Article • Dean Baker’s Beat the Press

Bloomberg Is Concerned that Janet Yellen’s Dollar Policy May Lessen Wealth Inequality

Article • Dean Baker’s Beat the Press

Fact-based, data-driven research and analysis to advance democratic debate on vital issues shaping people’s lives.

Center for Economic and Policy Research

1611 Connecticut Ave. NW

Suite 400

Washington, DC 20009

Tel: 202-293-5380

Fax: 202-588-1356

https://cepr.net

You don’t have to look far, it’s literally the first sentence in a Bloomberg piece on dollar policy under incoming Treasury Secretary Janet Yellen.

“Janet Yellen once touted the benefits of a weaker greenback for exports, but as the incoming Treasury secretary, she faces pressure to return the U.S. to a “strong-dollar” policy — and may cause trembles on Wall Street if she doesn’t.”

For folks who don’t know, the vast majority of U.S. stock is held by the richest 10 percent of households in the country, with the richest 1 percent holding close to 50 percent of all stock wealth. The run-up in the stock market over the last four decades has been the main factor behind the rise in the inequality of wealth over this period. A drop in the stock market would reduce wealth inequality, which is apparently a really bad outcome in the view of Bloomberg.

But getting beyond its promotion of wealth inequality it is worth looking at the substance of this piece pushing Janet Yellen to support a stronger dollar.

The piece gives us some dollar boosterism from Larry Summers, Treasury Secretary under President Clinton and the head of President Obama’s National Economic Council:

“’It would be unwise to appear actively devaluationist or indifferent to the dollar,’”

…

“Summers highlighted that the dollar’s dominant role in the global financial system puts the onus on the Treasury to manage its responsibilities carefully. Favoring a strong dollar is ‘prudent’ for the incoming secretary, in particular given Biden’s plans for ‘expansionary policy,’ said Summers, who is a paid contributor to Bloomberg.”

Yellen also got some advice from Hank Paulson, Treasury Secretary under President George W. Bush, and a former CEO at Goldman Sachs:

“’Interest rates are at historic lows, and the federal debt is larger as a share of the economy than at any time since the end of World War II,’ Paulson wrote. ‘It is critically important to bend down the steep trajectory of the rising national debt. Otherwise, the dollar will eventually be debased. Washington won’t be able to pay its bills.’”

It is hard to make sense of either of these comments, other than Summers and Paulson both want a stronger dollar.

Starting with the Paulson quotes, U.S. government debt is almost entirely denominated in dollars. How would a fall in the value of the dollar against the euro, yen, and other currencies make it harder to pay off our debt? There could be a problem if we had borrowed large amounts of money in euros, yen, and other currencies, but we didn’t, so what’s the issue?

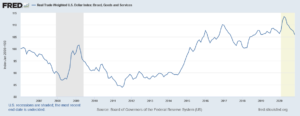

Also, what does the dollar being “debased” mean? The value of the dollar measured against the currencies of our trading partners is more than 20 percent higher than it was at its low point in 2011. Was the dollar debased in 2011?

Summers warns that Yellen shouldn’t be “actively devaluationist or indifferent to the dollar,” expressing his desire for a strong dollar.

I have to say it’s somewhat funny to hear this concern from Larry Summers, one of the world’s most prominent economists, that the Treasury Secretary’s comments can have an influence on the value of the dollar. I remember arguing back in the 2000s that Treasury Secretaries could talk down the value of the dollar, and being ridiculed for the idea that their comments could have any impact on currency values. (Of course, I recommended other measures as well.) Anyhow, it’s good to see that respectable economists now believe that the Treasury Secretary’s words may affect the dollar’s value.

But getting to the substance, the value of the dollar against other currencies is the main factor determining the balance of trade. If the dollar were 20 percent lower against other currencies, as a first approximation, the price of imports would be 20 percent higher for people in the United States and our exports to other countries would cost them 20 percent less. The real world is more complicated, but the direction of change in prices is unambiguous.

This means that if we had a lower valued dollar, we would buy fewer imports and export more goods and services to other countries, thereby reducing our trade deficit. This is an especially important goal in a context where, as Larry Summers says, Biden has plans for “expansionary policy.”

Expansionary policy would typically mean large amounts of government spending to boost demand. While it would be great to see large increases in government spending on child care, health care, and clean energy, given the composition of Congress, that doesn’t look very likely right now. Also, with interest rates extraordinarily low, there is not much the Fed can do at this point to further boost spending.

That means a lower trade deficit is likely to be one of the few paths open to President Biden to boost demand and lower unemployment. A lower-valued dollar is central to that story.

Long and short, there is no reason for Chair Yellen to take the Summers-Paulson complaints about a lower-valued dollar seriously. A lowered value dollar is essential for reducing our trade deficit, and with other paths to expansion blocked by Republicans in Congress, a smaller trade deficit may be the only way for President Biden to restore the economy to full employment.