February 25, 2019

February 25, 2019, Eileen Appelbaum

Federal Trade Commission

Office of the Secretary

Constitution Center

400 7th Street SW

Washington, DC 20024

Re: Proposed Consent Agreement in the Matter of Staples/Essendant, Inc., File No. 1810180

Comment of Dr. Eileen Appelbaum, Co-Director and Senior Economist, Center for Economic and Policy Research

Dear Sir or Madam:

The proposed merger between Staples and Essendant has received much well—deserved criticism for failing to fully take into account the significant potential direct and indirect anti—competitive effects of this merger. While agreeing with this criticism, this comment focuses on an issue that may not have received full scrutiny by the Federal Trade Commission (FTC) in reaching its decision in the proposed consent agreement: the special circumstances surrounding a merger when one of the entities is a private equity-backed company. Staples is private equity-backed as a result of its acquisition by Sycamore Partners Management, Essling Capital, and HarbourVest Partners through a $6.9 billion leveraged buyout on September 12, 2017. Acquisition by these firms increased Staples’ debt by $2.931 billion as it is Staples, not the investment firms that acquired it, that is responsible for repaying the debt incurred to finance the transaction.[1]

Private equity-owned companies differ from publicly-traded companies in important but not well-understood respects that may impinge upon decisions regarding mergers. The purpose of this comment is to bring these special characteristics of PE-owned companies to the attention of the FTC for use in its deliberations about this and similar proposed mergers. [2]

Private Equity’s Growing Share of Mergers and Acquisition

Private equity firms have a long history of engagement in M&A activity. This has accelerated in the recent period. Between 2010 and 2015, PE firms sponsored about a quarter of mergers and acquisitions (25.6 percent in 2010 and 25.4 percent in 2015). The share of PE-sponsored mergers and acquisitions has risen dramatically in the last three years, reaching 34.2 percent in 2018. The median M&A deal size has doubled in the past eight years to $60.0 million in North America, with much of the increase occurring in the last two years. The growth in deal size can be attributed in part to the rising share of private equity in overall M&A activity. The median size of private equity M&A deals in 2018 was $140.0 million, nearly triple the overall median deal size.[3]

The so-called “buy and build” strategy has become a staple of private equity investing in the period since the financial crisis as organic growth has proven more difficult to achieve. PE firms have turned to acquisitions—add-ons to their original portfolio companies—as a means to increase revenue and earnings as they prepare for a successful exit from their original investments.

PitchBook, a widely respected resource for information on developments in the private equity space, expects PE’s share of mergers and acquisitions to rise further as it assets under management (AUM) continues to grow.[4]

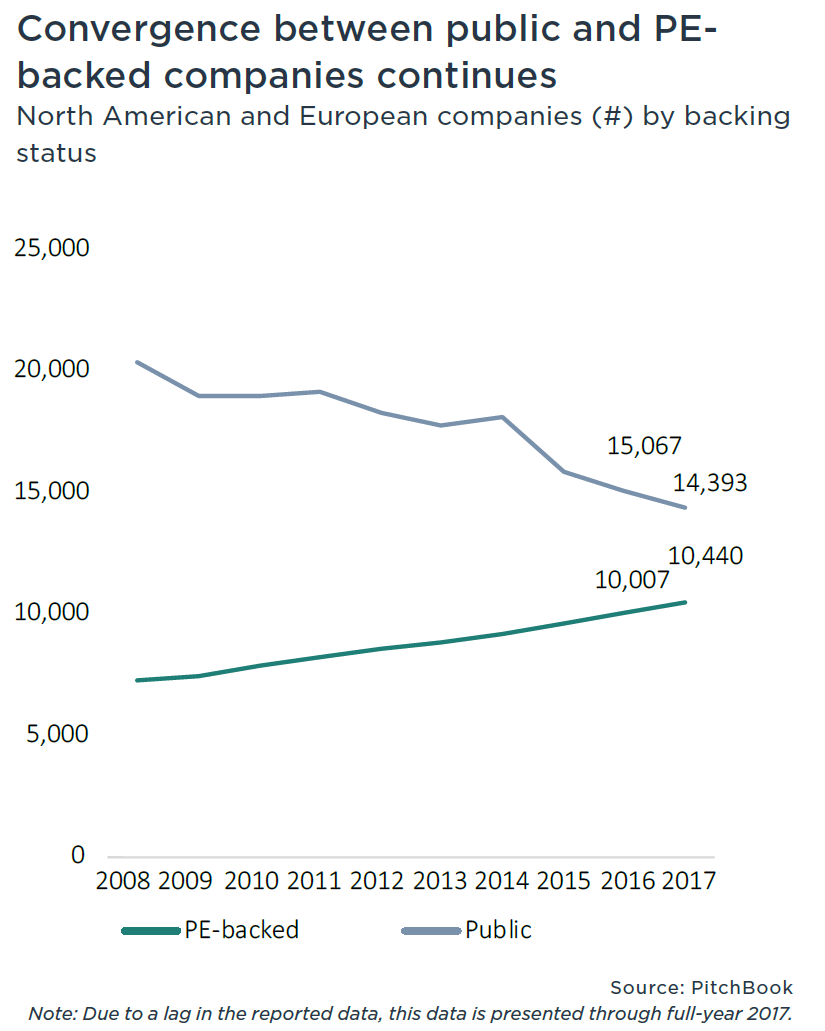

Not only is private equity engaged in acquiring companies via M&A activity, but private equity-owned portfolio companies have become increasingly attractive targets in M&A activities. In 2017 (the most recent year for which we have 12 months of data), 42 percent of companies that were the target of a completed merger or acquisition were private equity backed (see Figure).[5]

PE Mergers and Acquisitions Require Closer Scrutiny by Antitrust and Regulatory Agencies

Private Equity Business Model Differs Markedly from Publicly Traded Corporations

The private equity business model differs from that of publicly-traded companies in ways that suggest that M&A activity by PE sponsors warrants close attention from the FTC.

Private equity firms prefer to hold portfolio companies for three to five years before exiting these investments via an IPO or sale to a publicly—traded corporation. When they buy an established, profitable company, they use the company’s assets as collateral for debt used to acquire the company — typically financing 70 percent of the purchase price with this debt, less in smaller companies with fewer assets. The 30 percent equity stake is provided by a fund that is sponsored by the PE firm. The acquired company — not the PE fund that buys it or the PE firm that sponsors the fund – is responsible for repaying this debt. The PE fund consists of the general partner (a committee of partners and principals of the PE firm) and limited partner investors (pension funds, endowments, sovereign wealth funds, wealthy individuals). Limited partners typically provide 98 percent of the equity in the PE fund and the PE firm via the general partner provides 2.0 percent (though a few PE firms provide as much as 10.0 percent). Principals in the PE firm may take seats on the board of directors of the acquired company (referred to as a “portfolio company”’), but in any case, they appoint the company’s board members. The PE firm typically asks the CEO of the acquired company to come up with a 100-day plan for how they will meet performance goals set by the PE firm. This often results in companies acquired by private equity squeezing workers – cutting hours, reducing compensation, or even firing workers. Those CEOs that either can’t or won’t meet the PE firm’s expectations are quickly replaced with a CEO willing to do the PE firm’s bidding. PE firms typically have a cadre of executives they can turn to, whose loyalty is to the PE firm and not to the company they have been hired to manage.

It is typical for the PE firm to enter into a Management Services Agreement with the acquired company that requires the portfolio company to make annual “monitoring fee” payments directly to the PE firm (not the PE fund) and to pay all transactions costs associated with the acquisition of other companies, including time spent by PE firm partners working on the transaction. In 2018, 58.0 percent of private equity firms required their portfolio companies to pay monitoring fees; 85.5 percent required payment of transactions fees.[6] These are not arms—length transactions. The board of directors may require the portfolio company to engage in a dividend recapitalization – i.e., to issue junk bonds and use the proceeds to pay a dividend to its shareholders, which consists of the PE firm (via the General Partner) and the limited partner investors in the PE fund that owns it. It may also require the company to sell off assets, such as real estate. Proceeds of these sales will be used to repay any loans for which the asset was used as collateral. Typically, the asset is sold for more than the loan, with the difference going to the PE fund or, sometimes, the PE firm. The portfolio company now has to lease the real estate (or other assets) that it previously owned, and is saddled with rent payments. In all of these ways, the private equity firm transfers resources of the portfolio company to itself. As a result, the portfolio company may lack resources to respond to business cycle fluctuations, changes in customer preferences, or the introduction of major new technologies.

The high debt placed on the portfolio company at the time of purchase boosts the profit the PE fund makes when it successfully exits this investment. The PE firm via the general partner receives 20.0 percent of any gain, despite having contributed only 2.0 percent of the equity. In the case in which the acquisition is financed with 70.0 percent debt, the PE firm has very little of its own funds at risk, just 0.6 percent of the purchase price (.02 x .30 = .006).

The PE model contrasts sharply with how publicly-traded companies operate. Shareholders in publicly-traded companies expect them to be going concerns that create shareholder value for the foreseeable future. CEOs of these companies are hired by independent boards and typically have a substantial history of related management experience and success. None of the actions just described are available to a publicly-traded company. Public shareholders would flee a company that loaded itself with debt equal to 70.0 percent of its enterprise value. They would also look askance at the practice of issuing junk bonds to pay dividends. The parent firm cannot charge departments or subsidiaries fees for monitoring their activities and can’t require departments or subsidiaries to bear the costs of acquisitions the firm makes. The firm may engage in sale-lease-back transactions, but the proceeds of such sales are then available to the firm itself for investments in improving operations or other business needs—unlike the PE case, in which the portfolio company does NOT receive the proceeds of the sale and does not have those funds available to improve its performance.

There are, thus, substantial differences between the operation and motivation of PE-owned firms and publicly-traded firms. The low risk – high reward nature of the PE business model for the PE firm is a classic case of moral hazard. It results, as is typical in such cases, in excessive risk taking by the PE firm—often to the detriment of the portfolio company, its workers, creditors and customers. Portfolio companies face a high risk environment as a result of the risks taken on its behalf by the PE firm.

The original 100-day plan may be based on overly optimistic assumptions about the state of the economy, the direction of prices, or other conditions necessary to operate a highly leveraged company at a profit. An economic downturn or the introduction of a disruptive technology may upset plans for repayment of debt. High debt loads leveraged on acquired companies, together with the lack of responsibility for repayment of this debt by either the PE fund or the PE firm, may leave the private equity owners indifferent to the portfolio company’s inability to make scheduled payments on its debt. The threat of bankruptcy looms large in such circumstances.

The opaqueness of the operations of private equity firms—abetted by the lack of transparency in their famously private business dealings—provides opportunities for self-dealing that are utilized by some private equity firms to profit even as their portfolio companies spiral into bankruptcy. Examples of such actions in cases of bankruptcy are well documented in the bankruptcy proceedings.[7]

Regulators evaluating a merger or acquisition by a private equity owned company may be unaware of these differences in the business models of publicly-traded and private equity- owned companies. As a result, these regulators may fail to fully consider key aspects of the acquisition of a company by a PE-owned business, or to fully investigate the PE firm’s plans and intentions. Possibilities that the merger may increase the risk of bankruptcy need to be entertained. The possibility that a looming threat of bankruptcy may lead the PE firm to mine the assets of the failing company to extract value at the expense of creditors or to violate firewalls and engage in unfair competitive practices in the markets in which the company operates need to be examined.

Private Equity Uses Excessive Amounts of Debt in Leveraged Buyouts

During the 2008-09 financial crisis, highly leveraged firms experienced a disproportionate share of bankruptcies.[8] Leverage declined during and in the immediate aftermath of the crisis, but soon began rising to high levels again. In response, the Federal Reserve Board, the Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency issued guidance to banks in March 2013 covering transactions characterized by a borrower with a high degree of financial leverage.[9] In light of the problems that resulted from tremendous growth in the volume of leveraged lending prior to the 2008 financial crisis, the guidelines noted (p. 7):

“Generally, a leverage level after planned asset sales (that is, the amount of debt that must be serviced from operating cash flow) in excess of 6X Total Debt/EBITDA raises concerns for most Industries.”

Initially, this effort by regulators to tamp down on bank financing for takeovers with high levels of debt put a crimp in private equity’s ability to over-leverage companies acquired for PE fund portfolios.[10] PE firms responded by establishing affiliates to make loans that exceeded the 6X earning guidance of the regulators,[11] and the regulators themselves soon walked the guidance back. The current administration has made it clear that the guidelines were suggestions, not rules, and would not be enforced.

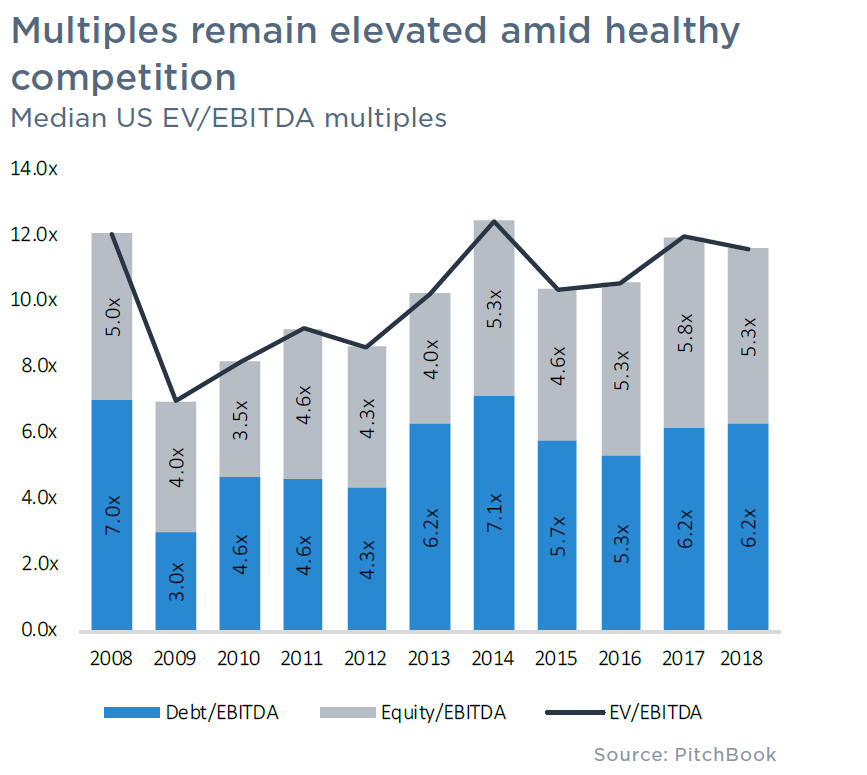

The result, as this figure shows, has been a return to the use of risky levels of leverage. [12]

The median price is the price paid for a company that falls in the middle of all prices paid to acquire companies in a given year. Half of the deals for companies are priced above the median price, and half are priced below. As can be seen in the figure above, leverage on the median—priced company was 7.0X EBITDA in 2008, fell to between 3.0X and 4.6X in 2009 to2012, reached 7.1X in 2014, and was 6.2X in both 2017 and 2018. These are very large amounts of debt loaded onto acquired companies as median prices paid to acquire companies were 11.9X and 11.5X EBITDA, respectively, in those two years. The proportion of deals priced above 10.0X EBITDA in 2018 was 61.4 percent, the highest share ever recorded. Looking forward to 2019, PitchBook expects a pickup in high-priced transactions as PE funds need to spend down high levels of “dry powder”—commitments from limited partners in the fund that have not yet been deployed.[13]

PE funds are willing to overpay for acquisitions because they face the prospect of having to return dry powder that is not spent in the first half of a PE fund’s life (in the first five or six years following the launch of the fund) to the LP investors in the fund, along with the management fees collected on those capital commitments. This is something PE firms prefer to avoid, even if it means paying a price to acquire a company that is not justified by the portfolio company’s earnings.

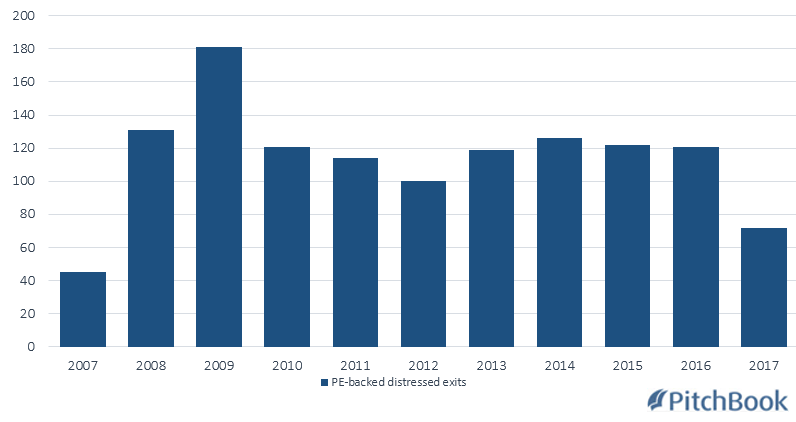

PitchBook also reviewed exits from investments in portfolio companies accounted for by these companies going bankrupt or out of business.[14]

In most years, about 120 firms meet this fate. In 2016, this accounted for 8.2 percent of all exits.[15] But the number fell by about half in 2017 and 2018 (the latter year is not shown in the graph). The decline can be attributed to generally low leverage ratios (below 5 for the median PE deal) in the years in which companies that exited in the last two years were acquired. Distressed exits can be expected to increase going forward, as leverage ratios have risen above 6 in recent years. (See previous figure.)

Add-Ons: PE-Backed Companies Buying Up Smaller Competitors

The high prices paid for portfolio companies not only puts these companies at risk in case of a downturn in economic activity, it also undermines the ability of PE funds to exit investments in these companies at a profit. PE firms have responded with a “buy and build” strategy that consists of horizontal mergers between the original portfolio company—now referred to as the “platform company” —and its smaller rivals, which can be acquired at prices far less than 10X EBITDA. This dilutes the overall purchase price of the expanded company, facilitating a profitable exit. PitchBook reports[16] (p.5) that:

“Many buyout shops are utilizing the now-ubiquitous buy-and-build strategy with success.… PitchBook research on the effects of add-on investing on fund performance show a clear trend of outperformance by firms that used a higher rate of add-ons.”

PitchBook’s research department analyzed the growing use of add-ons by PE firms.[17] They explain the growing prevalence of such acquisitions by the fact that the smaller and less expensive add-ons enable the PE firm to “blend down” the aggregate acquisition multiple and enable it to exit at a higher profit when the expanded company is sold or taken public. The study found that PE funds that complete more add-ons generate better cash-on-cash returns, have higher internal rates of return (IRR) performance, and have a disproportionate share (36.3 percent) of top-quartile funds. PitchBook reports (p.1) that:

“Nearly 30.0 percent of PE-backed companies now undertake at least one add-on acquisition, compared to less than 20.0 percent that did so in the early 2000s…. More than 25.0 percent of add-ons are now being acquired by platforms with at least five total add-on deals.

Soundcore Capital Partners, a new private equity firm, completed 20 add-ons across just two platforms shortly after the firm was founded. Soundcore is quoted (p. 2) as describing its strategy as pursuing healthy acquisitions in “highly-fragmented, niche markets” and utilizing the platform’s “unlimited potential to expand into hundreds of smaller, local territories … through multiple add-on acquisitions.”

These add-on acquisitions are generally small enough to fly under the radar of anti-trust regulators. The threshold below which companies do not need to provide the Federal Trade Commission with a premerger report was established at $50 million in 1976. It is indexed to the growth of GDP and on February 28, 2018, it was $84.3 million.[18]

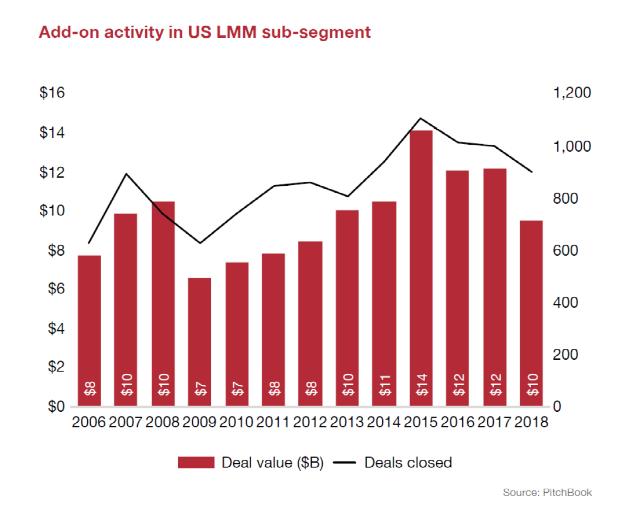

A recent report by Abacus Finance, using PitchBook data, examines the annual number of add-ons by PE firms of companies with enterprise values below $50 million in every year from 2006 to 2018. The number peaked in 2015 at over 1,100; it has declined since, but remains robust. As can be seen in the figure below, thousands of companies in what is referred to as the sub-$50 million segment of the lower middle market (LMM) have been acquired as add-ons to PE-owned platform companies.[19]

These acquisitions, while too small individually to come to the attention of the FTC, may greatly expand the size of the original platform company and its dominance in a product line or regional market. This should trigger a careful review by regulators when the enlarged platform company undertakes a merger or acquisition or is the target of such activity to be sure the platform company has not gained considerable market power via add-ons. Prior add-on activity may constitute a post-merger threat to the efficient allocation of resources — and to efficient market outcomes.

Conclusion

Private equity firms’ involvement in M&A activity has increased dramatically in recent years. Large mergers and acquisitions that involve a PE-backed company, either as the acquiring company or as the target, warrant special scrutiny by anti-trust regulators. The PE business model is likely to be unfamiliar to most regulators, and its unique features have implications for its post-merger behavior and for markets in which PE platform companies compete. PE firms’ use of high levels of leverage and their willingness to overpay for portfolio companies increases the risk of bankruptcy of the merged companies and raises the probability that the post-merger conditions in the market in which they operate will look different from what regulators anticipated when the merger was approved. Horizontal acquisitions of smaller companies to reduce the aggregate purchase price of the expanded platform company may lead to its dominance in particular product markets or geographic regions, and may affect the competitiveness of markets in which these companies operate. While each of these add-on acquisitions was too small to come to the attention of regulators at the time they occurred, a merger proposed by the now-much expanded platform company should include a look-back at these earlier transactions and their likely effects post-merger.

Eileen Appelbaum

Co-Director and Senior Economist

Center for Economic Policy and Research (CEPR)

1611 Connecticut Ave, Suite 400

Washington, DC 20009

[1] PitchBook, “Staples: Private Company Profile,” Last Updated 17—Jan—2019 (requires subscription).

[2] Eileen Appelbaum is Co—Director and Senior Economist at the Center for Economic and Policy Research. She is coauthor with Rosemary Batt of Private Equity at Work: When Wall Street Manages Main Street. The book was selected by the Academy of Management as one of the four best books of 2014 and 2015. https://www.russellsage.org/publications/private—equity—work

[3] PitchBook 2018 Annual M&A Report, p.7. https://files.pitchbook.com/website/files/pdf/PitchBook_2018_Annual_MA_Report.pdf

[4] Ibid.

[5] Ibid., p. 11

[6] PitchBook 2018 Annual Global PE Deal Multiples, p. 3.

[7] See detailed discussion of the bankruptcy of the Mervyn’s department store chain in Eileen Appelbaum and Rosemary Batt, Private Equity at Work: When Wall Street Manages Main Street, NY: Russell Sage Press, 2014. https://www.russellsage.org/publications/private—equity—work See also analysis of bankruptcies of private equity—owned supermarket chains in the last three years in Rosemary Batt and Eileen Appelbaum, “Private Equity Pillage: Grocery Stores and Workers at Risk,” The American Prospect, October 26, 2018.

https://prospect.org/article/private—equity—pillage—grocery—stores—and—workers—risk

[8] Edie Hotchkiss, David C. Smith and Per J. Str?mberg, “Private Equity and the Resolution of Financial Distress,” Working Paper, July 2012. www.law.uchicago.edu/files/filesStromberg.pdf (accessed February 13, 2014);

[9] Federal Reserve Board, the Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency, Interagency Guidance on Leveraged Lending, March 21, 2013.

[10] Gillian Tan, “Buyout Firms Feel Pinch From Lending Crackdown,” Wall Street Journal, March 25, 2015. https://www.wsj.com/articles/buyout—shops—feel—pinch—from—lending—crackdown—1427304125; Lauren Tara LaCapra, Greg Roumeliotis and Michelle Sierra, “Banks Deny KKR Buyout Loan amid Regulatory Crackdown,” Reuters, May 29, 2014. http://www.reuters.com/article/2014/05/29/us—kkr—loan—idUSKBN0E92BS20140529?feedType=RSS&feedName=businessNews

[11] Miriam Gottfried and Rachel Louise Ensign, “The New Business Banker: A Private Equity Firm,” Wall Street Journal, August 12, 2018. https://www.wsj.com/articles/the—new—business—banker—a—private—equity—firm—1534075200

[12] PitchBook 2018 Annual US PE Breakdown, p. 4.

[13] Ibid., p. 4.

[14] Lewis, Adam, “PE—Backed Distressed Exits in Freefall,” PitchBook, February 23, 2018. https://pitchbook.com/news/articles/pe—backed—distressed—exits—in—freefall

[15] PitchBook 2018 Annual US PE Breakdown, p. 11.

[16] Ibid, p. 5.

[17] PitchBook 3Q 2018 Analyst Note, Additive Dealmaking Part II: An analysis of add-ons effect on fund performance, 2018. https://files.pitchbook.com/website/files/pdf/PitchBook_3Q_2018_Analyst_Note_Additive_Dealmaking_Part_II.pdf

[18] Federal Trade Commission, HSR Threshold adjustments and reportability requirements for 2018. https://www.ftc.gov/news—events/blogs/competition—matters/2018/02/hsr—threshold—adjustments—reportability—2018

[19] Abacus Finance, “Breaking Down PE’s Push into the Lower Middle Market, A Review of Key Dynamics in the Lower Middle Market,” 1Q 2019. http://static1.1.sqspcdn.com/static/f/915290/28080234/1550194988397/Abacus_Finance_Breaking_Down_PE_Push_Into_Lower_Middle_Market.pdf?token=pHZsnq2FC3oxUlyfeq0F7h0IvJs%3D