Fact-based, data-driven research and analysis to advance democratic debate on vital issues shaping people’s lives.

Center for Economic and Policy Research

1611 Connecticut Ave. NW

Suite 400

Washington, DC 20009

Tel: 202-293-5380

Fax: 202-588-1356

https://cepr.net

November 15, 2017

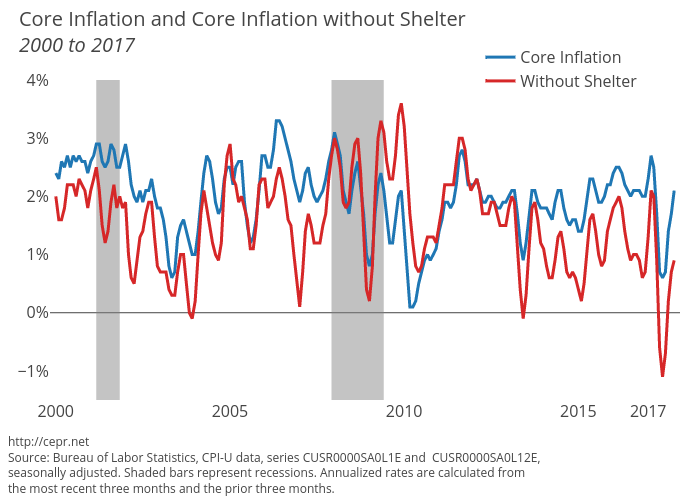

Rent remains the main source of the core inflation. Rent proper increased by 0.3 percent in October and is up 3.7 percent for the last year. Owners’ equivalent rent has risen by 0.3 percent and is up 3.2 percent for the last year. The main reason for the difference is that the rent proper index often includes utilities, which have risen more rapidly in price than rent itself. A core CPI, that excludes rent, rose just 0.1 percent in October and is up 0.7 percent over the last year. For more, check out the latest Prices Byte.