Read More Leer más Join the discussion Participa en la discusión

This is an assertion in a major Post article on infrastructure, but it doesn’t fit with the evidence. Trump is actually only proposing to put up $200 billion (0.09 percent of GDP) over the next decade towards his infrastructure initiative.

The rest is supposed to come from state and local governments and private investors. As the piece notes, many are dubious whether anything like this amount will be forthcoming. Also, Trump is proposing large cuts to Amtrak and a wide range of other areas of infrastructure spending, so his proposed increase in spending is far less this $200 billion figure.

While the Post wants to assure readers that Trump really expects that his proposal might lead to an increase in infrastructure spending of $1.5 trillion (0.7 percent of GDP) over the next decade, let me suggest an alternative possibility. Trump made big promises about infrastructure spending during the campaign. It is likely that many of his supporters took these promises seriously.

However, Trump really doesn’t give a damn about infrastructure and the Republicans in Congress are not willing to increase the deficit, give back part of their tax cut, or reduce military spending to accommodate additional infrastructure spending. Therefore, Trump goes out and touts a plan that everyone knows doesn’t add up but still allows him to pretend to be meeting his commitment to his base.

I have no idea if my alternative scenario is accurate, but I would argue that it is at least as plausible as the Post’s claim that Trump or anyone else actually expects this plan to produce $1.5 trillion in additional infrastructure spending. Since neither the Post nor I know what is in the heads of Trump and his top aides, how about they just report the plan and what Trump’s people say about it, and not claim to know what anyone’s real “aims” are.

This is an assertion in a major Post article on infrastructure, but it doesn’t fit with the evidence. Trump is actually only proposing to put up $200 billion (0.09 percent of GDP) over the next decade towards his infrastructure initiative.

The rest is supposed to come from state and local governments and private investors. As the piece notes, many are dubious whether anything like this amount will be forthcoming. Also, Trump is proposing large cuts to Amtrak and a wide range of other areas of infrastructure spending, so his proposed increase in spending is far less this $200 billion figure.

While the Post wants to assure readers that Trump really expects that his proposal might lead to an increase in infrastructure spending of $1.5 trillion (0.7 percent of GDP) over the next decade, let me suggest an alternative possibility. Trump made big promises about infrastructure spending during the campaign. It is likely that many of his supporters took these promises seriously.

However, Trump really doesn’t give a damn about infrastructure and the Republicans in Congress are not willing to increase the deficit, give back part of their tax cut, or reduce military spending to accommodate additional infrastructure spending. Therefore, Trump goes out and touts a plan that everyone knows doesn’t add up but still allows him to pretend to be meeting his commitment to his base.

I have no idea if my alternative scenario is accurate, but I would argue that it is at least as plausible as the Post’s claim that Trump or anyone else actually expects this plan to produce $1.5 trillion in additional infrastructure spending. Since neither the Post nor I know what is in the heads of Trump and his top aides, how about they just report the plan and what Trump’s people say about it, and not claim to know what anyone’s real “aims” are.

Read More Leer más Join the discussion Participa en la discusión

It seems that bad guys (Russians and others) are using Facebook to spread all sorts of nonsense under false identities. Mark Zuckerberg, Facebook’s CEO and very rich person, tells us that he is very concerned about the problem but doesn’t know exactly what to do. Congress can help out Facebook and Zuckerberg.

Back in the late 1990s, when the Internet was rapidly becoming an important means of communication, the entertainment industry became concerned about people transferring copies of copyrighted music without permission. It got Congress to pass the Digital Millennium Copyright Act of 1998 (DMCA).

There are many aspects to the DMCA, but the key part is that it imposes harsh punitive damages for anyone who allows copyrighted material to be transferred through their site. If a copyright holder notifies the owner of the site that they have posted their material without authorization, the owner of the site must remove it within 48 hours or face steep penalties.

The site owner is liable for damages even if a third party posted the infringing material. This means that if someone were to post a copyrighted song in the comments section to this blog, CEPR would be liable if it was not removed after notification.

It is important to note that the damages are punitive, not just actual. Suppose someone posts a minor hit from thirty years ago that 20 people download from this site. Given the prices commanded for downloads of old music, the actual damages would be a few cents. Nonetheless, under the DMCA, CEPR could be liable for thousands of dollars in damages. This can be a great model for Facebook and other potential purveyors of fake news.

Here’s how it would work. Imagine that I get a posting on my Facebook feed from something that looks dubious. I send a note to Facebook indicating that I don’t think that this posting is from a real source. Facebook then has 48 hours to investigate and determine if the source is real. If it determines that it is not real it must notify every person who received the posting, either directly or through its sharing system, that the source was fake.

Just as is the case with the DMCA, Facebook could face stiff penalties, say $10,000 a shot, for failing to act within the 48-hour time frame. This would ensure that Facebook would have a powerful incentive to move quickly to prevent the spread of fake news and false stories.

My guess is that Facebook has the technical expertise to meet this requirement. But if it doesn’t, who gives a damn? This is a reasonable expectation of a system like Facebook and if Mark Zuckerberg and his crew lack the competence to meet it, then a better run competitor will take its place.

See, this is all fun and easy. It just requires a Congress that cares as much about protecting democracy as the copyrights of Disney and Time-Warner.

It seems that bad guys (Russians and others) are using Facebook to spread all sorts of nonsense under false identities. Mark Zuckerberg, Facebook’s CEO and very rich person, tells us that he is very concerned about the problem but doesn’t know exactly what to do. Congress can help out Facebook and Zuckerberg.

Back in the late 1990s, when the Internet was rapidly becoming an important means of communication, the entertainment industry became concerned about people transferring copies of copyrighted music without permission. It got Congress to pass the Digital Millennium Copyright Act of 1998 (DMCA).

There are many aspects to the DMCA, but the key part is that it imposes harsh punitive damages for anyone who allows copyrighted material to be transferred through their site. If a copyright holder notifies the owner of the site that they have posted their material without authorization, the owner of the site must remove it within 48 hours or face steep penalties.

The site owner is liable for damages even if a third party posted the infringing material. This means that if someone were to post a copyrighted song in the comments section to this blog, CEPR would be liable if it was not removed after notification.

It is important to note that the damages are punitive, not just actual. Suppose someone posts a minor hit from thirty years ago that 20 people download from this site. Given the prices commanded for downloads of old music, the actual damages would be a few cents. Nonetheless, under the DMCA, CEPR could be liable for thousands of dollars in damages. This can be a great model for Facebook and other potential purveyors of fake news.

Here’s how it would work. Imagine that I get a posting on my Facebook feed from something that looks dubious. I send a note to Facebook indicating that I don’t think that this posting is from a real source. Facebook then has 48 hours to investigate and determine if the source is real. If it determines that it is not real it must notify every person who received the posting, either directly or through its sharing system, that the source was fake.

Just as is the case with the DMCA, Facebook could face stiff penalties, say $10,000 a shot, for failing to act within the 48-hour time frame. This would ensure that Facebook would have a powerful incentive to move quickly to prevent the spread of fake news and false stories.

My guess is that Facebook has the technical expertise to meet this requirement. But if it doesn’t, who gives a damn? This is a reasonable expectation of a system like Facebook and if Mark Zuckerberg and his crew lack the competence to meet it, then a better run competitor will take its place.

See, this is all fun and easy. It just requires a Congress that cares as much about protecting democracy as the copyrights of Disney and Time-Warner.

Read More Leer más Join the discussion Participa en la discusión

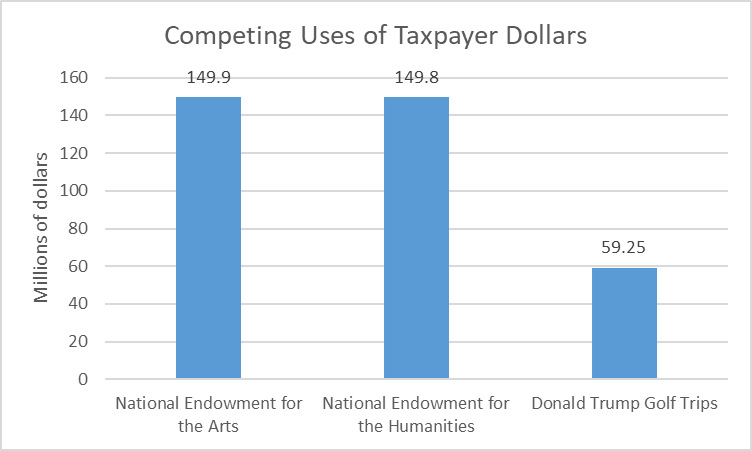

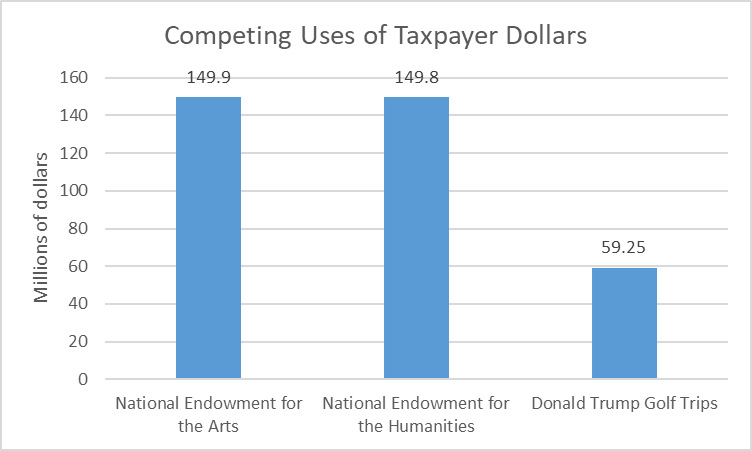

Donald Trump is proposing to eliminate the National Endowments for the Arts and Humanities, as noted in an NYT column today. Each agency received just under $150 million in the 2017 budget, an amount that is equal to just under 0.004 percent of total spending. Another way to think about the money the government spends promoting the arts and the humanities is comparing it to spending on Donald Trump’s golfing trips.

According to calculations from the Center for American Progress Action Fund, we were on a path to spend $59.25 million on Donald Trump’s golfing for each year he is in the White House. This means that by ending funding for either the Endowment for the Arts or the Endowment for the Humanities we can pay for two and a half years of Donald Trump’s golf trips. If both are shut down, it would cover the cost of five years of Donald Trump’s golf trips.

Source: See text.

Donald Trump is proposing to eliminate the National Endowments for the Arts and Humanities, as noted in an NYT column today. Each agency received just under $150 million in the 2017 budget, an amount that is equal to just under 0.004 percent of total spending. Another way to think about the money the government spends promoting the arts and the humanities is comparing it to spending on Donald Trump’s golfing trips.

According to calculations from the Center for American Progress Action Fund, we were on a path to spend $59.25 million on Donald Trump’s golfing for each year he is in the White House. This means that by ending funding for either the Endowment for the Arts or the Endowment for the Humanities we can pay for two and a half years of Donald Trump’s golf trips. If both are shut down, it would cover the cost of five years of Donald Trump’s golf trips.

Source: See text.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The Washington Post reported on new health care spending projections from the Centers for Medicare and Medicaid Services (CMS) which show spending rising to almost 20 percent of GDP by 2026 compared to 17.9 percent in 2016. It is worth noting that these projections have consistently overstated cost growth. For example in 2005, CMS projected that health care costs would rise to 19.6 percent of GDP in 2016.

The piece also notes that prescription drugs are projected to be the most rapidly growing component of health care costs. It is worth mentioning that prescription drugs are only expensive because of government-granted patent monopolies. The free market price is typically less than 10 percent of the patent monopoly price and often less than 1 percent. The generic versions of drugs that sell for tens of thousands of dollars or even hundreds of thousands of dollars in the United States often cost just a few hundred dollars.

A number of Democratic senators have proposed legislation that would have the government pay for research upfront. This would mean that new drugs could sell at generic prices. This would eliminate all the corruption associated with the current system, including the incentive to lie about the effectiveness and safety of drugs. It would likely save more than $380 billion a year (just under 2.0 percent of GDP) on prescription drug expenditures.

The Washington Post reported on new health care spending projections from the Centers for Medicare and Medicaid Services (CMS) which show spending rising to almost 20 percent of GDP by 2026 compared to 17.9 percent in 2016. It is worth noting that these projections have consistently overstated cost growth. For example in 2005, CMS projected that health care costs would rise to 19.6 percent of GDP in 2016.

The piece also notes that prescription drugs are projected to be the most rapidly growing component of health care costs. It is worth mentioning that prescription drugs are only expensive because of government-granted patent monopolies. The free market price is typically less than 10 percent of the patent monopoly price and often less than 1 percent. The generic versions of drugs that sell for tens of thousands of dollars or even hundreds of thousands of dollars in the United States often cost just a few hundred dollars.

A number of Democratic senators have proposed legislation that would have the government pay for research upfront. This would mean that new drugs could sell at generic prices. This would eliminate all the corruption associated with the current system, including the incentive to lie about the effectiveness and safety of drugs. It would likely save more than $380 billion a year (just under 2.0 percent of GDP) on prescription drug expenditures.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Most newspapers try to reserve such editorializing for the opinion pages, but a NYT article on the Trump budget told readers:

“Yet for all of the talk of fiscal restraint, Mr. Trump’s budget also amounted to an institutional surrender to the free-spending ways of Capitol Hill, which Mr. Mulvaney said had surprised the president and prompted him to refrain from even bothering to advocate deficit reduction.”

This is far from the only issue with this piece. The headline tells readers that the budget would “[add] $7 trillion to deficits.” This is the cumulative deficit projected over the 10-year budget horizon. It should be described as the addition to the “debt.” The amount is equal to 21.4 percent of the end of period GDP.

There are some other items worth noting. My additions are in parentheses.

“The White House budget request would add $984 billion (have a deficit of 4.7 percent of GDP) to the federal deficit next year…”

“Last week, Mr. Trump signed a two-year bipartisan budget deal, struck by congressional leaders largely without his involvement, to boost both domestic and military spending by $300 billion (0.74 percent of GDP).”

“That law increases military spending by $195 billion (0.48 percent of GDP) over the next two years and nondefense spending by $131 billion (0.32 percent of GDP) over the same period. The White House is proposing $540 billion (2.6 percent of GDP) in nondefense spending for 2019 — $57 billion below the new spending cap set by Congress.”

“The plan contains at least $1.8 trillion (0.8 percent of GDP) in cuts to federal entitlement programs such as Medicaid, Medicare and food stamps.”

“The centerpiece of Mr. Trump’s budget is a plan to devote $200 billion (0.09 percent of GDP) over the next decade in new spending to improve the country’s crumbling infrastructure, starting with $44.6 billion in 2019 (0.21 percent of GDP).”

“Mr. Trump’s plan would also allocate $13 billion in new spending to tackle opioid abuse through prevention, treatment and recovery support services as well as mental health programs.”

The $13 billion is a five year total which is equal to 0.00012 percent of projected GDP or 0.059 percent of the budget over this period.

Most newspapers try to reserve such editorializing for the opinion pages, but a NYT article on the Trump budget told readers:

“Yet for all of the talk of fiscal restraint, Mr. Trump’s budget also amounted to an institutional surrender to the free-spending ways of Capitol Hill, which Mr. Mulvaney said had surprised the president and prompted him to refrain from even bothering to advocate deficit reduction.”

This is far from the only issue with this piece. The headline tells readers that the budget would “[add] $7 trillion to deficits.” This is the cumulative deficit projected over the 10-year budget horizon. It should be described as the addition to the “debt.” The amount is equal to 21.4 percent of the end of period GDP.

There are some other items worth noting. My additions are in parentheses.

“The White House budget request would add $984 billion (have a deficit of 4.7 percent of GDP) to the federal deficit next year…”

“Last week, Mr. Trump signed a two-year bipartisan budget deal, struck by congressional leaders largely without his involvement, to boost both domestic and military spending by $300 billion (0.74 percent of GDP).”

“That law increases military spending by $195 billion (0.48 percent of GDP) over the next two years and nondefense spending by $131 billion (0.32 percent of GDP) over the same period. The White House is proposing $540 billion (2.6 percent of GDP) in nondefense spending for 2019 — $57 billion below the new spending cap set by Congress.”

“The plan contains at least $1.8 trillion (0.8 percent of GDP) in cuts to federal entitlement programs such as Medicaid, Medicare and food stamps.”

“The centerpiece of Mr. Trump’s budget is a plan to devote $200 billion (0.09 percent of GDP) over the next decade in new spending to improve the country’s crumbling infrastructure, starting with $44.6 billion in 2019 (0.21 percent of GDP).”

“Mr. Trump’s plan would also allocate $13 billion in new spending to tackle opioid abuse through prevention, treatment and recovery support services as well as mental health programs.”

The $13 billion is a five year total which is equal to 0.00012 percent of projected GDP or 0.059 percent of the budget over this period.

Read More Leer más Join the discussion Participa en la discusión

Hey, I thought it was just a way to give a middle finger to low-income people for getting government aid, but the Washington Post tells readers that the plan to provide baskets of food in place of the current cash-like system where we allow people to buy the food they want:

“It would do this [hugely cut spending on food stamps] in part by requiring many beneficiaries to accept food deliveries in addition to financial assistance, a change the White House believes will improve nutrition quality and cut back on costs.”

It’s good we have the Post to tell us what the White House really believes. Otherwise, we might think bad things about them.

Hey, I thought it was just a way to give a middle finger to low-income people for getting government aid, but the Washington Post tells readers that the plan to provide baskets of food in place of the current cash-like system where we allow people to buy the food they want:

“It would do this [hugely cut spending on food stamps] in part by requiring many beneficiaries to accept food deliveries in addition to financial assistance, a change the White House believes will improve nutrition quality and cut back on costs.”

It’s good we have the Post to tell us what the White House really believes. Otherwise, we might think bad things about them.

Read More Leer más Join the discussion Participa en la discusión

That’s what careful readers of the administration’s budget must assume. After all, the budget tells us that we should expect savings of $59 billion in 2028 from reducing “improper payments Government-wide” (Table S-2). However, we build up to these large annual savings very gradually. There is nothing noted for savings in 2019 and just $1 billion in 2020. Even in 2024, the last year of a hypothetical second Trump administration, the projected savings are only $6 billion.

If we assume that these improper payments were always there, but it will take vigilant effort and ten years to weed out the full $59 billion (and even in 2028 there could still be more improper payments) it means that we could be improperly spending more than $50 billion a year throughout the Trump administration. And that is their assessment.

That’s what careful readers of the administration’s budget must assume. After all, the budget tells us that we should expect savings of $59 billion in 2028 from reducing “improper payments Government-wide” (Table S-2). However, we build up to these large annual savings very gradually. There is nothing noted for savings in 2019 and just $1 billion in 2020. Even in 2024, the last year of a hypothetical second Trump administration, the projected savings are only $6 billion.

If we assume that these improper payments were always there, but it will take vigilant effort and ten years to weed out the full $59 billion (and even in 2028 there could still be more improper payments) it means that we could be improperly spending more than $50 billion a year throughout the Trump administration. And that is their assessment.

Read More Leer más Join the discussion Participa en la discusión