Fact-based, data-driven research and analysis to advance democratic debate on vital issues shaping people’s lives.

Center for Economic and Policy Research

1611 Connecticut Ave. NW

Suite 400

Washington, DC 20009

Tel: 202-293-5380

Fax: 202-588-1356

https://cepr.net

February 2017, Dean Baker

Remarks by Dean Baker, Co-Director, Center for Economic and Policy Research (CEPR)

The Svedberg Seminar, Uppsala University

February 13, 2017

Introduction

I often begin talks by telling my audience that “drugs are cheap.” This typically leads people to believe they are listening to a crazy person. At least in the United States, everyone knows that drugs are not cheap. It is common for prescriptions of brand drugs to cost several hundred dollars. More expensive drugs can easily cost tens of thousands of dollars a year. And, the new generation of cancer drugs carry list prices that run into the hundreds of thousands of dollars a year.

If people are lucky enough to have good insurance, most of the cost will be picked up by the insuance company, but insurers are not happy paying tens of thousands of dollars a year for a patient’s drugs either. To save money and discourage usage insurers are increasingly requiring substantial co-payments. These copayments can be a huge blow to patients who may already not be able to hold down a full-time job because of their health. Paying 25 percent of the bill for a drug selling for $40,000 a year, still comes to $10,000 a year. That’s close to 20 percent of the median family income in the United States.

This is a background that is familiar to people in the United States who have someone with a serious health condition among their family or friends. They know drugs are extremely expensive for them. But, I am not crazy for saying that drugs are cheap. They are in fact in almost all cases cheap to manufacture.

To take one example that has frequently been in the news in the United States, the Hepatitis C drug Sovaldi has a list price of $84,000 for a three-month course of treatment. By all accounts, the drug is genuine breakthrough in the treatment of the Hepatitis C, in most cases curing a debilitating and sometimes fatal disease. There has been an extensive public debate as to whether insurers or government health care programs should be forced to pay for this expensive drug. The issue is complicated further by the fact that many people suffering from Hepatitis C might have contracted it through intravenous drug use.

The United States is estimated to have 3 million people suffering from Hepatitis C. This implies a bill of well over one hundred billion dollar if everyone were to be treated, even if its manufacturer, Gilead Sciences, provided substantial discounts.

But it doesn’t cost $84,000 or anything close to that figure to manufacture Sovaldi. In fact, in India a high quality generic version of the drug is available for $200 for a three month course of treatment, less than 0.3 percent of the list price in the United States.1 We wouldn’t need a major debate to decide whether we would spend $200 for a drug that would hugely improve a patient’s health and would possibly save their life. The reason we have this debate is that the drug has a list price that is more than 400 times higher.

Patent Monopolies: The Villain Behind High Prices

Of course people have realized at this point that the reason Sovaldi has a high price in the United States is that Gilead Sciences has a patent monopoly on the drug. This monopoly gives it the exclusive right to sell the drug in the United States. The U.S. government will arrest anyone who tries to sell Sovaldi in competition with Gilead Sciences.2 The United States is unique in that we both grant pharmaceutical companies a patent monopoly on their drugs, and then let them sell the drugs for whatever price they want. Other wealthy countries also grant patent monopolies, which are required by a number of international agreements, but they have some form of price control which limits what companies can charge. For this reason, drug prices in other wealthy countries are typically around half of the price in the United States.

My comments will refer largely to the United States. This is first and foremost because it is the market with which I am most familiar. However the same problems appear in other countries, even if they may not be as extreme as in the United States. Furthermore, it is the explicit goal of the United States government to use trade agreements like the Trans-Atlantic Trade and Investment Pact to raise the price of drugs in other countries to U.S. levels. So the United States may well represent the future for the prescription drug market in Sweden and the rest of Europe.

Patent Monopolies as Incentive for Innovation

The rationale for patent monopolies is to provide an incentive for drug companies to innovate. It is expensive to develop new drugs. Even if the industry has a tendency to exaggerate the cost, and downplay the extent to which they benefit from publicly financed research, they do encounter substantial expenses that they would not be able to recover if new drugs were sold in a free market.3 The question for critics of this system is whether there are feasible alternatives to patent monopolies that would be as effective in producing new drugs and would be less wasteful than the patent system. While we will not know the answer to this question until we actually have an alternative in place to provide a basis for comparison, there are strong reasons for believing that an alternative system would be vastly more efficient. In addition, a system in which drugs were sold at their free market price would forever end the situation where people are unable to afford drugs that are essential for their life or health.4

Problems of Patent Monopolies

There are two distinct types of problems associated with patent monopolies. The first stems simply from the fact that the patent protected price makes drugs much more expensive for patients than the free market price. As a result, fewer patients have access to drugs they need and/or they have to go through more obstacles to gain access. The other set of problems stem from the behavior of drug companies to maximize their profits. This is often referred to as “rent-seeking” behavior. It amounts to actions by drug companies which serve no productive use from an economic standpoint. Rent-seeking behavior is exclusively redistributive. It allows drug companies to increase their profits at the expense of patients, insurers and governments.

It is worth noting that these points are completely standard in economic analyses of trade. If someone were to propose a 20 percent tariff on imported steel, any serious economist could quickly point out the loss to consumers as a result of this arbitrary increase in the price of steel. They would also point to rent-seeking activities by the steel companies, for example lobbying politicians to extend and increase the tariff, as a further source of waste. The same logic would apply to patent protection for prescription drugs, except the price increases are equivalent to tariffs of 1000 percent or even 10,000 percent of the free market price.5 Unfortunately economists spend far more time worrying about the costs associated with 20 percent tariffs on things like steel than they do on patent monopolies for prescription drugs.

The first type of loss, from people having to pay high prices, takes several different forms. The most obvious is the case where people simply can’t buy the drug because patent monopolies raise the price by several thousand percent above the free market price. The result is that people get worse health care and quite possibly die. But even those who might be able to afford the drug often suffer because of the high price. In the United States it is common for many lower income people to cut pills in half or to take them every other day in order to make a prescription go further. In many cases this can seriously undermine the effectiveness of the drug.

Even when people have reasonably good insurance they often have to battle their insurer to pay the cost of an expensive drug. This may mean that they have to go to a second physician to verify that an expensive drug is in fact necessary. In some cases an insurer has a policy where they will pay for a drug for a particular use, but not for the use prescribed by the doctor. This can lead doctors to put down a false diagnosis so that their patient is able to have their drug covered by the insurance company. Needless to say, this can create a problem for a patient in future treatment since it means they will have an inaccurate medical record.

There is also a massive gaming process whereby the drug companies try to get around insurers’ efforts to discourage the use of an expensive drug. Sometimes the pharmaceutical company will provide coupons to cover patients’ copayment, making them more likely to opt for an expensive drug and leave the insurers with the bill. When its patent on the allergy drug Claritin expired, Schering-Plough pushed to make it an over-the-counter drug not requiring a prescription. Since insurance generally doesn’t cover the cost of over-the-counter drugs, this action meant that the generic versions of Claritin would likely cost patients more money than their co-pay on Schering-Plough’s new patented product, Clarinex.

In addition to this gaming, the high price of patent protected drugs has created a whole industry of “pharmacy benefit managers” who act as intermediaries between insurers or hospitals and drug companies. They negotiate prices that typically are substantial discounts from the list prices, leaving the uninsured as the only ones who might actually pay the full list price. In any case, there would be no reason for the industry of pharmacy benefit managers to exist if prescription drugs were sold in a free market.

Costs on the Research Side Due to Rent-Seeking

Science advances most quickly when the research is fully open. In this situation, the community of researchers can assess research and look for flaws and also quickly build upon interesting findings. Openness has no place in research supported by patent monopolies. It is in the interest of the pharmaceutical company to make available only the information needed to receive a patent. The test results it submits to the Food and Drug Administration (FDA) are kept secret from the public, with firms only disclosing the findings they choose to share. Needless to say, these results are likely to be ones that reflect well on their drugs, with the companies less likely to highlight results that question a drug’s effectiveness or suggest it could be harmful.

This was the allegation in the case of the arthritis drug Vioxx, where the manufacturer allegedly concealed evidence the drug increased the risk of heart attack and stroke among patients with heart conditions. The result was a number of strokes and heart attacks that might have been prevented if doctors and patients knew of the risks associated with Vioxx. Drug companies also have an incentive to promote the use of their drug in situations where it may not be appropriate. Efforts to promote drugs for “off-label” use are a regular source of scandal in the business press.

A recent analysis that looked at five prominent instances in which it was alleged that either drug companies concealed information about their drugs or marketed them for inappropriate uses, found that the cost born by patients was in the range of $27 billion annually over the years 1994–2008.6 While this estimate is far from precise, it suggests that the cost associated with improper drug use due to deliberate misrepresentations and mis-marketing is substantial, quite likely in the range of the amount spent by the industry on drug research. Also, it is worth repeating that these costs, in terms of bad health outcomes, are the result of deliberate actions stemming from the perverse incentives created by patent monopolies, not costs from the sort of mistakes that are an inevitable part of the research process.

Patent monopolies also distort the research process itself. Most obviously they encourage drug companies to pursue patent rents rather than finding drugs that meet the most urgent health needs. This means that if a pharmaceutical company produces a drug for a particular condition that earns large amounts of revenue, its competitors have a strong incentive to try to produce similar drugs for the same condition to capture a share of the rents.

For example, in the case of Sovaldi, Merck and AbbVie, along with several smaller drug manufacturers, are rushing to market alternatives to Sovaldi as treatments for Hepatitis C..7 In a context where Gilead Sciences, the maker of Sovaldi, has a monopoly on effective treatments for Hepatitis C, this sort of competition is highly desirable because it will lead to lower prices. However, if Sovaldi was being sold in a free market at $200 to $300 for a course of treatment, there would be little reason to waste the time of highly skilled scientists finding additional treatments for a condition where an effective drug already exists. If drugs were sold without patent protection, research dollars would usually be better devoted to developing a drug for a condition where no effective treatment exists than developing duplicative drugs for a condition that can be well-treated by an existing drug.

Patent protection also is likely to slow and/or distort the research process by encouraging secrecy. Research advances most quickly when it is open. However, companies seeking profits through patent monopolies have incentive to disclose as little information as possible in order to avoid helping competitors. This forces researchers to work around rather than build upon research findings. Williams (2010) found that the patenting of DNA sequences in the human genome project slowed future innovation and product development by between 20 to 30 percent.7

Finally, relying on patent incentives to support medical research encourages drug companies to direct research toward finding a patentable product. This means that if evidence suggests that a condition can be most effectively treated through diet, exercise, environmental factors, or even old off-patent drugs, a pharmaceutical manufacturer would have no incentive to pursue this research.8 Ideally, the manufacturer would make this evidence publicly available so that researchers supported by the government, universities, or other non-profit organizations could pursue it, but there is little incentive for them to go this route. In fact, if they are concerned that such research could lead to an alternative to a patentable product that they might develop or be in the process of developing, their incentive is to conceal the research.

Lawyering and Lobbying: Other Forms of Patent-Induced Waste

When the government is the payer, which is to some extent the case in the U.S., the willingness to pay for a particular drug can often be the outcome of a political battle, with the drug’s producer working with patients to pressure the government to pay for drugs of questionable value.10 While the government in the U.S. plays a smaller role in providing health care than in most other wealthy countries, it nonetheless plays a huge role in shaping the market. It directly pays for drugs through Medicare, Medicaid, and other government health care programs, and can set standards that effectively require private insurers to pay for drugs. This gives the pharmaceutical industry a substantial incentive to be involved in the political process. According to Center for Responsive Politics, the pharmaceutical industry ranked 5th in campaign contributions to members of Congress in 2016.11 The broader category of health related industries ranked second, behind only finance, insurance, and real estate in total contributions to politicians.12

Because this involves decisions on public health, the victory of drug companies is not just a question of getting more money at the expense of competitors or the general public. They may lobby for policies that are detrimental to public health in order to boost their profits. For example, pharmaceutical companies that produce pain relief medication have been leading the fight against medical marijuana. It turns out that marijuana is an effective substitute in many cases for prescription pain medications. In order to protect its market share, the industry is trying to keep a major potential competitor off the market.13 There can be major consequences for public health as patients take stronger and more addictive medications when marijuana may be an effective treatment. Similarly, the industry uses its ties to disease groups to try to keep generic competitors from being covered by the government or insurers.14 This is precisely the sort of corruption that would be expected in a situation where there is such a huge gap between the monopoly price and the cost of production.

The fact that there is so much money as stake with patent protection in pharmaceuticals means that the sector is also a primary target for litigation. Pharmaceutical companies routinely bring suits to harass competitors, discourage generic competition, or to gain a slice of the patent rents associated with a highly profitable drug. The pharmaceutical and medical equipment industries together accounted for almost a quarter of the patent-related lawsuits over the years 1995–2014. The suits in the pharmaceutical sector also had the highest median damage settlement, with medical equipment coming in a close third just behind the telecommunication industry.15

In any legal battle, there is a fundamental asymmetry between the situation of brand drug manufacturers, which have the right to sell a drug at monopoly prices for the duration of its patent protection, and potential generic entrants, who are looking to have the right to sell a drug in a competitive market. This means that the brand manufacturer stands much more to lose than the generic producer stands to gain. As a result, the brand producer has an incentive to spend much more on legal expenses than a potential generic competitor if doing so can block, or at least delay, generic competition. The brand producer also may attempt side payments as a way to discourage the entry by a generic competitor. While this collusion is illegal, it can be hard to detect, especially if the payment takes the form of a contract (e.g. the generic producer is paid to manufacture one of the brand manufacturer’s drugs) which could have been reached without any collusion.

For all of the reasons discussed above, patent-supported research is particularly ill-suited for the pharmaceutical sector. The question is whether it is possible to design an alternative mechanism that can be equally effective in developing new drugs.14

Publicly Financed Pharmaceutical Research

The basic logic of a system of publicly financed medical research would be that the government expand its current funding for biomedical research, which now goes primarily through NIH, by an amount that is roughly equal to the patent supported research currently being conducted by the pharmaceutical industry. Pharma, the industry trade group, puts this funding level at roughly $50 billion or 0.3 percent of GDP, a figure that is also consistent with data from the National Science Foundation. That would be a reasonable target, with the idea that the public funding would eventually replace the patent-supported funding.17 Adding in research on medical equipment and tests would increase this figure by $12–15 billion.17

In order to minimize the risk of political interference and also the risk that excessive bureaucracy could impede innovation, it would be desirable that the bulk of this funding would be committed to private firms under long-term contracts (e.g. 10–15 years).19 This would allow for the imposition of clear rules that apply to all research directly or indirectly funded by the public sector, without a need for micro-management. The contracts would be subject to regular oversight for their duration, but the contractors would be free to set priorities for which lines of research to support. The contractors could also freely subcontract, just as the major pharmaceutical companies do now. They could also use their funds to buy research produced by other companies, just as the pharmaceutical industry does at present. As the period for a contract approached its end, the contractor could attempt to gain a new long-term contract. It would argue its case based on its track record with the prior contract.

The basic rules governing these contracts would be that all the results stemming from publicly financed research would be placed in the public domain, subject to copyleft-type restrictions.20 This means that any patents for drugs, research tools, or other intermediate steps developed by contractors or subcontractors, would be freely available for anyone to use, subject to the condition that they also would place any subsequent patents in the public domain. Similarly, test results used to get approval for a drug from Food and Drug Administration would be available for any generic producer to use to gain acceptance for their own product.

In addition to requiring that patents be placed in the public domain, there would also be a requirement that all research findings be made available to the public as quickly as practical. This means, for example, that results from pre-clinical testing be made available as soon as they are known, so that other researchers could benefit from the findings. This should prevent unnecessary duplication and allow for more rapid progress in research. These restrictions would apply to both direct contractors and any sub-contractors that were hired.21

This disclosure requirement would not be a negative for participants in the context of this sort of open-source contract system. Because the goal is to generate useful innovations rather than procure a patent, a contractor would be able to make an effective case for the usefulness of their work even if competitors were the ones that ultimately used it to develop a useful drug or medical device. The incentive in this system is to disseminate any interesting findings as widely as possible in the hope that other researchers will be able to build upon them.

The contracting system in the Defense Department can be seen as a loose model for contracting in pharmaceutical research. When the Defense Department is planning a major project, such as a new fighter plane or submarine, it will typically sign a contract with a major corporation like General Electric or Lockheed. The contractor will generally subcontract much of the project, because it is not prepared to do all the work in-house. The same would be the case with a contractor doing research developing pharmaceuticals or medical equipment, although the expected results will be somewhat less clearly specified. While that is a disadvantage of contracting with medical research, because the outcomes will be less well-defined, a major advantage is that there would be no excuse for secrecy in the medical research process. There is a clear justification for secrecy in military research, because it wouldn’t make sense to allow potential enemies to have access to the latest military technology. By contrast, biomedical research will be advanced more quickly by allowing the greatest possible access.

Secrecy has often been an important factor allowing military contractors to conceal waste or fraud, because only a very select group of people have access to the specific terms of a contract and the nature of the work a company is doing. In the case of bio-medical research, there is no reason that the terms of the contract would not be fully public. And, all research findings would have to be posted in a timely manner. With such rules, it should be possible to quickly identify any contractor whose output clearly did not correspond to the money they were receiving from the government. For all the instances of waste and fraud in military contracting, it nonetheless has been effective in giving the U.S. the most technologically advanced military in the world.

Because the system of patent protection and rules on data exclusivity is now enshrined in a large number of international agreements that would be difficult to circumvent, it is important that an alternative system work around this structure. As proposed here, patent protection under current rules would still be available to drug companies conducting research with their own funds. However, they would run the risk that at the point where they have an FDA-approved drug, there is a new drug available at generic prices that is comparably effective. This sort of competition would likely force the company to sell its drug at a price comparable to the generic, leaving it little margin for recouping its research costs.

Simply the risk of this sort of generic competition should make the current system of patent-financed drug development unprofitable, especially if the industry’s claims about its research costs are anywhere close to being accurate. In this way, the existing rules on patents can be left in place, even as a new system of publicly financed research comes to dominate the process of drug development.

The Cost-Benefit Arithmetic of an Alternative System

The simple arithmetic summing the extra costs, deadweight losses, and wasteful rent-seeking behavior associated with patents, and comparing it to the amount of actual research that is funded, suggests the opportunity for large gains through an alternative system. The first and most obvious advantage is that all the drugs and medical equipment developed through this process would be immediately available at free market prices. Instead of costing hundreds of thousands of dollar a year, breakthrough cancer drugs might cost $1,000 a year, or even less. The cost would be the price of safely manufacturing these drugs and with very few exceptions, that cost would be quite low. With drugs selling at prices that even middle-income families could readily afford, the whole industry of middle-men that has grown up around mediating between the drug companies and insurers, hospitals, and patients would disappear. There would be no need for it.

This would also end the horror stories that many patients must now endure as they struggle to find ways to pay for expensive drugs even as they suffer from debilitating or potentially fatal diseases. Doctors also would not be forced to compromise in prescribing a drug they consider inferior because it will be covered by a patient’s insurance when the preferred drug is not. Also, doctors would likely make better informed prescribing decisions because no one would stand to profit by having them prescribe a drug that may not provide the best treatment for their patient.

A similar story would apply to the use of medical equipment. In almost all cases, the cost of manufacturing the most modern medical equipment is relatively cheap. The cost of usage is even less. For example, the most modern screening equipment only involves a small amount of electricity a limited amount of a skilled technician’s time, and the time of a doctor to review the scan. Instead of a scan costing thousands of dollars, the cost would likely be no more than $200–$300. Here also, the price would then be a minor factor in deciding how best to treat a patient. A doctor would naturally recommend the device that best meets the patient’s needs. And in a context where no one has an incentive to mislead about the quality of the equipment, the doctor is likely to make better choices. The same would be the case with various lab tests, all of which would be available at their free market price. With few exceptions, this would be a trivial expense compared to the current system.

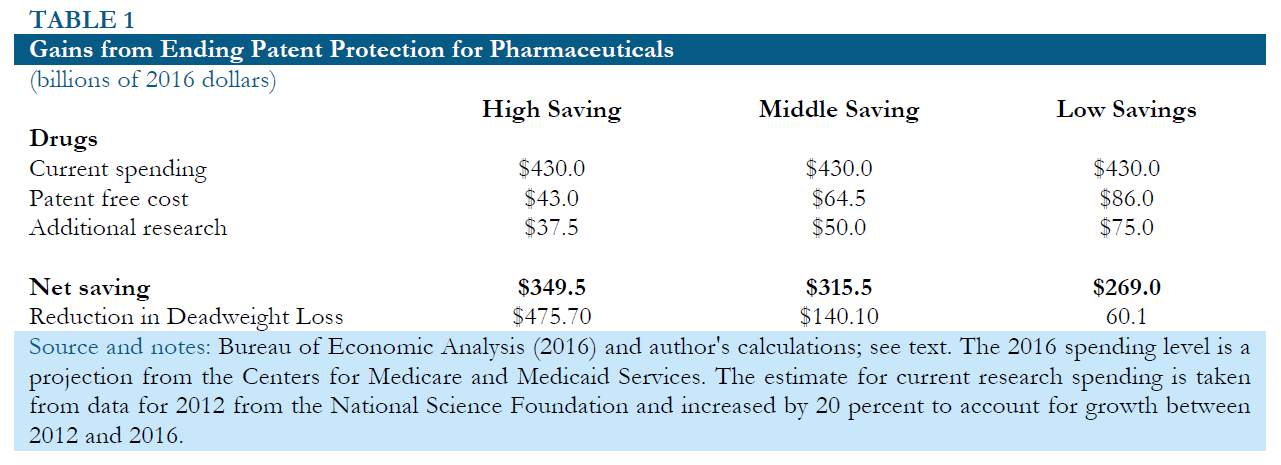

Table 1 below shows the potential gains from replacing patent supported research with direct public funding under three alternative sets of assumptions.

The most optimistic scenario, shown in column 1, assumes that 75 cents of public spending on research is roughly equivalent to one dollar of spending financed by patent monopolies. The greater efficiency would be based on the idea that increased openness and the elimination of unnecessary duplication led to more effective research. It also assumes that prescription drugs would sell for 10 percent of their current price without any patent or related protections..22 In this case, the implied annual savings in the United States would be $349.5 billion. Adding in the reduction in deadweight loss from a prior set of calculations brings the total benefits to more than $800 billion a year. 23

Column 2 shows an intermediate scenario in which $1.00 of public money for research is needed to replace $1.00 of patent supported research. This case assumes that prescription drugs would cost 15 percent as much to produce as they do today if all patent and related protections were eliminated. In this case the savings would be $315.5 billion. Adding in the reduction in deadweight loss brings the total net benefit to more than $450 billion a year.

Column 3 shows a scenario in which it takes $1.50 of public money to replace $1.00 of patent supported research. This implies that because money is going through the government, the research process becomes hugely less efficient than is currently the case. This is in spite of the fact that the research is now fully open, so that all researchers can benefit quickly from new findings, and a main motivation for unnecessary duplicative research has been eliminated. This scenario assumes that it would cost 20 percent as much to manufacture drugs in a world without patent and related protections as is the case at present. In this scenario, the savings would still be $269 billion annually or 1.5 percent of GDP. Adding in the reduction in deadweight loss in the most inelastic scenario would put the total net benefit at $329 billion annually.

The next set of rows shows the additional benefits from publicly funded research for medical equipment. The assumption in all three cases is that the cost of buying and using this equipment would fall by 70 percent if it was sold in a free market. The 2016 spending level is a projection from the Center for Medicare and Medicaid Services. The estimate for current research spending is taken from data for 2012 from the National Science Foundation and increased by 20 percent to account growth between 2012 and 2016. The optimistic scenario assumes that 75 cents in publicly funded research is equivalent to a dollar of patent-supported research. The middle scenario assumes that they are equally effective, and pessimistic scenario assumes that $1.50 in publicly funded research is needed to replace $1.00 in patent supported research. In these cases, the net annual savings in optimistic, middle, and pessimistic scenarios would be $24.1 billion, $20.4 billion, and $12.9 billion, respectively.24

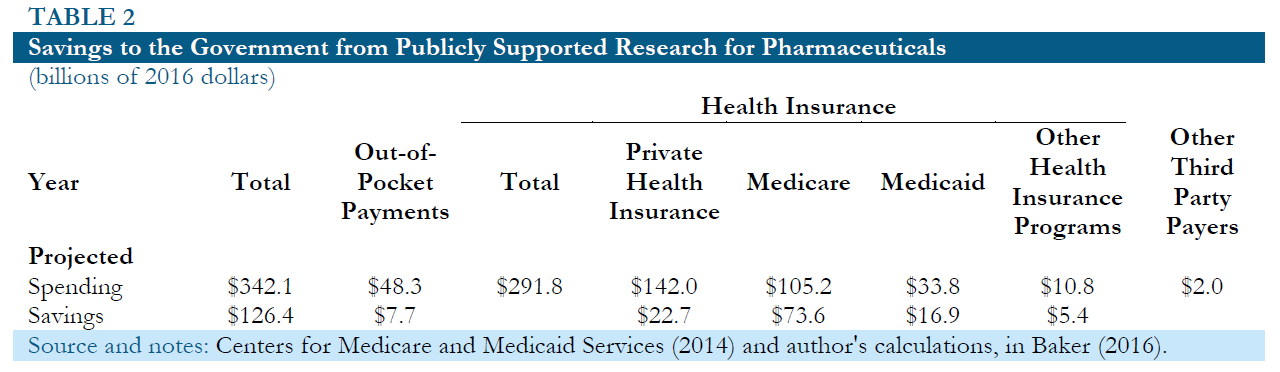

While publicly financed research would require the government directly commits funding for research, it should not be necessary to secure additional tax revenue. The government already directly or indirectly pays for a large portion of prescription drug expenditures through Medicare, Medicaid and various other health care programs. In addition, it effectively subsidizes private spending on drugs as a result of the tax-deductible status of employer provided health insurance and various other tax deductions. Table 2 shows the Centers for Medicare and Medicaid Services (CMS) projections for 2016 spending on prescription drugs and medical equipment by source.25 It also shows the assumed savings in each case.

For Medicaid and other government programs, the assumed savings are 50 percent on both drugs and medical equipment, based on the fact that these programs typically pay substantially lower prices for drugs than private insurers. In the case of Medicare, the assumed savings are 70 percent on drugs and 50 percent on medical equipment, under the assumption that insurers within the program pay somewhat lower prices drugs than insurers not connected with Medicare. In the case of private insurers and the out-of-pocket payments, it is assumed that the savings to the government will be equal to 16 percent of current payments for drugs 14 percent for medical equipment. This uses the assumption that drug prices will fall 80 percent if not subject to patent protection and the price of medical equipment will fall by 70 percent. The calculation further assumes that 20 percent of this saving accrues to the government in the form of higher tax revenue, because less money will be deducted for health care expenditures.

Even with these relatively conservative assumptions the savings to the government based on the 2016 projections would still be over $139 billion.26 This substantially exceeds the amount of public funding that would be needed to replace patent supported research in even the most pessimistic scenario described above. This means that the savings to the government from having drugs sold in a free market without patent or related protections should be more than enough to support a system of publicly funded drug development. There would be no need for additional tax revenue even in a relatively pessimistic scenario.

It is possible that there could be some short-term need for additional funding due to the lag between research spending and the development of new drugs. At least initially, there would be no savings from publicly funded research because all the drugs being sold would still be subject to the same protections as they are today. The savings would only accrue over time as new drugs were produced through the public system and being sold at free market prices. For this reason, a switch to direct public funding of research may at least initially increase budget deficits, even if it led to substantial savings over a longer time frame.

Publicly Funded Clinical Trials

Switching all at once to a system of fully funded research would likely be a difficult step both politically and practically. This would involve a radical transformation of a massive industry of a sort that is rarely seen in the U.S. or anywhere else. Fortunately, there is an intermediate step that can be used to advance toward a system of fully funded research which would offer enormous benefits in its own right.

There is a simple and basic divide in the research process between the pre-clinical phase of drug development and the clinical phase. The pre-clinical phase involves the development of new drugs or new uses of existing drugs and preliminary tests on lab animals. The clinical phase involves testing on humans and eventually proceeding to the FDA approval process if the earlier phases of testing are successful. The clinical testing phase accounts for more than 60 percent of spending on research, although this number is reduced if a return is imputed on the pre-clinical testing phase, because there is a considerably longer lag between pre-clinical expenditures and an approved drug than with clinical tests.

The clinical testing process involves a standard set of procedures, and is therefore far more routinized than the pre-clinical portion of drug development. For this reason, the clinical testing portion of the drug development process could be more easily adapted to a program of direct public funding. The model could be the same as discussed earlier, with the government contracting on a long-term basis with existing or new drug companies. However, the contracts would specify the testing of drugs in particular areas. As was the case described earlier, all results would be fully public, and all patent and related rights associated with the testing process would be put in the public domain subject to copyleft-type rules. This would likely mean that in many cases the contracting companies would have to buy up rights to a compound(s) before they initiated testing, because another company held a patent on it.

There are many advantages to separating out the clinical testing portion of drug development rather than attempting to fully replace patent supported research all at once. First, it would be much easier to slice off particular areas to experiment with public funding. For example, it should be possible to set aside a certain amount of funding for clinical trials for new cancer or heart drugs without worrying about fully replacing private support for research in these areas. Also, it should be possible to obtain dividends much more quickly in the form of new drugs being available at generic prices. The time lag between the beginning of preclinical research and an approved drug can be as long as 20 years. The clinical testing process typically takes less than eight years and can be considerably shorter if a drug’s benefits become quickly evident in trials.

Another important early dividend from the public funding of clinical trials is that the results of these trials would be posted as soon as they are available. This means that researchers and doctors would not only have access to the summary statistics showing the success rates in the treatment group relative to the control group, but they would also have access to the data on specific individuals in the trial.27 This would allow them to independently analyze the data to determine if there were differences in outcomes based on age, gender, or other factors. It would also allow for researchers to determine the extent to which interactions with other drugs affected the effectiveness of a new drug.

In addition, the public disclosure of test results may put pressure on the pharmaceutical industry to change its practices. The problem of misreporting or concealing results in order to promote a drug is one that arises in the process of clinical testing. While misrepresented results can be a problem at any stage in the drug development process, misrepresentations at the pre-clinical phase are unlikely to have health consequences because they will be uncovered in clinical testing. The problem of patients being prescribed drugs that are less effective than claimed or possible harmful to certain patients due to misrepresentations is entirely an issue with clinical testing. If experiments with a limited number of publicly funded clinical trials can change the norms on disclosure of test results, they will have made an enormous contribution to public health.

Conclusion

The system of relying on patent monopolies for financing prescription drug research has enormous costs. These costs take exactly the form economists predict from a government intervention in the market. The main difference with patent monopolies on drugs is that the intervention is far larger than most other forms of intervention that arise in policy debates like tariffs on trade or various excise taxes and subsidies. Furthermore, since drugs are often essential for people’s lives and health, the costs take a different form than paying higher prices for items like shoes or furniture. These costs are likely to rise in the years ahead as the gap between the patent-protected prices and free market prices grow ever larger.

For this reason, we should be considering alternative mechanisms for supporting prescription drug research. I have argued that a system of direct government funding, which relies on private companies working on long-term contracts, is likely to be far more efficient than the current system. By paying all research costs upfront, drugs could be sold at free market prices without monopoly protections, just like most other products. Also, since a condition of receiving public money is that all findings would be fully public as soon as is practical, doctors will be able to make more informed decisions in prescribing drugs. In addition, research is likely to advance more quickly in a context of openness than secrecy.

For these reasons, we should be looking for alternatives to patent-financed drug research. There is much room for improvement.

References

Baker, Dean, 2016. Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer. Washington, DC: Center for Economic and Policy Research.

Bureau of Economic Analysis. 2016. “National Income and Product Accounts.” Washington, D.C.: BEA.

Center for Responsive Politics. 2016a. “Top Interest Groups Giving to Members of Congress, 2016 Cycle.” Washington, D.C.: Center for Responsive Politics. https://www.opensecrets.org/industries/mems.php. Accessed 2016-07-18.

_____. 2016b. “Interest Groups.” Washington, D.C.: Center for Responsive Politics. https://www.opensecrets.org/industries/. Accessed 2016-07-18.

Centers for Medicare and Medicaid Services. 2014. “NHE Projections 2014-2024 – Tables.” Balitmore, MD: Centers for Medicare and Medicaid Services. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/Downloads/Proj2014Tables.zip.

Collins, Simon. 2016. “1000-Fold Mark Up for Drugs in High Income Countries Blocks Access to HIV, HCV, and Cancer Drugs.” The Body Pro, October 26. http://www.thebodypro.com/content/78658/1000-fold-mark-up-for-drug-prices-in-high-income-c.html.

GNU. 2016. “What is Copyleft?” Boston, MA: Free Software Foundation. https://www.gnu.org/copyleft/copyleft.html. Accessed 2017-03-02.

Ingraham, Christopher. 2016. “One striking chart shows why pharma companies are fighting legal marijuana.” Washington Post, July 13. https://www.washingtonpost.com/news/wonk/wp/2016/07/13/one-striking-chart-shows-why-pharma-companies-are-fighting-legal-marijuana/?tid=pm_business_pop_b/.

Investopedia. 2015. “Who are Gilead Sciences’ (GILD) main competitors?” Investopedia, May 22. http://www.investopedia.com/ask/answers/052215/who-are-gilead-sciences-gild-main-competitors.asp.

Katari, Ravi and Dean Baker. 2015. “Patent Monopolies and the Costs of Mismarketing Drugs.” Washington, D.C.: Center for Economic and Policy Research. https://cepr.net/documents/publications/mismarketing-drugs-2015-04.pdf.

National Science Foundation. 2012. “Business Research and Development and Innovation: 2012.” Arlington, VA: National Science Foundation. Chapter 2. http://www.nsf.gov/statistics/2016/nsf16301/#chp2.

Nuñez, Daniela. 2006. “Survey finds close ties between drug companies and patient groups.” Consumers Union, Safe Patient Project, October 30. http://safepatientproject.org/posts/2257-survey_finds_close_ties_between_drug_companies_and_patient_groups.

Pollack, Andrew. 2016. “Makers of Humira and Enbrel Using New Drug Patents to Delay Generic Versions.” The New York Times, July 15. http://www.nytimes.com/2016/07/16/business/makers-of-humira-and-enbrel-using-new-drug-patents-to-delay-generic-versions.html.

PricewaterhouseCoopers. 2015. “2015 Patent Litigation Study: A change in patentee fortunes.” New York, NY: PricewaterhouseCoopers. https://www.pwc.com/us/en/forensic-services/publications/assets/2015-pwc-patent-litigation-study.pdf.

Williams, Heidi L. 2010. “Intellectual Property Rights and Innovation: Evidence from the Human Genome.” Cambridge, MA: National Bureau of Economic Research, Working Paper 16213.

1 Simon Collins compares the list price for brand drugs in the United States and other wealthy countries with the generic price India and other developing countries; see Collins (2016).

2 I have angered people by saying that competitors will be arrested, which is not literally true. Gilead Sciences would have to go to court with a civil suit alleging that its competitor is infringing on its patent. As part of this suit, it would typically request a court to order the competitor to stop the infringement while the case for damages is being assessed. If the competitor continued to sell Sovaldi in violation of a court order to stop, they would face arrest; however, the charge would be contempt of court, not violating Gilead Sciences’ patent. So, the competitor would not literally face jail for patent infringement.

3 In the United States, much of the pre-clinical research is funded by the National Institutes of Health, which currently receive $32 billion a year in federal funding. Sometimes public funding is also used to finance clinical trials, leaving relatively little risk and expense to the private sector. A dramatic example of this sort of public risk and private gain is the development of a vaccine for the Zika virus. Sanofi, the French pharmaceutical company, developed this vaccine through the clinical testing phase, under contract with the U.S. army. They are now likely to get an exclusive license to market the vaccine even though they had little, if any, of their own money at risk the development process.

4 In the developing world, even the free market price will pose a serious obstacle for many patients. But in almost all cases this will be a problem that is soluble with the resources available to aid agencies.

5 It’s also worth noting that the economic distortions are proportional to the square of the tariff. If a tariff is doubled, the resulting waste is increased four-fold.

6 Katari and Baker (2015).

7 See, for example, Investopedia (2015).

8 Williams (2010).

9 The U.S. and many other countries now allow for the patenting of a new use for an existing drug; however, there are still likely to be limits to the extent to which this might provide incentives for researching new uses of an old drug. If it turned out that a common drug, like aspirin, was an effective treatment for some other condition, it would be very difficult to keep people from using the cheap generic versions for the newly discovered treatment, even if it violated the patent.

10 Pharmaceutical companies are often major funders of organizations established as support groups for victims of specific diseases and their families. These support groups are often encouraged to lobby insurers and the government to pay for expensive drugs sold by the sponsoring pharmaceutical company. See, for example, Nuñez (2006).

11 Center for Responsive Politics (2016a).

12 Center for Responsive Politics (2016b).

13 Ingraham (2016).

14 Pollack (2016).

15 PricewaterhouseCoopers (2015).

16 This discussion pursues the logic of directly funded research. There have been several proposals for creating a fund for prizes which would be used to buy out patents and place them in the public domain. While a prize system would have enormous advantages over the current system, most importantly because drugs would be available at their free market price, it shares some of the major drawbacks with the current patent system. Mainly, it would still encourage secrecy in the research process, because companies would have the same incentive as they do now to prevent their competitors from gaining the benefit of their research findings. The awarding of prizes may also prove problematic. The company that manages to patent a drug may not be the one responsible for the key scientific breakthroughs responsible for its development. In principle, prizes could be awarded for important intermediate steps, and not just achieving a final endpoint, but this is likely to make the prize process complicated and contentious.

17 It would be necessary to have some system of international coordination so that the U.S. was not funding research for the whole world. This would presumably involve some payments scaled to GDP, with richer countries paying a larger share of their income. While there would undoubtedly be some problems working through such a system, the current system of imposing patent and related protections on U.S. trading partners has not been quite contentious.

18 National Science Foundation (2012).

19 The use of private drug companies also a potentially valuable benefit from a political economy standpoint. There is no reason that the existing pharmaceutical companies could not bid for public research money, as long as they are prepared to abide by the conditions placed on this funding. This means that insofar as they are efficient in their conduct of research, they would be able to continue to exist and profit on this sort of system. This should reduce their political opposition to an alternative funding mechanism. Insofar as their expertise is primarily in marketing rather than developing drugs, they would run into difficulties under this proposed alternative system.

20 Copyleft is a type of copyright developed by the Free Software Movement, under which copyrighted software can be freely used as long as any derivative software is also put in the public domain subject to the same condition. See GNU (2016).

21 This would be the sort of issue that would be examined in periodic reviews of contractors. If a contractor had excessive delays in posting findings on an ongoing basis, this would be grounds for revoking the contract. Contractors would also be held responsible for the behavior of any subcontractors, who would also be bound by the requirement to post findings in a timely manner.

22 It is worth noting that with some drugs the price may be high currently not because the compound itself is subject to patent protection, but rather one of the inputs. The implicit assumption in this discussion is that the inputs would also be in the public domain because they would have been produced with public funding.

23 These calculations can be found in Baker (2016), chapter 5.

24 Even these calculations don’t fully capture the potential benefits from having drugs sold in a free market. CMS projects that private insurers will pay just over $150 billion for prescription drugs and medical equipment in 2016. With insurance expenses averaging more than 20 percent of benefits paid out, if these combined payments fell by $100 billion, it would imply savings of more than $20 billion in the administrative costs of insurers.

25 Centers for Medicare and Medicaid Services (2014).

26 These calculations are based on CMS projections of spending on prescription drugs. Data from the Bureau of Economic Analysis show spending levels that are more than 30 percent higher. A calculation of savings based on the Bureau of Economic Analysis spending levels would therefore be correspondingly higher.

27 Some information on individuals may have to be put into categories (e.g. between the age of 25 and 34, rather than a specific age) in order to preserve the anonymity of particular patients. With rare diseases, these categories may have to be fairly broad, but it will still be possible to disclose car more information than is currently available.