Fact-based, data-driven research and analysis to advance democratic debate on vital issues shaping people’s lives.

Center for Economic and Policy Research

1611 Connecticut Ave. NW

Suite 400

Washington, DC 20009

Tel: 202-293-5380

Fax: 202-588-1356

https://cepr.net

July 28, 2017

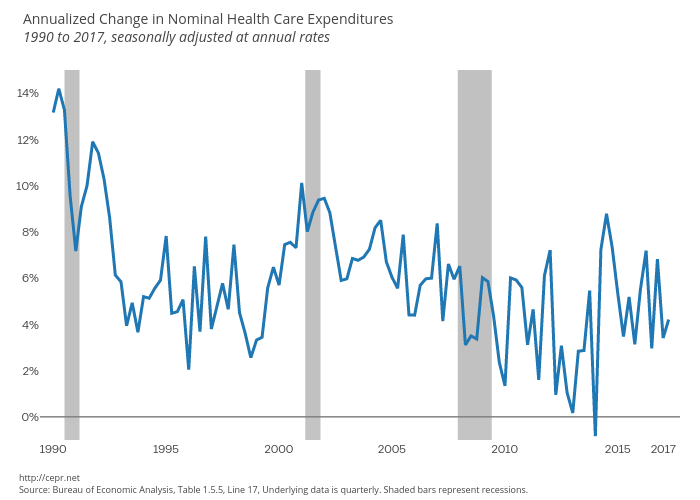

Health care spending continues to be restrained in the second quarter. Over the last year, nominal spending on personal health care services (the vast majority of health care spending) increased by just 4.3 percent. Spending on health care has grown much less rapidly in the last decade than in the 1990s and prior decades. For more, check out the latest GDP Byte.