October 01, 2008

Dean Baker

TPMCafé (Talking Points Memo), October 1, 2008

See article on original website

The Federal Reserve Board chairman described the credit squeeze as being “as severe as any supply-induced constraint ever, other than from policy actions.” That statement should help to prompt Congress into quick passage of the bank bailout bill, except this quote is from February of 1991, and the chairman at the time was Alan Greenspan.1

The economy is in a recession and banks always tighten up on credit in a recession. When the economy’s growth prospects are in question, it puts the health of any particular business into question. Therefore, banks will be far more hesitant to make loans during a period of economic weakness. There were literally hundreds of news stories about the credit squeeze in the 1990-1991 recession.

While the story of the big Wall Street banks teetering and/or crashing may be unique to the current downturn, the stories we are hearing of the main street credit squeeze could be cut and pasted from the news coverage of the 1990-1991 recession. There is little reason to believe that the current tightness is any worse than what we have seen in prior recessions.

The most obvious measure of credit tightness is interest rates. We expect that banks will raise interest rates if the demand for credit substantially exceeds the supply. Yet, the interest rates on most categories of loans are far below their averages over recent decades. According to the Mortgage Bankers Association, the average interest rate on 30-year fixed rate mortgages was 6.07 percent last week, down from 6.08 percent the prior week. Back in the early 90s, the average interest rate on 30-year mortgages was over 9.0 percent.

State and local governments are complaining about having to pay interest rates of 5.0 percent, but back in the early 90s they were paying more than 6.0 percent. The same applies to loans for large and small businesses. The interest rates are somewhat higher now than they were in prior months, but they are still relatively low by historic standards. (Real interest rates are even lower by historic standards, since the inflation rate is higher today than it was in the early 90s.)

Of course this past history doesn’t mitigate the pain being suffered by families and businesses trying to make ends meet. But it is important to put the problem in context. No one told us that the world would collapse if we didn’t cough up $700 billion for the Wall Street banks in the 1990-1991 recession.

The bottom line is that we have badly over-leveraged banks who are on the edge of collapse and we have a credit tightening due to an economic downturn. These problems are related, but even if we could snap our fingers and make the banks healthy again tomorrow, we would still have a serious credit problem due to the recession. In other words, many of the businesses and people who have been appearing on news shows because they could not get credit would still not be able to get credit. (Although they probably will not be appearing on the news shows once the bailout passes.)

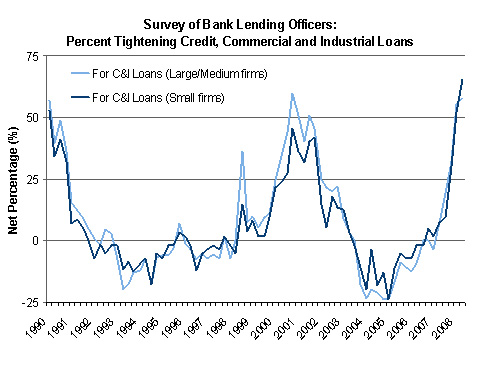

Figure 1

Figures 1 and 2 show the results of Federal Reserve Board’s Survey of Bank Loan Officers. Figure 1 shows the net percentage (those reporting tightening minus those reporting easing) reporting the tightening of lending standards for commercial and industrial loans. The data go back to the recession of 1990. As can be seen, there is a sharp spike in the percentage of officers reporting tightening this year. However, the data show roughly the same spike in 1990 at the beginning of that recession.

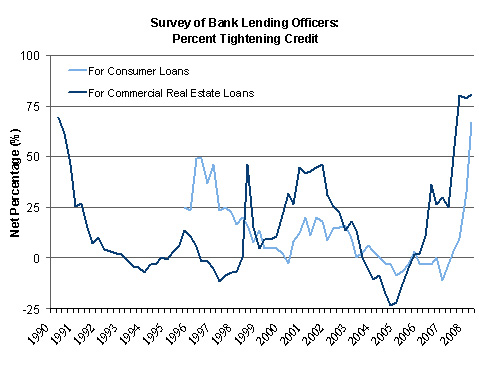

Figure 2

Figure 2 shows the net percentage of loan officers reporting tightening for commercial real estate loans and credit card loans. These data also show a spike in 2008, but it is not qualitatively different than the spike shown in 1990 for commercial real estate. (The credit card series begins in 1996. Of course it is not surprising if the tightening of standards on credit card debt was much sharper in this recession, given the extraordinary destruction in housing equity in the last two years.

Just to remind everyone, the cause is the loss of more than $4 trillion in housing equity due to the collapse of the housing bubble. The collapse of this bubble has not only devastated the construction and real estate market, it also has forced consumers to cut back. Tens of millions of homeowners no longer have any equity against which to borrow. Even those who still have equity realize that they will have to increase their savings to support themselves in retirement.

And all this came about because the experts who are now insisting that we need a bailout had previously insisted that there was no housing bubble and that everything was just fine. It is always important to keep things in context.

1 “Economic Scene: Barriers to Ending the Credit Crunch,” New York Times, February 1, 1991.

Dean Baker is the co-director of the Center for Economic and Policy Research (CEPR). He is the author of Plunder and Blunder: The Rise and Fall of the Bubble Economy. He also has a blog on the American Prospect, “Beat the Press,” where he discusses the media’s coverage of economic issues.