Article • Dean Baker’s Beat the Press

Fact-based, data-driven research and analysis to advance democratic debate on vital issues shaping people’s lives.

Center for Economic and Policy Research

1611 Connecticut Ave. NW

Suite 400

Washington, DC 20009

Tel: 202-293-5380

Fax: 202-588-1356

https://cepr.net

Edward Glaeser had an interesting column in the NYT this morning which offered some useful suggestions for increasing housing construction and reducing rents. However, in making his case he does get the recent course of rental inflation seriously wrong.

The piece tells readers:

“It will take a forceful solution to address such a big problem. Nominal rents have risen by 6.5 percent a year since the start of the Biden administration and continue to surge even while overall inflation is dropping.”

Rents rose rapidly in 2021-2023 as tens of millions of workers, who previously had to go to an office five days a week, suddenly had the option to work from home. These people both needed more space for a home office and had the money to pay for it, since they were saving thousands of dollars a year on commuting costs, as well as hundreds of hours of commuting time.

But this surge ended in 2022. With demand leveling off, and housing supply increasing as supply chain problems eased, the rental market stabilized. This is missed in the Consumer Price Index’s (CPI) rental indexes, since it is largely driven by leases that might have been signed a year or two in the past.

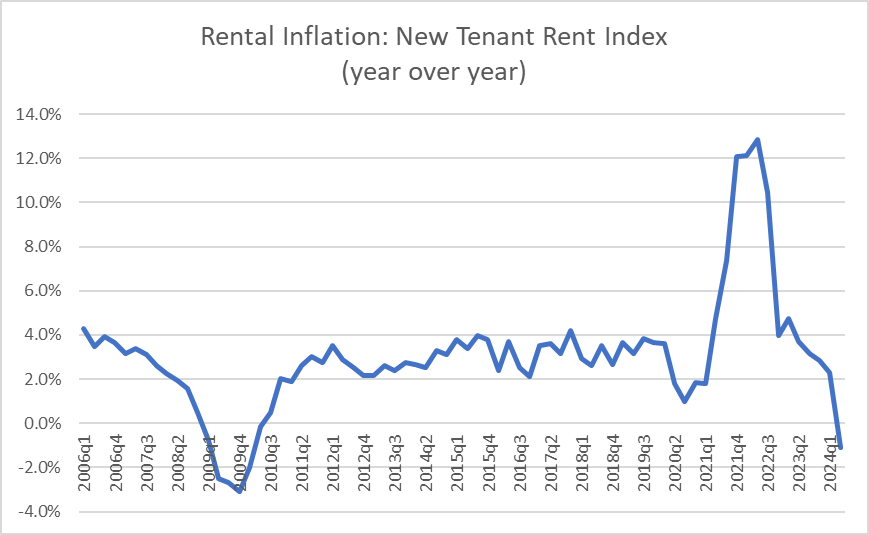

The Bureau of Labor Statistics has a separate index that measures inflation in rental units that change hands. This index is a better measure of current market conditions. It leads the overall CPI rental indexes since eventually leases roll over and reflect the current market rents.

Source: Bureau of Labor Statistics.

As can be seen, the new tenant rent index rose sharply in 2021 and peaked at almost 13.0 percent in the second quarter of 2022. Rental inflation in this index then declined rapidly and actually turned negative in the most recent quarter.

While rents may not actually decline in the overall CPI rental indexes, it is clear that rental inflation will be falling sharply and could get close to zero in the quarters ahead. That does not change the underlying issue raised by Glaeser. Housing costs are too high, and the main culprit is an inadequate supply of housing. But we should be clear that in the near-term future we will get some good news on rents, even if will not be good enough to solve our housing problems.