January 27, 2017

January 27, 2017 (GDP Byte)

By Dean Baker

The core PCE deflator targeted by the Fed rose at just a 1.3 percent annual rate in the quarter.

A surge in the trade deficit held GDP growth to just 1.9 percent in the 4th quarter, bringing the growth rate for the full year to 1.9 percent, the same as for the fourth quarter of 2015. (That is, GDP grew 1.9 percent between the fourth quarter of 2014 and the fourth quarter of 2015, then grew an additional 1.9 percent between the fourth quarter of 2015 and the fourth quarter of 2016.) The growth rate in final demand in the quarter was even worse, at 0.9 percent, as inventories accumulation added a full percentage point to growth in the quarter. The 2016 GDP growth brought the average for the eight years of the Obama administration to 1.8 percent.

Most of the growth in the quarter was attributable to consumption, which advanced at a 2.5 percent annual rate. Durable goods consumption was the driving force, rising at a 10.9 percent rate, its second consecutive double-digit growth figure. Much of this is due to car sales, which are likely at, or near, a peak for this cycle. If that is the case, the contribution of durable goods to growth will be considerably less in future quarters.

Consumption of non-durables rose at a 2.3 percent rate after falling at a 0.5 percent rate in the third quarter. This is roughly equal to its 2.4 percent growth rate over the last year.

Service consumption grew at just a 1.3 percent rate. This is partly due to a drop in reported spending on housing and utilities, which subtracted 0.26 percentage points from the overall growth rate. These figures are erratic and often reflect weather-driven use of utilities.

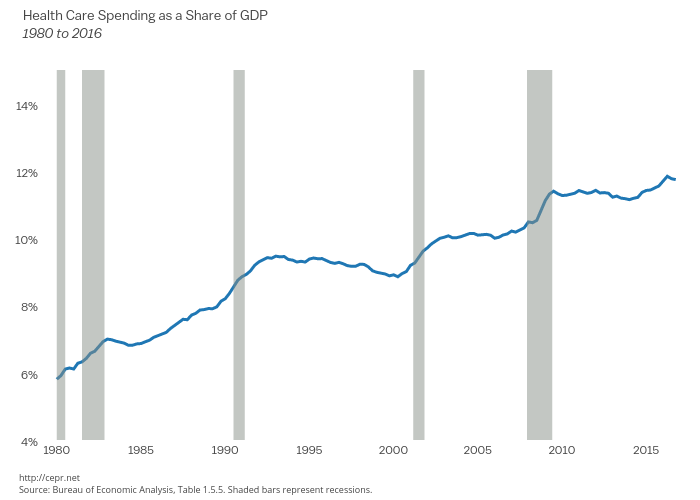

However service consumption was also held down by the continued moderation in the growth of health care spending. Real spending rose at a 1.6 percent annual rate in the fourth quarter, while nominal spending rose at a 3.1 percent annual rate, almost a full percentage point below the 4.0 percent growth rate of nominal GDP in the quarter.

The relative stability in health care spending over the last seven years has been striking. Health care costs have risen far less than had been projected by the Congressional Budget Office and other forecasters. This has led to enormous savings on Medicare and Medicaid and also meant a shift from health care benefits to wage compensation. The slow growth in spending is especially striking since it is occurring at a time when the aging of the population should be putting substantial pressure on costs.

The rise in the trade deficit is likely the result of the run-up in the value of the dollar earlier in the year, and it has continued through the fourth quarter. Imports rose at a 8.3 percent annual rate, while exports fell at a 4.3 percent rate. Whether or not the trade picture turns around likely depends far more on the value of the dollar than whatever deals Donald Trump is able to negotiate with individual companies about keeping jobs in the United States.

Fixed non-residential investment grew at a weak 2.4 percent annual rate. Structure investment fell at a 5.0 percent rate while equipment investment increased at a 3.1 percent rate after declining the prior three quarters. Investment in intellectual property products rose at a 6.4 percent rate. The rise in the trade deficit is having a dampening effect on investment, as it lessens the need for manufacturing firms to expand. Housing investment rose at a 10.2 percent rate after falling in the prior two quarters.

A striking aspect of this report is the weak evidence of any inflationary pressures in spite of the tightening labor market in recent years. The overall GDP deflator increased at 2.1 percent annual rate in the fourth quarter. The core personal consumption expenditure deflator targeted by the Federal Reserve Board rose at just a 1.3 percent annual rate. There is no evidence of any upward trend in this measure, which remains well below the Fed’s 2.0 percent target rate.

The absence of any inflationary pressures, coupled with the modest overall growth rate, should mean that the recovery can continue on this path for some time into the future. While it would be desirable to see more rapid growth to further tighten the labor market and produce larger real wage gains, there is little reason to believe there will be any notable uptick in the immediate future barring changes in policy.