The Americas Blog seeks to present a more accurate perspective on economic and political developments in the Western Hemisphere than is often presented in the United States. It will provide information that is often ignored, buried, and sometimes misreported in the major U.S. media.

Spanish description lorem ipsum dolor sit amet, consectetur adipiscing elit. Nunc in arcu neque. Nulla at est euismod, tempor ligula vitae, luctus justo. Ut auctor mi at orci porta pellentesque. Nunc imperdiet sapien sed orci semper, finibus auctor tellus placerat. Nulla scelerisque feugiat turpis quis venenatis. Curabitur mollis diam eu urna efficitur lobortis.

• DemocracyHondurasHondurasLatin America and the CaribbeanAmérica Latina y el CaribeUnited StatesEE. UU.US Foreign PolicyPolítica exterior de EE. UU.

• IMFFondo Monetario InternacionalLatin America and the CaribbeanAmérica Latina y el CaribeUS Foreign PolicyPolítica exterior de EE. UU.VenezuelaVenezuela

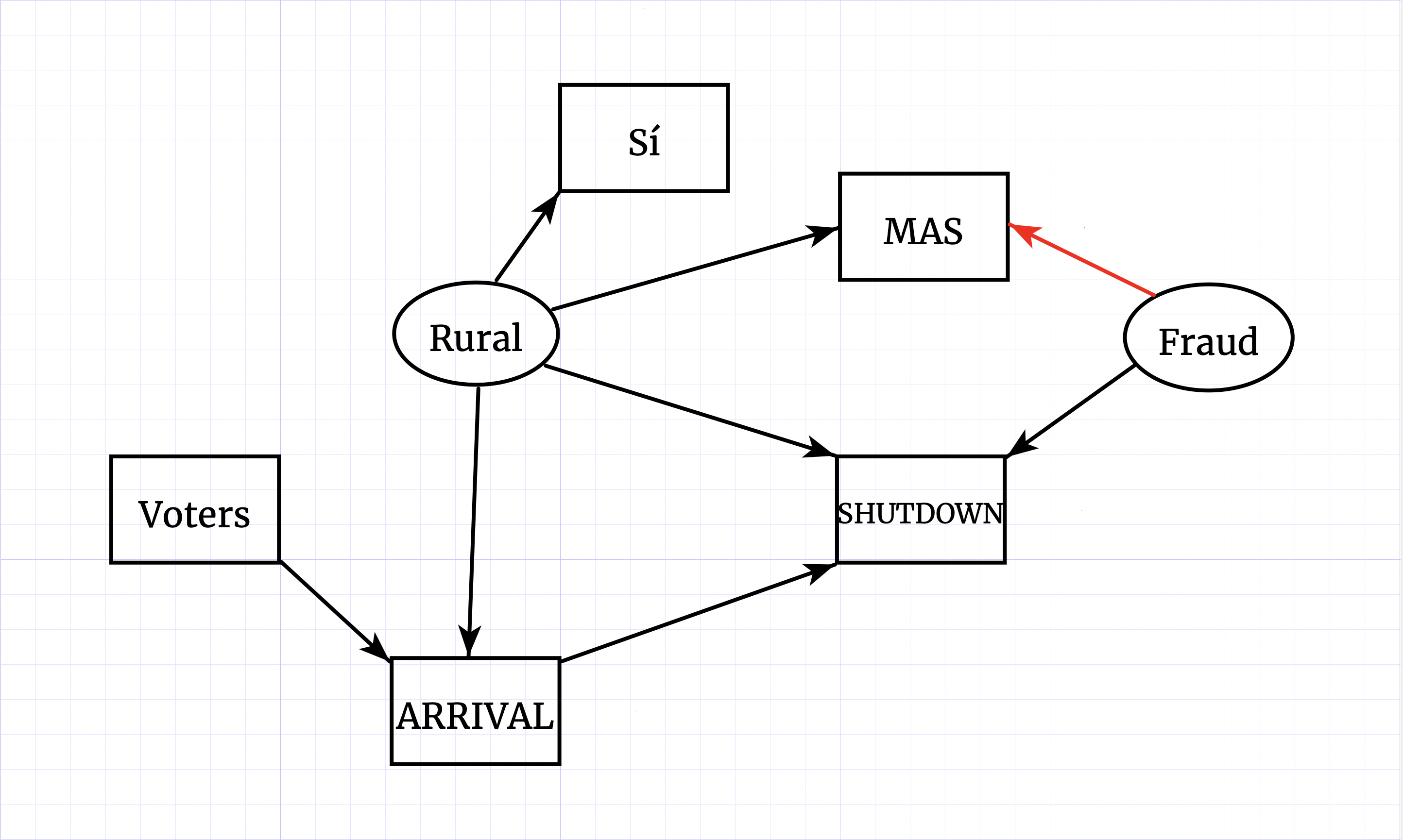

• BoliviaBoliviaElectionsEleccionesLatin America and the CaribbeanAmérica Latina y el CaribeWorldEl Mundo

• BoliviaBoliviaElectionsEleccionesLatin America and the CaribbeanAmérica Latina y el CaribeWorldEl Mundo

• BoliviaBoliviaElectionsEleccionesLatin America and the CaribbeanAmérica Latina y el CaribeWorldEl Mundo