December 15, 2010

December 15, 2010 (Prices Byte)

Rents slowly accelerate amidst slowing medical care and falling vehicle prices.

The Consumer Price Index rose 0.1 percent in November. Over the last three months, headline inflation has run at an annualized rate of 1.8 percent, compared to 1.7 percent in the previous three. Despite November’s more moderate 0.2 percent rise in energy prices, the last three months have seen a 14.8 percent annualized rate of inflation in energy, compared to 7.6 percent in the three months ending in August.

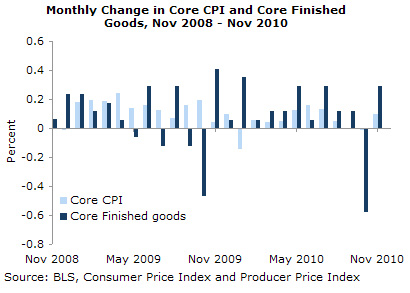

The low rate of inflation in the CPI has come with low and falling core prices. The core index also rose 0.1 percent in November and at a 0.7 annualized rate since August. Over the last three months, prices have fallen in apparel (3.1 percent annualized), recreation (1.4 percent), education and communication (0.2 percent), and other goods and services (0.6 percent).

Among the major groups showing any gains, housing prices rose at a 0.4 percent annualized rate in November and 0.3 percent over the last three months. Owners’ equivalent rent has very slowly accelerated over the course of the year—from a 0.4 percent annualized rate for the three months ending in February to 1.0 percent over the last three.

Falling prices in household gas and electricity have kept housing prices down. Also leading to low housing inflation, prices for lodging away from home fell 1.2 percent in November. These prices have now fallen at a 9.1 percent annualized rate over the last three months after a brief rise earlier this year.

Transportation prices rose 0.3 percent in November, but at an 8.4 percent annualized rate since August. The difference is largely attributable to the moderation in gasoline prices, which rose only 0.7 percent in November, in comparison to 1.8 and 4.4 percent the previous two months.

The price of new vehicles fell for the second consecutive month—0.4 percent—and has now declined at a 1.7 percent annualized rate over the last three months. The price of used vehicles also fell for the third consecutive month after recovering from the tight market post-cash-for-clunkers. Despite the sharp rise over the last year, used car prices are roughly back to where they were in 1994.

Finally, medical care prices rose 0.1 percent for the second consecutive month. Medical care services, for example, rose 0.1 percent in November, though it rose 0.8 percent and 0.2 percent the previous two months.

Nonfuel import and nonagricultural export prices both rose 0.8 percent in November. Nonfuel import prices rose 3.0 percent over the last twelve months, while in the last year nonagricultural export prices rose 5.1 percent. Both sets of prices have, over the last three years, been driven primarily by a sharp rise, fall, and recovery in the price of nonfuel industrial supplies.

In recent months, inflation in core producer prices have varied by stage of production. The core finished goods index rose 0.3 percent in November, following a 0.6 percent fall in October. The price of core finished goods has otherwise risen steadily at a 1.3 percent rate over the last 12 months. As with imports and exports of industrial supplies, inflation in core intermediate goods has resumed—growing at a 5.9 percent annualized rate over the last three months compared to -3.0 percent for the three months ending in August.

The low rate of core inflation in both producer and consumer prices is liable to remain. Even if rents continue their slow acceleration, inflation in rent and owners’ equivalent rent remains low. If medical prices continue to moderate, there will be very little price pressure in the economy at all.