July 20, 2017

With the release of the annual Social Security and Medicare trustees’ report, President Trump’s appointees endorsed sharp improvements in Medicare’s financing that occurred under former President Obama. Medicare had a projected shortfall of 3.54 percent of covered payroll (over a 75-year planning period) during the last year of the Bush administration, now it is down to just 0.64 percent.

This development should give pause to those who wish to fundamentally restructure Social Security and Medicare based on these projections. A lot changed over the eight years of the Obama administration and even more can change over 75 years. This is worth taking into account when looking at Social Security’s 75-year shortfall, which is at 2.83 percent of payroll under the intermediate scenario.

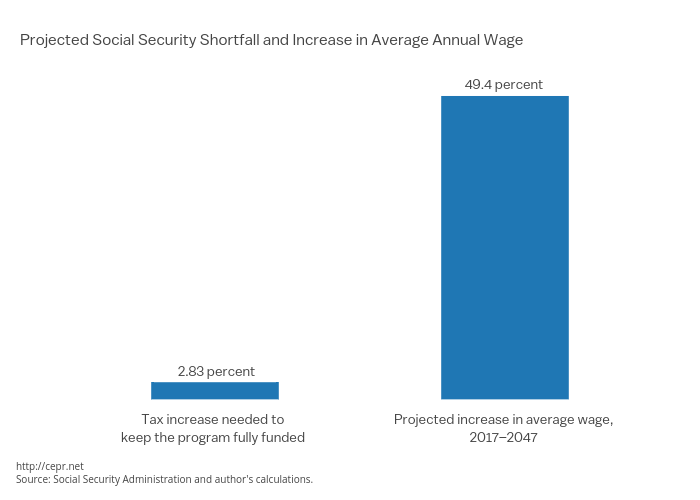

The figure below compares the tax increase that would be required to fully fund Social Security — 2.83 percent — with the projected increase in average wages over the next 30 years. The tax increase is dwarfed by the increase in wages over this period, which would be 49.4 percent by the trustees’ own estimates. Wage increases are over 17 times more important than the tax increase.

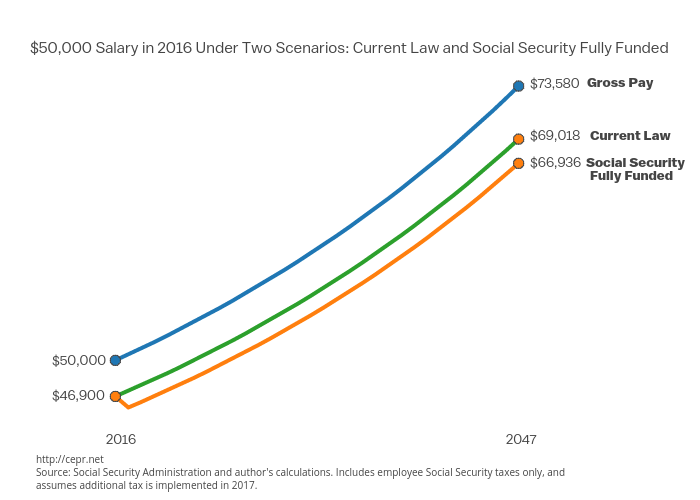

The next figure is a simple projection of what would happen to a salary of $50,000 per year in 2016 ($46,900 with the current Social Security taxes taken out) over the same 30-year period. With the current Social Security tax rate, this salary would be $69,018 per year in 2047 based on the average wage increase. With Social Security fully funded, it would be $66,936.

It’s unlikely that these projections will hold over such a long time frame, but this should demonstrate that workers should be much more concerned with making sure they receive their share of productivity gains in wage increases over this period than they should be about tax increases. This is not about Social Security needing to be less generous, it is about making sure that workers receive their fair share.

In fact, this problem cuts the other way as well. Unlike Medicare taxes which apply to entire incomes, Social Security taxes apply only up to a threshold — the payroll tax cap — which was set at $127,200 in 2017. With the upward redistribution of income that has occurred over the last four decades, Social Security has less of a base on which to draw. 90 percent of wage income was subject to the tax in 1983 — it was 82.6 percent in 2015. This decline represents a large share of the program’s shortfall.

For Social Security, as with Medicare, long-term financing problems are not indicative of inherent or intractable problems with social programs. Rather, they are indicative of other problems, like policies that redistribute income upwards, and they are fixable.