The NYT had an article featuring employers complaining that they couldn’t get low-cost immigrant labor. The piece focuses on the H-2B visa program which allows a limited number of foreign workers to come into the United States temporarily to work at low paying jobs such as restaurant work and housekeeping.

In particular, the article highlights the concerns of the two owners of landscaping businesses in the Denver area, Rhonda Fox, who owns a family business and Phil Steinhauer, who owns a larger business. Both complain that the limited number of foreign workers available under the visa program is hurting their business. They complain that, because of Denver’s low unemployment rate and highly educated workforce, they are unable to get workers at the $15 an hour pay rate they offer.

The piece explains:

“Landscape work is harsh. Digging in the dirt and heaving equipment in blistering heat produces aching backs and raw hands. Low-skilled workers can earn a similar wage making a sandwich or working in an air-conditioned warehouse.

“‘We put a $5,000 ad in The Denver Post, and we didn’t have one applicant,’ Ms. Fox said. Paying a wage high enough to attract local workers would put her out of business, she said, because her customers would balk at the resulting price increases.

“Like Ms. Fox and other landscapers, Mr. Steinhauer signed planting contracts with customers last year based on the assumption that his crews would earn roughly $15 an hour. ‘These are unskilled positions,’ he said. ‘Would you pay $50 to plant a bush in your garden?'”

Actually, some people would pay $50 to plant a bush in their garden, just as some people pay for chauffeurs, cooks, and nannies. The number of people who would hire such personal servants would obviously be much greater if we created a large supply of cheap foreign labor, but that would mean that the workers who currently hold these positions would earn much less money.

The NYT is apparently much more sympathetic to the relatively affluent employers who depend on cheap labor than the workers who would get less pay as a result of the competition. Unfortunately, its concern does not extend to those of us who have to go to doctors and dentists who must pay much higher prices for their services, because the government rigidly restricts the competition for these very highly paid workers.

The NYT had an article featuring employers complaining that they couldn’t get low-cost immigrant labor. The piece focuses on the H-2B visa program which allows a limited number of foreign workers to come into the United States temporarily to work at low paying jobs such as restaurant work and housekeeping.

In particular, the article highlights the concerns of the two owners of landscaping businesses in the Denver area, Rhonda Fox, who owns a family business and Phil Steinhauer, who owns a larger business. Both complain that the limited number of foreign workers available under the visa program is hurting their business. They complain that, because of Denver’s low unemployment rate and highly educated workforce, they are unable to get workers at the $15 an hour pay rate they offer.

The piece explains:

“Landscape work is harsh. Digging in the dirt and heaving equipment in blistering heat produces aching backs and raw hands. Low-skilled workers can earn a similar wage making a sandwich or working in an air-conditioned warehouse.

“‘We put a $5,000 ad in The Denver Post, and we didn’t have one applicant,’ Ms. Fox said. Paying a wage high enough to attract local workers would put her out of business, she said, because her customers would balk at the resulting price increases.

“Like Ms. Fox and other landscapers, Mr. Steinhauer signed planting contracts with customers last year based on the assumption that his crews would earn roughly $15 an hour. ‘These are unskilled positions,’ he said. ‘Would you pay $50 to plant a bush in your garden?'”

Actually, some people would pay $50 to plant a bush in their garden, just as some people pay for chauffeurs, cooks, and nannies. The number of people who would hire such personal servants would obviously be much greater if we created a large supply of cheap foreign labor, but that would mean that the workers who currently hold these positions would earn much less money.

The NYT is apparently much more sympathetic to the relatively affluent employers who depend on cheap labor than the workers who would get less pay as a result of the competition. Unfortunately, its concern does not extend to those of us who have to go to doctors and dentists who must pay much higher prices for their services, because the government rigidly restricts the competition for these very highly paid workers.

Read More Leer más Join the discussion Participa en la discusión

No one expects great insights from people who write columns for the Washington Post but Dana Milbank hit a serious low today when he referred to the fact that Representative Joseph Crowley took large amounts of money from the financial industry and other special interests as “largely non-ideological.” Those of us who don’t write columns for the Washington Post realize that campaign contributors are not in the charity business. They expect and generally get something in exchange for their money.

At the very least, they do not give money to people who they expect to push efforts to seriously harm their profits (which Dodd-Frank did not do) or to have them jailed when they break the law. They apparently felt confident that Crowley could be relied upon in these areas.

No one expects great insights from people who write columns for the Washington Post but Dana Milbank hit a serious low today when he referred to the fact that Representative Joseph Crowley took large amounts of money from the financial industry and other special interests as “largely non-ideological.” Those of us who don’t write columns for the Washington Post realize that campaign contributors are not in the charity business. They expect and generally get something in exchange for their money.

At the very least, they do not give money to people who they expect to push efforts to seriously harm their profits (which Dodd-Frank did not do) or to have them jailed when they break the law. They apparently felt confident that Crowley could be relied upon in these areas.

Read More Leer más Join the discussion Participa en la discusión

For folks who can remember all the way back to last fall, the promise was that a huge boom in investment would lead to more rapid productivity growth. Higher productivity would mean pay would be close to 10 percent higher than in the baseline scenario after a decade.

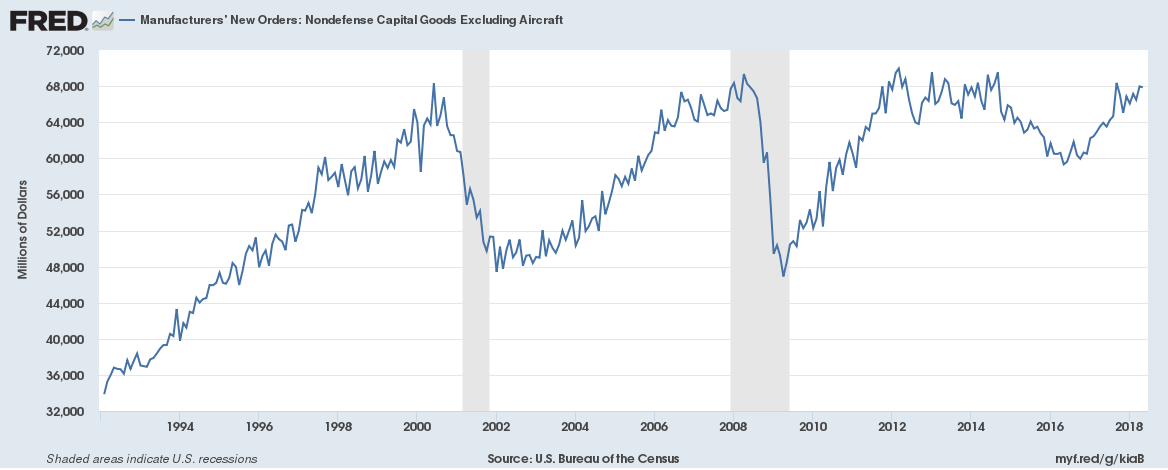

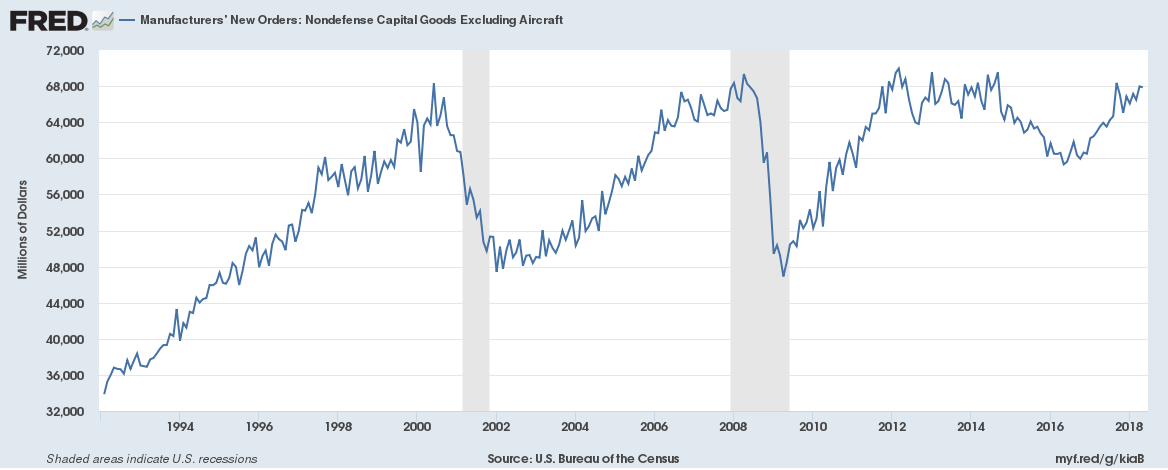

Well, the data disagree. We got new data on capital goods orders yesterday. Here’s the picture.

If you see a boom here since the tax cut, you may want to get the prescription on your glasses checked. It’s not a terrible story, but we’re still below the pre-recession peaks and even the levels reached during the horrible Obama years. Oh well, at least rich people got lots of money out of the deal.

By the way, the drop in capital goods orders in 2015 and 2016 was due to the plunge in world oil prices from $100 a barrel to $40 a barrel. Much of the increase in the last year and a half has been attributable to the partial recovery to $70 a barrel. I am not inclined to give the Trump administration the blame for higher gas prices, but I suppose if they insist, we can yell at them over $3 per gallon gas.

For folks who can remember all the way back to last fall, the promise was that a huge boom in investment would lead to more rapid productivity growth. Higher productivity would mean pay would be close to 10 percent higher than in the baseline scenario after a decade.

Well, the data disagree. We got new data on capital goods orders yesterday. Here’s the picture.

If you see a boom here since the tax cut, you may want to get the prescription on your glasses checked. It’s not a terrible story, but we’re still below the pre-recession peaks and even the levels reached during the horrible Obama years. Oh well, at least rich people got lots of money out of the deal.

By the way, the drop in capital goods orders in 2015 and 2016 was due to the plunge in world oil prices from $100 a barrel to $40 a barrel. Much of the increase in the last year and a half has been attributable to the partial recovery to $70 a barrel. I am not inclined to give the Trump administration the blame for higher gas prices, but I suppose if they insist, we can yell at them over $3 per gallon gas.

Read More Leer más Join the discussion Participa en la discusión

Mexico seems all but certain to elect Andrés Manuel López Obrador, a left-wing candidate, as president this weekend. One of the main factors is the contempt with which the Mexican public regards a political and economic elite that have run the country in a way that has produced few benefits for the bulk of the population. It is striking that this uprising is taking place almost a quarter century into the NAFTA era.

We were told endlessly by our elites that NAFTA was doing great things for Mexico. The Washington Post stands out as a particular villain in this story. It repeatedly ran fantasy pieces on how NAFTA was creating a thriving middle class in Mexico.

The Post even went full Trump back in 2007 when it made up the absurd claim that NAFTA had led Mexico’s economy to quadruple between 1998 and 2007. The actual figure was 84.2 percent. Unfortunately, the Washington Post has not been the only institution to make up numbers to promote NAFTA. The World Bank got into the act too.

A true assessment of the impact of NAFTA on Mexico would require considerable research, but just at the basic level of GDP growth it has been a disaster. Mexico’s per capita GDP has risen at just a 1.2 percent annual rate since 1993. This compares to a 1.5 percent annual rate in the United States. This means that the countries are even further apart economically today than when the agreement took effect in 1994, but don’t hold your breath waiting for the NAFTA proponents to acknowledge that it might not have been a good deal.

Mexico seems all but certain to elect Andrés Manuel López Obrador, a left-wing candidate, as president this weekend. One of the main factors is the contempt with which the Mexican public regards a political and economic elite that have run the country in a way that has produced few benefits for the bulk of the population. It is striking that this uprising is taking place almost a quarter century into the NAFTA era.

We were told endlessly by our elites that NAFTA was doing great things for Mexico. The Washington Post stands out as a particular villain in this story. It repeatedly ran fantasy pieces on how NAFTA was creating a thriving middle class in Mexico.

The Post even went full Trump back in 2007 when it made up the absurd claim that NAFTA had led Mexico’s economy to quadruple between 1998 and 2007. The actual figure was 84.2 percent. Unfortunately, the Washington Post has not been the only institution to make up numbers to promote NAFTA. The World Bank got into the act too.

A true assessment of the impact of NAFTA on Mexico would require considerable research, but just at the basic level of GDP growth it has been a disaster. Mexico’s per capita GDP has risen at just a 1.2 percent annual rate since 1993. This compares to a 1.5 percent annual rate in the United States. This means that the countries are even further apart economically today than when the agreement took effect in 1994, but don’t hold your breath waiting for the NAFTA proponents to acknowledge that it might not have been a good deal.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post had yet another hysterical piece about how “America’s Severe Trucker Shortage” could undermine the economy. While the piece features the usual complaints from employers about how they can’t get anyone to work for them no matter how much they pay, the data indicate they aren’t trying very hard. Here’s the inflation adjusted average hourly pay for production and non-supervisory workers in the trucking industry since 1990.

Real Hourly Wage: Truck Transportation, Production and Non-Supervisory Workers

Source: Bureau of Labor Statistics.

As the figure shows, the real hourly wage for workers in the industry is still more than 10 percent below its 1990 peak. While this would include some workers who are not truckers (for example, the people handling orders), truckers would be the bulk of employees and certainly, if their pay was rising rapidly it would show up in the data.

The piece includes this incredible assertion: “economists say, if competition for truckers pushes up prices so quickly that the country faces uncontrolled inflation, which can easily lead to a recession,” although it doesn’t actually name any economists who say anything like this. There are a bit less than 1.3 million production and non-supervisory workers in the trucking industry. Suppose their pay went up by an average of $20,000 a year, which would be more than a 40 percent increase. (The Bureau of Labor Statistics puts their average pay currently at just $46,000 a year.)

This huge pay increase would then add $20 billion to costs in the economy, or roughly 0.1 percent of GDP. (It’s a bit less than 10 percent of what we pay our doctors each year.) It would be very interesting to see if the Post could find any economist who would say that this would lead to “uncontrolled inflation.”

The Washington Post had yet another hysterical piece about how “America’s Severe Trucker Shortage” could undermine the economy. While the piece features the usual complaints from employers about how they can’t get anyone to work for them no matter how much they pay, the data indicate they aren’t trying very hard. Here’s the inflation adjusted average hourly pay for production and non-supervisory workers in the trucking industry since 1990.

Real Hourly Wage: Truck Transportation, Production and Non-Supervisory Workers

Source: Bureau of Labor Statistics.

As the figure shows, the real hourly wage for workers in the industry is still more than 10 percent below its 1990 peak. While this would include some workers who are not truckers (for example, the people handling orders), truckers would be the bulk of employees and certainly, if their pay was rising rapidly it would show up in the data.

The piece includes this incredible assertion: “economists say, if competition for truckers pushes up prices so quickly that the country faces uncontrolled inflation, which can easily lead to a recession,” although it doesn’t actually name any economists who say anything like this. There are a bit less than 1.3 million production and non-supervisory workers in the trucking industry. Suppose their pay went up by an average of $20,000 a year, which would be more than a 40 percent increase. (The Bureau of Labor Statistics puts their average pay currently at just $46,000 a year.)

This huge pay increase would then add $20 billion to costs in the economy, or roughly 0.1 percent of GDP. (It’s a bit less than 10 percent of what we pay our doctors each year.) It would be very interesting to see if the Post could find any economist who would say that this would lead to “uncontrolled inflation.”

Read More Leer más Join the discussion Participa en la discusión

In a period of record low productivity growth Thomas Friedman tells us the robots are taking all the jobs. Hey, no one ever said you had to have a clue to write for the New York Times. Here’s the punch line:

“From 1960 to 2000, Quartz reported, U.S. manufacturing employment stayed roughly steady at around 17.5 million jobs. But between 2000 and 2010, thanks largely to digitization and automation, ‘manufacturing employment plummeted by more than a third,’ which was ‘worse than any decade in U.S. manufacturing history.'”

The little secret that Friedman apparently has not heard about is the explosion of the trade deficit, which peaked at almost 6 percent of GDP ($1.2 trillion in today’s economy) in 2005 and 2006. This matters, because the reason millions of manufacturing workers lost their jobs in this period was decisions on trade policy by leaders of both political parties, not anything the robots did. That changes the story of the collapse of political parties (the theme of Friedman’s piece) a bit.

Friedman’s confusion continues in the next paragraph:

“These climate changes are reshaping the ecosystem of work — wiping out huge numbers of middle-skilled jobs — and this is reshaping the ecosystem of learning, making lifelong learning the new baseline for advancement.

“These three climate changes are also reshaping geopolitics. They are like a hurricane that is blowing apart weak nations that were O.K. in the Cold War — when superpowers would shower them with foreign aid and arms, when China could not compete with them for low-skilled work and when climate change, deforestation and population explosions had not wiped out vast amounts of their small-scale agriculture.”

The reason that highly skilled workers are benefiting at the expense of less-educated workers is because we have made patent and copyright protection longer and stronger. It is more than a little bizarre that ostensibly educated people have such a hard time understanding this.

We have these protections to provide incentives for people to innovate and do creative work. That is explicit policy. Then we are worried that people who innovate and do creative work are getting too much money at the expense of everyone else. Hmmm, any ideas here?

Remember, without patents and copyrights, Bill Gates would still be working for a living.

One more item, China competes with “low-skilled” work in the United States and not with doctors and dentists because our laws block the latter form of competition. There was nothing natural about this one either. Yes, this is all in my [free] book Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer.

In a period of record low productivity growth Thomas Friedman tells us the robots are taking all the jobs. Hey, no one ever said you had to have a clue to write for the New York Times. Here’s the punch line:

“From 1960 to 2000, Quartz reported, U.S. manufacturing employment stayed roughly steady at around 17.5 million jobs. But between 2000 and 2010, thanks largely to digitization and automation, ‘manufacturing employment plummeted by more than a third,’ which was ‘worse than any decade in U.S. manufacturing history.'”

The little secret that Friedman apparently has not heard about is the explosion of the trade deficit, which peaked at almost 6 percent of GDP ($1.2 trillion in today’s economy) in 2005 and 2006. This matters, because the reason millions of manufacturing workers lost their jobs in this period was decisions on trade policy by leaders of both political parties, not anything the robots did. That changes the story of the collapse of political parties (the theme of Friedman’s piece) a bit.

Friedman’s confusion continues in the next paragraph:

“These climate changes are reshaping the ecosystem of work — wiping out huge numbers of middle-skilled jobs — and this is reshaping the ecosystem of learning, making lifelong learning the new baseline for advancement.

“These three climate changes are also reshaping geopolitics. They are like a hurricane that is blowing apart weak nations that were O.K. in the Cold War — when superpowers would shower them with foreign aid and arms, when China could not compete with them for low-skilled work and when climate change, deforestation and population explosions had not wiped out vast amounts of their small-scale agriculture.”

The reason that highly skilled workers are benefiting at the expense of less-educated workers is because we have made patent and copyright protection longer and stronger. It is more than a little bizarre that ostensibly educated people have such a hard time understanding this.

We have these protections to provide incentives for people to innovate and do creative work. That is explicit policy. Then we are worried that people who innovate and do creative work are getting too much money at the expense of everyone else. Hmmm, any ideas here?

Remember, without patents and copyrights, Bill Gates would still be working for a living.

One more item, China competes with “low-skilled” work in the United States and not with doctors and dentists because our laws block the latter form of competition. There was nothing natural about this one either. Yes, this is all in my [free] book Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer.

Read More Leer más Join the discussion Participa en la discusión

Okay, that is sarcastic. Of course the Washington Post wants to talk about the federal debt, but only part of the debt. It continually highlights debts and deficits. But borrowing to finance spending is only one way the government makes future commitments for taxpayers.

The government also obligates taxpayers by issuing patent and copyright monopolies. These monopolies, which allow companies to charge prices that can be ten or even a hundred times the free market price, are effectively privately collected taxes. The government grants these monopolies as an alternative to direct spending.

For example, the government could replace the roughly $70 billion a year that U.S. pharmaceutical companies spend on patent research with direct spending. The Washington Post would, of course, be very upset about the $70 billion increase in the budget deficit ($700 billion over the 10-year budget horizon).

However, this could save us around $380 billion a year in spending on prescription drugs, as prices fell to their free market level. Since the Post never mentions the obligations the government creates for taxpayers by granting patent and copyright monopolies, the savings from this sort of switch would never enter the equation in the Post’s budget pontification, only the costs.

It’s not very honest reporting, but hey, it’s the Washington Post. (And yes, this is all talked about in Rigged.)

Okay, that is sarcastic. Of course the Washington Post wants to talk about the federal debt, but only part of the debt. It continually highlights debts and deficits. But borrowing to finance spending is only one way the government makes future commitments for taxpayers.

The government also obligates taxpayers by issuing patent and copyright monopolies. These monopolies, which allow companies to charge prices that can be ten or even a hundred times the free market price, are effectively privately collected taxes. The government grants these monopolies as an alternative to direct spending.

For example, the government could replace the roughly $70 billion a year that U.S. pharmaceutical companies spend on patent research with direct spending. The Washington Post would, of course, be very upset about the $70 billion increase in the budget deficit ($700 billion over the 10-year budget horizon).

However, this could save us around $380 billion a year in spending on prescription drugs, as prices fell to their free market level. Since the Post never mentions the obligations the government creates for taxpayers by granting patent and copyright monopolies, the savings from this sort of switch would never enter the equation in the Post’s budget pontification, only the costs.

It’s not very honest reporting, but hey, it’s the Washington Post. (And yes, this is all talked about in Rigged.)

Read More Leer más Join the discussion Participa en la discusión

NPR’s Morning Edition had a segment interviewing economics reporter Jim Zarroli on Harley Davidson’s announcement that it would shift some production to Europe to get around tariffs imposed by the European Union in response to Trump’s tariffs. At one point, Zarroli comments that Trump imposed the tariffs in response to what he “sees” as unfair trade practices.

Actually, no one has any idea what Trump “sees,” meaning what he actually thinks. We do know what he says. It’s best to just report what Trump or other political figures say or do and not make assertions about their actual motives.

NPR’s Morning Edition had a segment interviewing economics reporter Jim Zarroli on Harley Davidson’s announcement that it would shift some production to Europe to get around tariffs imposed by the European Union in response to Trump’s tariffs. At one point, Zarroli comments that Trump imposed the tariffs in response to what he “sees” as unfair trade practices.

Actually, no one has any idea what Trump “sees,” meaning what he actually thinks. We do know what he says. It’s best to just report what Trump or other political figures say or do and not make assertions about their actual motives.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The Washington Post repeated a standard theme in reporting on Trump’s trade war with China, that our main concern is not the trade deficit but rather China’s alleged theft of our intellectual property. I have written about this issue before, but there is an important aspect that seems to have gone largely unmentioned, China is likely to have more at risk in this story than the United States.

Using the purchasing power parity measure (clearly the appropriate one for this issue), China’s economy is already 20 percent larger than the US economy. In a decade, it will be twice the size of the US economy. Given these facts, it is almost certain that China will be spending far more on research and creative work than the United States. This means that it will have far more to lose than the United States if there is no internationally agreed upon mechanism for sharing the cost.

This doesn’t mean stronger and longer copyright protection as our policymakers would insist. That is a great way to redistribute income upward, which has been a major goal of economic policy over the last four decades, but not a very efficient way to support innovation and creative work in the 21st century.

We can and should be looking to more modern mechanisms than these relics from the feudal guild system. (I have some ideas in chapter 5 of my [free] book Rigged.) However, the point is that China actually has more interest in a workable mechanism for sharing costs than the United States does. Anyone looking to benefit the US economy as a whole would be noting this point and the enormous leverage it gives us. On the other hand, if the goal is simpler to make Microsoft, Pfizer, and Disney richer, and then wring our hands over inequality, the current focus of policy makes sense.

The Washington Post repeated a standard theme in reporting on Trump’s trade war with China, that our main concern is not the trade deficit but rather China’s alleged theft of our intellectual property. I have written about this issue before, but there is an important aspect that seems to have gone largely unmentioned, China is likely to have more at risk in this story than the United States.

Using the purchasing power parity measure (clearly the appropriate one for this issue), China’s economy is already 20 percent larger than the US economy. In a decade, it will be twice the size of the US economy. Given these facts, it is almost certain that China will be spending far more on research and creative work than the United States. This means that it will have far more to lose than the United States if there is no internationally agreed upon mechanism for sharing the cost.

This doesn’t mean stronger and longer copyright protection as our policymakers would insist. That is a great way to redistribute income upward, which has been a major goal of economic policy over the last four decades, but not a very efficient way to support innovation and creative work in the 21st century.

We can and should be looking to more modern mechanisms than these relics from the feudal guild system. (I have some ideas in chapter 5 of my [free] book Rigged.) However, the point is that China actually has more interest in a workable mechanism for sharing costs than the United States does. Anyone looking to benefit the US economy as a whole would be noting this point and the enormous leverage it gives us. On the other hand, if the goal is simpler to make Microsoft, Pfizer, and Disney richer, and then wring our hands over inequality, the current focus of policy makes sense.

Read More Leer más Join the discussion Participa en la discusión