September 04, 2012

Along with former Senator Alan Simpson, Erskine Bowles has become known to much of the public as the co-chair of President Obama’s deficit commission. The two of them produced a report that is viewed by many in the media and leading Democrats in Congress as providing the basis for a “Grand Bargain” on a long-term deficit reduction package.

However, in addition to his duties on President Obama’s deficit commission, Erskine Bowles also has a day job. In fact he has many of them. Over the last decade, Mr. Bowles has sat on a large number of corporate boards. This is in addition to serving as the President of the University of North Carolina from 2005 to 2010 and unsuccessful runs for a U.S. Senate seat in North Carolina in 2002 and 2004.

Some of the companies for which Mr. Bowles served as a director have gained considerable notoriety in recent years. He served on the board of Krispy Kreme, the upstart doughnut company that was briefly a Wall Street darling. He also sat on the board of General Motors from June of 2005 until it went into bankruptcy in the spring of 2009. He joined the board of Morgan Stanley, the Wall Street investment bank, near the peak of the housing bubble in December of 2005. He remains on its board today. He also joined the board of Facebook in September of last year.

Given Mr. Bowles prominence in public debates on policy issues, it seems reasonable to examine the track record from his extensive service on corporate boards. As a simple way to aggregate the performance of different company stocks, we weighted the holdings by the size of Mr. Bowles payment for his stint as a director. (We used the average annual payment for the period he served.) By selecting a company in the chart below, it displays the start and end date and stock price for each of the companies on which he served as a director. By hovering over the company names, it also shows the average annual compensation for the years he served. The points on the X axis are when he left a board or joined a new one. (Graph requires a browser supporting HTML5, sources are available on request.)

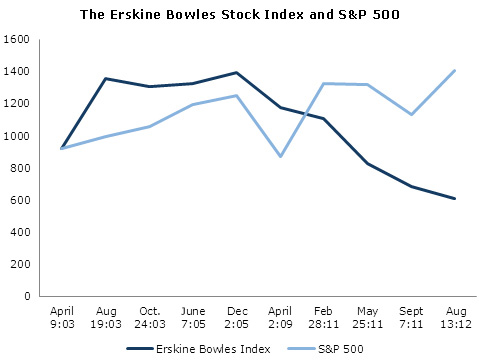

Using these data, we constructed an Erskine Bowles stock index. It is constructed to begin on April 9, 2003, the date when Mr. Bowles started as a director of Krispy Kreme. The start point of the index is set to 916.92, the value of the S&P 500 index on April 1, 2003. (Mr. Bowles did serve on a number of boards for brief periods prior to 2003, most notably Wachovia, the bank which was taken over by Wells Fargo at the peak of the financial crisis in the fall of 2008. These were not included, because it is difficult to find data on stock prices and executive compensation for earlier dates.) Figure 1 shows the performance of the Erskine Bowles stock index relative to the S&P 500 over the last nine years and four months.

As can be seen, the Erskine Bowles index considerably underperformed the S&P 500 over this period. While some of the companies did perform well in the period in which Mr. Bowles sat on their board, most notably Krispy Kreme (the company ran into serious problems after Mr. Bowles left the board), others did not fare well. General Motors fell into bankruptcy in the period that he sat on its board. Morgan Stanley lost much of its stock value and came near bankruptcy in the fall of 2008. And Facebook has seen its price plunge since its initial public offering.

As a result of these poor performers, the Erskine Bowles stock index lost 33.5 percent of its value over this period. By contrast, the S&P 500 increased by 53.1 percent. (We did not attempt to include dividends in this calculation.) Clearly investors would have been much better off holding the S&P 500.

It’s not clear how much the bad performance of the Erskine Bowles index can be attributed to his work as a director. It is also possible that he has simply made poor decisions in selecting companies when deciding to serve on corporate boards. Alternatively, it is possible that companies that are facing problems seek out Mr. Bowles as a director. Determining which of the factors is most important would require further research. However if the future is like the past, investors would be best advised to stay away from those companies that have Mr. Bowles as a director.