payments made in the fourth quarter in anticipation of higher tax rates. The saving rate for the quarter was just 2.6 percent, the lowest rate since the start of the downturn.

The Commerce Department has announced that it plans to change its methodology with the next release to count research and development and intangibles as investments. This will raise GDP since these expenditures will be counted as a final good rather than a cost of production.

While the idea is sound in principle, there are large methodological problems in implementation. For example, spending that is entirely rent-seeking in nature (e.g. innovating around a patent) will be counted the same as spending that leads to real economic benefits.

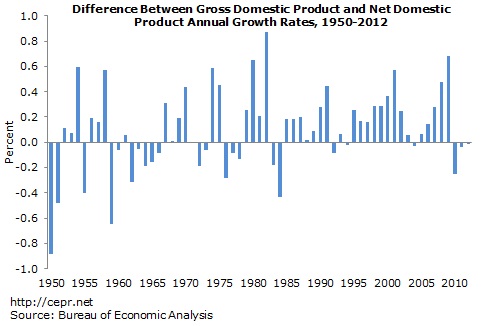

A way around this problem is to focus on net domestic product (NDP). The advantage of using the net measure is that it corrects for measurement errors in assessing the value of investment. If we overstate the value as an investment, we also overstate the value of the depreciation, making the net figure close to accurate. And, since we can’t eat depreciation, it is net NDP we care about.

While GDP and NDP were nearly equal on average until 1980, NDP growth since 1980 has trailed GDP growth by 0.3 percentage points in the last three decades. This gap will increase with the new methodology.

The weak first quarter GDP numbers should be the final nail in the coffin of the analysts who had been singing about an acceleration in growth based on the February jobs report and some other positive reports from the same time period. The 1.5 percent growth of final demand for the quarter is likely to be close to GDP growth for the rest of 2013, assuming that the sequester cuts are not reversed. At this rate of growth, it is likely that the unemployment rate will go up rather than down through the rest of 2013.