The headline of the piece was “manufacturing gains likely to spur Fed’s stimulus cuts.” The actual news was that manufacturing output was reported as rising 0.8 percent in February, reversing most of a 0.9 percent decline in January. It’s a bit hard to see this as solid growth. If we add in December, manufacturing has grown at a 0.4 percent annual rate over the last three months.

Manufacturing output is just 1.5 percent above its year ago level. This has led to a drop in the capacity utilization rate of 0.1 percentage point to 76.4 percent. It is pretty hard to see this as an argument for cutting back stimulus.

The headline of the piece was “manufacturing gains likely to spur Fed’s stimulus cuts.” The actual news was that manufacturing output was reported as rising 0.8 percent in February, reversing most of a 0.9 percent decline in January. It’s a bit hard to see this as solid growth. If we add in December, manufacturing has grown at a 0.4 percent annual rate over the last three months.

Manufacturing output is just 1.5 percent above its year ago level. This has led to a drop in the capacity utilization rate of 0.1 percentage point to 76.4 percent. It is pretty hard to see this as an argument for cutting back stimulus.

Read More Leer más Join the discussion Participa en la discusión

This NYT piece compares life expectancy and health outcomes in Fairfax, Virginia, a wealthy county of Washington suburbs, with McDowell County, West Virginia, a poor coal-mining county in Appalachia. It describes some of the differences in living conditions that have led to a 15-year gap in life expectancies between the two counties. The differences in health outcomes in these counties are attributable to factors that have led to sharp increase in gaps in life expectancy by income across the country.

This NYT piece compares life expectancy and health outcomes in Fairfax, Virginia, a wealthy county of Washington suburbs, with McDowell County, West Virginia, a poor coal-mining county in Appalachia. It describes some of the differences in living conditions that have led to a 15-year gap in life expectancies between the two counties. The differences in health outcomes in these counties are attributable to factors that have led to sharp increase in gaps in life expectancy by income across the country.

Read More Leer más Join the discussion Participa en la discusión

Joe Stiglitz had a nice piece on globalization pointing out that recent “trade” agreements have been largely about shaping rules and regulations to benefit the one percent rather than reducing trade barriers. The strategy of the Obama administration and other proponents of deals like the Trans-Pacific Partnership is to make nonsense claims about the economic benefits of these deals and use ad hominem arguments against the opponents (i.e. call them Neanderthal “protectionists”).

In reality, it is the proponents of these deals who are the protectionists, supporting the barriers that limit competition from foreign doctors and others in highly paid professions. And, one of the main goals of these deals is to increase the strength of patent and copyright protection, often raising the price of the affected items by several thousand percent about the free market price.

Joe Stiglitz had a nice piece on globalization pointing out that recent “trade” agreements have been largely about shaping rules and regulations to benefit the one percent rather than reducing trade barriers. The strategy of the Obama administration and other proponents of deals like the Trans-Pacific Partnership is to make nonsense claims about the economic benefits of these deals and use ad hominem arguments against the opponents (i.e. call them Neanderthal “protectionists”).

In reality, it is the proponents of these deals who are the protectionists, supporting the barriers that limit competition from foreign doctors and others in highly paid professions. And, one of the main goals of these deals is to increase the strength of patent and copyright protection, often raising the price of the affected items by several thousand percent about the free market price.

Read More Leer más Join the discussion Participa en la discusión

Some folks might think that the point of a newspaper is to provide information to readers. Those people have nothing to do with reporting at the Washington Post. That is why, in an article on unexpected state budget surpluses, the paper told readers that capital gains taxes from the initial public offerings of Facebook and Twitter generated $3 billion in unexpected revenue for California, that Florida’s legislature is voting on a $400 million tax cut, and Idaho is projecting an $80 million surplus.

These are all very cute numbers which probably mean almost nothing to 99 percent of Washington Post readers. If the paper was actually trying to inform readers it might have told them that the money from Facebook and Twitter amounts to approximately 3 percent of the state’s revenue for a year. It could have told readers that Florida’s proposed tax cut comes to a bit more than $20 per person and that Idaho’s projected surplus is equal to just under 3.0 percent of its budget.

While most Post readers understand percentages and can relate to to a per person dollar amount, it is unlikely that many are familiar with the size of these states budgets or economies offhand. They could take two minutes to look this information up on the web, but most readers will have less time for this task than the Washington Post’s reporter. In fairness, the piece did point out that a proposal to use $4.6 billion to fund pre-kindergarten programs would take up about 3 percent of the state’s overall budget. (The higher level of implied spending presumably includes money other than what appears in the general budget.)

Some folks might think that the point of a newspaper is to provide information to readers. Those people have nothing to do with reporting at the Washington Post. That is why, in an article on unexpected state budget surpluses, the paper told readers that capital gains taxes from the initial public offerings of Facebook and Twitter generated $3 billion in unexpected revenue for California, that Florida’s legislature is voting on a $400 million tax cut, and Idaho is projecting an $80 million surplus.

These are all very cute numbers which probably mean almost nothing to 99 percent of Washington Post readers. If the paper was actually trying to inform readers it might have told them that the money from Facebook and Twitter amounts to approximately 3 percent of the state’s revenue for a year. It could have told readers that Florida’s proposed tax cut comes to a bit more than $20 per person and that Idaho’s projected surplus is equal to just under 3.0 percent of its budget.

While most Post readers understand percentages and can relate to to a per person dollar amount, it is unlikely that many are familiar with the size of these states budgets or economies offhand. They could take two minutes to look this information up on the web, but most readers will have less time for this task than the Washington Post’s reporter. In fairness, the piece did point out that a proposal to use $4.6 billion to fund pre-kindergarten programs would take up about 3 percent of the state’s overall budget. (The higher level of implied spending presumably includes money other than what appears in the general budget.)

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

A NYT commentary by Jeff Sommer told readers that the Fed is not likely to focus much on recent trends in stock and housing prices at its next meeting because asset prices are not part of its mandate. The piece commented:

“Even if such issues [recent trends in stock and house prices] provide a subtext for Fed discussions, the direct effects of Fed policy on the stock and housing markets may not be an explicit part of the Fed’s agenda this week.

“That’s partly because Congress didn’t include financial asset prices in the Fed’s mandate, which is ‘to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.’ Those stable prices referred to items like cars, food and shoes, not to financial assets like stocks and bonds, whose price levels fall outside the Fed’s traditional purview.”

The last two recessions were caused by collapses in asset bubbles. These collapses had enormous impact on employment, as well as inflation and interest rates. It would be absurd for Fed officials to say they will not focus on asset prices because they are not directly part of their mandate.

A NYT commentary by Jeff Sommer told readers that the Fed is not likely to focus much on recent trends in stock and housing prices at its next meeting because asset prices are not part of its mandate. The piece commented:

“Even if such issues [recent trends in stock and house prices] provide a subtext for Fed discussions, the direct effects of Fed policy on the stock and housing markets may not be an explicit part of the Fed’s agenda this week.

“That’s partly because Congress didn’t include financial asset prices in the Fed’s mandate, which is ‘to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.’ Those stable prices referred to items like cars, food and shoes, not to financial assets like stocks and bonds, whose price levels fall outside the Fed’s traditional purview.”

The last two recessions were caused by collapses in asset bubbles. These collapses had enormous impact on employment, as well as inflation and interest rates. It would be absurd for Fed officials to say they will not focus on asset prices because they are not directly part of their mandate.

Read More Leer más Join the discussion Participa en la discusión

Gretchen Morgenson had a column on a new report from the Inspector General of the Justice Department which found that prosecuting mortgage fraud was a low priority, contrary to claims by the Obama administration. Since there is so much confusion on the topic it is worth repeating again what the Justice Department would have done if law enforcement had been its concern.

It’s not a question of simply locking up Jamie Dimon and Lloyd Blankfein and other top bankers, the point would be to build a case from the bottom up. This means going to mortgage agents at Countrywide, Ameriquest, and other major subprime issuers. Investigators would confront them with stacks of improperly documented mortgages and ask them why they put through mortgages with improper or even obviously false documentation.

Folks who took out a mortgage in years prior to bubble know the ordeal involved. You had to bring in your first grade teacher to vouch for your character. Everything had to be properly documented and was closely scrutinized. This was not the procedure that was followed in the bubble years. Justice Department investigators would ask the mortgage agents why they passed through mortgages without proper documentation.

Since this was a widespread practice and not the work of a few rogue agents, presumably office managers told these agents to get mortgages and that proper documentation did not matter. Faced with the risk of jail for committing fraud, it is likely that many agents would be prepared to testify that they were acting on instructions from their branch manager. The investigators would then confront their branch managers with the testimony from their employers and ask them what prompted them to tell employers to ignore standard procedures and pass through improperly documented mortgages. Again, faced the prospect of several years in jail, it is likely that many branch managers would be prepared to testify against their bosses at the corporate headquarters. (The Justice Department has pursued this sort of investigation in going after illegal campaign contributions to Washington Mayor Vincent Gray.)

The same practice would be followed at Goldman Sachs, Morgan Stanley, and the other investment banks that securitized the loans. The folks who were constructing the securities are all smart people who know what a good mortgage looks like. They surely knew that many of the mortgages they were throwing into the pools were not properly documented and almost certainly fraudulent. In these cases the Justice Department investigators would ask the Harvard MBAs whether they are really stupider than rocks.

At least some would admit to not being morons and acknowledge that they knowingly packaged fraudulent mortgages into securities. These bright young ambitious MBAs would then be offered the opportunity to stay out of jail if they told investigators why they thought it was a good idea to package fraudulent mortgages into mortgage backed securities.

Would this process have put Jamie Dimon, Lloyd Blankfein, Robert Rubin and the rest behind bars? Who knows, but we know with certainty that the Justice Department never started on this path so there was no way that the honchos could ever be held accountable for any crimes they did commit. This speaks volumes about the nature of justice in the United States today.

There is one other issue that is worth addressing here. Many commentators have argued that the honchos were foolish, not crooked. They really did believe that the house prices would just keep rising. In this case all the mortgages would end up being good mortgages. (If a bank forecloses on a fraudulent loan where the house has appreciated 20-30 percent, it is not likely to suffer a loss.)

It is entirely possible that the top people at the banks really did believe that the bubble would keep inflating indefinitely, but it is also irrelevant. (The Enron boys may have believed they really had a good business model. That doesn’t change the fact that they broke the law.) The issue at hand is whether they knowingly issued and passed along mortgages that were not documented properly. That is fraud and a criminal act. It doesn’t change anything if they were also stupid.

Gretchen Morgenson had a column on a new report from the Inspector General of the Justice Department which found that prosecuting mortgage fraud was a low priority, contrary to claims by the Obama administration. Since there is so much confusion on the topic it is worth repeating again what the Justice Department would have done if law enforcement had been its concern.

It’s not a question of simply locking up Jamie Dimon and Lloyd Blankfein and other top bankers, the point would be to build a case from the bottom up. This means going to mortgage agents at Countrywide, Ameriquest, and other major subprime issuers. Investigators would confront them with stacks of improperly documented mortgages and ask them why they put through mortgages with improper or even obviously false documentation.

Folks who took out a mortgage in years prior to bubble know the ordeal involved. You had to bring in your first grade teacher to vouch for your character. Everything had to be properly documented and was closely scrutinized. This was not the procedure that was followed in the bubble years. Justice Department investigators would ask the mortgage agents why they passed through mortgages without proper documentation.

Since this was a widespread practice and not the work of a few rogue agents, presumably office managers told these agents to get mortgages and that proper documentation did not matter. Faced with the risk of jail for committing fraud, it is likely that many agents would be prepared to testify that they were acting on instructions from their branch manager. The investigators would then confront their branch managers with the testimony from their employers and ask them what prompted them to tell employers to ignore standard procedures and pass through improperly documented mortgages. Again, faced the prospect of several years in jail, it is likely that many branch managers would be prepared to testify against their bosses at the corporate headquarters. (The Justice Department has pursued this sort of investigation in going after illegal campaign contributions to Washington Mayor Vincent Gray.)

The same practice would be followed at Goldman Sachs, Morgan Stanley, and the other investment banks that securitized the loans. The folks who were constructing the securities are all smart people who know what a good mortgage looks like. They surely knew that many of the mortgages they were throwing into the pools were not properly documented and almost certainly fraudulent. In these cases the Justice Department investigators would ask the Harvard MBAs whether they are really stupider than rocks.

At least some would admit to not being morons and acknowledge that they knowingly packaged fraudulent mortgages into securities. These bright young ambitious MBAs would then be offered the opportunity to stay out of jail if they told investigators why they thought it was a good idea to package fraudulent mortgages into mortgage backed securities.

Would this process have put Jamie Dimon, Lloyd Blankfein, Robert Rubin and the rest behind bars? Who knows, but we know with certainty that the Justice Department never started on this path so there was no way that the honchos could ever be held accountable for any crimes they did commit. This speaks volumes about the nature of justice in the United States today.

There is one other issue that is worth addressing here. Many commentators have argued that the honchos were foolish, not crooked. They really did believe that the house prices would just keep rising. In this case all the mortgages would end up being good mortgages. (If a bank forecloses on a fraudulent loan where the house has appreciated 20-30 percent, it is not likely to suffer a loss.)

It is entirely possible that the top people at the banks really did believe that the bubble would keep inflating indefinitely, but it is also irrelevant. (The Enron boys may have believed they really had a good business model. That doesn’t change the fact that they broke the law.) The issue at hand is whether they knowingly issued and passed along mortgages that were not documented properly. That is fraud and a criminal act. It doesn’t change anything if they were also stupid.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post finds politics to be very confusing. It apparently thinks that the people paid high six or even seven figure salaries to lobby for the pharmaceutical industry are humanitarians trying to advance global health.

Toward the end of an article on efforts by drug companies to get stronger patent-type protections in the Trans-Pacific Partnership (TPP) the Post told readers:

“But pharmaceutical industry advocates worry that without strong global rules, the drug development process will suffer.”

Of course the industry advocates say they “worry” that drug development will suffer, just as the defense lawyer always says her client is innocent. Just as lawyers are paid to defend their clients, lobbyists are paid to promote the case for their client. Newspaper reporters and editors should understand this fact.

It would also be worth mentioning that the protections being pushed by the pharmaceutical industry in this deal will likely worsen inequality and lead to fewer jobs for workers in the United States. They will transfer more money to the shareholders and top executives of the drug companies. They will also leave consumers in the countries who are parties to the TPP with less money to buy U.S. made products.

The Washington Post finds politics to be very confusing. It apparently thinks that the people paid high six or even seven figure salaries to lobby for the pharmaceutical industry are humanitarians trying to advance global health.

Toward the end of an article on efforts by drug companies to get stronger patent-type protections in the Trans-Pacific Partnership (TPP) the Post told readers:

“But pharmaceutical industry advocates worry that without strong global rules, the drug development process will suffer.”

Of course the industry advocates say they “worry” that drug development will suffer, just as the defense lawyer always says her client is innocent. Just as lawyers are paid to defend their clients, lobbyists are paid to promote the case for their client. Newspaper reporters and editors should understand this fact.

It would also be worth mentioning that the protections being pushed by the pharmaceutical industry in this deal will likely worsen inequality and lead to fewer jobs for workers in the United States. They will transfer more money to the shareholders and top executives of the drug companies. They will also leave consumers in the countries who are parties to the TPP with less money to buy U.S. made products.

Read More Leer más Join the discussion Participa en la discusión

It’s always entertaining when people who obviously have no clue about the basic facts on Social Security take to educating people on Social Security. Of course it’s unfortunate when such people actually get taken seriously. In the hope of reducing this risk, BTP takes this opportunity to address Abby Huntsman’s warning to millennials about the risks posed to them by Social Security.

Ms. Huntsman (the daughter of unsuccessful presidential candidate Jon Huntsman) tells her audience that the problem is that people are living much longer so that we are seeing much higher ratios of retirees to workers than when the program was first established in 1937. There are two big problems with the basics of Huntsman’s story. First, most of the gain in life expectancy that she points to in the segment is the result of reduced infant mortality, not people living longer. For example, the Social Security trustees report shows life expectancy at birth increased by more than 15 years from 1940 to 2012, however life expectancy at age 65 has increased by just 6.5 years. It’s great to see lower infant mortality rates, but this doesn’t affect the finances of Social Security, it is the increase in life expectancy at age 65 that matters.

However the bigger problem with Huntsman’s diatribe is that this increase in life expectancy was expected at the time the program was created. As a result, a number of increases in the tax rate were put into place in the next five decades. The initial tax rate was just 2.0 percent of wages on both the worker and the employer. Since 1990 it has been 6.2 percent of wages for both employer and employee. (The taxable wage base was also increased substantially.) These increases were put in place to deal with the costs associated with a rise in the ratio of retirees to workers. The age for receiving full benefits has also been increased from 65 to 66 at present, and will rise to 67 for people reaching age 62 after 2022. It is flat-out wrong to claim either that the increase in life expectancy caught anyone by surprise or that no changes were made to deal with longer life expectancies.

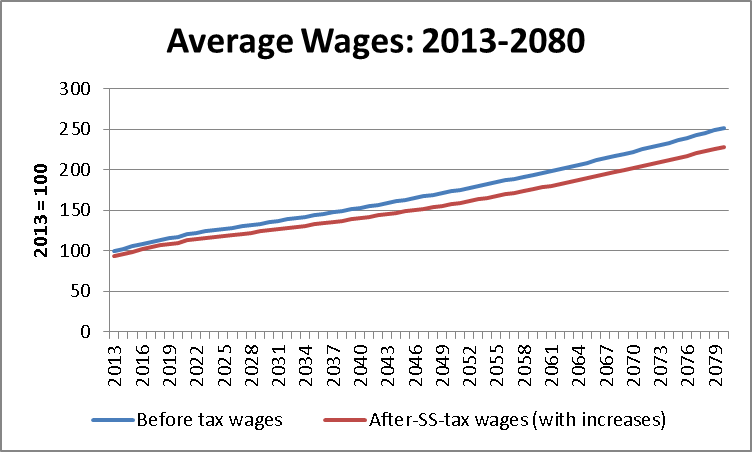

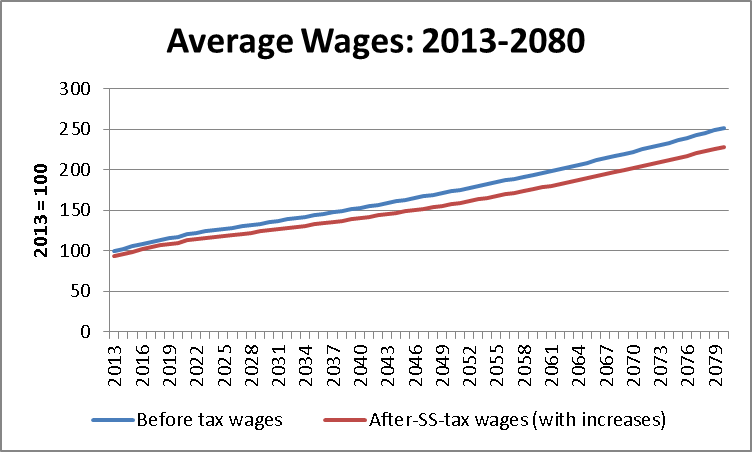

The other part of Huntsman story that is even more misleading is the idea that the finances of the program poses some insoluble problem or that the program will impose an unbearable burden on millenials. In fact, average wages are projected to grow substantially in coming decades. If most millenials get their share of wage growth, then they will enjoy far higher standards of living than do workers today, even if their taxes are increased to cover the cost of a larger number of retirees.

The figure below shows the Social Security trustess projections for wages over the next seven decades. It also shows after Social Security tax wages under the assumption that taxes are increased at the rate 0.05 percentage points on both workers and employers each year from 2020 to 2050. This increase will be enough to leave the program fully funded well into the next century even assuming no other changes are ever made.

Source: Social Security Trustees Report and author’s calculations.

Of course there is a big problem wiith this story. In the last three decades most workers have not shared in the growth of the economy. Most of the gains have gone to profits or highly paid workers like Wall Street traders, CEOs, and some celebrity types like Ms. Huntsman. If this pattern continues then millenials may not see rising living standards in the decades ahead. However, the risk to living standards posed by the continuing upward redistribution swamps any risks posed by a larger population of retirees. It is understandable that those who benefit from the upward redististribution would prefer to have public attention focused on Social Security, but this focus is not based in economic reality.

Correction:

Mike Anderson has pointed out that the tax increase specified in this post would not be enough to produce a balance over the trust fund’s 75-year planning horizon. In order to get to balance with a tax increase phased in over 30 years, beginning in 2020, it would be necessary to have a tax increase of roughly 0.22 percentage points annually (0.11 percentage points on both the employee and employer). This implies a cumulative tax increase of 6.6 percentage points by 2050, slightly larger than the 6.4 percentage point increase in the payroll tax between 1960 and 1990. This calculation assumes no reduction in scheduled benefits, no increase in the retirement age, and no increase in the cap on taxable income. It also assumes no further tax increases in years after 2050. Under this schedule real after-Social Security tax compensation would be on average almost 50 percent higher in 2050 than it is today. By 2060 it would be more than 60 percent higher.

It is also worth noting that these calculations assume some further upward redistribution of income. If some of the upward redistribution of the last three decades were reversed, the tax increases needed to balance the trust fund would be smaller.

Second Correction:

Sorry folks, sometimes you need a little sleep to see your spreadsheet clearly. Anyhow, having checked again, it looks like I was much closer to the mark the first time. An increase in the tax rate of 0.14 percentage points annually (0.07 percent on both the worker and the employer) begginning in 2020 and running for thirty years should be sufficient to make the trust fund balanced for its 75 year planning horizon. This leaves a total increase in the tax rate of 4.25 percentage points (2.23 on both the worker and the employer) by 2050. (The spreadsheet is available on request.)

It’s always entertaining when people who obviously have no clue about the basic facts on Social Security take to educating people on Social Security. Of course it’s unfortunate when such people actually get taken seriously. In the hope of reducing this risk, BTP takes this opportunity to address Abby Huntsman’s warning to millennials about the risks posed to them by Social Security.

Ms. Huntsman (the daughter of unsuccessful presidential candidate Jon Huntsman) tells her audience that the problem is that people are living much longer so that we are seeing much higher ratios of retirees to workers than when the program was first established in 1937. There are two big problems with the basics of Huntsman’s story. First, most of the gain in life expectancy that she points to in the segment is the result of reduced infant mortality, not people living longer. For example, the Social Security trustees report shows life expectancy at birth increased by more than 15 years from 1940 to 2012, however life expectancy at age 65 has increased by just 6.5 years. It’s great to see lower infant mortality rates, but this doesn’t affect the finances of Social Security, it is the increase in life expectancy at age 65 that matters.

However the bigger problem with Huntsman’s diatribe is that this increase in life expectancy was expected at the time the program was created. As a result, a number of increases in the tax rate were put into place in the next five decades. The initial tax rate was just 2.0 percent of wages on both the worker and the employer. Since 1990 it has been 6.2 percent of wages for both employer and employee. (The taxable wage base was also increased substantially.) These increases were put in place to deal with the costs associated with a rise in the ratio of retirees to workers. The age for receiving full benefits has also been increased from 65 to 66 at present, and will rise to 67 for people reaching age 62 after 2022. It is flat-out wrong to claim either that the increase in life expectancy caught anyone by surprise or that no changes were made to deal with longer life expectancies.

The other part of Huntsman story that is even more misleading is the idea that the finances of the program poses some insoluble problem or that the program will impose an unbearable burden on millenials. In fact, average wages are projected to grow substantially in coming decades. If most millenials get their share of wage growth, then they will enjoy far higher standards of living than do workers today, even if their taxes are increased to cover the cost of a larger number of retirees.

The figure below shows the Social Security trustess projections for wages over the next seven decades. It also shows after Social Security tax wages under the assumption that taxes are increased at the rate 0.05 percentage points on both workers and employers each year from 2020 to 2050. This increase will be enough to leave the program fully funded well into the next century even assuming no other changes are ever made.

Source: Social Security Trustees Report and author’s calculations.

Of course there is a big problem wiith this story. In the last three decades most workers have not shared in the growth of the economy. Most of the gains have gone to profits or highly paid workers like Wall Street traders, CEOs, and some celebrity types like Ms. Huntsman. If this pattern continues then millenials may not see rising living standards in the decades ahead. However, the risk to living standards posed by the continuing upward redistribution swamps any risks posed by a larger population of retirees. It is understandable that those who benefit from the upward redististribution would prefer to have public attention focused on Social Security, but this focus is not based in economic reality.

Correction:

Mike Anderson has pointed out that the tax increase specified in this post would not be enough to produce a balance over the trust fund’s 75-year planning horizon. In order to get to balance with a tax increase phased in over 30 years, beginning in 2020, it would be necessary to have a tax increase of roughly 0.22 percentage points annually (0.11 percentage points on both the employee and employer). This implies a cumulative tax increase of 6.6 percentage points by 2050, slightly larger than the 6.4 percentage point increase in the payroll tax between 1960 and 1990. This calculation assumes no reduction in scheduled benefits, no increase in the retirement age, and no increase in the cap on taxable income. It also assumes no further tax increases in years after 2050. Under this schedule real after-Social Security tax compensation would be on average almost 50 percent higher in 2050 than it is today. By 2060 it would be more than 60 percent higher.

It is also worth noting that these calculations assume some further upward redistribution of income. If some of the upward redistribution of the last three decades were reversed, the tax increases needed to balance the trust fund would be smaller.

Second Correction:

Sorry folks, sometimes you need a little sleep to see your spreadsheet clearly. Anyhow, having checked again, it looks like I was much closer to the mark the first time. An increase in the tax rate of 0.14 percentage points annually (0.07 percent on both the worker and the employer) begginning in 2020 and running for thirty years should be sufficient to make the trust fund balanced for its 75 year planning horizon. This leaves a total increase in the tax rate of 4.25 percentage points (2.23 on both the worker and the employer) by 2050. (The spreadsheet is available on request.)

Read More Leer más Join the discussion Participa en la discusión

Apparently it was in large part, according to this WSJ article. The piece tells readers that Ireland’s economy shrank by 2.3 percent from the third to the fourth quarter, meaning that it dropped at a 9.2 percent annual rate, to use the normal terminology of people in the United States when talking about growth data. However the article later tells us that the story is not as bad as it first appears, since much of this decline is due to a major drug going off patent, which has reduced the income flows recorded in Ireland.

Due to its low corporate tax rate, many multinational companies book income in Ireland even though it was actually generated elsewhere. These phantom income flows have little to do with the state of the Irish economy. To avoid this problem it is more useful to look at gross national income. If we look at the OECD data on Irish national income we find that the number for 2012 (the most recent year available) was still 8.6 percent below the 2008 level. In fact, it was 2.3 percent below the 2005 level. Obviously Ireland is yet another one of those great success stories from the economic whizzes at the European Commission.

Apparently it was in large part, according to this WSJ article. The piece tells readers that Ireland’s economy shrank by 2.3 percent from the third to the fourth quarter, meaning that it dropped at a 9.2 percent annual rate, to use the normal terminology of people in the United States when talking about growth data. However the article later tells us that the story is not as bad as it first appears, since much of this decline is due to a major drug going off patent, which has reduced the income flows recorded in Ireland.

Due to its low corporate tax rate, many multinational companies book income in Ireland even though it was actually generated elsewhere. These phantom income flows have little to do with the state of the Irish economy. To avoid this problem it is more useful to look at gross national income. If we look at the OECD data on Irish national income we find that the number for 2012 (the most recent year available) was still 8.6 percent below the 2008 level. In fact, it was 2.3 percent below the 2005 level. Obviously Ireland is yet another one of those great success stories from the economic whizzes at the European Commission.

Read More Leer más Join the discussion Participa en la discusión