The media have been engaged big time in the numbers without context game, throwing out really big numbers faster than anyone can catch them. (For the biggest, the overall size of the stimulus, given the time frame, we are looking at a stimulus that is about five times as large as the Obama stimulus.) While there are many great comparisons to be made on who got what, for tonight I just want to focus on one, the handout to Boeing compared with the money provided to the Corporation for Public Broadcasting.

As most people know, Boeing was already in trouble for reasons having nothing to do with the coronavirus. Safety problems with its new 737 Max led to two deadly crashes. Apparently the problems stem from very basic features of the plane which cannot be easily fixed. These problems have whacked Boeing’s profits and stock price and forced it to send its CEO packing, although he did get a $62 million going away present.

Anyhow, being the empathetic crew they are, Trump and the Republicans rushed to set aside a nice chunk of taxpayer dollars for Boeing in their big corporate slush fund. Boeing is slated to get $17 billion in loans to help get it through the crisis.

We should be clear on what exactly this means. The government is not handing Boeing $17 billion, it is lending it $17 billion at an interest rate below what the market would charge. So it is wrong to say that the government is giving Boeing $17 billion. What it is giving Boeing is the difference between what it would have to pay to borrow this money in private capital markets and what it is paying the government on its loans.

It is not easy to know what the current market rate would be, given the extraordinary credit situation, but let’s say this gap is 5.0 percentage points. If we assume the loans are out for a year (it could be considerably longer), then we would effectively be handing Boeing $850 million (5.0 percent of $17 billion).

While it is important to make the distinction between a handout of $17 billion and a loan of $17 billion, it is also important to correct a lie that was told about the last bailout and will be told about this one. The lie is that we made a profit on the bailout, the money was repaid with interest.

In an economic crisis, there are lots of businesses and individuals who would love to be able to borrow at the discount rate the government is providing to its favored recipients. As the lowest cost borrower, the government could always make money by lending to businesses at an interest rate between what the market would charge them and what the government pays. Yet, no one in their right mind would suggest that the government have an open-ended facility for this purpose, even though it would be hugely profitable by the bailout apologists’ standards.

Giving subsidized loans, even though they earn the government interest, is a huge subsidy. And, if we did an infinite amount of such loans we would have a serious problem with inflation, just the same as if the government were to hand everyone $100,000 a year. Serious people understand this fact, even if they choose not to be honest about it.

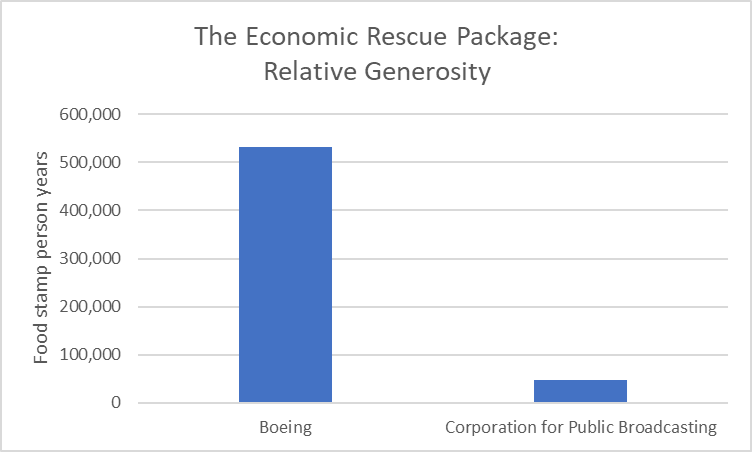

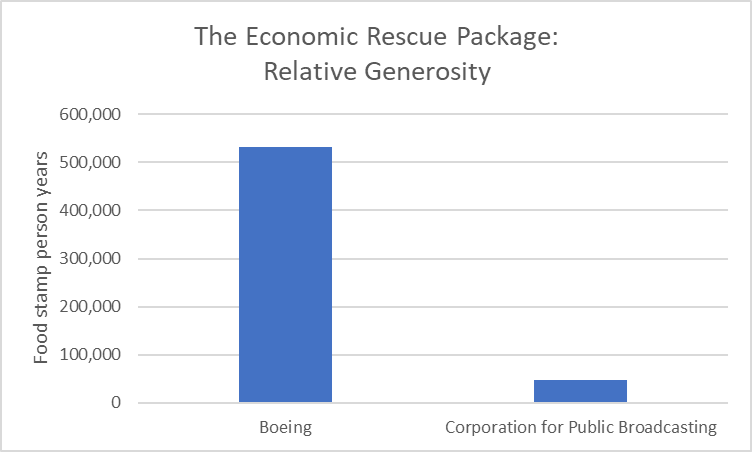

Anyhow, for our big comparison, we will look at the $850 million gift to Boeing and the $75 million in the package that was designated for the Corporation for Public Broadcasting (CPB). CPB gives money to a wide range of public broadcasters including the Public Broadcasting Service and National Public Radio.

To put this in a context that might be meaningful to people, we will use the metric of a “food stamp person year.” The average food stamp beneficiary in 2018 received $127 per month, which translates in $1,560 a year. To account for inflation, I rounded up to $1,600 per person per year.

Source: Author’s calculations, see text.

While some people are undoubtedly upset by the CPB getting $75 million, Boeing is getting more than ten times as much money from the rescue package. Some of this money will likely help to keep its workers employed, but much of this will go to the 8-digit paycheck of Boeing’s new CEO and keeping its shareholders happy.

Anyhow, people can have different opinions on the merits of these items, but they should at least have a clear idea of their relative size.

The media have been engaged big time in the numbers without context game, throwing out really big numbers faster than anyone can catch them. (For the biggest, the overall size of the stimulus, given the time frame, we are looking at a stimulus that is about five times as large as the Obama stimulus.) While there are many great comparisons to be made on who got what, for tonight I just want to focus on one, the handout to Boeing compared with the money provided to the Corporation for Public Broadcasting.

As most people know, Boeing was already in trouble for reasons having nothing to do with the coronavirus. Safety problems with its new 737 Max led to two deadly crashes. Apparently the problems stem from very basic features of the plane which cannot be easily fixed. These problems have whacked Boeing’s profits and stock price and forced it to send its CEO packing, although he did get a $62 million going away present.

Anyhow, being the empathetic crew they are, Trump and the Republicans rushed to set aside a nice chunk of taxpayer dollars for Boeing in their big corporate slush fund. Boeing is slated to get $17 billion in loans to help get it through the crisis.

We should be clear on what exactly this means. The government is not handing Boeing $17 billion, it is lending it $17 billion at an interest rate below what the market would charge. So it is wrong to say that the government is giving Boeing $17 billion. What it is giving Boeing is the difference between what it would have to pay to borrow this money in private capital markets and what it is paying the government on its loans.

It is not easy to know what the current market rate would be, given the extraordinary credit situation, but let’s say this gap is 5.0 percentage points. If we assume the loans are out for a year (it could be considerably longer), then we would effectively be handing Boeing $850 million (5.0 percent of $17 billion).

While it is important to make the distinction between a handout of $17 billion and a loan of $17 billion, it is also important to correct a lie that was told about the last bailout and will be told about this one. The lie is that we made a profit on the bailout, the money was repaid with interest.

In an economic crisis, there are lots of businesses and individuals who would love to be able to borrow at the discount rate the government is providing to its favored recipients. As the lowest cost borrower, the government could always make money by lending to businesses at an interest rate between what the market would charge them and what the government pays. Yet, no one in their right mind would suggest that the government have an open-ended facility for this purpose, even though it would be hugely profitable by the bailout apologists’ standards.

Giving subsidized loans, even though they earn the government interest, is a huge subsidy. And, if we did an infinite amount of such loans we would have a serious problem with inflation, just the same as if the government were to hand everyone $100,000 a year. Serious people understand this fact, even if they choose not to be honest about it.

Anyhow, for our big comparison, we will look at the $850 million gift to Boeing and the $75 million in the package that was designated for the Corporation for Public Broadcasting (CPB). CPB gives money to a wide range of public broadcasters including the Public Broadcasting Service and National Public Radio.

To put this in a context that might be meaningful to people, we will use the metric of a “food stamp person year.” The average food stamp beneficiary in 2018 received $127 per month, which translates in $1,560 a year. To account for inflation, I rounded up to $1,600 per person per year.

Source: Author’s calculations, see text.

While some people are undoubtedly upset by the CPB getting $75 million, Boeing is getting more than ten times as much money from the rescue package. Some of this money will likely help to keep its workers employed, but much of this will go to the 8-digit paycheck of Boeing’s new CEO and keeping its shareholders happy.

Anyhow, people can have different opinions on the merits of these items, but they should at least have a clear idea of their relative size.

Read More Leer más Join the discussion Participa en la discusión

There have been a number of pieces in major news outlets telling us what the recovery will look like from this recession. Most have been pretty negative. The important thing to know about these forecasts is that the people making these forecasts don’t have a clue what they are talking about.

The shape of recovery will depend first and foremost on the extent to which the coronavirus is contained or is treatable, areas in which most of our prognosticators have zero expertise. I can think of a scenario in which we have a very robust recovery.

Suppose that in three months we have developed treatments to the point that the disease is not much more deadly than the standard flu. In that case, we would look to restart the economy while trying to protect the most vulnerable segments of the population.

If this happens, there will be lots of people with money to spend (many are getting full paychecks, plus $1,200 from the government). They have gone three months without going to a restaurant, seeing a movie, or any other form of recreation. There will also be lots of pent-up demand for cars, houses, and many other things. This could lead to quite a burst of spending that could keep the economy going strong for some time. (Look for some inflation, insofar as a poorly designed economic survival package didn’t focus on keeping workers tied to their firms, so that businesses could restart quickly without having to hire and train workers.)

Will this happen? Ask someone who knows something about the virus, not me.

The point is that the course of the recovery will depend on what happens with the progress in containing and/or treating the coronavirus, and anyone who cannot speak authoritatively on that point has no clue what the recovery will look like.

There have been a number of pieces in major news outlets telling us what the recovery will look like from this recession. Most have been pretty negative. The important thing to know about these forecasts is that the people making these forecasts don’t have a clue what they are talking about.

The shape of recovery will depend first and foremost on the extent to which the coronavirus is contained or is treatable, areas in which most of our prognosticators have zero expertise. I can think of a scenario in which we have a very robust recovery.

Suppose that in three months we have developed treatments to the point that the disease is not much more deadly than the standard flu. In that case, we would look to restart the economy while trying to protect the most vulnerable segments of the population.

If this happens, there will be lots of people with money to spend (many are getting full paychecks, plus $1,200 from the government). They have gone three months without going to a restaurant, seeing a movie, or any other form of recreation. There will also be lots of pent-up demand for cars, houses, and many other things. This could lead to quite a burst of spending that could keep the economy going strong for some time. (Look for some inflation, insofar as a poorly designed economic survival package didn’t focus on keeping workers tied to their firms, so that businesses could restart quickly without having to hire and train workers.)

Will this happen? Ask someone who knows something about the virus, not me.

The point is that the course of the recovery will depend on what happens with the progress in containing and/or treating the coronavirus, and anyone who cannot speak authoritatively on that point has no clue what the recovery will look like.

Read More Leer más Join the discussion Participa en la discusión

I routinely complain about reporters failing to put numbers in context. Their coverage of the stimulus being pushed through Congress is a huge FAIL. The $2 trillion deal is being compared to Obama’s $800 billion stimulus package. This is an incredibly inadequate comparison.

First, the $800 billion includes a number of tax provisions that would have been passed even if the economy was doing great. The actual stimulus was around $720 billion. Some of this money was designated for later years but most was for 2009 and 2010, so we can say that it was roughly $350 billion a year for those two years.

By contrast, the McConnell bill is $2 trillion for essentially nine months, and possibly as short as two and a half weeks, if anyone takes Trump’s Easter re-opening seriously. We have to adjust for the fact that the economy is 50 percent larger today than in 2009, so that would make Obama’s stimulus $525 billion a year. That compares to McConnell’s $2 trillion over nine months, which is $2.7 trillion on an annual basis.

So, in terms of size, the McConnell package on annual basis is about five times the Obama package. To be clear, that is not an indictment, we have to spend what is necessary to keep people whole through this crisis. But the media should be clear in conveying the enormity of the package being debated.

I routinely complain about reporters failing to put numbers in context. Their coverage of the stimulus being pushed through Congress is a huge FAIL. The $2 trillion deal is being compared to Obama’s $800 billion stimulus package. This is an incredibly inadequate comparison.

First, the $800 billion includes a number of tax provisions that would have been passed even if the economy was doing great. The actual stimulus was around $720 billion. Some of this money was designated for later years but most was for 2009 and 2010, so we can say that it was roughly $350 billion a year for those two years.

By contrast, the McConnell bill is $2 trillion for essentially nine months, and possibly as short as two and a half weeks, if anyone takes Trump’s Easter re-opening seriously. We have to adjust for the fact that the economy is 50 percent larger today than in 2009, so that would make Obama’s stimulus $525 billion a year. That compares to McConnell’s $2 trillion over nine months, which is $2.7 trillion on an annual basis.

So, in terms of size, the McConnell package on annual basis is about five times the Obama package. To be clear, that is not an indictment, we have to spend what is necessary to keep people whole through this crisis. But the media should be clear in conveying the enormity of the package being debated.

Read More Leer más Join the discussion Participa en la discusión

We know that Donald Trump is obsessed with the stock market, seeing it as the main measure of the economy’s performance under his tenure. Unfortunately, many non-Trump supporters, who don’t own lots of stock, seem to share his concern.

Let’s be clear what the stock market measures. It is not designed to measure the well-being of a typical household or even the overall growth of the economy. Stock prices are ostensibly telling us the expected value of the future flow of profits to a company. Policies that raise after-tax profits should raise stock prices, even if they are horrible for the economy, while policies that might be good for the economy should still lower stock prices if they will reduce corporate profits.

This means, for example, an increase in the corporate income tax of 10 percentage points should be expected to lower stock prices by 10 percent, other things equal. Regulations that lower drug prices and have publicly financed research (no patent monopolies) should send the stock price of the drug companies plummeting, just as Medicare for All would devastate the stock price of the health insurance companies.

If a progressive is hugely bothered by a plunge in stock prices, then they really don’t support progressive economic policy. Of course, that doesn’t mean it is good news that the stock market plummets because the economy is shut down by a pandemic, but the real bad news in this story is that the economy is shut down by the pandemic (and many people will get sick and die), not the stock market falling.

We know that Donald Trump is obsessed with the stock market, seeing it as the main measure of the economy’s performance under his tenure. Unfortunately, many non-Trump supporters, who don’t own lots of stock, seem to share his concern.

Let’s be clear what the stock market measures. It is not designed to measure the well-being of a typical household or even the overall growth of the economy. Stock prices are ostensibly telling us the expected value of the future flow of profits to a company. Policies that raise after-tax profits should raise stock prices, even if they are horrible for the economy, while policies that might be good for the economy should still lower stock prices if they will reduce corporate profits.

This means, for example, an increase in the corporate income tax of 10 percentage points should be expected to lower stock prices by 10 percent, other things equal. Regulations that lower drug prices and have publicly financed research (no patent monopolies) should send the stock price of the drug companies plummeting, just as Medicare for All would devastate the stock price of the health insurance companies.

If a progressive is hugely bothered by a plunge in stock prices, then they really don’t support progressive economic policy. Of course, that doesn’t mean it is good news that the stock market plummets because the economy is shut down by a pandemic, but the real bad news in this story is that the economy is shut down by the pandemic (and many people will get sick and die), not the stock market falling.

Read More Leer más Join the discussion Participa en la discusión

It is more than a bit painful to see Chuck Schumer and Nancy Pelosi go through a silly charade of imposing conditions on the $500 billion slush fund that McConnell has made a centerpiece of the Senate bill. Those of us who have been alive for the last three years know that there is exactly zero chance that Trump and Mnuchin will comply with any oversight conditions.

It is the official position of the Trump administration (argued in court cases) that they don’t have to turn over a damn thing to Congress. Do Schumer and Pelosi not know this? The administration’s position is that if Congress doesn’t like it, the recourse is impeachment. And we know where that one ends up.

Just today, Trump was openly telling the governors that he was happy to offer federal help, but it has to be a two way street. In other words, Mr. “we need a favor, though” was making federal aid to state government conditional on governors kissing his rear. Do the Democrats leaders in Congress really not see what is going on here?

This is like Lucy holding the football for Charlie Brown, and telling him that she will pull it away at the last moment, and then Charlie Brown races to kick his field goal anyhow.

Come on folks — this is just painfully stupid, no slush fund for known criminals!

It is more than a bit painful to see Chuck Schumer and Nancy Pelosi go through a silly charade of imposing conditions on the $500 billion slush fund that McConnell has made a centerpiece of the Senate bill. Those of us who have been alive for the last three years know that there is exactly zero chance that Trump and Mnuchin will comply with any oversight conditions.

It is the official position of the Trump administration (argued in court cases) that they don’t have to turn over a damn thing to Congress. Do Schumer and Pelosi not know this? The administration’s position is that if Congress doesn’t like it, the recourse is impeachment. And we know where that one ends up.

Just today, Trump was openly telling the governors that he was happy to offer federal help, but it has to be a two way street. In other words, Mr. “we need a favor, though” was making federal aid to state government conditional on governors kissing his rear. Do the Democrats leaders in Congress really not see what is going on here?

This is like Lucy holding the football for Charlie Brown, and telling him that she will pull it away at the last moment, and then Charlie Brown races to kick his field goal anyhow.

Come on folks — this is just painfully stupid, no slush fund for known criminals!

Read More Leer más Join the discussion Participa en la discusión

I had planned to use my segment this week to outline an incremental approach to Medicare for All, since we are obviously not going to get there all at once, or at least not any time soon. (It starts with lowering the Medicare age to 64 and reducing payments to providers – the pharmaceutical industry, the medical equipment industry, and doctors — but you’ll have to tune in next week to get the full story.) But with the economy collapsing due to coronavirus and Donald Trump’s gang tossing out half-baked stimulus proposals, I decided to deal with the crisis at hand.

At the most basic level we have to understand the problem we face. The issue here is not what we typically face in a recession, with too little demand in the economy. People have money, and in principle are willing to spend, but the problem is that they don’t have the opportunity to spend. They can’t go to restaurants, movies, sports events, or travel. This is why sending out checks is silly. People will spend on necessities, but most of the money will be saved.

Our problem is not creating demand in the economy, the problem is keeping people more or less whole for a possibly extended period in which much of the economy is shut down. We also want to make sure that the economy can bounce back quickly when the crisis is over.

As far as the first part of the story, the Trump $1,200 check is grossly inadequate and misdirected. How far will $1,200 go if people are missing two months or even three months of paychecks. The median wage in the economy is a bit under $20 an hour. That comes to $800 a week or a bit more than $3,200 a month. A $1,200 check will not come close to keeping people whole through an extended shutdown period.

There are also many people who are not being hit by the crisis. People who are retired or who are still getting their paychecks should be doing just fine. There is no obvious reason to be sending these people $1,200 checks.

The alternative that I, and many other economists, have been pushing is a system like that adopted by Denmark and now the United Kingdom, where the government picks up the bulk of the pay (75 percent in the case of Denmark, 80 percent in the case of the UK) for workers who are being laid off. The payments are made directly to the companies, who then pay their workers. (In Denmark, the companies have to make up the remaining 25 percent of workers’ pay.)

The advantage of this route is that it can, as much as possible, keep workers whole through what could be an extended period of time where they cannot work at their regular jobs. It also takes advantage of the structures that are already in place. Workers getting paychecks from their employers will keep getting paychecks from their employers.

Also, the great aspect to this system over the send out checks route is that workers remain tied to their employers. At the end of the crisis, we will not be in a situation where millions of businesses suddenly have to find and train a new workforce. They can keep the same people on staff so that once the crisis is over they should be able to ramp up quickly to their pre-crisis capacity.

This is not the entirety of a survival package. There are workers who are self-employed or gig workers. These people need the opportunity to collect unemployment benefits based on their prior earnings. It should be possible to improvise a system of unemployment payments based on the 1099 forms that these workers should have filed in prior quarters.

There will still be some people who will fall through the cracks in these systems. At the very least we should be making eligibility for programs like Temporary Assistance to Needy Families and food stamps less strict in the crisis. This would mean, for example, temporarily eliminating work requirements. Incredibly, it seems the Trump administration is determined to go in the opposite direction.

State and local governments will also need large cash infusions during this period of crisis. Their main sources of revenue, income and sales taxes, will be going through the floor in the crisis. This is at a time where they will be facing enormous demands for medical care and other costly crisis-related measures. The federal government will have to reimburse these governments for the lost revenue and additional crisis-related expenses. (Yeah, Republicans are not likely to do this, but that should be a non-negotiable condition of any package going through the House.)

There are other measures that the federal government should have been doing a month or more ago to directly deal with the spread and treatment of the coronavirus. This includes ensuring an adequate supply of tests, face masks and other protective gear, ventilators, and emergency medical facilities.

It should also be rushing to train health care workers to do more mundane tasks, such as taking patients’ temperatures, changing bedding, and cleaning surfaces. This would free up time for badly overworked nurses and other more highly trained medical professionals. We also have to ensure that these and other essential workers have adequate child care arrangements.

Undoubtedly, other problems will arise that will have to be addressed if the economy is largely shutdown for two or three months, or possibly even longer. We have never experienced a situation where large segments of the economy are literally put out of business for a prolonged period of time.

The normal market mechanisms will not be working during this period, which means that the government will have to step in to address shortages of important items or emergency situations. This is a situation in which having a trustworthy and competent government really makes a difference. Unfortunately, we have Donald Trump.

I had planned to use my segment this week to outline an incremental approach to Medicare for All, since we are obviously not going to get there all at once, or at least not any time soon. (It starts with lowering the Medicare age to 64 and reducing payments to providers – the pharmaceutical industry, the medical equipment industry, and doctors — but you’ll have to tune in next week to get the full story.) But with the economy collapsing due to coronavirus and Donald Trump’s gang tossing out half-baked stimulus proposals, I decided to deal with the crisis at hand.

At the most basic level we have to understand the problem we face. The issue here is not what we typically face in a recession, with too little demand in the economy. People have money, and in principle are willing to spend, but the problem is that they don’t have the opportunity to spend. They can’t go to restaurants, movies, sports events, or travel. This is why sending out checks is silly. People will spend on necessities, but most of the money will be saved.

Our problem is not creating demand in the economy, the problem is keeping people more or less whole for a possibly extended period in which much of the economy is shut down. We also want to make sure that the economy can bounce back quickly when the crisis is over.

As far as the first part of the story, the Trump $1,200 check is grossly inadequate and misdirected. How far will $1,200 go if people are missing two months or even three months of paychecks. The median wage in the economy is a bit under $20 an hour. That comes to $800 a week or a bit more than $3,200 a month. A $1,200 check will not come close to keeping people whole through an extended shutdown period.

There are also many people who are not being hit by the crisis. People who are retired or who are still getting their paychecks should be doing just fine. There is no obvious reason to be sending these people $1,200 checks.

The alternative that I, and many other economists, have been pushing is a system like that adopted by Denmark and now the United Kingdom, where the government picks up the bulk of the pay (75 percent in the case of Denmark, 80 percent in the case of the UK) for workers who are being laid off. The payments are made directly to the companies, who then pay their workers. (In Denmark, the companies have to make up the remaining 25 percent of workers’ pay.)

The advantage of this route is that it can, as much as possible, keep workers whole through what could be an extended period of time where they cannot work at their regular jobs. It also takes advantage of the structures that are already in place. Workers getting paychecks from their employers will keep getting paychecks from their employers.

Also, the great aspect to this system over the send out checks route is that workers remain tied to their employers. At the end of the crisis, we will not be in a situation where millions of businesses suddenly have to find and train a new workforce. They can keep the same people on staff so that once the crisis is over they should be able to ramp up quickly to their pre-crisis capacity.

This is not the entirety of a survival package. There are workers who are self-employed or gig workers. These people need the opportunity to collect unemployment benefits based on their prior earnings. It should be possible to improvise a system of unemployment payments based on the 1099 forms that these workers should have filed in prior quarters.

There will still be some people who will fall through the cracks in these systems. At the very least we should be making eligibility for programs like Temporary Assistance to Needy Families and food stamps less strict in the crisis. This would mean, for example, temporarily eliminating work requirements. Incredibly, it seems the Trump administration is determined to go in the opposite direction.

State and local governments will also need large cash infusions during this period of crisis. Their main sources of revenue, income and sales taxes, will be going through the floor in the crisis. This is at a time where they will be facing enormous demands for medical care and other costly crisis-related measures. The federal government will have to reimburse these governments for the lost revenue and additional crisis-related expenses. (Yeah, Republicans are not likely to do this, but that should be a non-negotiable condition of any package going through the House.)

There are other measures that the federal government should have been doing a month or more ago to directly deal with the spread and treatment of the coronavirus. This includes ensuring an adequate supply of tests, face masks and other protective gear, ventilators, and emergency medical facilities.

It should also be rushing to train health care workers to do more mundane tasks, such as taking patients’ temperatures, changing bedding, and cleaning surfaces. This would free up time for badly overworked nurses and other more highly trained medical professionals. We also have to ensure that these and other essential workers have adequate child care arrangements.

Undoubtedly, other problems will arise that will have to be addressed if the economy is largely shutdown for two or three months, or possibly even longer. We have never experienced a situation where large segments of the economy are literally put out of business for a prolonged period of time.

The normal market mechanisms will not be working during this period, which means that the government will have to step in to address shortages of important items or emergency situations. This is a situation in which having a trustworthy and competent government really makes a difference. Unfortunately, we have Donald Trump.

Read More Leer más Join the discussion Participa en la discusión

• GovernmentEl GobiernoHealth and Social ProgramsLos Programas Sociales y de SaludUnited StatesEE. UU.

(This piece is co-authored with Jared Bernstein and is also posted on his site.)

While the indicators are lagging, the U.S. economy is in a recession that will very likely be extremely deep. It’s likely that real GDP falls at double-digit pace in the quarter that begins next month and the unemployment rate more than doubles. If that sounds implausible, history shows that in sharp downturns, the unemployment rate takes the elevator up and the stairs down.

To their credit, after a slow start Congress appears to have grasped this urgency and is working around the clock on what may turn out to be the largest stimulus package in our history, with a price tag of $1-2 trillion, or 5-10 percent of GDP (the Recovery Act was $800 billion over two years, roughly 2.0 percent of GDP). Given that fighting the virus essentially calls for putting the U.S. economy in deep freeze for an unknown period, we vigorously support going big.

But even as Congress must speed toward completion and passage of this legislation, there is time to avoid wasting resources, and there is one, large part of the bill—$500 billion, according to the Washington Post—that threatens to create a “slush fund” for businesses with virtually no oversight, no benefits for workers, and far too much discretion for President Trump to dole out goodies to himself and his cronies.

The lending mechanism in question allocates $500 billion to backstop (i.e., repayment is guaranteed by the government) private-sector loans to the tune of $50 billion to airlines, $8 billion for cargo carriers, $17 billion for businesses “critical to national security,” and $425 billion for businesses, states, and cities.

To be clear, there’s nothing wrong and a lot right with providing resources of these magnitudes for businesses. The bill also proposes $350 billion for small business with a smart, built-in incentive to help workers: if employers use a portion of the loan to maintain their payrolls, that portion is forgiven.

But the $500 billion carries no such incentives (there is a requirement that CEO can’t raise their pay over last year’s level, but that could mean just “restricting” a CEO to a $15 million paycheck, an extremely mild condition). Nor does there appear to be adequate oversight or “underwriting,” the process by which banks determine credit worthiness, leading Sen. Warren to tweet that it “sounds like Trump hotel properties like Mar-a-Largo could receive huge bags of cash – and then fire their workers – if Steve Mnuchin decides to do a solid for his boss with taxpayer dollars.”

We know for a fact that Democrats want to complete this stimulus package as quickly as possible to get money out the door to people and small businesses that are a few paychecks away from personal despair and possible failure or bankruptcy. But the bill won’t pass without the support of Democrats in both chambers (the stimulus will require 60 votes in the Senate).

Yes, time is of the essence, but Democrats must use their leverage to remove this Trump/Mnuchin slush fund while they quickly negotiate the attaching of pro-worker conditionality to it. The main thing for this moment is to get the help to families (direct cash) and small businesses out the door.

There is no obvious reason that we can’t do something similar for larger firms by making loans available for purposes of meeting their payrolls.* If the airlines and other especially hard hit businesses need additional assistance to get through the crisis, we can work through a well-designed package that ensures both that shareholders and top executives share the pain and that President Trump can’t use the money to help himself and his friends.

But let’s train our water hoses on where the immediate fire is—low, moderate income households and small businesses with a week or two of cash reserves and little access to credit markets. No question, this is an emergency, but that doesn’t excuse opportunistic, potentially wasteful spending with no oversight. We have important work to do, none of which includes setting up a half-a-trillion-dollar slush fund.

*Technical note: Supporters of this part of the bill argue that because the liquidity for the $500 billion is provided by the Federal Reserve (though one of the “lending facilities” the Fed’s been setting up), it cannot include the same forgiveness feature for maintaining payroll that’s part of small business loan package. The reason given is that the under the Fed’s charter, this would invoke credit risk the Fed cannot undertake. We do not find this at all convincing. First, as with all such lending programs, the Treasury must backstop the Fed’s credit risk. Once they do so, given that the fiscal authorities guarantee the full loan, it is unclear to us why the forgiveness feature is problematic. Other conditions, such as no buybacks, dividends, any payroll maintenance, or even just some oversight should not invoke Fed risk and are thus no-brainers in this context.

(This piece is co-authored with Jared Bernstein and is also posted on his site.)

While the indicators are lagging, the U.S. economy is in a recession that will very likely be extremely deep. It’s likely that real GDP falls at double-digit pace in the quarter that begins next month and the unemployment rate more than doubles. If that sounds implausible, history shows that in sharp downturns, the unemployment rate takes the elevator up and the stairs down.

To their credit, after a slow start Congress appears to have grasped this urgency and is working around the clock on what may turn out to be the largest stimulus package in our history, with a price tag of $1-2 trillion, or 5-10 percent of GDP (the Recovery Act was $800 billion over two years, roughly 2.0 percent of GDP). Given that fighting the virus essentially calls for putting the U.S. economy in deep freeze for an unknown period, we vigorously support going big.

But even as Congress must speed toward completion and passage of this legislation, there is time to avoid wasting resources, and there is one, large part of the bill—$500 billion, according to the Washington Post—that threatens to create a “slush fund” for businesses with virtually no oversight, no benefits for workers, and far too much discretion for President Trump to dole out goodies to himself and his cronies.

The lending mechanism in question allocates $500 billion to backstop (i.e., repayment is guaranteed by the government) private-sector loans to the tune of $50 billion to airlines, $8 billion for cargo carriers, $17 billion for businesses “critical to national security,” and $425 billion for businesses, states, and cities.

To be clear, there’s nothing wrong and a lot right with providing resources of these magnitudes for businesses. The bill also proposes $350 billion for small business with a smart, built-in incentive to help workers: if employers use a portion of the loan to maintain their payrolls, that portion is forgiven.

But the $500 billion carries no such incentives (there is a requirement that CEO can’t raise their pay over last year’s level, but that could mean just “restricting” a CEO to a $15 million paycheck, an extremely mild condition). Nor does there appear to be adequate oversight or “underwriting,” the process by which banks determine credit worthiness, leading Sen. Warren to tweet that it “sounds like Trump hotel properties like Mar-a-Largo could receive huge bags of cash – and then fire their workers – if Steve Mnuchin decides to do a solid for his boss with taxpayer dollars.”

We know for a fact that Democrats want to complete this stimulus package as quickly as possible to get money out the door to people and small businesses that are a few paychecks away from personal despair and possible failure or bankruptcy. But the bill won’t pass without the support of Democrats in both chambers (the stimulus will require 60 votes in the Senate).

Yes, time is of the essence, but Democrats must use their leverage to remove this Trump/Mnuchin slush fund while they quickly negotiate the attaching of pro-worker conditionality to it. The main thing for this moment is to get the help to families (direct cash) and small businesses out the door.

There is no obvious reason that we can’t do something similar for larger firms by making loans available for purposes of meeting their payrolls.* If the airlines and other especially hard hit businesses need additional assistance to get through the crisis, we can work through a well-designed package that ensures both that shareholders and top executives share the pain and that President Trump can’t use the money to help himself and his friends.

But let’s train our water hoses on where the immediate fire is—low, moderate income households and small businesses with a week or two of cash reserves and little access to credit markets. No question, this is an emergency, but that doesn’t excuse opportunistic, potentially wasteful spending with no oversight. We have important work to do, none of which includes setting up a half-a-trillion-dollar slush fund.

*Technical note: Supporters of this part of the bill argue that because the liquidity for the $500 billion is provided by the Federal Reserve (though one of the “lending facilities” the Fed’s been setting up), it cannot include the same forgiveness feature for maintaining payroll that’s part of small business loan package. The reason given is that the under the Fed’s charter, this would invoke credit risk the Fed cannot undertake. We do not find this at all convincing. First, as with all such lending programs, the Treasury must backstop the Fed’s credit risk. Once they do so, given that the fiscal authorities guarantee the full loan, it is unclear to us why the forgiveness feature is problematic. Other conditions, such as no buybacks, dividends, any payroll maintenance, or even just some oversight should not invoke Fed risk and are thus no-brainers in this context.

Read More Leer más Join the discussion Participa en la discusión

Those of us at CEPR have been putting out a lot of material on what the appropriate response by Congress to the coronavirus crisis should be. We have said the immediate focus has to be containing the virus and finding the necessary resources (health care workers and equipment) to treat people. However, we also recognize the economy is taking an enormous hit and tens of millions of people will lose their jobs.

In this context, economists would usually think of ways to increase demand to boost employment. This doesn’t make sense here. The problem is not a lack of demand in the economy, the problem is that people are literally unable to work. Restaurants, theaters, hotels and other businesses are being forced to close. In some areas, people cannot leave their homes. Increased consumer demand will not change this story.

The economic problem is ensuring that these people can sustain themselves through the crisis. This means making sure that they have enough money to pay their rent or mortgage, utilities, food, and other necessities. If we define full employment as a situation where everyone who wants to and is able to work has a job, we could well be in this situation with 40 million fewer people employed.

We want to make sure that businesses are in a situation to be up and running quickly once the crisis has passed, which is why some of us have advocated work-sharing type programs. We may need some additional stimulus at that point, but for now, the goal of economic policy is keeping people in their homes and as comfortable as possible, under the circumstances.

Those of us at CEPR have been putting out a lot of material on what the appropriate response by Congress to the coronavirus crisis should be. We have said the immediate focus has to be containing the virus and finding the necessary resources (health care workers and equipment) to treat people. However, we also recognize the economy is taking an enormous hit and tens of millions of people will lose their jobs.

In this context, economists would usually think of ways to increase demand to boost employment. This doesn’t make sense here. The problem is not a lack of demand in the economy, the problem is that people are literally unable to work. Restaurants, theaters, hotels and other businesses are being forced to close. In some areas, people cannot leave their homes. Increased consumer demand will not change this story.

The economic problem is ensuring that these people can sustain themselves through the crisis. This means making sure that they have enough money to pay their rent or mortgage, utilities, food, and other necessities. If we define full employment as a situation where everyone who wants to and is able to work has a job, we could well be in this situation with 40 million fewer people employed.

We want to make sure that businesses are in a situation to be up and running quickly once the crisis has passed, which is why some of us have advocated work-sharing type programs. We may need some additional stimulus at that point, but for now, the goal of economic policy is keeping people in their homes and as comfortable as possible, under the circumstances.

Read More Leer más Join the discussion Participa en la discusión

Andrew Sorkin used his column to make the basic point about a bailout, it has to be centered on keeping workers attached to their jobs, by keeping the paychecks flowing. His proposal is a no-interest bridge loan to any business, including the self-employed, to stay in business and continue to pay their workers. The businesses would have five years to pay back the loans.

This is a reasonable plan, although I am somewhat partial to the Danish system where the government picks up 75 percent of the wage bill, as long as the company picks up the other 25 percent. (Workers have to chip in by giving up five days of paid vacation [seriously].)

Anyhow, we can debate the relative merits of these proposals, but the basic point is right. We don’t know how long we will effectively have the economy in a freeze mode, but we need to make sure that workers can survive this period, and then companies are set to pick up and run again once it is over. That is why it is so important to have a plan that keeps workers on their companies payroll even if they are not actually working.

Sorkin does get the story badly wrong at the end. He tells readers:

“In truth, the plan’s entire aim is to return the economy to the state it was in before the crisis with as little change and interruption as possible.

“But once we do that, and the economy gets back on its feet, we need to have a very serious, almost grave, conversation in the country with our political and business leaders about financial responsibility and our policies. Over the past 20 years, we have lurched from bailouts to wars to rescue packages to bailouts again, and we never fill up our coffers during the best of times to pay for any of them.

“At some point, our debt will become the crisis that we can’t end with more money.”

Nope, this part is completely wrong. The rise in the debt is of very little consequence. What’s the bad story here, we end up with a debt to GDP ratio of 250 percent of GDP and then …. we end up making money on our debt because investors are willing to pay the government to lend it money?

Interest on the debt can be a burden, but we are way below the burdens we faced in the early 1990s (it was over 3.0 percent of GDP then, compared to less than 2.0 percent today), and that burden did not prevent the 1990s from being a very prosperous decade.

More importantly any honest accounting of the debt must include the copyright and patent rents the government commits us to paying. This comes to almost 2.0 percent of GDP each year for prescription drugs alone. Anyone who tries to tell us about the burden of the debt, without adding in these obligations the government makes for us, deserves only ridicule. They are either ignorant of economics or dishonest.

Andrew Sorkin used his column to make the basic point about a bailout, it has to be centered on keeping workers attached to their jobs, by keeping the paychecks flowing. His proposal is a no-interest bridge loan to any business, including the self-employed, to stay in business and continue to pay their workers. The businesses would have five years to pay back the loans.

This is a reasonable plan, although I am somewhat partial to the Danish system where the government picks up 75 percent of the wage bill, as long as the company picks up the other 25 percent. (Workers have to chip in by giving up five days of paid vacation [seriously].)

Anyhow, we can debate the relative merits of these proposals, but the basic point is right. We don’t know how long we will effectively have the economy in a freeze mode, but we need to make sure that workers can survive this period, and then companies are set to pick up and run again once it is over. That is why it is so important to have a plan that keeps workers on their companies payroll even if they are not actually working.

Sorkin does get the story badly wrong at the end. He tells readers:

“In truth, the plan’s entire aim is to return the economy to the state it was in before the crisis with as little change and interruption as possible.

“But once we do that, and the economy gets back on its feet, we need to have a very serious, almost grave, conversation in the country with our political and business leaders about financial responsibility and our policies. Over the past 20 years, we have lurched from bailouts to wars to rescue packages to bailouts again, and we never fill up our coffers during the best of times to pay for any of them.

“At some point, our debt will become the crisis that we can’t end with more money.”

Nope, this part is completely wrong. The rise in the debt is of very little consequence. What’s the bad story here, we end up with a debt to GDP ratio of 250 percent of GDP and then …. we end up making money on our debt because investors are willing to pay the government to lend it money?

Interest on the debt can be a burden, but we are way below the burdens we faced in the early 1990s (it was over 3.0 percent of GDP then, compared to less than 2.0 percent today), and that burden did not prevent the 1990s from being a very prosperous decade.

More importantly any honest accounting of the debt must include the copyright and patent rents the government commits us to paying. This comes to almost 2.0 percent of GDP each year for prescription drugs alone. Anyone who tries to tell us about the burden of the debt, without adding in these obligations the government makes for us, deserves only ridicule. They are either ignorant of economics or dishonest.

Read More Leer más Join the discussion Participa en la discusión

The fact that Donald Trump’s tax cut did not produce the investment and growth that was promised is widely known. There was a modest uptick in growth in 2018, from 2.4 percent the prior year to 2.9 percent in 2018, but this pace fell back to 2.3 percent last year. Virtually, all forecasts showed the growth rate falling still lower in 2020, even before the coronavirus began to impose large economic costs.

This is well below the 3.0 percent growth, for as far as the eye can see, promised by the Trump administration. In fact, the 2.5 percent average growth rate for the first three years of the Trump administration is only slightly better than the 2.3 percent average growth rate for the last three years of the Obama administration.

More important than the growth figures is the fact that there is zero evidence that it gave any substantial boost to investment. The investment share of GDP crept up slightly from 13.2 percent of GDP in 2017 to 13.5 percent in 2018, but it was back down to 13.4 percent last year. And, in the fourth quarter of 2019 it was back to 13.2 percent. The investment share never got as high as the 13.7 percent reached in 2014 under Obama. There certainly is not much of a boom story here.

Some tax cut proponents insist that the tax cut would have led to the promised boom had it not been for Donald Trump’s trade war. While there is little doubt that the trade war has had a negative effect on investment and growth, the impact would have to be far larger than any models project in order for the trade war to have been the only thing that stifled an investment boom. Also, from the standpoint of touting Donald Trump’s economic record, it is a bit hard to maintain that his tax cut would have led to a great investment boom, if not for damage caused by his ill-conceived trade war.

The story of the tax cut and the economy is simple. We gave a large tax cut, a bit less than $200 billion a year (around 0.9 percent of GDP), with the main beneficiaries being rich people. And, the rich spent a reasonable portion of their tax cut, leading to a boost in consumption and a boost to growth. This proves the old theory that if we give people more money, they will spend more. Of course, that is more true if we give the money to low and middle income people, but even high income people will spend more when they have more money.

The tax cut did lead to a large increase in the budget deficit, which is not necessarily a problem, except that we could have instead done things with this money like provide free child care, extend health care coverage, provide large subsidies to promote clean energy and conservation. In effect, we targeted increasing consumption by the rich instead of these alternative uses of resources.

The Tax Gaming Continues!

While the investment and growth failures of the tax cut are widely known, there is another failure of the tax cut which has gotten less attention. The main selling point of the corporate tax cut, which was at the center of the Trump plan, was that it would lead to an investment boom, leading to more rapid productivity growth and higher wages, but there was another more plausible story they also pushed.

The pre-Trump corporate tax rate was 35 percent, but few businesses were paying taxes at anything close to this rate. The overall average was close to 21 percent. The 35 percent statutory rate put us at the top of the OECD. However, our actually tax collections were slightly below the median.

The Trumpers argued that they would lower the rate, but would eliminate the loopholes, so that we would actually collect something close to the new 21 percent statutory rate. If this were true, it would actually be a change for the better.

The point is that whatever our tax take actually is, we want to minimize the resources involved in collecting this tax. When corporations employ elaborate tax avoidance or evasion strategies to get their tax rate down, they are employing considerable resources in this effort. This is a complete waste from an economic perspective. We have highly educated people working as tax lawyers and accountants instead of engaged in work that could have social benefits, such as improving medical technology or teaching.

These tax avoidance and evasion strategies also contribute to income inequality, since there is big money in designing them. If a clever accountant can find a way to save Apple or Google $400 million on their taxes, then these companies would come out ahead paying them $399,999,999. We shouldn’t design our economy so that tax gaming is one of the best ways to make a big fortune.

Anyhow, whether or not their promises on eliminating tax gaming were ever sincere, it is now clear that they were not accurate. We have lowered the tax rate, as they intended, but tax gaming continues to be as robust as ever.

We can see this clearly from the Congressional Budget Office’s (CBO) projections on corporate tax collections. In April of 2018, after the tax cut had been passed into law, CBO projected that we would collect $307 billion in corporate taxes this year. In January of this year, it projected that we would collect $234 billion in corporate taxes, a difference of more than 20 percent. This comes to less than 11 percent of projected profits.

The failure to limit tax gaming is also apparent in the continuing growth in the foreign share of corporate profits. The simplest and most common form of tax gaming is to have profits recorded in a tax haven like Ireland or the Cayman Islands. It is very difficult for governments to determine where profits were actually earned. For this reason, companies would rather have their profits booked in a country with a very low tax rate.

The latest data on profits from the Federal Reserve Board show that the tax cut did not discourage companies from booking their profits abroad. In fact, the foreign share of corporate profits rose from 21.3 percent in 2017, the last year before the tax cut, to 26.1 percent last year.

Ending Tax Gaming

If anyone was actually interested in ending tax gaming, there is a simple solution that I have written about in the past. We just make companies give us a percentage of their stock as non-voting shares.

For example, if we want a tax rate of 25 percent, we require they give us shares equal to 25 percent of their total outstanding shares. These shares get treated just like any other shares. If companies pay a dividend of $2.00 a share to their other shares, they make a payment of $2.00 to the government on each of its non—voting shares. If it buys back 10 percent of its shares at $100 a share, it buys back 10 percent of the government’s shares at $100 a share. If the company is bought out at $150 a share, then the government gets $150 for each of the shares it holds.

Going this route, there is no way the company can cheat the government out its tax obligation unless it also cheats its shareholders. I describe this plan in somewhat more detail here. (The best description is probably Matthew Klein’s Financial Times write up, which is unfortunately behind a paywall.)

If for some reason this sounds too much like socialism (it is just collecting taxes that are owed) we can make the shares purely notional. The companies will just have to make payments “as if” the government owned shares.

The neat thing about this is that states can adopt the same approach with their corporate taxes. If, for example, they tax 10 percent of a company’s worldwide profits at a 2 percent rate, they can just set a basis for the company’s tax as the returns on 0.2 percent of its shares. Since there is a large amount of fluctuation in share prices, they can just make the basis the average of the last five year’s returns, adjusted for an inflation factor. (The inflation factor would mean, for example, that the basis for the tax would be 10 percent more than the average of the last five years.) Here again, there is no way to avoid the tax unless the company cheats its shareholders.

People have proposed many convoluted and expensive mechanisms to reduce tax avoidance and evasion. The non-voting share route is a very simple way to go. That probably means it will never be taken seriously by people in policy making positions.

The fact that Donald Trump’s tax cut did not produce the investment and growth that was promised is widely known. There was a modest uptick in growth in 2018, from 2.4 percent the prior year to 2.9 percent in 2018, but this pace fell back to 2.3 percent last year. Virtually, all forecasts showed the growth rate falling still lower in 2020, even before the coronavirus began to impose large economic costs.

This is well below the 3.0 percent growth, for as far as the eye can see, promised by the Trump administration. In fact, the 2.5 percent average growth rate for the first three years of the Trump administration is only slightly better than the 2.3 percent average growth rate for the last three years of the Obama administration.

More important than the growth figures is the fact that there is zero evidence that it gave any substantial boost to investment. The investment share of GDP crept up slightly from 13.2 percent of GDP in 2017 to 13.5 percent in 2018, but it was back down to 13.4 percent last year. And, in the fourth quarter of 2019 it was back to 13.2 percent. The investment share never got as high as the 13.7 percent reached in 2014 under Obama. There certainly is not much of a boom story here.

Some tax cut proponents insist that the tax cut would have led to the promised boom had it not been for Donald Trump’s trade war. While there is little doubt that the trade war has had a negative effect on investment and growth, the impact would have to be far larger than any models project in order for the trade war to have been the only thing that stifled an investment boom. Also, from the standpoint of touting Donald Trump’s economic record, it is a bit hard to maintain that his tax cut would have led to a great investment boom, if not for damage caused by his ill-conceived trade war.

The story of the tax cut and the economy is simple. We gave a large tax cut, a bit less than $200 billion a year (around 0.9 percent of GDP), with the main beneficiaries being rich people. And, the rich spent a reasonable portion of their tax cut, leading to a boost in consumption and a boost to growth. This proves the old theory that if we give people more money, they will spend more. Of course, that is more true if we give the money to low and middle income people, but even high income people will spend more when they have more money.

The tax cut did lead to a large increase in the budget deficit, which is not necessarily a problem, except that we could have instead done things with this money like provide free child care, extend health care coverage, provide large subsidies to promote clean energy and conservation. In effect, we targeted increasing consumption by the rich instead of these alternative uses of resources.

The Tax Gaming Continues!

While the investment and growth failures of the tax cut are widely known, there is another failure of the tax cut which has gotten less attention. The main selling point of the corporate tax cut, which was at the center of the Trump plan, was that it would lead to an investment boom, leading to more rapid productivity growth and higher wages, but there was another more plausible story they also pushed.

The pre-Trump corporate tax rate was 35 percent, but few businesses were paying taxes at anything close to this rate. The overall average was close to 21 percent. The 35 percent statutory rate put us at the top of the OECD. However, our actually tax collections were slightly below the median.

The Trumpers argued that they would lower the rate, but would eliminate the loopholes, so that we would actually collect something close to the new 21 percent statutory rate. If this were true, it would actually be a change for the better.

The point is that whatever our tax take actually is, we want to minimize the resources involved in collecting this tax. When corporations employ elaborate tax avoidance or evasion strategies to get their tax rate down, they are employing considerable resources in this effort. This is a complete waste from an economic perspective. We have highly educated people working as tax lawyers and accountants instead of engaged in work that could have social benefits, such as improving medical technology or teaching.

These tax avoidance and evasion strategies also contribute to income inequality, since there is big money in designing them. If a clever accountant can find a way to save Apple or Google $400 million on their taxes, then these companies would come out ahead paying them $399,999,999. We shouldn’t design our economy so that tax gaming is one of the best ways to make a big fortune.

Anyhow, whether or not their promises on eliminating tax gaming were ever sincere, it is now clear that they were not accurate. We have lowered the tax rate, as they intended, but tax gaming continues to be as robust as ever.

We can see this clearly from the Congressional Budget Office’s (CBO) projections on corporate tax collections. In April of 2018, after the tax cut had been passed into law, CBO projected that we would collect $307 billion in corporate taxes this year. In January of this year, it projected that we would collect $234 billion in corporate taxes, a difference of more than 20 percent. This comes to less than 11 percent of projected profits.

The failure to limit tax gaming is also apparent in the continuing growth in the foreign share of corporate profits. The simplest and most common form of tax gaming is to have profits recorded in a tax haven like Ireland or the Cayman Islands. It is very difficult for governments to determine where profits were actually earned. For this reason, companies would rather have their profits booked in a country with a very low tax rate.

The latest data on profits from the Federal Reserve Board show that the tax cut did not discourage companies from booking their profits abroad. In fact, the foreign share of corporate profits rose from 21.3 percent in 2017, the last year before the tax cut, to 26.1 percent last year.

Ending Tax Gaming

If anyone was actually interested in ending tax gaming, there is a simple solution that I have written about in the past. We just make companies give us a percentage of their stock as non-voting shares.

For example, if we want a tax rate of 25 percent, we require they give us shares equal to 25 percent of their total outstanding shares. These shares get treated just like any other shares. If companies pay a dividend of $2.00 a share to their other shares, they make a payment of $2.00 to the government on each of its non—voting shares. If it buys back 10 percent of its shares at $100 a share, it buys back 10 percent of the government’s shares at $100 a share. If the company is bought out at $150 a share, then the government gets $150 for each of the shares it holds.

Going this route, there is no way the company can cheat the government out its tax obligation unless it also cheats its shareholders. I describe this plan in somewhat more detail here. (The best description is probably Matthew Klein’s Financial Times write up, which is unfortunately behind a paywall.)

If for some reason this sounds too much like socialism (it is just collecting taxes that are owed) we can make the shares purely notional. The companies will just have to make payments “as if” the government owned shares.

The neat thing about this is that states can adopt the same approach with their corporate taxes. If, for example, they tax 10 percent of a company’s worldwide profits at a 2 percent rate, they can just set a basis for the company’s tax as the returns on 0.2 percent of its shares. Since there is a large amount of fluctuation in share prices, they can just make the basis the average of the last five year’s returns, adjusted for an inflation factor. (The inflation factor would mean, for example, that the basis for the tax would be 10 percent more than the average of the last five years.) Here again, there is no way to avoid the tax unless the company cheats its shareholders.

People have proposed many convoluted and expensive mechanisms to reduce tax avoidance and evasion. The non-voting share route is a very simple way to go. That probably means it will never be taken seriously by people in policy making positions.

Read More Leer más Join the discussion Participa en la discusión