April 29, 2015

April 29, 2015

GDP grew at just a 0.2 percent annual rate in the first quarter, considerably worse than most analysts had expected. Even this weak number was inflated by an accumulation of inventories. Final sales actually shrank at a 0.5 percent annual rate in the quarter. Weaker inventory accumulation will be a drag on growth in future quarters.

As was the case in the first quarter of 2014, weather likely played a large role in the weak showing. Of particular note, structure investment fell at a 23.1 percent annual rate, subtracting 0.75 percentage points from the growth in the quarter. While there is evidence of overbuilding in many markets, this sharp decline was likely due to many project starts in the Northeast and Midwest being delayed by unusually bad weather. Car sales were also weak, declining at a 3.1 percent annual rate, subtracting 0.08 percentage points from growth. The growth is spending on restaurants and hotels was also weak, which is consistent with bad weather having an impact.

Weather probably also played a role in the 1.5 percent rate of decline in state and local government spending, which was all on the investment side. The decline in state and local spending subtracted 0.17 percentage points from GDP growth in the quarter. Spending on residential construction increased at just a 1.4 percent annual rate, that compares to 6.7 percent growth over the last year.

The other noteworthy source of weakness was trade. The rise in the trade deficit subtracted 1.25 percentage points from the quarter’s growth. Most of this was on the export side, with exports falling at 7.2 percent annual rate and exports of goods falling at a 13.3 percent annual rate. This is undoubtedly due to the impact of the rise in the dollar. Unless this rise is reversed, we are likely to see a further decline in our trade position, which will be a drag on growth for the foreseeable future.

The evidence in this report suggests inflation is falling rather than rising toward the Fed’s 2.0 percent target. The overall price deflator fell at a 0.1 percent annual rate, driven down by lower energy prices. But even the core deflator rose at just a 0.9 percent annual rate, down from a 1.3 percent rate of increase over the last year.

One piece of positive news in this report is that health care prices again appear to be restrained. The price index for health care services actually fell slightly in the first quarter. Over the last year nominal spending on services has risen by 6.2 percent, which translated into a 5.5 percent increase in real spending.

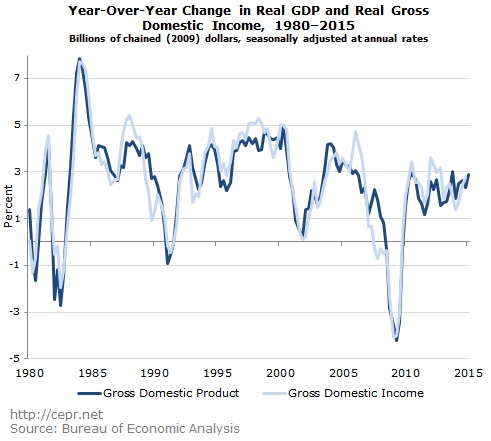

It is worth noting that tendency earlier in the upturn for the growth in gross domestic income (GDI) to outpace the growth in gross domestic product seems to have disappeared in the last two years. (We don’t have data yet for the GDI for the first quarter.) Some analysts had taken the more rapid growth in GDI to indicate the economy was actually doing better than indicated by the GDP data. The more plausible explanation is that some amount of capital gains income is improperly recorded in the GDI measure, leading to an overstatement in GDI growth during periods in which stock or housing prices rise rapidly.

It is important to recognize that while much of the weakness in this report is due to weather, even with optimistic assumptions, the underlying rate of growth would almost certainly not be much over 2.0 percent. This is not even keeping pace with potential GDP, which means that we are making up none of the ground lost in the downturn. It would be difficult to imagine that the Fed would want to slow the economy with interest rate hikes in this context.

It is also important to recognize that the weather-related weakness in the first quarter virtually guarantees strong growth in the next two quarters. Many analysts will undoubtedly seize on these stronger growth reports as evidence of a new boom as they did last year. Hopefully those in policy positions will know enough to dismiss such tales of boom.