Fact-based, data-driven research and analysis to advance democratic debate on vital issues shaping people’s lives.

Center for Economic and Policy Research

1611 Connecticut Ave. NW

Suite 400

Washington, DC 20009

Tel: 202-293-5380

Fax: 202-588-1356

https://cepr.net

April 28, 2017

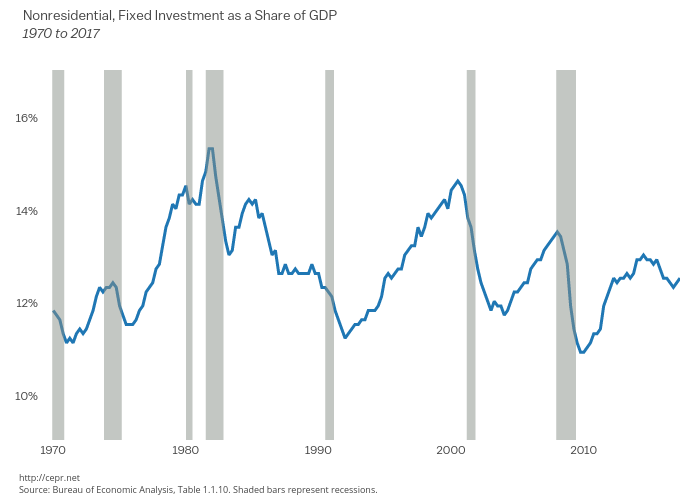

According to the latest numbers from the Bureau of Economic Analysis, non-residential investment increased at a 9.4 percent annual rate in the first quarter. Structure investment grew at an extraordinary 22.1 percent rate. This was likely due to the relatively mild winter in the Northeast and Midwest. Growth will be much slower or even negative in future quarters. Equipment investment grew by 9.1 percent, the strongest growth since it also grew at a 9.1 percent rate in the third quarter of 2015. Recent data on capital goods orders indicate that growth in this sector is likely to be very modest for the near future.