The NYT told readers that the Obama administration wants to increase the demand for goods and services, “which could then give employers the confidence to hire.” Actually, an increase in the demand for goods and services forces employers to hire at the risk of losing business.

If a restaurant doesn’t have enough staff to serve its customers, it will lose customers. If a factory doesn’t have enough workers to fill its order then it loses orders. Increased demand forces businesses to use more labor.

Confidence may affect the extent to which firms actually hire more workers, as opposed to increasing the number of hours worked per worker. The latter still remains well below its pre-recession level. This is a strong piece of evidence that a lack of demand, not confidence, is the main factor impeding business expansion.

The article at one point comments that:

“Many businesses and consumers remain sufficiently scarred by the financial crisis and long economic slump that they are awaiting clear evidence of a recovery before beginning to spend and hire at a healthy pace again.”

Actually consumers are already spending at a healthy pace. Their saving rate is close to 5 percent, well below the pre-bubble average of 8 percent. As a result of this low rate of saving (and high rate of consumption), most workers will have very little wealth accumulated at the point their retire. This is especially troublesome given plans in Washington to cut Social Security and Medicare.

The article also discusses the possibility that the Fed will change the composition of its holdings of U.S. government bonds. It could try to bring down longer term interest rates by selling short-term bonds and buying 10-year or 30-year Treasury bonds.

It would have been worth mentioning that the Fed could also reduce the government’s projected interest burden by holding these bonds. Currently the Fed is refunding roughly $80 billion a year (@2.2 percent of spending) to the Treasury from the interest it earns on its assets.

If the Fed continued to hold these bonds, rather than sell them off as it currently plans, it could save the government close to $600 billion in interest payments over the next decade. Given the concerns in Washington over deficits, this would have been worth mentioning.

The NYT told readers that the Obama administration wants to increase the demand for goods and services, “which could then give employers the confidence to hire.” Actually, an increase in the demand for goods and services forces employers to hire at the risk of losing business.

If a restaurant doesn’t have enough staff to serve its customers, it will lose customers. If a factory doesn’t have enough workers to fill its order then it loses orders. Increased demand forces businesses to use more labor.

Confidence may affect the extent to which firms actually hire more workers, as opposed to increasing the number of hours worked per worker. The latter still remains well below its pre-recession level. This is a strong piece of evidence that a lack of demand, not confidence, is the main factor impeding business expansion.

The article at one point comments that:

“Many businesses and consumers remain sufficiently scarred by the financial crisis and long economic slump that they are awaiting clear evidence of a recovery before beginning to spend and hire at a healthy pace again.”

Actually consumers are already spending at a healthy pace. Their saving rate is close to 5 percent, well below the pre-bubble average of 8 percent. As a result of this low rate of saving (and high rate of consumption), most workers will have very little wealth accumulated at the point their retire. This is especially troublesome given plans in Washington to cut Social Security and Medicare.

The article also discusses the possibility that the Fed will change the composition of its holdings of U.S. government bonds. It could try to bring down longer term interest rates by selling short-term bonds and buying 10-year or 30-year Treasury bonds.

It would have been worth mentioning that the Fed could also reduce the government’s projected interest burden by holding these bonds. Currently the Fed is refunding roughly $80 billion a year (@2.2 percent of spending) to the Treasury from the interest it earns on its assets.

If the Fed continued to hold these bonds, rather than sell them off as it currently plans, it could save the government close to $600 billion in interest payments over the next decade. Given the concerns in Washington over deficits, this would have been worth mentioning.

Read More Leer más Join the discussion Participa en la discusión

National income really is very basic stuff. It gets taught in every intro econ class. Anyone writing on economics should know it inside out. They should be able to do it blindfolded, with one hand tied behind their back, and standing upside down.

Unfortunately, it seems that most people reporting and writing on economics for major news outlets can’t do national income accounting at all. Let’s take Robert Samuelson at the Washington Post. I had a lesson on this topic for him last month, which I won’t repeat here.

But his column today really would benefit enormously from an understanding of national income accounting. He is asking why the economy has not recovered despite President Obama’s stimulus. His answer is that firms are not investing because of regulatory uncertainty created by President Obama’s health care plan and other measures and that consumers are worried after the collapse of the housing bubble and therefore not spending money.

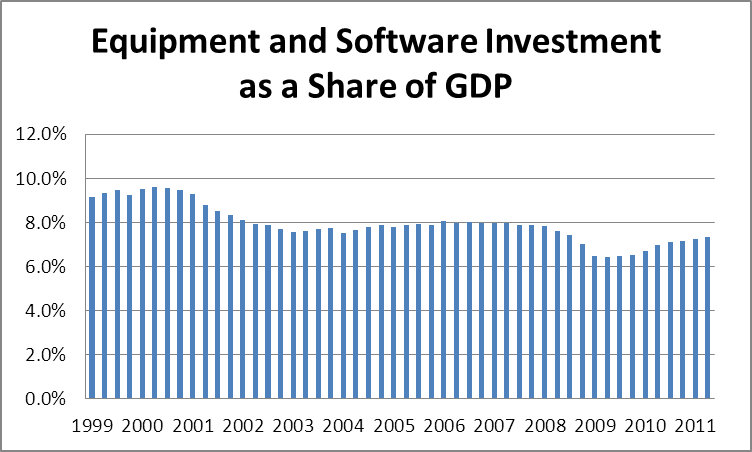

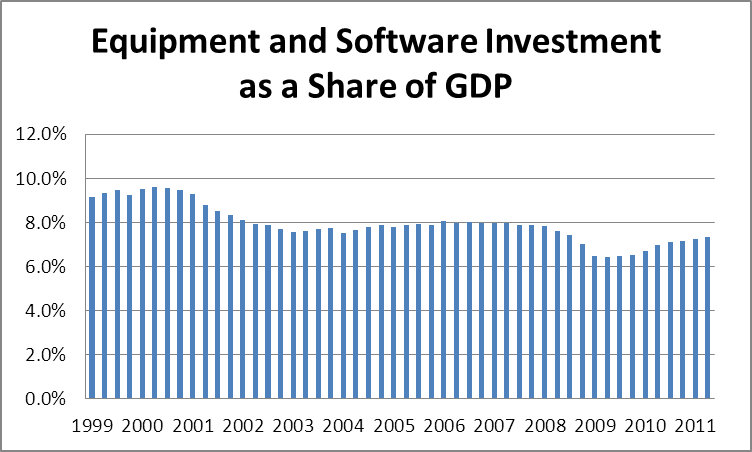

See, if Robert Samuelson understood national income accounting, he would know that there really is no problem with either investment or consumption. Investment in equipment and software has pretty much risen back to its pre-recession level as a share of GDP. This is actually quite impressive, since there is a huge amount of excess capacity in most sectors of the economy.

Consumption is actually high, not low. The saving rate is hovering near 5.0 percent. This is well-below its post-war average of 8.0 percent, before the wealth created by the stock and housing bubbles sparked a consumption boom.

So, if neither investment nor consumption is the problem, then why isn’t the economy bouncing back? This is where national income accounting would be very useful to Mr. Samuelson. The problem is that the country has a large trade deficit. It is close to 4.0 percent of GDP now, and would likely be in the 5-6 percent range if we were back at full employment. (Higher GDP increases imports, which would increase the size of the deficit.) This creates a huge shortfall in demand.

This shortfall was filled during the housing bubble years by a consumption boom and boom in residential construction and some categories of non-residential construction. With the loss of housing bubble wealth, there is no reason to expect consumption to return to its bubble levels. Nor would this be desirable, since it would mean that families are not saving adequately for retirement even as the nation’s elite (e.g. the Washington Post, Peter Peterson, etc.) are planning to cut back their Social Security and Medicare.

The only way to get close to full employment in the short-term is through much higher levels of deficit spending. In the longer term we will have to lower the value of the dollar to get the trade deficit closer to balanced.

It really is that simple. The problem is not regulation, taxes, or uncertainty, the problem was that the stimulus was not big enough or long enough. As it is, we are sitting around watching our national leaders debate why the water that they heated to 160 degrees is not boiling. This is getting really painful.

National income really is very basic stuff. It gets taught in every intro econ class. Anyone writing on economics should know it inside out. They should be able to do it blindfolded, with one hand tied behind their back, and standing upside down.

Unfortunately, it seems that most people reporting and writing on economics for major news outlets can’t do national income accounting at all. Let’s take Robert Samuelson at the Washington Post. I had a lesson on this topic for him last month, which I won’t repeat here.

But his column today really would benefit enormously from an understanding of national income accounting. He is asking why the economy has not recovered despite President Obama’s stimulus. His answer is that firms are not investing because of regulatory uncertainty created by President Obama’s health care plan and other measures and that consumers are worried after the collapse of the housing bubble and therefore not spending money.

See, if Robert Samuelson understood national income accounting, he would know that there really is no problem with either investment or consumption. Investment in equipment and software has pretty much risen back to its pre-recession level as a share of GDP. This is actually quite impressive, since there is a huge amount of excess capacity in most sectors of the economy.

Consumption is actually high, not low. The saving rate is hovering near 5.0 percent. This is well-below its post-war average of 8.0 percent, before the wealth created by the stock and housing bubbles sparked a consumption boom.

So, if neither investment nor consumption is the problem, then why isn’t the economy bouncing back? This is where national income accounting would be very useful to Mr. Samuelson. The problem is that the country has a large trade deficit. It is close to 4.0 percent of GDP now, and would likely be in the 5-6 percent range if we were back at full employment. (Higher GDP increases imports, which would increase the size of the deficit.) This creates a huge shortfall in demand.

This shortfall was filled during the housing bubble years by a consumption boom and boom in residential construction and some categories of non-residential construction. With the loss of housing bubble wealth, there is no reason to expect consumption to return to its bubble levels. Nor would this be desirable, since it would mean that families are not saving adequately for retirement even as the nation’s elite (e.g. the Washington Post, Peter Peterson, etc.) are planning to cut back their Social Security and Medicare.

The only way to get close to full employment in the short-term is through much higher levels of deficit spending. In the longer term we will have to lower the value of the dollar to get the trade deficit closer to balanced.

It really is that simple. The problem is not regulation, taxes, or uncertainty, the problem was that the stimulus was not big enough or long enough. As it is, we are sitting around watching our national leaders debate why the water that they heated to 160 degrees is not boiling. This is getting really painful.

Read More Leer más Join the discussion Participa en la discusión

This is a very nice front page piece. This is what newspapers are supposed to.

This is a very nice front page piece. This is what newspapers are supposed to.

Read More Leer más Join the discussion Participa en la discusión

Thomas Friedman is once again orthogonal to reality. In his column today he urges a “grand bargain” where the Republicans abandon extremists of the right and agree to tax increases and Democrats abandon extremists of the left and agree to cut Medicare and Social Security (euphemistically referred to as “entitlements”). There is one little problem with Friedman’s story.

Support for Social Security and Medicare is not confined to extremists of the left. Overwhelming majorities of every group, including Republicans and self-identified supporters of the Tea Party, are opposed to cuts to Social Security and Medicare. The only people who seem to support such cuts are wealthy people like Mr. Friedman.

The reality is that Social Security is easily affordable as everyone familiar with the projections knows. According to the latest projections from the Congressional Budget Office, the program can pay every penny of benefits for more than a quarter century with no changes whatsoever. To make the program fully solvent throughout its 75-year planning horizon would require a tax increase equal to 5 percent of the wage growth projected over the next 30 years. This is why people familiar with the program’s finances are generally unwilling to support cuts in Social Security benefits, unlike Mr. Friedman.

Medicare is more of an issue, but that is because the U.S. health care system is broken. We already pay more than twice as much per person for our health care as people in other wealthy countries. This gap is projected to increase in the decades ahead. If we had the same per person health care costs as any other wealthy country we would be looking at huge budget surpluses, not deficits. This is why serious people focus on fixing the health care system, not cutting Medicare.

The large deficits the country currently faces are due to an economic collapse caused by Wall Street greed and the incompetence of people with names like Alan Greenspan, Ben Bernanke, and Hank Paulson. Mr. Friedman doesn’t call for sacrifices from these people, for example with a financial speculation tax like the one recently proposed by German Chancellor Angela Merkel and French President Nicolas Sarkozy.

Thomas Friedman is once again orthogonal to reality. In his column today he urges a “grand bargain” where the Republicans abandon extremists of the right and agree to tax increases and Democrats abandon extremists of the left and agree to cut Medicare and Social Security (euphemistically referred to as “entitlements”). There is one little problem with Friedman’s story.

Support for Social Security and Medicare is not confined to extremists of the left. Overwhelming majorities of every group, including Republicans and self-identified supporters of the Tea Party, are opposed to cuts to Social Security and Medicare. The only people who seem to support such cuts are wealthy people like Mr. Friedman.

The reality is that Social Security is easily affordable as everyone familiar with the projections knows. According to the latest projections from the Congressional Budget Office, the program can pay every penny of benefits for more than a quarter century with no changes whatsoever. To make the program fully solvent throughout its 75-year planning horizon would require a tax increase equal to 5 percent of the wage growth projected over the next 30 years. This is why people familiar with the program’s finances are generally unwilling to support cuts in Social Security benefits, unlike Mr. Friedman.

Medicare is more of an issue, but that is because the U.S. health care system is broken. We already pay more than twice as much per person for our health care as people in other wealthy countries. This gap is projected to increase in the decades ahead. If we had the same per person health care costs as any other wealthy country we would be looking at huge budget surpluses, not deficits. This is why serious people focus on fixing the health care system, not cutting Medicare.

The large deficits the country currently faces are due to an economic collapse caused by Wall Street greed and the incompetence of people with names like Alan Greenspan, Ben Bernanke, and Hank Paulson. Mr. Friedman doesn’t call for sacrifices from these people, for example with a financial speculation tax like the one recently proposed by German Chancellor Angela Merkel and French President Nicolas Sarkozy.

Read More Leer más Join the discussion Participa en la discusión

Gregory Mankiw says that the economy’s big problem is a lack of investment in equipment and software. And, he has some remedies that he suggests for President Obama. He is pushing tax reform, more NAFTA-style trade agreements, reduced regulation and weakening the power of workers.The general story is that we want to be even more business friendly.

Of course we did have a president who tried being business friendly. His name was George W. Bush. Gregory Mankiw should remember him since he was President Bush’s chief economist for several years.

Let’s compare the track record on investment in equipment and software. At its peak before the recession, investment in equipment and software was 8.0 percent of GDP. At 7.4 percent of GDP in the most recent quarter, this category of investment has bounced back from its low in 2009 of 6.4 percent, but still has not made it back to the pre-recession peak.

But this still looks pretty good compared to the record under President Bush. The pre-recession peak share was 9.6 percent in 2000. The share continued to fall through the first three years of the Bush presidency, hitting 7.6 percent in 2003 and then stayed pretty much flat through the rest of the Bush presidency.

Source: Bureau of Economic Analysis.

Given this track record, it seems like Mankiw might be giving advice on how to boost to investment to the wrong president.

Gregory Mankiw says that the economy’s big problem is a lack of investment in equipment and software. And, he has some remedies that he suggests for President Obama. He is pushing tax reform, more NAFTA-style trade agreements, reduced regulation and weakening the power of workers.The general story is that we want to be even more business friendly.

Of course we did have a president who tried being business friendly. His name was George W. Bush. Gregory Mankiw should remember him since he was President Bush’s chief economist for several years.

Let’s compare the track record on investment in equipment and software. At its peak before the recession, investment in equipment and software was 8.0 percent of GDP. At 7.4 percent of GDP in the most recent quarter, this category of investment has bounced back from its low in 2009 of 6.4 percent, but still has not made it back to the pre-recession peak.

But this still looks pretty good compared to the record under President Bush. The pre-recession peak share was 9.6 percent in 2000. The share continued to fall through the first three years of the Bush presidency, hitting 7.6 percent in 2003 and then stayed pretty much flat through the rest of the Bush presidency.

Source: Bureau of Economic Analysis.

Given this track record, it seems like Mankiw might be giving advice on how to boost to investment to the wrong president.

Read More Leer más Join the discussion Participa en la discusión

When discussing President Obama’s stimulus package, the Post told readers:

“The toughest critique came from Republicans who see key elements of the president’s plan as stimulus spending that they say is likely to add to the deficit without creating jobs.”

Of course the Post has no clue how Republicans “see key elements.” Like the rest of us, the Post’s reporters know that the Republicans routinely say that they don’t believe that the stimulus created jobs, but it has no idea how they actually view the stimulus.

It is possible that they are familiar with the evidence that shows the stimulus created even more jobs than President Obama had predicted. The problem was that the economy needed more than 8 million jobs and the stimulus was only designed to create 2-3 million. However, even if Republicans know these facts they may still say that the stimulus added to the deficit without creating jobs.

When discussing President Obama’s stimulus package, the Post told readers:

“The toughest critique came from Republicans who see key elements of the president’s plan as stimulus spending that they say is likely to add to the deficit without creating jobs.”

Of course the Post has no clue how Republicans “see key elements.” Like the rest of us, the Post’s reporters know that the Republicans routinely say that they don’t believe that the stimulus created jobs, but it has no idea how they actually view the stimulus.

It is possible that they are familiar with the evidence that shows the stimulus created even more jobs than President Obama had predicted. The problem was that the economy needed more than 8 million jobs and the stimulus was only designed to create 2-3 million. However, even if Republicans know these facts they may still say that the stimulus added to the deficit without creating jobs.

Read More Leer más Join the discussion Participa en la discusión

The Post is world-renowned for having relied on David Lereah, the chief economist at the National Association of Realtors and the author of Why the Housing Boom Will Not Bust and How You Can Profit from It as its main expert on the housing market during the build-up of the housing bubble. Remarkably, it still seems to rely exclusively on economists who do not understand the housing market as sources on economic issues.

It headlined an article on President Obama’s stimulus package:

“economists give good reviews but say more needed on mortgage debt.”

The article included comments from Mark Zandi and the chairman of Macroeconomic Advisers. Both Zandi and Macroeconomic Advisers were dismissive of the idea that the housing bubble posed any serious threat to the economy.

In fact, it is easy to show that mortgage debt is not the major problem facing the economy, even though the housing crash has placed many homeowners in a precarious situation. Even after the crash, consumption continues to be a far larger share of GDP than its average over the post-World War II period and the saving rate – which is hovering near 5 percent – continues to be well below its 8 percent average.

Source: Bureau of Economic Analysis.

Source: Bureau of Economic Analysis.

It is easy to show that the main factors keeping demand depressed are the sharp falloff in construction due to the overbuilding from the bubbles in residential and non-residential construction and the large trade deficit. The trade deficit was offset in the bubble years by bubble-driven consumption and construction, but it is ridiculous to envision the U.S. economy returning to this growth path.

The Post should try to find some economists with a better understanding of the economy as sources for its news articles.

The Post is world-renowned for having relied on David Lereah, the chief economist at the National Association of Realtors and the author of Why the Housing Boom Will Not Bust and How You Can Profit from It as its main expert on the housing market during the build-up of the housing bubble. Remarkably, it still seems to rely exclusively on economists who do not understand the housing market as sources on economic issues.

It headlined an article on President Obama’s stimulus package:

“economists give good reviews but say more needed on mortgage debt.”

The article included comments from Mark Zandi and the chairman of Macroeconomic Advisers. Both Zandi and Macroeconomic Advisers were dismissive of the idea that the housing bubble posed any serious threat to the economy.

In fact, it is easy to show that mortgage debt is not the major problem facing the economy, even though the housing crash has placed many homeowners in a precarious situation. Even after the crash, consumption continues to be a far larger share of GDP than its average over the post-World War II period and the saving rate – which is hovering near 5 percent – continues to be well below its 8 percent average.

Source: Bureau of Economic Analysis.

Source: Bureau of Economic Analysis.

It is easy to show that the main factors keeping demand depressed are the sharp falloff in construction due to the overbuilding from the bubbles in residential and non-residential construction and the large trade deficit. The trade deficit was offset in the bubble years by bubble-driven consumption and construction, but it is ridiculous to envision the U.S. economy returning to this growth path.

The Post should try to find some economists with a better understanding of the economy as sources for its news articles.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post told readers that the economy is at risk of a double-dip recession because reported job growth fell to zero in August. Actually, the zero figure was due to some quirks (e.g. the Verizon strike). The only double-dip recession of the last 50 years (1980-81) was quite deliberately engineered by the Fed. A major component of GDP will have to turn sharply negative to cause growth to go in reverse. This will require more than the gradual shrinking of the government sector, and there are no obvious candidates at the moment.

The Washington Post told readers that the economy is at risk of a double-dip recession because reported job growth fell to zero in August. Actually, the zero figure was due to some quirks (e.g. the Verizon strike). The only double-dip recession of the last 50 years (1980-81) was quite deliberately engineered by the Fed. A major component of GDP will have to turn sharply negative to cause growth to go in reverse. This will require more than the gradual shrinking of the government sector, and there are no obvious candidates at the moment.

Read More Leer más Join the discussion Participa en la discusión

We can infer this based on his confident assertion that tens of millions of workers will absolutely have to experience prolonged bouts of unemployment because of the collapse of the housing bubble. He bases this assertion on a book by Kenneth Rogoff and Carmen Reinhart that reviewed eight centuries of financial crises.

Rogoff and Reinhart find that it typically takes 8-10 years to recover from the effects of a financial crisis. They therefore infer that we should it expect 8-10 years to recover from this crisis. Brooks strongly endorses this view, telling the country to just get used to it.

Of course by the Rogoff, Reinhart, Brooks methodology we should expect most newborns to die before they reach the age of 5. If we looked back over the last 8 centuries and picked random 20 year intervals, in most countries during most of the period, the vast majority of children would die before they reach the age of 5. Therefore we should conclude that this time is not different, most children born in 2011 will not live to be 5.

The reason that we do expect our children to live beyond 5 today is that we have had enormous improvements in nutrition, sanitation and health care. It is now the exception that children don’t live past 5.

We also might think that we have learned something about economics in this period. (Admittedly, the track record of our top economists might suggest otherwise.) This is why it is reasonable to think that the gods have simply not ordered that we suffer through 8-10 years of high unemployment.

Brooks also repeats Republican claptrap about how the stimulus did not create any jobs. Actually, we have some evidence on this one. It shows that the stimulus likely created even more jobs than predicted. The problem was that it was too small, as those familiar with arithmetic said at the time.

We can infer this based on his confident assertion that tens of millions of workers will absolutely have to experience prolonged bouts of unemployment because of the collapse of the housing bubble. He bases this assertion on a book by Kenneth Rogoff and Carmen Reinhart that reviewed eight centuries of financial crises.

Rogoff and Reinhart find that it typically takes 8-10 years to recover from the effects of a financial crisis. They therefore infer that we should it expect 8-10 years to recover from this crisis. Brooks strongly endorses this view, telling the country to just get used to it.

Of course by the Rogoff, Reinhart, Brooks methodology we should expect most newborns to die before they reach the age of 5. If we looked back over the last 8 centuries and picked random 20 year intervals, in most countries during most of the period, the vast majority of children would die before they reach the age of 5. Therefore we should conclude that this time is not different, most children born in 2011 will not live to be 5.

The reason that we do expect our children to live beyond 5 today is that we have had enormous improvements in nutrition, sanitation and health care. It is now the exception that children don’t live past 5.

We also might think that we have learned something about economics in this period. (Admittedly, the track record of our top economists might suggest otherwise.) This is why it is reasonable to think that the gods have simply not ordered that we suffer through 8-10 years of high unemployment.

Brooks also repeats Republican claptrap about how the stimulus did not create any jobs. Actually, we have some evidence on this one. It shows that the stimulus likely created even more jobs than predicted. The problem was that it was too small, as those familiar with arithmetic said at the time.

Read More Leer más Join the discussion Participa en la discusión

Joe Biden seems badly confused after his recent trip to China. In an oped column he told NYT readers that:

“according to the International Monetary Fund, America’s gross domestic product, almost $15 trillion, is still more than twice as large as China’s; our per-capita G.D.P., above $47,000, is 11 times China’s.”

Mr. Biden was looking at the wrong table. It seems that he was using GDP measures based on exchange rate comparison. This would lead to an understatement of China’s GDP if its currency is under-valued.

Economists typically use purchasing power parity measures to make comparisons. These measures apply a common set of prices for the goods and services produced in different countries. The IMF’s projections show that China’s GDP is projected to be over $11 trillion in 2011 measured on a purchasing power parity basis, more than 70 percent of the U.S. level. Furthermore, it is projected to pass the United States by this measure by the end of the next presidential term of office.

Joe Biden seems badly confused after his recent trip to China. In an oped column he told NYT readers that:

“according to the International Monetary Fund, America’s gross domestic product, almost $15 trillion, is still more than twice as large as China’s; our per-capita G.D.P., above $47,000, is 11 times China’s.”

Mr. Biden was looking at the wrong table. It seems that he was using GDP measures based on exchange rate comparison. This would lead to an understatement of China’s GDP if its currency is under-valued.

Economists typically use purchasing power parity measures to make comparisons. These measures apply a common set of prices for the goods and services produced in different countries. The IMF’s projections show that China’s GDP is projected to be over $11 trillion in 2011 measured on a purchasing power parity basis, more than 70 percent of the U.S. level. Furthermore, it is projected to pass the United States by this measure by the end of the next presidential term of office.

Read More Leer más Join the discussion Participa en la discusión