November 07, 2013

November 7, 2013 (GDP Byte)

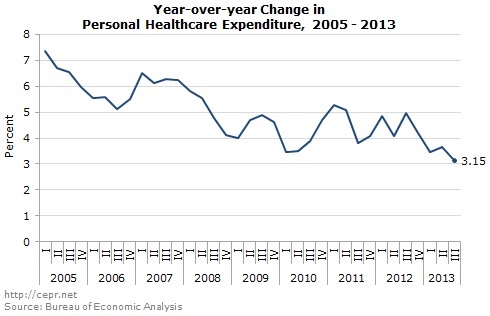

Health care costs fell slightly over the last year as a share of GDP.

A sharp jump in inventory accumulation raised third quarter GDP growth to 2.8 percent, up from 2.5 percent in the second quarter. However, the growth rate of final sales was just 2.0 percent, virtually identical to the 2.1 percent rate in the second quarter.

The only components of final demand that showed much strength in the quarter were construction, both residential and non-residential. Residential construction grew at a 14.6 percent annual rate, its fifth consecutive quarter of double digit growth. It added 0.43 percentage points to growth in the quarter. It is virtually certain that residential construction will continue to grow in the 4th quarter and through 2014; however, the rate is likely to slow considerably. Non-residential construction grew at a 12.3 percent annual rate, adding 0.32 percentage points to growth. Construction in the non-residential sector is considerably more erratic. It cannot be counted on to make an important contribution to growth in future quarters.

Equipment investment actually fell at a 3.7 percent annual rate, subtracting 0.21 percentage points from growth in the quarter. This drop will be reversed in future quarters, but investment growth is likely to be modest unless the economy picks up for other reasons.

Consumption grew at a modest 1.5 percent rate, the slowest pace since the second quarter of 2011. Growth in consumption was held down by a growth rate of just 0.1 percent in services, the weakest growth since a drop of 1.2 percent in the second quarter of 2009. One factor contributing to slow reported growth was a drop 11.2 billion in spending on housing and utilities which subtracted 0.28 percentage points from growth in the quarter. This component is erratic and likely reflects less than normal utility usage due to better than normal weather.

Another important factor slowing spending on services was continued restraint in health care spending. Real spending grew at just a 0.9 percent annual rate in the quarter. Measured as a share of nominal GDP, spending on health care services has actually fallen slightly over the last year. If this trend continues, it will eliminate most of the long-term budget shortfall when the Congressional Budget Office incorporates it into its projections.

The goods component of consumption grew at a rapid 4.3 percent annual rate driven largely by car purchases. This growth is likely to slow modestly in coming quarters. Overall, consumers continue to spend a relatively high share of their income with the saving rate at just 4.7 percent, well below its pre-bubble average.

Trade was a modest positive for growth adding 0.31 percentage points. A 4.5 percent rise in exports more than offset a 1.9 percent increase in imports. The weak growth in imports was likely an aberration that will not be repeated, which means that trade cannot be counted on for making a positive contribution to growth in future quarters.

The government sector also made a small positive contribution to growth, adding 0.04 percentage points to the quarter’s growth rate. A 1.5 percent growth rate in state and local spending was more than enough to offset a 1.7 percent decline in spending by the federal government. Most of the decline came in the non-defense sector, which shrank at a 3.3 percent rate in the quarter.

The data continue to show no evidence of inflation. The GDP price index grew at a 1.9 percent annual rate in the quarter. It is up by just 1.3 percent from its year ago level. There is no sector in which inflation appears to be accelerating. It would be unfortunate if the spurt in investors misled the public about the strength of the economy. Given the government shutdown and the almost certain slowing of inventories in the fourth quarter, 2013 is virtually guaranteed to be the third consecutive year with growth of 2.0 percent or less. With the growth rate of potential GDP in the 2.2-2.4 percent range, this means that the economy is continuing to fall further behind its potential level of output more than 4 years into the recovery.