Article

Fact-based, data-driven research and analysis to advance democratic debate on vital issues shaping people’s lives.

Center for Economic and Policy Research

1611 Connecticut Ave. NW

Suite 400

Washington, DC 20009

Tel: 202-293-5380

Fax: 202-588-1356

https://cepr.net

The tax cut deal between the White House and Congressional Republicans would reduce the payroll tax rate on employees by 2 percentage points (from 6.2 percent to 4.2 percent) for one year in 2011, but fails to extend the more progressive Making Work Pay tax credit. Authorized for tax years 2009 and 2010 in the Recovery Act, the Making Work Pay tax credit provided a refundable tax credit of up to 6.2 percent of earned income, capped at $400 ($800 for joint returns), for taxpayers with adjusted gross incomes below $95,000 ($190,000 for joint filers).

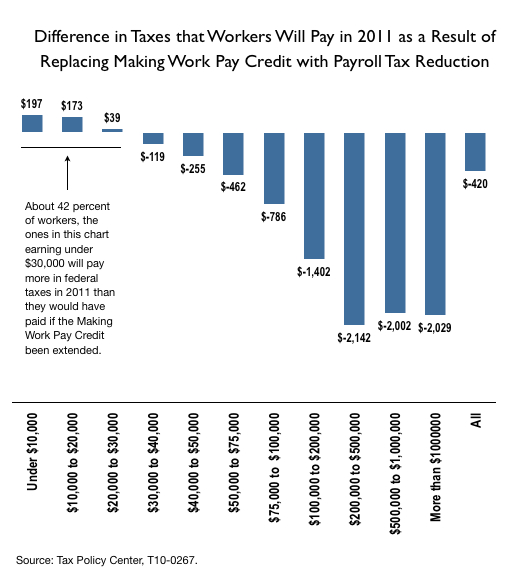

Because the payroll tax cut isn’t capped, most tax filers (about 58 percent of those who benefit, according to the Tax Policy Center’s preliminary estimates) will receive a greater benefit from it than they would have under the Making Work Pay credit. However, about 42 percent of tax filers will pay more in taxes in 2011 than they would of had the Making Work Pay Credit been extended. The chart below shows the average difference in taxes that workers will pay by income level.

The deal would extend three other fairly targeted tax benefits for certain low-wage workers that were included in the Recovery Act: 1) an increase in the EITC phaseout threshold for married couples filing jointly; 2) an increase in the Earned Income Tax Credit (EITC) for families with three or more children; and 3) allowing families with income between $3,000 and roughly $13,000 to receive a refundable Child Tax Credit. These extensions are a good thing, but it’s worth noting that low-wage workers without children don’t benefit at all from them, and that the EITC more generally provides only a tiny benefit for workers without children (and none at all for those under age 25 or over age 65). In fact, for minimum wage workers without children (and even many with children), the current combined amount of earnings and the EITC that they receive today is substantially lower than the minimum wage earnings alone that they received in 1979.

Instead of cutting payroll taxes directly, a better deal would extend the Making Work Pay tax credit and increase the cap to $600. If the misguided payroll tax cut stays in (for more on why it shouldn’t, see this post by Dean), Congress should at least double the size of the EITC for workers without children (the maximum benefit is currently only $457) and extend it to workers under age 25 and age 65 or older, or adopt a partial restoration of Making Work Pay in a way that targets the benefits to workers with below-median incomes.