December 09, 2009

December 9, 2009 (Housing Market Monitor)

By Dean Baker

Most modification plans leave homeowners without equity and paying excessive housing costs.

The Federal Housing Authority has been taking steps over the last month to tighten its standards on the loans it guarantees, most notably by dropping several initiators who have had especially bad track records. While this is a necessary and appropriate step given its financial situation, tighter standards from the FHA will have a dampening impact on the housing market in the coming year.

Remarkably, little attention has been given to the extent to which the FHA filled the gap created by the collapse of the subprime market. At the peak of the bubble in 2006, subprime mortgages accounted for almost a quarter of all mortgages. This share fell to near zero in subsequent years. The FHA, which had been marginalized by the explosion of subprime, saw its share increase from less than 3 percent of the market in 2006 to 23 percent this year. In a context of falling house prices and double-digit unemployment, this rapid expansion virtually guaranteed that the FHA would face problems.

Now that the FHA is tightening up, its market share will presumably fall back towards its historic level in the 8-10 percent range. While some FHA borrowers will be able to find other loans, many will not. If the FHA market share drops by 10 percentage points and half of the would be FHA borrowers cannot find mortgages elsewhere, this implies a drop in demand of 5 percent, or more than 250,000 potential buyers. This will have a substantial impact on the housing market.

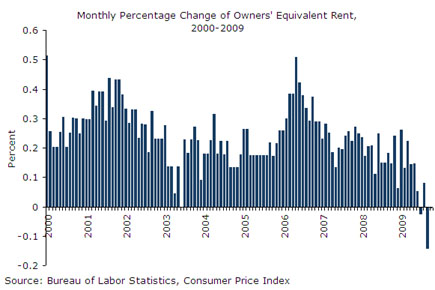

The continuing decline in nominal rents is making it ever more apparent that the main beneficiaries of mortgage modification programs are likely to be banks. Under some of the proposals being discussed, the government would pay up to $50,000 to keep homeowners in their homes. In the vast majority of these situations, even after a loan has been modified, homeowners will be paying considerably more on their mortgage and other ownership costs than they would to rent the same home. In the markets that were most inflated by the bubble, this difference can be well over $1,000 a month. In other words, each month that the government keeps the family in their home as a homeowner is a further drain on their income and savings.

Also, in the vast majority of cases, homes are sufficiently underwater such that there is no reasonable prospect that the homeowner will ever build up equity in their home. It seems that many policymakers even now have not come to the grips with the housing bubble. They fail to recognize that the surge in house prices from 1996 to 2006 was a one-time blip that is now in the process of being corrected. There is no more reason to expect that house prices will rise back to bubble-inflated levels than there is to believe that the NASDAQ will return to the peaks of the Internet bubble in 2000. As a result, most of the homeowners who receive modifications are likely to find that they either have to bring cash to a closing, arrange a short sale, or default at some future date.

If mortgage modifications cause homeowners to pay more money for housing for each month they stay in their home and still leave them with no equity when they sell their home, it is difficult to see how this policy helps homeowners. The money that the government pays out is going to banks and other lenders, allowing them to collect much more money on their loans than would likely be the case without modifications. Unlike the TARP funds, which were loans that had to be repaid with interest, the money that the government pays in modifications is simply given to banks.

Policymakers who are interested in helping homeowners facing foreclosure must focus on developing policies that either ensure that homeowners will be paying comparable amounts to the rent on a similar unit and/or that they will actually have equity in their home at the point where they sell it. A policy that both raises monthly housing costs and leaves homeowners with no reasonable prospect of accruing equity is not helping homeowners.

Dean Baker is Co-Director of the Center for Economic and Policy Research, in Washington, D.C. CEPR’s Housing Market Monitor is published weekly and provides an incisive breakdown of the latest indicators and developments in the housing sector.