January 30, 2014

January 30, 2014 (GDP Byte)

Inventories grew at the fastest pace ever in the fourth quarter.

The economy grew at a 3.2 percent annual rate in the fourth quarter following a 4.1 percent rise in the third quarter. This is the best two quarter performance since the fourth quarter of 2011 and the first quarter of 2012 when the economy grew at 4.9 percent and 3.7 percent annual rates, respectively. Consumption grew at a 3.3 percent rate, accounting for 70.6 percent of the growth in the quarter. Investment continued the weakness it has shown over the last two years, growing at just a 3.8 percent annual rate. Somewhat surprisingly, housing fell at a 9.8 percent annual rate, its first decline since the third quarter of 2010.

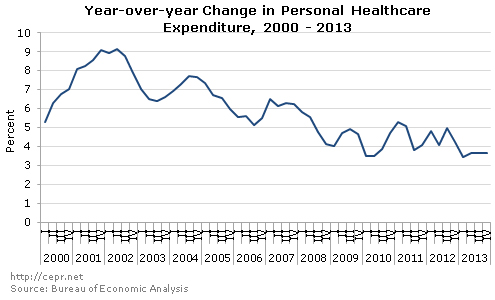

Within consumption, the category of food services and accommodations grew at a 10.2 percent annual rate and accounted for 13.2 percent of the growth in the quarter. This category, together with food sold in stores, accounted for almost 19.0 percent of 4th quarter growth. Health care spending continues to be contained, with consumer spending on health care services rising at just a 2.7 percent rate over the last year.

The personal saving rate for the quarter was 4.3 percent, the second lowest in the recovery and well below the 10 percent average for the post-war era and even for the stock bubble driven decade of the 1990s. It is also worth noting that savings is measured out of income-side GDP rather than output side. In recent quarters, income-side GDP has run well ahead of output side GDP. Insofar as this gap represents an error in measurement on the income side — for example if capital gains are showing up as income — this would imply the true saving rate is considerably lower than the reported rate.

While non-residential investment is largely back to its pre-recession share of GDP, reports of increased business confidence are not being reflected in increased investment. Non-residential investment is up by just 2.1 percent over its year-ago level. Nominal spending on information processing equipment actually fell at a 6.7 percent annual rate in the quarter. (The fall in real terms was smaller, due to a drop in prices.)

The drop in housing construction was a sharp turnaround from the last five quarters in which housing had growth at a double-digit rate and contributed an average of 0.38 percentage points to GDP growth. The decline was driven by a sharp drop in the “other structures” category, which followed a big increase in the third quarter. This will not be repeated in future quarters, so housing will again to add growth, but probably not as much as in 2012 and 2013.

After rising rapidly in third quarter, the pace of inventory accumulation accelerated even more in the fourth quarter to a $127.2 billion annual rate, the fastest pace on record. This will mean less growth in future quarters, as slower accumulations subtract from growth.

Imports were little changed in the quarter, while exports grew at 11.4 percent annual rate. As a result, trade added 1.33 percentage points to growth. Interestingly, the growth in goods exports sharply outpaced the growth in services exports: 15.1 percent compared to 3.4 percent. This was third consecutive quarter in which this has been the case.

Federal spending was a large drag on growth, contracting at a 12.6 percent annual rate. This reduced growth by 0.98 percentage points, as both defense and non-defense spending declined at double digit rates. State and local spending grew at a modest 0.5 percent pace, the third consecutive quarterly increase.

Inflation hawks will find no grounds for concern in this report with the GDP price index rising at a 1.3 percent annual rate. The core PCE rose at just a 1.1 percent rate.

Future quarters will almost certainly see sharp reversals in several components figuring prominently in this report. Housing will again contribute to growth, while the government sector will be a much smaller drag. On the negative side, consumer spending is likely to slow and imports will again grow. Also, slower inventory accumulation will be a drag on growth. The net effect should mean modest growth in the 2.5-3.0 percent range in 2014.