It is a bit bizarre that in the various discussions of a wealth tax no one mentions the most obvious way that rich people can avoid paying: renounce their U.S. citizenship. This would make them completely exempt from a U.S. wealth tax.

While Warren’s proposal, and presumably Sanders’ as well, would include a steep exit tax on the wealth of people renouncing their citizenship, this would only apply after the tax is in place. While there is little reason to believe that most billionaires are especially bright, it unlikely that most of them are morons. If they don’t want to pay the tax they could leave while it was being debated in Congress, if they thought it likely to pass.

It’s not clear how many would choose this route, but many billionaires have made it quite clear that they are not committed to the country and don’t have much respect for democracy. If they felt their wealth was seriously threatened, it’s hard to believe that many would not simply choose to give up their citizenship.

It is a bit bizarre that in the various discussions of a wealth tax no one mentions the most obvious way that rich people can avoid paying: renounce their U.S. citizenship. This would make them completely exempt from a U.S. wealth tax.

While Warren’s proposal, and presumably Sanders’ as well, would include a steep exit tax on the wealth of people renouncing their citizenship, this would only apply after the tax is in place. While there is little reason to believe that most billionaires are especially bright, it unlikely that most of them are morons. If they don’t want to pay the tax they could leave while it was being debated in Congress, if they thought it likely to pass.

It’s not clear how many would choose this route, but many billionaires have made it quite clear that they are not committed to the country and don’t have much respect for democracy. If they felt their wealth was seriously threatened, it’s hard to believe that many would not simply choose to give up their citizenship.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The New York Times gives Steven Rattner the opportunity to push stale economic bromides in columns on a regular basis. His column today goes after Senator Elizabeth Warren.

He begins by telling us that Warren’s plan for financing a Medicare for All program is “yet more evidence that a Warren presidency a terrifying prospect.” He goes on to warn us:

“She would turn America’s uniquely successful public-private relationship into a dirigiste, European-style system. If you want to live in France (economically), Elizabeth Warren should be your candidate.”

It’s not worth going into every complaint in Rattner’s piece, and to be clear, there are very reasonable grounds for questioning many of Warren’s proposals. However, he deserves some serious ridicule for raising the bogeyman of France and later Germany.

In spite of its “dirigiste” system France actually has a higher employment rate for prime age workers (ages 25 to 54) than the United States. (Germany has a much higher employment rate.) France has a lower overall employment rate because young people generally don’t work and people in their sixties are less likely to work.

In both cases, this is the result of deliberate policy choices. In the case of young people, the French are less likely to work because college is free and students get small living stipends. For older workers, France has a system that is more generous to early retirees. One can disagree with both of these policies, but they are not obvious failures. Large segments of the French population benefit from them.

France and Germany both have lower per capita GDP than the United States, but the biggest reason for the gap is that workers in both countries put in many fewer hours annually than in the United States. According to the OECD, an average worker in France puts in 1520 hours a year, in Germany just 1360. That compares to 1780 hours a year in the United States. In both countries, five or six weeks a year of vacation are standard, as are paid family leave and paid sick days. Again, one can argue that it is better to have more money, but it is not obviously a bad choice to have more leisure time as do workers in these countries.

Anyhow, the point is that Rattner’s bogeymen here are not the horror stories that he wants us to imagine for ordinary workers, even if they may not be as appealing to rich people like himself. Perhaps the biggest tell in this piece is when Rattner warns us that under Warren’s proposals “private equity, which plays a useful role in driving business efficiency, would be effectively eliminated.”

Okay, the prospect of eliminating private equity, now we’re all really scared!

The New York Times gives Steven Rattner the opportunity to push stale economic bromides in columns on a regular basis. His column today goes after Senator Elizabeth Warren.

He begins by telling us that Warren’s plan for financing a Medicare for All program is “yet more evidence that a Warren presidency a terrifying prospect.” He goes on to warn us:

“She would turn America’s uniquely successful public-private relationship into a dirigiste, European-style system. If you want to live in France (economically), Elizabeth Warren should be your candidate.”

It’s not worth going into every complaint in Rattner’s piece, and to be clear, there are very reasonable grounds for questioning many of Warren’s proposals. However, he deserves some serious ridicule for raising the bogeyman of France and later Germany.

In spite of its “dirigiste” system France actually has a higher employment rate for prime age workers (ages 25 to 54) than the United States. (Germany has a much higher employment rate.) France has a lower overall employment rate because young people generally don’t work and people in their sixties are less likely to work.

In both cases, this is the result of deliberate policy choices. In the case of young people, the French are less likely to work because college is free and students get small living stipends. For older workers, France has a system that is more generous to early retirees. One can disagree with both of these policies, but they are not obvious failures. Large segments of the French population benefit from them.

France and Germany both have lower per capita GDP than the United States, but the biggest reason for the gap is that workers in both countries put in many fewer hours annually than in the United States. According to the OECD, an average worker in France puts in 1520 hours a year, in Germany just 1360. That compares to 1780 hours a year in the United States. In both countries, five or six weeks a year of vacation are standard, as are paid family leave and paid sick days. Again, one can argue that it is better to have more money, but it is not obviously a bad choice to have more leisure time as do workers in these countries.

Anyhow, the point is that Rattner’s bogeymen here are not the horror stories that he wants us to imagine for ordinary workers, even if they may not be as appealing to rich people like himself. Perhaps the biggest tell in this piece is when Rattner warns us that under Warren’s proposals “private equity, which plays a useful role in driving business efficiency, would be effectively eliminated.”

Okay, the prospect of eliminating private equity, now we’re all really scared!

Read More Leer más Join the discussion Participa en la discusión

The New York Times had a column by “global investor” Ruchir Sharma this weekend in which he touted the Swiss model as being preferable to the Scandinavian model promoted by Bernie Sanders and other progressives. He notes that Switzerland is considerably richer, has a smaller government role in its economy, and still manages to provide health insurance to everyone.

There are a few points worth making about Sharma’s piece. First, one of the big factors that contributed to Switzerland’s wealth is that it shielded the wealth of rich criminals from around the world. Not only did it hide this wealth from tax authorities, it is also allowed drug dealers, gun runners, and corrupt dictators to park their money in a safe haven for themselves and their families. Not every country would want to follow this path to prosperity and in any case there is a limit to the amount of illicit funds to be deposited in such havens.

One of the reasons Sharma is impressed with Switzerland is that, rather than having the government provide health care for its population, it requires its citizens to purchase private insurance. This does lead to universal coverage, although it seems to come at a substantial price. According to the OECD, Switzerland’s health care costs of $7,300 per person are considerably less than the U.S per person cost of $10,600, but 17 percent more than #3 Norway’s costs and almost 40 percent higher than Denmark’s. It’s not clear that our model for reform should be the second most costly system in the world.

The next point is that this treatment of health care is a big factor in the difference between the 50 percent government share of GDP in the Scandinavian countries compared to the one third in Switzerland. Perhaps it makes a big difference to people whether they are mandated to pay premiums to an insurance company as opposed to taxes to the government, but it is not obvious why that would be the case.

This treatment of health care is also relevant to Sharma’s point on relative wealth:

“The typical Swiss family has a net worth around $540,000, twice its Scandinavian peer.”

Middle income families have greater need for wealth in Switzerland, where they have to pay for their health insurance, than in the Scandinavian countries where it is paid for by the government. How much additional wealth is needed would depend on the timing of health care payments over people’s lifetimes.

There is an area where progressives Democrats are looking to Switzerland as a model. The country has a wealth tax on its richest people. Both Senators Warren and Sanders have proposed a comparable tax for the United States.

The New York Times had a column by “global investor” Ruchir Sharma this weekend in which he touted the Swiss model as being preferable to the Scandinavian model promoted by Bernie Sanders and other progressives. He notes that Switzerland is considerably richer, has a smaller government role in its economy, and still manages to provide health insurance to everyone.

There are a few points worth making about Sharma’s piece. First, one of the big factors that contributed to Switzerland’s wealth is that it shielded the wealth of rich criminals from around the world. Not only did it hide this wealth from tax authorities, it is also allowed drug dealers, gun runners, and corrupt dictators to park their money in a safe haven for themselves and their families. Not every country would want to follow this path to prosperity and in any case there is a limit to the amount of illicit funds to be deposited in such havens.

One of the reasons Sharma is impressed with Switzerland is that, rather than having the government provide health care for its population, it requires its citizens to purchase private insurance. This does lead to universal coverage, although it seems to come at a substantial price. According to the OECD, Switzerland’s health care costs of $7,300 per person are considerably less than the U.S per person cost of $10,600, but 17 percent more than #3 Norway’s costs and almost 40 percent higher than Denmark’s. It’s not clear that our model for reform should be the second most costly system in the world.

The next point is that this treatment of health care is a big factor in the difference between the 50 percent government share of GDP in the Scandinavian countries compared to the one third in Switzerland. Perhaps it makes a big difference to people whether they are mandated to pay premiums to an insurance company as opposed to taxes to the government, but it is not obvious why that would be the case.

This treatment of health care is also relevant to Sharma’s point on relative wealth:

“The typical Swiss family has a net worth around $540,000, twice its Scandinavian peer.”

Middle income families have greater need for wealth in Switzerland, where they have to pay for their health insurance, than in the Scandinavian countries where it is paid for by the government. How much additional wealth is needed would depend on the timing of health care payments over people’s lifetimes.

There is an area where progressives Democrats are looking to Switzerland as a model. The country has a wealth tax on its richest people. Both Senators Warren and Sanders have proposed a comparable tax for the United States.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

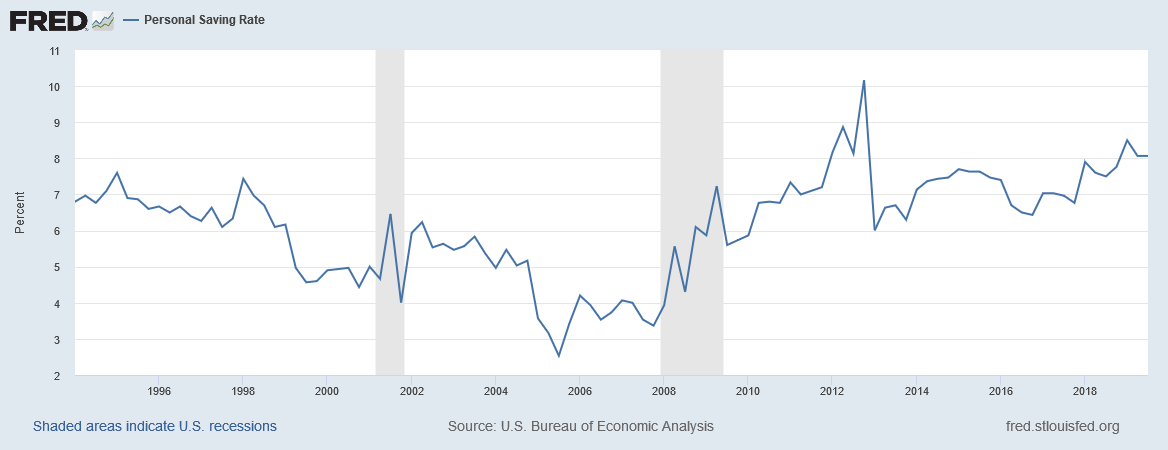

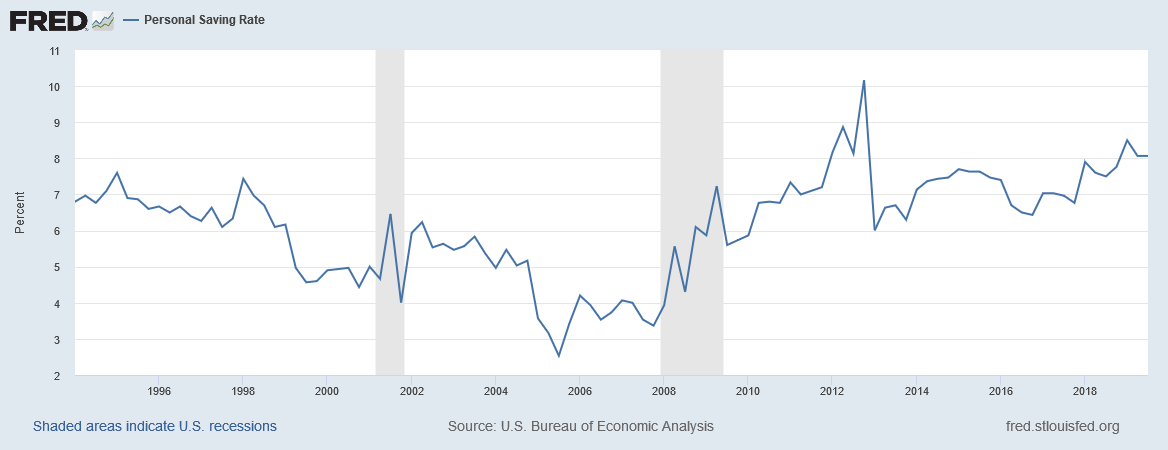

I hate to let the data ruin good lines in news stories, but apart from a few quarters in 2012, the savings rate is at its highest level in the last quarter-century.

This means that people are actually consuming a smaller share of their income than normal. That is consistent with a tax cut that gave a lot more money to rich people, who tend to consume a smaller share of their income than low and middle class people.

I hate to let the data ruin good lines in news stories, but apart from a few quarters in 2012, the savings rate is at its highest level in the last quarter-century.

This means that people are actually consuming a smaller share of their income than normal. That is consistent with a tax cut that gave a lot more money to rich people, who tend to consume a smaller share of their income than low and middle class people.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The Washington Post had a piece on newly released data on the federal budget deficit. The piece included the obligatory comments from the always wrong budget “experts” at the Committee for a Responsible Federal Budget. It also warned readers:

“U.S. debt is considered one of the safest investments in the world and interest rates remain low, which is why the government has been able to borrow money at cheap rates to finance the large annual deficits. But the costs are adding up. The government spent about $380 billion in interest payments on its debt last year, almost as much as the entire federal government contribution to Medicaid.”

“Almost as much as the entire federal government contribution to Medicaid!” Think about that. Try also thinking about the fact that interest payments were around 1.7 percent of GDP last year (before deducting money refunded from the Fed). That compares to a peak of 3.2 percent of GDP in 1991. Are you scared yet?

It’s also not quite right to claim that interest rates in the United States are especially low, at least not compared to other rich countries. The U.S. pays an interest rate on 10-year government bonds that is more than two full percentage points higher than the interest rate paid by Germany and the Netherlands. It’s even higher than the interest rate paid by Greece.

The Washington Post had a piece on newly released data on the federal budget deficit. The piece included the obligatory comments from the always wrong budget “experts” at the Committee for a Responsible Federal Budget. It also warned readers:

“U.S. debt is considered one of the safest investments in the world and interest rates remain low, which is why the government has been able to borrow money at cheap rates to finance the large annual deficits. But the costs are adding up. The government spent about $380 billion in interest payments on its debt last year, almost as much as the entire federal government contribution to Medicaid.”

“Almost as much as the entire federal government contribution to Medicaid!” Think about that. Try also thinking about the fact that interest payments were around 1.7 percent of GDP last year (before deducting money refunded from the Fed). That compares to a peak of 3.2 percent of GDP in 1991. Are you scared yet?

It’s also not quite right to claim that interest rates in the United States are especially low, at least not compared to other rich countries. The U.S. pays an interest rate on 10-year government bonds that is more than two full percentage points higher than the interest rate paid by Germany and the Netherlands. It’s even higher than the interest rate paid by Greece.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The Commerce Department reported that orders for non-defense capital goods fell 2.8 percent in September after dropping 3.1 percent in August. The September figure is more than 10 percent below the September 2018 level. If we pull out aircrafts, which are highly volatile and being pushed down by Boeing’s 737-Max problems, orders were still down by 0.5 percent. Orders for the month are up just 0.2 percent from the year-ago level.

This would have been worth some attention (both the NYT and WaPo ran wire service stories), since the rationale for the corporate tax cut pushed through by the Republicans in 2017 was supposed to be that it would lead to an investment boom. While there was a modest rise in investment in the first half of 2018 (but certainly not a boom), investment has been extraordinarily weak for the last year. Clearly, the tax cut has not produced the projected benefits.

The Commerce Department reported that orders for non-defense capital goods fell 2.8 percent in September after dropping 3.1 percent in August. The September figure is more than 10 percent below the September 2018 level. If we pull out aircrafts, which are highly volatile and being pushed down by Boeing’s 737-Max problems, orders were still down by 0.5 percent. Orders for the month are up just 0.2 percent from the year-ago level.

This would have been worth some attention (both the NYT and WaPo ran wire service stories), since the rationale for the corporate tax cut pushed through by the Republicans in 2017 was supposed to be that it would lead to an investment boom. While there was a modest rise in investment in the first half of 2018 (but certainly not a boom), investment has been extraordinarily weak for the last year. Clearly, the tax cut has not produced the projected benefits.

Read More Leer más Join the discussion Participa en la discusión