September 25, 2012

September 25, 2012 (Housing Market Monitor)

By Dean Baker

There may small speculative bubbles driving the lower end of the market in several cities.

The July Case-Shiller 20-City Index showed house prices continuing to rise in July, albeit at a somewhat slower pace than earlier in the spring. Prices rose by 0.4 percent in July, down from an average of 0.9 percent in the prior three months. This was the slowest rate of increase since a 0.1 percent rise in February. Even with the slower pace, 18 of the 20 cities still reported an increase in prices, while Cleveland reported a price decline of 0.4 percent, and prices were unchanged in New York City.

The biggest price increases were by 1.4 percent in Phoenix and Detroit, followed by a 1.1 percent rise in Atlanta. Prices in Detroit have been extraordinarily erratic in the last couple of years. Clearly there is a great deal of speculation in this market. The downturn has sent nominal prices back to their mid-90s levels, making it relatively cheap to speculate in the market. Prices have risen at a 33.2 percent annual rate over the last three months. However, since they had been falling in the second half of 2011, prices are only 6.2 percent above their year-ago level.

Speculation is also likely playing a big role in the price rises in Phoenix and Atlanta, both of which are being driven by the bottom end of the market. In the case of Phoenix, the rate of increase at the bottom end actually slowed somewhat in July to 1.5 percent. Nonetheless prices for homes in the bottom tier have risen at a 25.4 annual rate over the last three months and are up 33.4 percent from year-ago levels. The story is similar in Atlanta. Prices for homes in the bottom tier rose 3.5 percent in August and have risen at a 23.4 percent annual rate in the last three months.

There are several other cities that have seen extraordinarily rapid increases in the bottom end of the market. In Las Vegas, prices rose 1.8 percent in July and have risen at a 37.5 percent annual rate over the last three months. The rise in Minneapolis was 3.5 percent in July, pushing the annual rate to 36.1 percent over the last three months; in Miami the increase was 2.7 for a 35.1 percent annual rate over the last three months; and in Los Angeles the rise was 1.6 percent for a 22.9 percent annual rate of increase in the last three months.

In all of these cities, the bottom tier of the housing market was especially depressed. It is likely that investors are buying ahead of demand, leading to more rapid price increases. This creates the possibility of mini-bubbles. While a modest price drop in a portion of the market in these and other cities will not have substantial repercussions for the national economy, it may disappoint tens of thousands moderate-income homebuyers who will discover that they paid too much for a home.

The other data on the housing market continue to be overwhelmingly positive. If anything, the 4.8 million pace for existing home sales reported for August is somewhat above trend. (The annual rate of sales was around 3.5 million in the mid-90s, before the bubble started driving the market.) The inventory of unsold homes is just over six months’ supply at the current sales rate. A continuing flow of distressed sales into the market is not likely to radically change the picture.

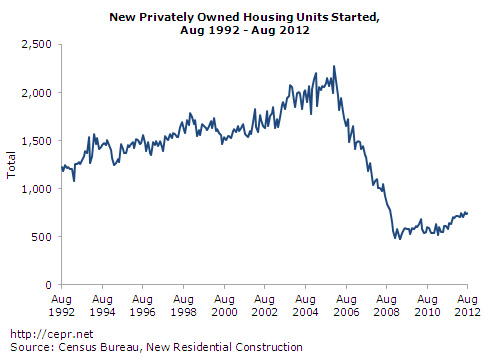

While both sales rates and prices are pretty much back to their trend levels, construction remains far below trend; although, even here the picture is improving. The rate of 750,000 starts reported in August is 29.1 percent above the rate from a year ago. With the vacancy rate falling back sharply from its peaks in 2009 and 2010, starts are almost certain to continue to rise. Residential construction can be expected to provide a substantial boost to the economy through the rest of 2012 and through 2013. Starts are not likely to get back to the 2 million peaks of the bubble years, but we will likely get to at least a 1.3-1.4 million range by 2014.