November 27, 2012

November 27, 2012 (Housing Market Monitor)

By Dean Baker

The increases in house prices continues to be driven by the bottom tier of the market.

All the data on the housing market continue to be positive over the last month showing rises in sales, construction and prices. Existing home sales are up by more than 10 percent against their year-ago levels. The 4.8 million annual rate of sales for the last three months, while well below the peaks reached during the bubble years, is consistent with the longer-term trend in sales. While it is possible that there will be some continued rise, especially if the extraordinarily low sales rate in prior years implies many people have put off sales, there is no reason to expect that a substantially higher rate of sales will be sustained for any substantial period of time.

By region, the upturn in sales has been strongest in the Midwest. Since this was the region least affected by the bubble, this upturn presumably reflects an economic improvement in states such as Michigan and Ohio more than the dynamics of the bubble.

The rise in housing starts has been especially impressive, with starts running close to 40 percent above year-ago levels. Of course this increase is against an extremely low level, with starts having fallen to less than 30 percent of their bubble peaks in 2009 and 2010. The Midwest also looks comparatively good in this category with starts near half of their 2005 peaks, whereas starts in the other regions are closer to 40 percent of the 2005 peaks.

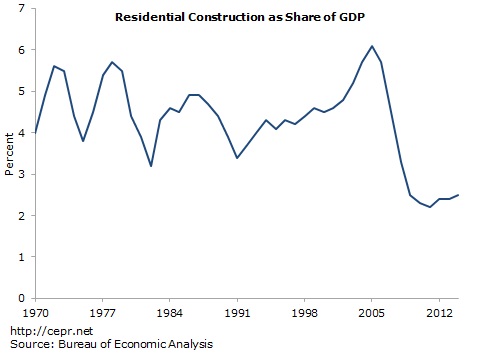

The best indicator of the future path for starts is the vacancy rate. This has fallen substantially from 2010 peaks, even though it is still much above the pre-bubble level. Housing has contributed an average of 0.3 percentage points to GDP growth over the last year. This contribution is likely to continue and possibly increase slightly in 2013.

The Case-Shiller 20 City Index rose by 0.4 percent in September, its eighth consecutive gain. It is now up by 3.0 percent over 2011 levels and has risen at a 4.6 percent annual rate over the last three months. Eighteen of the 20 cities in the index showed price increases, with Chicago being the laggard with a 0.7 percent decline in prices. Chicago and New York are the only cities where prices are below their year-ago levels – 1.5 percent and 2.3 percent, respectively.

The Case-Shiller 20 City Index rose by 0.4 percent in September, its eighth consecutive gain. It is now up by 3.0 percent over 2011 levels and has risen at a 4.6 percent annual rate over the last three months. Eighteen of the 20 cities in the index showed price increases, with Chicago being the laggard with a 0.7 percent decline in prices. Chicago and New York are the only cities where prices are below their year-ago levels – 1.5 percent and 2.3 percent, respectively.

The biggest gainers for the month were San Diego and Atlanta, where prices were up by 1.7 percent from August, followed by Phoenix (1.3 percent), Las Vegas (1.1 percent), Denver (1.0 percent) and Dallas (1.0 percent). Compared with September of 2011, the prices are up by 4.1 percent in San Diego, 20.4 percent in Phoenix, 3.8 percent in Las Vegas, 6.7 percent in Denver, and 4.4 percent in Dallas.

The price increases continue to be driven by the bottom tier of the market. There were seven cities where prices of homes in the bottom tier increased by more than 2.0 percent in September. (They increased by 1.9 percent in Seattle.) In Washington, D.C., they rose by 3.8 percent, bringing the annual rate of increase over the last three months to 34.6 percent. In Tampa, prices rose by 3.2 percent, for a 23.7 percent rate of increase over the last three months.

In San Francisco, prices rose by 2.6 percent in September and at 33.8 percent over the last three months. In Los Angeles, the increases were 2.0 percent and 27.4 percent. In Phoenix, prices in the bottom tier rose by 2.1 percent, bringing the annual rate over the last three months to 43.2 percent. In Atlanta, the September rise was 2.8 percent, making the annual rate of increase 65.1 percent over the last three months. While the latter is truly extraordinary, prices in the bottom tier were badly beaten down earlier. Even with the recent increases they are still 3.2 percent below the year-ago levels.

Still, it is difficult to look at the sharp run-ups in prices in the bottom tier and not see signs of irrational exuberance. There continues to be a relatively high vacancy rate in many of these markets and rents are not rising especially fast. There may be some reversals of this run-up, which will slow overall price appreciation in the year ahead.