The New York Times did a classic “the economy is awful” story by highlighting the fact that 1.3 million homeowners might not be moving because of the large gap between current mortgage rates and the rate they would have to pay on a new mortgage. While this is clearly a problem, the flip side is that millions of people were able to refinance their mortgages at an extraordinarily low rate from the start of the pandemic in March 2020 until the Fed began raising rates in March of 2022.

According to the New York Fed, more than 14 million homeowners refinanced their homes in this period. This is saving these families thousands of dollars a year in interest payments. Perhaps I missed it, but I don’t recall seeing any pieces on how these homeowners are much better off today as a result of these savings. These savings are not picked up in our standard measures of income. Also, according to advanced economic theory, 14 million is a larger number than 1.3 million.

The piece also hugely exaggerated the likely duration of this sort of lock-in story telling readers:

“But today’s challenge may be more lasting. That’s because 30-year mortgage rates get locked in for, well, 30 years, and because rates below 3 percent are unlikely to be seen again anytime soon.”

The piece puts the current gap between the market rate for new mortgages and the rates on existing mortgages at 3.2 percent, with current mortgage rates around 6.7 percent. Part of the recent rise in mortgage rates is due to a run-up in interest rates on long-term Treasury bonds. The 10-year rate now stands close to 4.4 percent, as opposed to a bit less than 3.0 percent before the pandemic.

However, part of the run-up stems from an unusually large gap between mortgage rates and the interest rate on Treasury bonds. Usually this is around 1.75 percentage points. It currently is around 2.3 percentage points.

We are likely to see improvements on both fronts in the near future. The Fed is likely to lower interest rates at some point this year and Treasury yields will fall in anticipation of rate cuts. (The Treasury rate had been under 3.8 percent as recently as December.)

It is not entirely clear why the gap between mortgage rates and Treasury rates has widened so much, but it is reasonable to think that it will not persist indefinitely. If we see Treasury rates fall under 4.0 percent and the gap between mortgage rates and Treasury rates return to something like its long-term average, then it is very plausible that we will see mortgage rates below 6.0 percent in the not distant future.

That will still be higher than the 3.0 percent rate that many homeowners were able to lock in during the pandemic but would mean a considerably smaller gap than we now see. In any case, it is highly unlikely that anything like the current gap will persist for thirty years or anything close to it.

The New York Times did a classic “the economy is awful” story by highlighting the fact that 1.3 million homeowners might not be moving because of the large gap between current mortgage rates and the rate they would have to pay on a new mortgage. While this is clearly a problem, the flip side is that millions of people were able to refinance their mortgages at an extraordinarily low rate from the start of the pandemic in March 2020 until the Fed began raising rates in March of 2022.

According to the New York Fed, more than 14 million homeowners refinanced their homes in this period. This is saving these families thousands of dollars a year in interest payments. Perhaps I missed it, but I don’t recall seeing any pieces on how these homeowners are much better off today as a result of these savings. These savings are not picked up in our standard measures of income. Also, according to advanced economic theory, 14 million is a larger number than 1.3 million.

The piece also hugely exaggerated the likely duration of this sort of lock-in story telling readers:

“But today’s challenge may be more lasting. That’s because 30-year mortgage rates get locked in for, well, 30 years, and because rates below 3 percent are unlikely to be seen again anytime soon.”

The piece puts the current gap between the market rate for new mortgages and the rates on existing mortgages at 3.2 percent, with current mortgage rates around 6.7 percent. Part of the recent rise in mortgage rates is due to a run-up in interest rates on long-term Treasury bonds. The 10-year rate now stands close to 4.4 percent, as opposed to a bit less than 3.0 percent before the pandemic.

However, part of the run-up stems from an unusually large gap between mortgage rates and the interest rate on Treasury bonds. Usually this is around 1.75 percentage points. It currently is around 2.3 percentage points.

We are likely to see improvements on both fronts in the near future. The Fed is likely to lower interest rates at some point this year and Treasury yields will fall in anticipation of rate cuts. (The Treasury rate had been under 3.8 percent as recently as December.)

It is not entirely clear why the gap between mortgage rates and Treasury rates has widened so much, but it is reasonable to think that it will not persist indefinitely. If we see Treasury rates fall under 4.0 percent and the gap between mortgage rates and Treasury rates return to something like its long-term average, then it is very plausible that we will see mortgage rates below 6.0 percent in the not distant future.

That will still be higher than the 3.0 percent rate that many homeowners were able to lock in during the pandemic but would mean a considerably smaller gap than we now see. In any case, it is highly unlikely that anything like the current gap will persist for thirty years or anything close to it.

Read More Leer más Join the discussion Participa en la discusión

The higher than expected March CPI released on Wednesday freaked everyone out and got the markets convinced we will see fewer, if any, interest rate cuts this year. I have never been a Fed tea leaf reader, and am not about to change professions now, but it will be bad news if the Fed puts off rate cuts that can revitalize the housing market.

The big concern posed by the CPI, following higher-than-expected inflation numbers in January and February, is whether inflation is reaccelerating. We know that rental inflation is still high as an outcome of the surge in working from home at the start of the pandemic.

But we can be very confident that it will slow sharply over the course of the year due to the much slower inflation rate shown in indexes (including the BLS index) measuring rents in units that change hands. This means that rental inflation will not be an ongoing problem that the Fed has to worry about.

However, the recent data have shown an uptick in inflation, even pulling out rent. This is ostensibly the cause for concern.

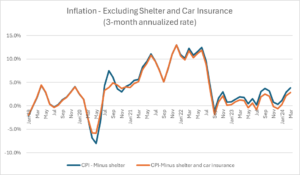

There are two important points to be made about this uptick. First, it is not unusual to see large jumps, and falls, in CPI inflation excluding rent. Rent is a huge factor in the index, and since the pace of rental inflation changes slowly, it anchors the overall rate. Inflation is much more erratic when rent is excluded as shown below.

Note that there were many points at which inflation in the non-shelter CPI crossed 2.0 percent even in the low-inflation decade preceding the pandemic. In fact, year-over-year inflation in this index hit 2.1 percent in January of 2020, just before the pandemic started. It was at 2.5 percent in July of 2018. So a somewhat above-target reading for the non-shelter CPI should not be a major cause for concern by itself.

However, there is the question of whether the recent uptick reflects underlying trends. Here the story points in the opposite direction.

The day after the CPI report came out, we got a much more benign reading on the Producer Price Index (PPI). The overall figure for the month was 0.2 percent (0.154 to be more precise), with the core also at 0.2 percent. There are differences in coverage and methodology between the CPI and PPI, but inflation in the indexes still track each other closely.

The figure below shows the PPI for services, the PPI for goods, and the CPI.

What is perhaps most striking is how closely the CPI follows the PPI for services. That probably shouldn’t be surprising, since services account for almost two-thirds of the CPI. (It is important to note that the PPI does not include rent, so these are services minus rent.)

When the CPI goes substantially above or below the service component of the PPI it is following movements in the goods component. As can be seen the CPI has been well above the service component in the PPI since May of 2022. The cause here is the supply chain problems that sent goods inflation sky-rocketing a bit more than a year earlier.

The good news in this picture is that the goods component of the PPI has been far below the service CPI for a bit over a year, and for part of this period was even negative. This is just another way of showing the widely noted fact that the prices of supply chain goods have stabilized and in many cases are even falling. This looks likely to continue for the near-term future, especially if we don’t have a policy of blocking cheaper imports with higher tariffs as some presidential candidates are advocating.

The Wage Story

There is another part of the longer-term inflation picture that needs to be included, the slowing of wage growth. Our various wage indices show somewhat different figures for wage growth, but they tell basically the same story. Wage growth accelerated sharply as the economy reopened in the second half of 2020 and especially 2021 and 2022, as employers had to compete to hire and retain workers.

We saw record rates of quits, as workers left jobs that didn’t pay enough, offer advancement opportunities, had unsafe workplaces, or where the boss was a jerk. This is a great story, as workers saw gains in wages that outpaced inflation and workplace satisfaction hit a record high. The gains in wages were especially large for those at the bottom of the wage distribution.

While that is a very bright picture, we could not sustain nominal wage gains of the sort we were seeing in 2021 and the first half of 2022, and still hit the Fed’s 2.0 percent inflation target. Wage growth peaked at roughly 6.0 percent, 2.5 percentage points higher than the rates we were seeing before the pandemic.

To be clear, wages were not driving inflation. There was a shift from wages to profits at the start of the pandemic. It doesn’t make sense to say that wages are the cause of inflation when the profit share is increasing. But it is true that given current rates of productivity growth, we cannot have 6.0 percent wage growth and sustain anything close to a 2.0 percent rate of inflation. (FWIW, I am not a fan of the Fed’s 2.0 percent inflation target, but the Fed is.)

However, wage growth has slowed sharply over the last two years, getting close to its pre-pandemic pace. Again, there are differences by indices, but the pace of wage growth has fallen by roughly 2.0 percentage points, leaving it 0.5 percentage points above its pre-pandemic pace.

One index, the Indeed Wage Tracker, has fallen back to its 2019 rate of wage growth. This index is noteworthy because it measures wages in job postings for new hires. In this sense it can be thought of as being analogous to the new tenant rent indexes that measure the rents of units that turn over.

Just as most people don’t move every month, most people don’t change jobs every month, but we expect the rents of units that don’t turn over to roughly follow the rents of units that do change hands. In the same way, it is reasonable to think that wage patterns of workers who stay in their jobs will roughly follow wage patterns for newly hired workers. The Indeed Wage Tracker is telling us that wage growth has fallen back to a non-inflationary pace. This may take some time to show up in the other wage series, but we can be pretty confident of the direction of change.

Profit Shares and Productivity

There are two other reasons we can be reasonably confident inflation is now under control. The first is that the rise in profit shares at the start of the pandemic has not gone away. In fact, profit shares increased somewhat in the fourth quarter, indicating we are going in the wrong direction.

It is not clear why profit shares continue to rise, and not fall back towards pre-pandemic levels. (Yeah, corporations are greedy, but they have always been greedy.) The increase during the supply-chain crisis was understandable, companies have much more market power when supply is constrained. But unless conditions of competition were permanently altered by the pandemic, it’s hard to see why they would stay elevated, and we certainly should not expect them to continue to rise.

In any case, the rise in the profit share in the fourth quarter, suggests that a lower pace of inflation would be consistent with the wage growth we are now seeing, if the profit share were to remain stable. If the profit share were to fall back towards its pre-pandemic level (which was already well above its level at the start of the century), we could sustain considerably lower inflation with the current pace of wage growth.

In other words, there seems little basis for believing that the current rate of wage growth is inconsistent with the Fed’s 2.0 percent inflation target. In this respect, the Biden administration is on exactly the right track in going after abuses of market power that allow for higher margins, such as attempting to block the merger of the nation’s two largest supermarket chains, Albertson’s and Safeway. Similarly, cracking down on drug companies abusing their government-granted patent monopolies will also have the effect of reducing profit margins.

The other big wildcard in this story is productivity growth. Productivity growth soared in the last three quarters of 2023, averaging 3.7 percent over this period. Productivity growth is notoriously erratic and the data are subject to large revisions. We also have to note that growth was horrible in 2022, actually falling for the year. So, it is far too early to claim we are on a faster growth path. Nonetheless, the recent data are encouraging and it looks like we will have respectable numbers again for the first quarter, although not above 3.0 percent.

Given advances in AI and other technologies, it hardly seems absurd to think we may be seeing a productivity uptick. We are clearly at the very beginning of the uses of many of these technologies, so there will be many gains that we will see down the road.

If we can sustain a faster pace of productivity growth, then we can have faster nominal wage growth and still hit the Fed’s 2.0 percent inflation target. To be clear, I am not talking about a wildly rapid pace of growth, if we can just sustain a 2.0 percent rate, well below the rates we saw in the upturn from 1995 to 2005 and the long Golden Age from 1947 to 1973, then 4.0 percent wage growth would be consistent with 2.0 percent inflation, even after a period in which profit margins shrank somewhat.

Time to Declare Victory and Lower Rates

The long and short here is that it is really time for the Fed to declare victory in its war on inflation and start lowering interest rates. One problem that seems to be delaying rate cuts is that the economy remains strong, leaving Chair Powell and other Fed officials to talk about the situation as a one-sided choice. They see a risk of inflation if they lower rates too much or too soon, but there is little basis for concern about a recession or rising unemployment.

However, that leaves other negative effects of high interest rates out of the equation, most notably their impact on the housing market. The number of existing homes being sold in the last year is down by almost a third from its 2020-21 pace. This means that millions of people who would otherwise be looking to move are being kept in place by the Fed’s high interest rate policy.

Higher interest rates are also a drain on people’s budgets insofar as they have credit card debt or other forms of short-term debt. And it makes it more expensive to buy new or used cars. The rise in interest rates also creates stress on the financial system. This stress led to the failure of Silicon Valley Bank last year, along with several other smaller banks. With luck we won’t see another major round of bank failures this year, but higher rates unambiguously increase the risk.

In short, even if the economy does not need lower rates to sustain a healthy growth path right now, there is a real cost to keeping rates high. It’s time for the Fed to change course.

The higher than expected March CPI released on Wednesday freaked everyone out and got the markets convinced we will see fewer, if any, interest rate cuts this year. I have never been a Fed tea leaf reader, and am not about to change professions now, but it will be bad news if the Fed puts off rate cuts that can revitalize the housing market.

The big concern posed by the CPI, following higher-than-expected inflation numbers in January and February, is whether inflation is reaccelerating. We know that rental inflation is still high as an outcome of the surge in working from home at the start of the pandemic.

But we can be very confident that it will slow sharply over the course of the year due to the much slower inflation rate shown in indexes (including the BLS index) measuring rents in units that change hands. This means that rental inflation will not be an ongoing problem that the Fed has to worry about.

However, the recent data have shown an uptick in inflation, even pulling out rent. This is ostensibly the cause for concern.

There are two important points to be made about this uptick. First, it is not unusual to see large jumps, and falls, in CPI inflation excluding rent. Rent is a huge factor in the index, and since the pace of rental inflation changes slowly, it anchors the overall rate. Inflation is much more erratic when rent is excluded as shown below.

Note that there were many points at which inflation in the non-shelter CPI crossed 2.0 percent even in the low-inflation decade preceding the pandemic. In fact, year-over-year inflation in this index hit 2.1 percent in January of 2020, just before the pandemic started. It was at 2.5 percent in July of 2018. So a somewhat above-target reading for the non-shelter CPI should not be a major cause for concern by itself.

However, there is the question of whether the recent uptick reflects underlying trends. Here the story points in the opposite direction.

The day after the CPI report came out, we got a much more benign reading on the Producer Price Index (PPI). The overall figure for the month was 0.2 percent (0.154 to be more precise), with the core also at 0.2 percent. There are differences in coverage and methodology between the CPI and PPI, but inflation in the indexes still track each other closely.

The figure below shows the PPI for services, the PPI for goods, and the CPI.

What is perhaps most striking is how closely the CPI follows the PPI for services. That probably shouldn’t be surprising, since services account for almost two-thirds of the CPI. (It is important to note that the PPI does not include rent, so these are services minus rent.)

When the CPI goes substantially above or below the service component of the PPI it is following movements in the goods component. As can be seen the CPI has been well above the service component in the PPI since May of 2022. The cause here is the supply chain problems that sent goods inflation sky-rocketing a bit more than a year earlier.

The good news in this picture is that the goods component of the PPI has been far below the service CPI for a bit over a year, and for part of this period was even negative. This is just another way of showing the widely noted fact that the prices of supply chain goods have stabilized and in many cases are even falling. This looks likely to continue for the near-term future, especially if we don’t have a policy of blocking cheaper imports with higher tariffs as some presidential candidates are advocating.

The Wage Story

There is another part of the longer-term inflation picture that needs to be included, the slowing of wage growth. Our various wage indices show somewhat different figures for wage growth, but they tell basically the same story. Wage growth accelerated sharply as the economy reopened in the second half of 2020 and especially 2021 and 2022, as employers had to compete to hire and retain workers.

We saw record rates of quits, as workers left jobs that didn’t pay enough, offer advancement opportunities, had unsafe workplaces, or where the boss was a jerk. This is a great story, as workers saw gains in wages that outpaced inflation and workplace satisfaction hit a record high. The gains in wages were especially large for those at the bottom of the wage distribution.

While that is a very bright picture, we could not sustain nominal wage gains of the sort we were seeing in 2021 and the first half of 2022, and still hit the Fed’s 2.0 percent inflation target. Wage growth peaked at roughly 6.0 percent, 2.5 percentage points higher than the rates we were seeing before the pandemic.

To be clear, wages were not driving inflation. There was a shift from wages to profits at the start of the pandemic. It doesn’t make sense to say that wages are the cause of inflation when the profit share is increasing. But it is true that given current rates of productivity growth, we cannot have 6.0 percent wage growth and sustain anything close to a 2.0 percent rate of inflation. (FWIW, I am not a fan of the Fed’s 2.0 percent inflation target, but the Fed is.)

However, wage growth has slowed sharply over the last two years, getting close to its pre-pandemic pace. Again, there are differences by indices, but the pace of wage growth has fallen by roughly 2.0 percentage points, leaving it 0.5 percentage points above its pre-pandemic pace.

One index, the Indeed Wage Tracker, has fallen back to its 2019 rate of wage growth. This index is noteworthy because it measures wages in job postings for new hires. In this sense it can be thought of as being analogous to the new tenant rent indexes that measure the rents of units that turn over.

Just as most people don’t move every month, most people don’t change jobs every month, but we expect the rents of units that don’t turn over to roughly follow the rents of units that do change hands. In the same way, it is reasonable to think that wage patterns of workers who stay in their jobs will roughly follow wage patterns for newly hired workers. The Indeed Wage Tracker is telling us that wage growth has fallen back to a non-inflationary pace. This may take some time to show up in the other wage series, but we can be pretty confident of the direction of change.

Profit Shares and Productivity

There are two other reasons we can be reasonably confident inflation is now under control. The first is that the rise in profit shares at the start of the pandemic has not gone away. In fact, profit shares increased somewhat in the fourth quarter, indicating we are going in the wrong direction.

It is not clear why profit shares continue to rise, and not fall back towards pre-pandemic levels. (Yeah, corporations are greedy, but they have always been greedy.) The increase during the supply-chain crisis was understandable, companies have much more market power when supply is constrained. But unless conditions of competition were permanently altered by the pandemic, it’s hard to see why they would stay elevated, and we certainly should not expect them to continue to rise.

In any case, the rise in the profit share in the fourth quarter, suggests that a lower pace of inflation would be consistent with the wage growth we are now seeing, if the profit share were to remain stable. If the profit share were to fall back towards its pre-pandemic level (which was already well above its level at the start of the century), we could sustain considerably lower inflation with the current pace of wage growth.

In other words, there seems little basis for believing that the current rate of wage growth is inconsistent with the Fed’s 2.0 percent inflation target. In this respect, the Biden administration is on exactly the right track in going after abuses of market power that allow for higher margins, such as attempting to block the merger of the nation’s two largest supermarket chains, Albertson’s and Safeway. Similarly, cracking down on drug companies abusing their government-granted patent monopolies will also have the effect of reducing profit margins.

The other big wildcard in this story is productivity growth. Productivity growth soared in the last three quarters of 2023, averaging 3.7 percent over this period. Productivity growth is notoriously erratic and the data are subject to large revisions. We also have to note that growth was horrible in 2022, actually falling for the year. So, it is far too early to claim we are on a faster growth path. Nonetheless, the recent data are encouraging and it looks like we will have respectable numbers again for the first quarter, although not above 3.0 percent.

Given advances in AI and other technologies, it hardly seems absurd to think we may be seeing a productivity uptick. We are clearly at the very beginning of the uses of many of these technologies, so there will be many gains that we will see down the road.

If we can sustain a faster pace of productivity growth, then we can have faster nominal wage growth and still hit the Fed’s 2.0 percent inflation target. To be clear, I am not talking about a wildly rapid pace of growth, if we can just sustain a 2.0 percent rate, well below the rates we saw in the upturn from 1995 to 2005 and the long Golden Age from 1947 to 1973, then 4.0 percent wage growth would be consistent with 2.0 percent inflation, even after a period in which profit margins shrank somewhat.

Time to Declare Victory and Lower Rates

The long and short here is that it is really time for the Fed to declare victory in its war on inflation and start lowering interest rates. One problem that seems to be delaying rate cuts is that the economy remains strong, leaving Chair Powell and other Fed officials to talk about the situation as a one-sided choice. They see a risk of inflation if they lower rates too much or too soon, but there is little basis for concern about a recession or rising unemployment.

However, that leaves other negative effects of high interest rates out of the equation, most notably their impact on the housing market. The number of existing homes being sold in the last year is down by almost a third from its 2020-21 pace. This means that millions of people who would otherwise be looking to move are being kept in place by the Fed’s high interest rate policy.

Higher interest rates are also a drain on people’s budgets insofar as they have credit card debt or other forms of short-term debt. And it makes it more expensive to buy new or used cars. The rise in interest rates also creates stress on the financial system. This stress led to the failure of Silicon Valley Bank last year, along with several other smaller banks. With luck we won’t see another major round of bank failures this year, but higher rates unambiguously increase the risk.

In short, even if the economy does not need lower rates to sustain a healthy growth path right now, there is a real cost to keeping rates high. It’s time for the Fed to change course.

Read More Leer más Join the discussion Participa en la discusión

The inflation hawks took March’s CPI as cause for celebration, inflation may not be dead yet. There is no doubt that it was a disappointing report for those hoping we could put the pandemic inflation behind us, but there still is not much basis for thinking the Fed needs to get out the nukes and start shooting big-time.

The key point to remember is that this inflation continues to be driven overwhelmingly by rent. We know that rental inflation will be falling because we have data on marketed units, the ones that change hands, that show sharply lower rental inflation and in some cases, such as the BLS index for new tenants, actually deflation.

The CPI rental indexes will follow the index for new tenants, but with a lag. That lag is proving longer than had generally been expected, but there is no reason to question the basic logic. If people who change apartments are seeing lower rental inflation, it is pretty hard to tell a story where this doesn’t eventually show up in lower rental inflation for people who stay in the same unit.

If we just look at the inflation rate excluding shelter, we have been skating close to, or even under, the Fed’s 2.0 percent target for most of 2023. The figure below shows annualized rates over the prior three months from 2019.

Source: Bureau of Labor Statistics and author’s calculations.

There definitely has been some acceleration in this measure in the last few months, but hardly an extraordinary one. We saw even larger upticks in inflation by this measure in the past, for example twice in 2019. Rent is typically a stabilizing factor in the overall inflation rate, precisely because the rate of rental inflation changes slowly.

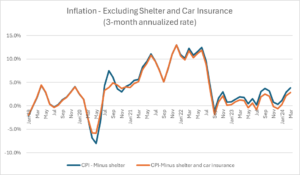

There is another item that has played a big role in pushing inflation higher in recent years, auto insurance. The story is that premiums have risen sharply in recent years because of higher payouts in claims. (Profits have risen some as well, but we know payouts are most of the story from comparing the CPI measure which picks up gross payments, with the measure in the PCE deflator, which pulls out claims.)

Some of the story with premiums is higher costs due to higher prices for auto repairs, but much of it is simply more claims. Auto theft shot up in the pandemic but is now coming down. More long-term, people are seeing more damage due to climate-related events such as floods and hurricanes. That will be an ongoing problem.

To be clear, higher auto insurance premiums are a big deal in the sense that people have to bear these costs out of their pockets, however it is not part of a conventional inflation picture. The Fed will not be lowering auto insurance premiums by raising interest rates. The solution to climate-related damage is to try to limit climate change, but if that is off the agenda for political reasons, then people will just have to get used to higher-priced auto insurance, among other things.

Anyhow, if we pull auto insurance out of the story, in addition to rent, inflation was well below the Fed’s target for most of 2023 and actually negative at several points. We still get the acceleration in recent months to a 2.9 percent annualized rate as of March, but this hardly seems like something worth getting terribly excited over given the past behavior of this index.

In short, there is still plenty of reason for believing that the pandemic inflation is behind us. For now, the March report gave the inflation hawks some fresh meat, but a more careful look suggests that it doesn’t change the basic picture of inflation being largely under control.

The inflation hawks took March’s CPI as cause for celebration, inflation may not be dead yet. There is no doubt that it was a disappointing report for those hoping we could put the pandemic inflation behind us, but there still is not much basis for thinking the Fed needs to get out the nukes and start shooting big-time.

The key point to remember is that this inflation continues to be driven overwhelmingly by rent. We know that rental inflation will be falling because we have data on marketed units, the ones that change hands, that show sharply lower rental inflation and in some cases, such as the BLS index for new tenants, actually deflation.

The CPI rental indexes will follow the index for new tenants, but with a lag. That lag is proving longer than had generally been expected, but there is no reason to question the basic logic. If people who change apartments are seeing lower rental inflation, it is pretty hard to tell a story where this doesn’t eventually show up in lower rental inflation for people who stay in the same unit.

If we just look at the inflation rate excluding shelter, we have been skating close to, or even under, the Fed’s 2.0 percent target for most of 2023. The figure below shows annualized rates over the prior three months from 2019.

Source: Bureau of Labor Statistics and author’s calculations.

There definitely has been some acceleration in this measure in the last few months, but hardly an extraordinary one. We saw even larger upticks in inflation by this measure in the past, for example twice in 2019. Rent is typically a stabilizing factor in the overall inflation rate, precisely because the rate of rental inflation changes slowly.

There is another item that has played a big role in pushing inflation higher in recent years, auto insurance. The story is that premiums have risen sharply in recent years because of higher payouts in claims. (Profits have risen some as well, but we know payouts are most of the story from comparing the CPI measure which picks up gross payments, with the measure in the PCE deflator, which pulls out claims.)

Some of the story with premiums is higher costs due to higher prices for auto repairs, but much of it is simply more claims. Auto theft shot up in the pandemic but is now coming down. More long-term, people are seeing more damage due to climate-related events such as floods and hurricanes. That will be an ongoing problem.

To be clear, higher auto insurance premiums are a big deal in the sense that people have to bear these costs out of their pockets, however it is not part of a conventional inflation picture. The Fed will not be lowering auto insurance premiums by raising interest rates. The solution to climate-related damage is to try to limit climate change, but if that is off the agenda for political reasons, then people will just have to get used to higher-priced auto insurance, among other things.

Anyhow, if we pull auto insurance out of the story, in addition to rent, inflation was well below the Fed’s target for most of 2023 and actually negative at several points. We still get the acceleration in recent months to a 2.9 percent annualized rate as of March, but this hardly seems like something worth getting terribly excited over given the past behavior of this index.

In short, there is still plenty of reason for believing that the pandemic inflation is behind us. For now, the March report gave the inflation hawks some fresh meat, but a more careful look suggests that it doesn’t change the basic picture of inflation being largely under control.

Read More Leer más Join the discussion Participa en la discusión

It is a bit bizarre that the NYT decided to frame the March Consumer Price Index data as raising a question about the Fed’s ability to cut interest rates this year. The subhead is:

“The surprisingly stubborn reading raised doubts about when — and even whether — the Federal Reserve will be able to start cutting interest rates this year.”

The Fed can cut interest rates any time it wants. Higher inflation data, like the March report, make it less likely that it will choose to cut rates, but the Fed still clearly has the option to do so.

This distinction is important since people should realize that the Fed is making policy choices. It has to weigh the risk of inflation compared to the benefits of lower rates, most notably lower interest rates on mortgages and car loans.

People can agree that the Fed is making the right call if it decides to put off any rate cuts, but they should recognize that it is not forced to delay cuts. It has chosen to do so.

It is a bit bizarre that the NYT decided to frame the March Consumer Price Index data as raising a question about the Fed’s ability to cut interest rates this year. The subhead is:

“The surprisingly stubborn reading raised doubts about when — and even whether — the Federal Reserve will be able to start cutting interest rates this year.”

The Fed can cut interest rates any time it wants. Higher inflation data, like the March report, make it less likely that it will choose to cut rates, but the Fed still clearly has the option to do so.

This distinction is important since people should realize that the Fed is making policy choices. It has to weigh the risk of inflation compared to the benefits of lower rates, most notably lower interest rates on mortgages and car loans.

People can agree that the Fed is making the right call if it decides to put off any rate cuts, but they should recognize that it is not forced to delay cuts. It has chosen to do so.

Read More Leer más Join the discussion Participa en la discusión

The New York Times is apparently finding it difficult to be honest with its readers about the burden of student loan debt. It ran a major column telling readers that the burden of student loan debt is discouraging young people from becoming priests or nuns.

The whole premise of this column rests on a lie, that student debt should be a major burden to people interested in pursuing low-paying careers that might serve a higher purpose. The reason this is a lie is that income-driven repayment plan that President Biden put in place should allow people working in low-paying occupations to face little or no burden from their student debt.

Under this plan, a single person (presumably the relevant category for nuns and priests) would have to pay zero if their annual income is less than $32,800 a year. If it is $40,000 they would owe $720 a year and at $50,000 they would have to pay $1,700 a year. This hardly seems like a crushing burden for someone who wants to devote their life to pursuing religious ends.

This is not the first time the NYT has run a piece on student loan debt that completely ignored Biden’s income-driven repayment plan. Back in January it had a lengthy piece on how student loan debt was making college a bad deal for many people that never once mentioned Biden’s plan.

It is kind of astounding that people could be writing on this important topic, for the country’s leading newspaper, who apparently know nothing about the debt burden students would face under current law. It would be very unfortunate if people made decisions on colleges and careers based on the information they’re getting from these pieces.

In addition to confusing people on their options for dealing with debt, this is also a major political issue. Since tens of millions of people have student loan debt, the existence of a repayment option that minimizes their burden is likely to be a big deal for them in how they view the political parties.

Not only did President Biden put this new income-driven plan in place (it makes earlier plans from Clinton and Obama more generous), 11 Republican state attorneys general are suing to have the courts declare the plan illegal. It is very likely that if Trump wins the election, he will end this income-driven repayment plan.

Voters should know the implications for their student loan debt burden when they go to vote this fall. Readers of the New York Times would not.

The New York Times is apparently finding it difficult to be honest with its readers about the burden of student loan debt. It ran a major column telling readers that the burden of student loan debt is discouraging young people from becoming priests or nuns.

The whole premise of this column rests on a lie, that student debt should be a major burden to people interested in pursuing low-paying careers that might serve a higher purpose. The reason this is a lie is that income-driven repayment plan that President Biden put in place should allow people working in low-paying occupations to face little or no burden from their student debt.

Under this plan, a single person (presumably the relevant category for nuns and priests) would have to pay zero if their annual income is less than $32,800 a year. If it is $40,000 they would owe $720 a year and at $50,000 they would have to pay $1,700 a year. This hardly seems like a crushing burden for someone who wants to devote their life to pursuing religious ends.

This is not the first time the NYT has run a piece on student loan debt that completely ignored Biden’s income-driven repayment plan. Back in January it had a lengthy piece on how student loan debt was making college a bad deal for many people that never once mentioned Biden’s plan.

It is kind of astounding that people could be writing on this important topic, for the country’s leading newspaper, who apparently know nothing about the debt burden students would face under current law. It would be very unfortunate if people made decisions on colleges and careers based on the information they’re getting from these pieces.

In addition to confusing people on their options for dealing with debt, this is also a major political issue. Since tens of millions of people have student loan debt, the existence of a repayment option that minimizes their burden is likely to be a big deal for them in how they view the political parties.

Not only did President Biden put this new income-driven plan in place (it makes earlier plans from Clinton and Obama more generous), 11 Republican state attorneys general are suing to have the courts declare the plan illegal. It is very likely that if Trump wins the election, he will end this income-driven repayment plan.

Voters should know the implications for their student loan debt burden when they go to vote this fall. Readers of the New York Times would not.

Read More Leer más Join the discussion Participa en la discusión

What would you call it when the median wealth of people between the ages of 55 and 64 rises by 47.4 percent in three years? If you’re CNN you would call it a retirement crisis. I wish I could say that I’m kidding, but that is the headline, “retirement crisis looms as Americans struggle to save.”

While CNN has touted and invented just about every piece of bad news imaginable since President Biden took office, this one might take the cake. The data on wealth is not hard to find, it comes from the Federal Reserve Board’s triannual Survey of Consumer Finance (SCF). The SCF showed sharp increases in median wealth for every age group.

Perhaps I missed it, but I don’t recall any CNN pieces on the retirement crisis in 2020 when people close to retirement had considerably less wealth. Maybe I’m just old-fashioned, but it seems if people have less money as they approach retirement, they are more likely to face problems in retirement than if they have more money.

To be clear, there are real retirement issues facing today’s workers. Traditional defined-benefit pensions have virtually disappeared outside of the public sector. While many workers have accumulated substantial sums in their 401(k) plans, most have not.

The largest source of wealth for the median worker is their home. Having more wealth in your home does mean you can borrow against your home, if necessary, and can pocket a substantial sum if you sell it, but it’s not the same as having a financial asset that can be freely used to support yourself. (Almost 80 percent of people in their late 60s are homeowners.)

It would be good if more workers had substantial sums accumulated in 401(k)s. Toward this end, President Biden signed the Secure 2.0 Act, which requires mid-size and large companies to enroll their workers in 401(k) plans. (Workers can opt-out if they choose.) He also imposed tougher rules on the financial industry to limit its ability to charge high fees on retirement accounts.

There is more that can and should be done to facilitate retirement savings, for example, the government could make a low-cost retirement plan, like the federal employees’ Thrift Saving Plan, available to all workers. This could substantially reduce the money wasted on administrative costs, allowing workers to accumulate more towards their retirement. But by almost every measure workers are better prepared for retirement than in 2020.

It is understandable why Donald Trump would like to see major media outlets touting a “retirement crisis” in this election year. It is not clear why a serious news outlet would do it.

What would you call it when the median wealth of people between the ages of 55 and 64 rises by 47.4 percent in three years? If you’re CNN you would call it a retirement crisis. I wish I could say that I’m kidding, but that is the headline, “retirement crisis looms as Americans struggle to save.”

While CNN has touted and invented just about every piece of bad news imaginable since President Biden took office, this one might take the cake. The data on wealth is not hard to find, it comes from the Federal Reserve Board’s triannual Survey of Consumer Finance (SCF). The SCF showed sharp increases in median wealth for every age group.

Perhaps I missed it, but I don’t recall any CNN pieces on the retirement crisis in 2020 when people close to retirement had considerably less wealth. Maybe I’m just old-fashioned, but it seems if people have less money as they approach retirement, they are more likely to face problems in retirement than if they have more money.

To be clear, there are real retirement issues facing today’s workers. Traditional defined-benefit pensions have virtually disappeared outside of the public sector. While many workers have accumulated substantial sums in their 401(k) plans, most have not.

The largest source of wealth for the median worker is their home. Having more wealth in your home does mean you can borrow against your home, if necessary, and can pocket a substantial sum if you sell it, but it’s not the same as having a financial asset that can be freely used to support yourself. (Almost 80 percent of people in their late 60s are homeowners.)

It would be good if more workers had substantial sums accumulated in 401(k)s. Toward this end, President Biden signed the Secure 2.0 Act, which requires mid-size and large companies to enroll their workers in 401(k) plans. (Workers can opt-out if they choose.) He also imposed tougher rules on the financial industry to limit its ability to charge high fees on retirement accounts.

There is more that can and should be done to facilitate retirement savings, for example, the government could make a low-cost retirement plan, like the federal employees’ Thrift Saving Plan, available to all workers. This could substantially reduce the money wasted on administrative costs, allowing workers to accumulate more towards their retirement. But by almost every measure workers are better prepared for retirement than in 2020.

It is understandable why Donald Trump would like to see major media outlets touting a “retirement crisis” in this election year. It is not clear why a serious news outlet would do it.

Read More Leer más Join the discussion Participa en la discusión

I usually see things pretty much the same way as Paul Krugman, but I seriously disagree with his column “Bidenomics is making China angry. That’s okay.” Krugman makes some reasonable points in the piece. Protecting our electric car industry and other green technologies is probably a good idea in order to give them some breathing space to grow and compete. It also makes sense to have productive capacity for advanced semi-conductors, so as not to be dependent on Taiwan in the event of a military conflict.

But it really is not okay that our policies are making China angry. We have to pursue policies that are in the U.S. national interest, but we should not be looking to gratuitously put it in China’s face. It will not be to our advantage, or the world’s, to have a Cold War with China similar to the one we had with the Soviet Union.

For those who are too young or too old to remember, we spent a huge amount of money on the military during the Cold War. In the 1970s and 1980s, when we were not in hot wars, military spending averaged over 7.0 percent of GDP.[1] When we were in hot wars like Korea and Vietnam, the tab came to well over 10.0 percent of GDP, with peaks in the early fifties of more than 15 percent of GDP. By contrast, last year we spent 3.6 percent of GDP on the military.

Apart from the lives lost in our wars (far more for the host countries than for us), this is also an enormous amount of money. If we increased our spending from last year’s 3.6 percent of GDP to 7.0 percent of GDP, the difference of 3.4 percent of GDP would translate into almost $1 trillion a year in our current economy (more than $8,000 per family). Double that if you want to have another Vietnam or Korea-type war.

And, if we’re talking about an arms race with China, these numbers would likely be very conservative. At its peak the Soviet economy was around 60 percent of the size of the U.S. economy. China’s economy is 25 percent larger than the U.S. economy and growing far more rapidly. It would require Trumpian levels of delusional thinking to believe that we could spend China into the ground, as we arguably did with the Soviet Union.

A Cooperative Alternative

We should not have illusions about China’s government. It is hardly anyone’s ideal of a liberal democracy. China’s president, Xi Jinping, is an authoritarian ruler who imprisons critics and is willing to use force to suppress political opposition. But that hardly distinguishes Xi from any number of leaders with whom the United States regularly does business.

Even if we go back to the Cold War with the Soviet Union, our foreign policy often looked to areas for possible cooperation. First and foremost, we had a number of arms control agreements designed to limit spending and the risks of accidental war. But we also looked to cooperate in other areas, most visibly space travel.

We can take a similar tack in our dealings with China. We can look to cooperate in areas that are mutually beneficial. Two obvious areas that stand out are climate and health. There could be enormous gains for both the U.S. and the world if we freely shared technologies needed to reduce greenhouse gas emissions, as well as technologies to prevent disease and improve health.

This would mean that our scientists and engineers would be collaborating with Chinese scientists in these areas, freely sharing their latest research findings. That means scientists from both countries could build on successes and learn from failures. It also would mean that once a technology is developed it can be freely employed, without having to worry about patent monopolies or other bureaucratic obstacles.

In the case of climate, we would likely benefit from getting access to China’s latest battery technology, where they appear to be well ahead of the United States. The U.S. also has innovations in many areas, such as geothermal energy, that would be valuable to China.

In the case of health, both countries have extensive networks of research in a wide range of areas. While it is common to tout the rapid development of Covid vaccines in the United States as a result of Operation Warp Speed, China developed its own vaccines in a comparable timeframe. These vaccines also proved to be very effective in preventing serious illness and death.

There would have been tremendous gains to the world if these technologies had been freely shared so that anyone anywhere in the world with the necessary manufacturing facilities could have begun producing the vaccines as soon as they were in the clinical testing phase. (The cost of throwing out a hundred million vaccines that proved ineffective is trivial compared to the benefit of having a hundred million vaccines in storage waiting to be distributed once they are shown to be effective.)

We are not going to get from where we are now to a massive sharing of technology in these two huge sectors overnight, but we can begin a process. We can pick limited areas where the gains are likely to be greatest, for example vaccines against infectious diseases. We would have to set ground rules for committing funding and the openness of research. Ideally, we would pull the rest of the world into this sort of collaboration since everyone would be in a position to benefit from having access to open research.

This sort of sharing would mean a different mechanism for supporting research and innovation. Instead of relying on government-granted patent monopolies, we would have to pay for the research upfront, as we did with the development of the Moderna vaccine. Paying directly for research is not an alien concept, we currently spend over $50 billion a year on biomedical research through the NIH.

In principle, there is no reason that we couldn’t replace the research now funded by government-granted patent monopolies with publicly funded research, but it is likely to mean fewer big paydays for those at the top. Successful researchers should get generous paychecks, and these could even be supplemented by prizes like the Nobel Prize. But in a system of direct funding, we probably would see fewer Moderna billionaires and others getting super-rich in these areas.

That is likely the biggest obstacle to pursuing this sort of cooperative path towards relations with China. There are people with big dollars at stake who are happy to keep the status quo and are just fine if we go the route of a Cold War with China.

It’s worth remembering that the first Cold War was often as much about corporate profits as confronting the Soviet Union. That is obviously true in the case of the big military contractors like Lockheed and McDonnell Douglas. But there were also plenty of cases where powerful corporations got the U.S. military to do its bidding to support their operations around the world. The concern of these companies is their profits, not the well-being of the United States or the future of democracy and the planet.

And we should recognize that if we go the full Cold War route, it is likely the future of the planet is at stake. We are having a hard enough time garnering political support for measures to limit global warming now. What would the situation look like if we are coughing up another $1 to $2 trillion a year to compete in an arms race with China?

There’s one other point worth noting about the route of increased cooperation, it may help to lead to a liberalization of China’s regime. I don’t mean to get pollyannish, there were many people who argued for admitting China to the WTO on the idea that increased trade would somehow turn the country into a liberal democracy. That one proved to be seriously wrong.

But as a practical matter, the Chinese engineers and scientists who are collaborating with their counterparts in the U.S. are likely to be children, siblings, and parents of the party officials who are calling the shots in China. If these people develop an appreciation for liberal values, it’s hard to believe that some of that doesn’t rub off on their family members.

I wouldn’t push that line with any great confidence, social psychology is not my terrain. But I will say that it offers more hope than the idea that shoe manufacturers getting rich off of cheap labor will somehow become great proponents of liberal democracy.

If Bidenomics Makes China Angry, That’s not Okay

The basic point here is that we should care a lot about our relations with China. That doesn’t mean we should structure our economy to make its leaders happy. We need to implement policies that support the prosperity and well-being of people in the United States. But we also need to try to find ways to cooperate with China in areas where it is mutually beneficial, and we certainly should not be looking for ways to put a finger in their eye.

[1] These figures use the definition of military spending in the National Income and Product Accounts. This is somewhat different than the measure used in the budget, primarily because it includes depreciation of capital equipment. The patterns of spending are similar in the two series.

I usually see things pretty much the same way as Paul Krugman, but I seriously disagree with his column “Bidenomics is making China angry. That’s okay.” Krugman makes some reasonable points in the piece. Protecting our electric car industry and other green technologies is probably a good idea in order to give them some breathing space to grow and compete. It also makes sense to have productive capacity for advanced semi-conductors, so as not to be dependent on Taiwan in the event of a military conflict.

But it really is not okay that our policies are making China angry. We have to pursue policies that are in the U.S. national interest, but we should not be looking to gratuitously put it in China’s face. It will not be to our advantage, or the world’s, to have a Cold War with China similar to the one we had with the Soviet Union.

For those who are too young or too old to remember, we spent a huge amount of money on the military during the Cold War. In the 1970s and 1980s, when we were not in hot wars, military spending averaged over 7.0 percent of GDP.[1] When we were in hot wars like Korea and Vietnam, the tab came to well over 10.0 percent of GDP, with peaks in the early fifties of more than 15 percent of GDP. By contrast, last year we spent 3.6 percent of GDP on the military.

Apart from the lives lost in our wars (far more for the host countries than for us), this is also an enormous amount of money. If we increased our spending from last year’s 3.6 percent of GDP to 7.0 percent of GDP, the difference of 3.4 percent of GDP would translate into almost $1 trillion a year in our current economy (more than $8,000 per family). Double that if you want to have another Vietnam or Korea-type war.

And, if we’re talking about an arms race with China, these numbers would likely be very conservative. At its peak the Soviet economy was around 60 percent of the size of the U.S. economy. China’s economy is 25 percent larger than the U.S. economy and growing far more rapidly. It would require Trumpian levels of delusional thinking to believe that we could spend China into the ground, as we arguably did with the Soviet Union.

A Cooperative Alternative

We should not have illusions about China’s government. It is hardly anyone’s ideal of a liberal democracy. China’s president, Xi Jinping, is an authoritarian ruler who imprisons critics and is willing to use force to suppress political opposition. But that hardly distinguishes Xi from any number of leaders with whom the United States regularly does business.

Even if we go back to the Cold War with the Soviet Union, our foreign policy often looked to areas for possible cooperation. First and foremost, we had a number of arms control agreements designed to limit spending and the risks of accidental war. But we also looked to cooperate in other areas, most visibly space travel.

We can take a similar tack in our dealings with China. We can look to cooperate in areas that are mutually beneficial. Two obvious areas that stand out are climate and health. There could be enormous gains for both the U.S. and the world if we freely shared technologies needed to reduce greenhouse gas emissions, as well as technologies to prevent disease and improve health.

This would mean that our scientists and engineers would be collaborating with Chinese scientists in these areas, freely sharing their latest research findings. That means scientists from both countries could build on successes and learn from failures. It also would mean that once a technology is developed it can be freely employed, without having to worry about patent monopolies or other bureaucratic obstacles.

In the case of climate, we would likely benefit from getting access to China’s latest battery technology, where they appear to be well ahead of the United States. The U.S. also has innovations in many areas, such as geothermal energy, that would be valuable to China.

In the case of health, both countries have extensive networks of research in a wide range of areas. While it is common to tout the rapid development of Covid vaccines in the United States as a result of Operation Warp Speed, China developed its own vaccines in a comparable timeframe. These vaccines also proved to be very effective in preventing serious illness and death.

There would have been tremendous gains to the world if these technologies had been freely shared so that anyone anywhere in the world with the necessary manufacturing facilities could have begun producing the vaccines as soon as they were in the clinical testing phase. (The cost of throwing out a hundred million vaccines that proved ineffective is trivial compared to the benefit of having a hundred million vaccines in storage waiting to be distributed once they are shown to be effective.)

We are not going to get from where we are now to a massive sharing of technology in these two huge sectors overnight, but we can begin a process. We can pick limited areas where the gains are likely to be greatest, for example vaccines against infectious diseases. We would have to set ground rules for committing funding and the openness of research. Ideally, we would pull the rest of the world into this sort of collaboration since everyone would be in a position to benefit from having access to open research.

This sort of sharing would mean a different mechanism for supporting research and innovation. Instead of relying on government-granted patent monopolies, we would have to pay for the research upfront, as we did with the development of the Moderna vaccine. Paying directly for research is not an alien concept, we currently spend over $50 billion a year on biomedical research through the NIH.

In principle, there is no reason that we couldn’t replace the research now funded by government-granted patent monopolies with publicly funded research, but it is likely to mean fewer big paydays for those at the top. Successful researchers should get generous paychecks, and these could even be supplemented by prizes like the Nobel Prize. But in a system of direct funding, we probably would see fewer Moderna billionaires and others getting super-rich in these areas.

That is likely the biggest obstacle to pursuing this sort of cooperative path towards relations with China. There are people with big dollars at stake who are happy to keep the status quo and are just fine if we go the route of a Cold War with China.

It’s worth remembering that the first Cold War was often as much about corporate profits as confronting the Soviet Union. That is obviously true in the case of the big military contractors like Lockheed and McDonnell Douglas. But there were also plenty of cases where powerful corporations got the U.S. military to do its bidding to support their operations around the world. The concern of these companies is their profits, not the well-being of the United States or the future of democracy and the planet.

And we should recognize that if we go the full Cold War route, it is likely the future of the planet is at stake. We are having a hard enough time garnering political support for measures to limit global warming now. What would the situation look like if we are coughing up another $1 to $2 trillion a year to compete in an arms race with China?

There’s one other point worth noting about the route of increased cooperation, it may help to lead to a liberalization of China’s regime. I don’t mean to get pollyannish, there were many people who argued for admitting China to the WTO on the idea that increased trade would somehow turn the country into a liberal democracy. That one proved to be seriously wrong.

But as a practical matter, the Chinese engineers and scientists who are collaborating with their counterparts in the U.S. are likely to be children, siblings, and parents of the party officials who are calling the shots in China. If these people develop an appreciation for liberal values, it’s hard to believe that some of that doesn’t rub off on their family members.

I wouldn’t push that line with any great confidence, social psychology is not my terrain. But I will say that it offers more hope than the idea that shoe manufacturers getting rich off of cheap labor will somehow become great proponents of liberal democracy.

If Bidenomics Makes China Angry, That’s not Okay

The basic point here is that we should care a lot about our relations with China. That doesn’t mean we should structure our economy to make its leaders happy. We need to implement policies that support the prosperity and well-being of people in the United States. But we also need to try to find ways to cooperate with China in areas where it is mutually beneficial, and we certainly should not be looking for ways to put a finger in their eye.

[1] These figures use the definition of military spending in the National Income and Product Accounts. This is somewhat different than the measure used in the budget, primarily because it includes depreciation of capital equipment. The patterns of spending are similar in the two series.

Read More Leer más Join the discussion Participa en la discusión

This is apparently news to BlackRock CEO, who is apparently believes it is still 65, according to a New York Times Dealbook piece.

“No one should have to work longer than they want to. But I do think it’s a bit crazy that our anchor idea for the right retirement age — 65 years old — originates from the time of the Ottoman Empire.”

The reforms to Social Security put in place in 1982 provided for a gradual increase in the normal retirement age from 65, for people turning 62 before 2002, to 67 for people turning 62 after 2022. It is also important to recognize that there is not a single age where workers start collecting benefits. They can begin getting benefits as early as age 62, but their payment will be reduced by roughly 6.0 percent for every year between the normal retirement age and the age where they start collecting benefits.

This means, for example, that a person who starts collecting benefits this year at age 62 would get roughly 30 percent less than their full scheduled benefit. (This is age 67 minus 62 [5 years] times 6 percent.)

For people who start collecting benefits after the normal retirement age, benefits increase by approximately 8 percent a year. This means that if someone who is 62 today waits until age 70 to start collecting benefits, they will get a boost to their benefits of roughly 24 percent (3 years times 8 percent). For this reason, the focus on the retirement age can be misleading, the issue is really a schedule of benefits.

This is important to keep in mind for those who think it would be good for people to work later in life. There is an obvious route to pursue if we want people to retire later that doesn’t involve reducing benefits. Instead of cutting off at age 70, we could have benefits increase to age 72 or even later.

This change is costless since the increase is set based on people’s life expectancy. That means that if people retiring at age 72 get 16 percent more each year than people who start collecting benefits at age 70, they can expect to collect benefits for a period that is 16 percent shorter. This is a simple and costless fix that should give people an incentive to retire later, if that is the outcome we are looking for.

It is also worth noting that if we think AI will take all the jobs then it is foolish to be worried that we need older people to work longer. We will not be facing a shortage of labor in that story.

This is apparently news to BlackRock CEO, who is apparently believes it is still 65, according to a New York Times Dealbook piece.

“No one should have to work longer than they want to. But I do think it’s a bit crazy that our anchor idea for the right retirement age — 65 years old — originates from the time of the Ottoman Empire.”

The reforms to Social Security put in place in 1982 provided for a gradual increase in the normal retirement age from 65, for people turning 62 before 2002, to 67 for people turning 62 after 2022. It is also important to recognize that there is not a single age where workers start collecting benefits. They can begin getting benefits as early as age 62, but their payment will be reduced by roughly 6.0 percent for every year between the normal retirement age and the age where they start collecting benefits.

This means, for example, that a person who starts collecting benefits this year at age 62 would get roughly 30 percent less than their full scheduled benefit. (This is age 67 minus 62 [5 years] times 6 percent.)

For people who start collecting benefits after the normal retirement age, benefits increase by approximately 8 percent a year. This means that if someone who is 62 today waits until age 70 to start collecting benefits, they will get a boost to their benefits of roughly 24 percent (3 years times 8 percent). For this reason, the focus on the retirement age can be misleading, the issue is really a schedule of benefits.

This is important to keep in mind for those who think it would be good for people to work later in life. There is an obvious route to pursue if we want people to retire later that doesn’t involve reducing benefits. Instead of cutting off at age 70, we could have benefits increase to age 72 or even later.

This change is costless since the increase is set based on people’s life expectancy. That means that if people retiring at age 72 get 16 percent more each year than people who start collecting benefits at age 70, they can expect to collect benefits for a period that is 16 percent shorter. This is a simple and costless fix that should give people an incentive to retire later, if that is the outcome we are looking for.

It is also worth noting that if we think AI will take all the jobs then it is foolish to be worried that we need older people to work longer. We will not be facing a shortage of labor in that story.

Read More Leer más Join the discussion Participa en la discusión

I was more than a bit surprised to see the profit data this morning. I really did believe that the profit surge during the pandemic was a one-off, associated with supply-chain issues.

We can argue about how much of this increase was a predictable story, where profits rise due to shortages, and how much was about companies exploiting market power to jack up prices, but the fact that profit shares increased is not disputable. In any case, it was reasonable to expect that profits would return to their pre-pandemic shares after supply chains returned to normal.

That doesn’t look like what is happening, as shown below.

Source: BEA and author’s calculations, see text.

The profit share of corporate income rose to 26.8 percent in the fourth quarter from 26.3 percent in the third quarter. That is down only 0.5 percentage points from its pandemic peak of 27.3 percent in the second quarter of 2021 and well above the 24.3 percent average for 2019.[1]

This rise in profit shares really should have the Fed rethinking its inflation-fighting strategy. It is certainly true that the 6.0 percent rate of wage growth at the end of 2021 and start of 2022 was inconsistent with the Fed’s 2.0 percent inflation target. However, the current rate of roughly 4.0 percent is obviously consistent with the Fed’s target, if it is allowing companies to increase their profit share. This implies that we should actually want to see a somewhat more rapid pace of wage growth, unless we think profit shares need to be increasing indefinitely.

There are a couple of important qualifications here. First, we saw extraordinary productivity growth in 2023. Clearly corporations were the main beneficiaries of this growth. If this uptick was an aberration and we revert to something closer to the pre-pandemic growth rate, then profit shares may not continue to rise with a 4.0 percent pace of wage growth and could even edge back somewhat.

The other big qualification is that there is a large and unusual discrepancy between GDP measured on the income side and GDP measured on the output side. In principle these sums should be identical, but in a $28 trillion economy, they never come out exactly the same.

In recent decades, the income side has generally been about 0.5 percentage points higher than the output side. In the fourth quarter, the income side was 2.0 percentage points lower. We usually assume that the true figure lies somewhere between the two measures.

This would imply that the true sum of wages and profits is 1.0 to 2.0 percentage points higher than what is now reported. If that gap ends up being disproportionately wages or profits it could change the picture somewhat, but even if the full 2.0 percentage points all ended up being wage income it would not change the fact that the profit share is still far above its pre-pandemic level.

The upshot is that it really is time for the Fed to declare “Mission Accomplished” and take its foot off the brake. If profit shares are rising, there is no reason for it to be trying to slow wage growth.

[1] These figures take Line 8 (net operating surplus) from NIPA Table 1.14, minus Line 11 (Federal Reserve Bank profits) from Table 6.16D divided by Line 8 plus Line 4 (labor compensation) from Table 1.14.

I was more than a bit surprised to see the profit data this morning. I really did believe that the profit surge during the pandemic was a one-off, associated with supply-chain issues.

We can argue about how much of this increase was a predictable story, where profits rise due to shortages, and how much was about companies exploiting market power to jack up prices, but the fact that profit shares increased is not disputable. In any case, it was reasonable to expect that profits would return to their pre-pandemic shares after supply chains returned to normal.

That doesn’t look like what is happening, as shown below.

Source: BEA and author’s calculations, see text.

The profit share of corporate income rose to 26.8 percent in the fourth quarter from 26.3 percent in the third quarter. That is down only 0.5 percentage points from its pandemic peak of 27.3 percent in the second quarter of 2021 and well above the 24.3 percent average for 2019.[1]

This rise in profit shares really should have the Fed rethinking its inflation-fighting strategy. It is certainly true that the 6.0 percent rate of wage growth at the end of 2021 and start of 2022 was inconsistent with the Fed’s 2.0 percent inflation target. However, the current rate of roughly 4.0 percent is obviously consistent with the Fed’s target, if it is allowing companies to increase their profit share. This implies that we should actually want to see a somewhat more rapid pace of wage growth, unless we think profit shares need to be increasing indefinitely.

There are a couple of important qualifications here. First, we saw extraordinary productivity growth in 2023. Clearly corporations were the main beneficiaries of this growth. If this uptick was an aberration and we revert to something closer to the pre-pandemic growth rate, then profit shares may not continue to rise with a 4.0 percent pace of wage growth and could even edge back somewhat.

The other big qualification is that there is a large and unusual discrepancy between GDP measured on the income side and GDP measured on the output side. In principle these sums should be identical, but in a $28 trillion economy, they never come out exactly the same.

In recent decades, the income side has generally been about 0.5 percentage points higher than the output side. In the fourth quarter, the income side was 2.0 percentage points lower. We usually assume that the true figure lies somewhere between the two measures.

This would imply that the true sum of wages and profits is 1.0 to 2.0 percentage points higher than what is now reported. If that gap ends up being disproportionately wages or profits it could change the picture somewhat, but even if the full 2.0 percentage points all ended up being wage income it would not change the fact that the profit share is still far above its pre-pandemic level.

The upshot is that it really is time for the Fed to declare “Mission Accomplished” and take its foot off the brake. If profit shares are rising, there is no reason for it to be trying to slow wage growth.

[1] These figures take Line 8 (net operating surplus) from NIPA Table 1.14, minus Line 11 (Federal Reserve Bank profits) from Table 6.16D divided by Line 8 plus Line 4 (labor compensation) from Table 1.14.

Read More Leer más Join the discussion Participa en la discusión

David Wallace-Wells had a column discussing the trip by Javier Milei, Argentina’s new president, to the World Economic Forum (WEF) in Davos, Switzerland. The WEF is an annual gathering of many of the world’s richest people, where they also invite politicians, academics, and others who they think may amuse them. According to Wallace-Wells, Mr. Milei definitely fits into that category.

The piece talked about how Milei calls himself as an anarchist, with the government just doing basic functions, like defending the country and running the criminal justice system. Otherwise, Milei would eliminate any role for government, if he had his choice.

It is humorous to hear politicians make declarations like this. As a practical matter, almost all of these self-described anarchists would have a very large role for the government. What they want to do is to write the rules in ways that sends income upwards and then just pretend it is the natural order of things.

Patent and Copyright Monopolies

The best place to go to start ripping off the phony face of these “anarchists” is with government-granted patent and copyright monopolies. These monopolies, which make folks like Bill Gates incredibly rich, are not part of any natural order. They are explicit government policies designed to promote innovation and creative work.

It is possible to argue for these government-granted monopolies as good policy, but that doesn’t change the fact that they are government policies. It is just a lie to say that you don’t want the government intervening in the market and then support these monopolies.

The lie also has the effect of avoiding a serious debate on the relative merits of these mechanisms for supporting innovation and creative work, compared to other mechanisms. People like Milei pretend that copyrights and patents are just the natural working of the market, whereas other mechanisms, like publicly funded open-source research and creative work are government interventions.