February 14, 2018

February 14, 2018 (Prices Byte)

By Dean Baker

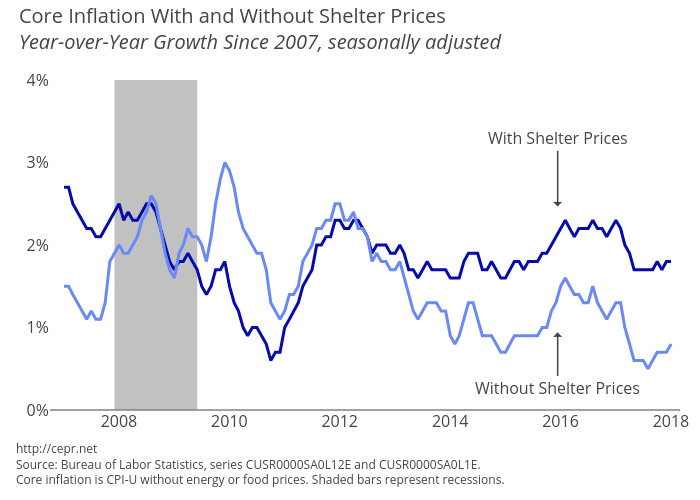

The core CPI, excluding shelter, rose just 0.8 percent over the last year.

A 3.0 percent jump in energy prices in January caused the overall Consumer Price Index (CPI) to rise by 0.5 percent in the month. This brought its year-over-year increase to 2.1 percent. However, core inflation remained modest, rising 0.3 percent in the month, with the year-over-year rate at just 1.8 percent.

Even this 1.8 percent rise is overwhelmingly due to the role of shelter. The core index, excluding shelter, has risen by 0.8 percent over the last year. There is no evidence whatsoever of accelerating inflation in the core index outside of shelter. Since the rise in the price of shelter is primarily the result of the limited supply of land in desirable areas, the inflation in this sector is not the result of conventional inflationary dynamics.

The outsized role of housing in driving inflation can be seen clearly from the regional prices indices. The year-over-year rate of inflation in both the Northeast and the Midwest was just 1.6 percent. It was 1.8 percent in the South. However, in the West it was 3.1 percent. This more rapid inflation reflects the sharp rise in rental prices in cities such as Los Angeles, San Francisco, Portland, and Seattle.

Outside of housing, inflation remains well contained in most other core sectors. New car and truck prices — which had shown some spikes in the fall, likely due to replacement demand following the hurricanes — fell 0.1 percent in January. They are down 1.3 percent over the last year. Used car prices rose 0.4 percent, but are still down 0.6 percent over the last year.

Auto insurance remains a problem, with the price up 1.3 percent in January. Over the last year insurance prices are up 8.5 percent. This rise in auto insurance prices added almost 0.3 percentage points to core inflation rate over the last year.

Apparel prices jumped 1.7 percent in January, likely due to seasonal factors. They are down 0.7 percent over the last year. Prescription drug prices fell 0.2 percent in January and are up just 2.4 percent over the last year. It is important to remember that most of the rising cost of drugs is due to new expensive drugs, which are not picked up in the CPI.

The overall medical care index is up just 2.0 percent year-over-year, indicating that costs in the sector mostly remain under control. Education costs also rose 2.0 percent over the last year, with the index rising just 0.1 percent in January. College textbook prices are down 0.7 percent over the last year.

It is interesting to see that the index for airfares fell 0.6 percent in January and is down by 5.1 percent over the last year. This is somewhat surprising, given both the extraordinary consolidation in the industry in recent years and the jump in energy prices, which means higher costs for jet fuel. It is possible that the index is not adequately picking up deteriorations in quality, like more crowded seating and larger penalties for changing flight plans.

The price index for fast food restaurants (limited service restaurants) rose 0.5 percent in January and is up 2.9 percent over the last year. This is likely due, in part, to higher minimum wages in many states and cities, which went into effect in January. Even if this is the case, the rising cost of fast food is not a major contributor to the overall inflation rate. With overall food prices rising 1.7 percent over the last year, the 1.2 percentage point gap with fast food prices would contribute a bit more than 0.03 percentage points to the overall rate of inflation over the last year.

Apart from the jump in energy prices, the rest of the CPI shows no evidence of accelerating inflation. If we remove housing from the core index, the inflation rate remains under 1.0 percent. It would be even lower without the factors driving up car insurance prices. The inflation rate remains well below the Federal Reserve’s 2.0 percent target for the core personal consumption expenditure deflator (which is 0.2–0.3 percentage points lower than the CPI), and it is not clear that it is moving higher at this point.