Article

Fact-based, data-driven research and analysis to advance democratic debate on vital issues shaping people’s lives.

Center for Economic and Policy Research

1611 Connecticut Ave. NW

Suite 400

Washington, DC 20009

Tel: 202-293-5380

Fax: 202-588-1356

https://cepr.net

June 28, 2011 (Housing Market Monitor)

Weaker consumption in the economy is explained by the massive loss of housing wealth, not pessimism.

By Dean Baker

The Case-Shiller 20-City index rose by 0.7 percent in April, the first increase since July of last year. Thirteen of the 20 cities showed increases in April, with several showing large price jumps for the month.

The biggest gainers were Atlanta and Seattle, with price increases of 1.6 percent, and Washington, DC, with a price rise of 3.0 percent. The Atlanta market had price increases in all three tiers, but the bottom tier showed by far the biggest jump with an 8.6 percent gain. This reversed a long series of sharp price declines. Even with the April jump, prices for homes in the bottom tier have still fallen at a 15.7 percent annual rate over the last three months. Most likely the seemingly erratic movement is simply measurement error, with the price declines in February and March being overstated.

The Seattle market was driven by a 1.7 percent price rise for houses in the upper tier. One of the factors that may be coming into play in the market is the lowering of the loan limit for Fannie Mae and Freddie Mac. This had been increased in some higher-price metropolitan areas to $729,250, but is scheduled to fall back to $625,500 on October 1. This means that someone wanting to buy a higher-end home in these cities may want to make their purchase before the loan limits fall, thereby getting a lower-cost loan.

The rise in high-end prices in Seattle fits this story; although prices did rise for all three tiers of the market. A 1.5 percent rise in the price of high-end homes in San Francisco, compared with 1.1 for middle-tier houses and a 0.3 percent drop for lower-tier homes, also fits this pattern. New York had a 1.2 percent jump at the high end while prices were pretty much flat for the lower two tiers. However, in Los Angeles, prices were flat for all three tiers and in Boston, the middle tier showed a 1.6 percent rise, while prices in the top tier fell by 0.3 percent. If a rush to beat this deadline is having an impact, clearly it is not driving prices in every market.

In Washington, D.C., prices are rising sharply all across the board, with the biggest rise being a 3.7 percent jump in the bottom tier. This segment of the market has risen at an 18.4 percent annual rate over the last three months. This is the sort of price rise that was seen in the bubble and may reflect some irrational exuberance about the D.C. market. It will not be sustained.

Most of the price declines seen in April were modest with Las Vegas and Detroit being the two exceptions. Las Vegas had a 0.7 percent drop. The bubble has fully deflated and overshot on the downside in the Las Vegas market. Adjusted for inflation, prices are almost 24 percent below their 1988 level, the first year in the index. Adjusted for inflation, house prices in Detroit are down by 35 percent from their 1991 level, the first year its prices are included in the index. This is the impact of the collapse of the auto industry in the city.

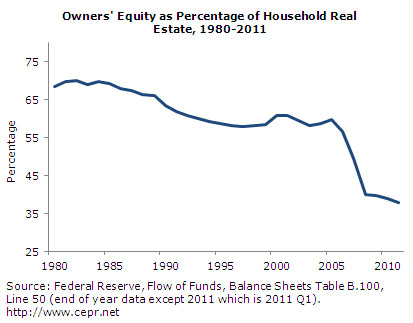

It is worth noting, since so many analysts seem to have missed it, that the plunge in house prices has sharply reduced homeowners’ equity. According to data from the Federal Reserve Board, the ratio of homeowners’ equity to value at the end of the first quarter of 2011 was just 38.0 percent, the lowest on record. Prior to the run-up of the housing bubble, the ratio of equity to value had never been below 60 percent and it had been near 67 percent until the late 80s. This massive loss in household wealth explains weaker consumption, not consumer pessimism.

The April rise in house prices is an interesting turn in the market. The plunge after the first-time buyers tax credit has ended, but there is still a substantial oversupply in most markets which will continue to put downward pressure on prices.