December 08, 2023

The rise in unemployment from the 3.4 percent low hit in April had some worried that a recession was looming. The Sahm Rule holds that a 0.5 percentage point rise in the unemployment rate presages a larger increase. (This is based on 3-month averages, not single month data.) The drop in unemployment to 3.7 percent should relax those fears.

The establishment survey showed the economy adding 199,000 jobs in November. Roughly 30,000 of these jobs were the return of striking UAW workers, and another 15,000 were workers being rehired after the end of the Screen Actors Guild strike. Adjusting for these one-time changes, job growth would have been just 150,000, a rate consistent with normal growth of the labor force.

Drop in Unemployment Due to 747,000 Rise in Employed People in Household Survey

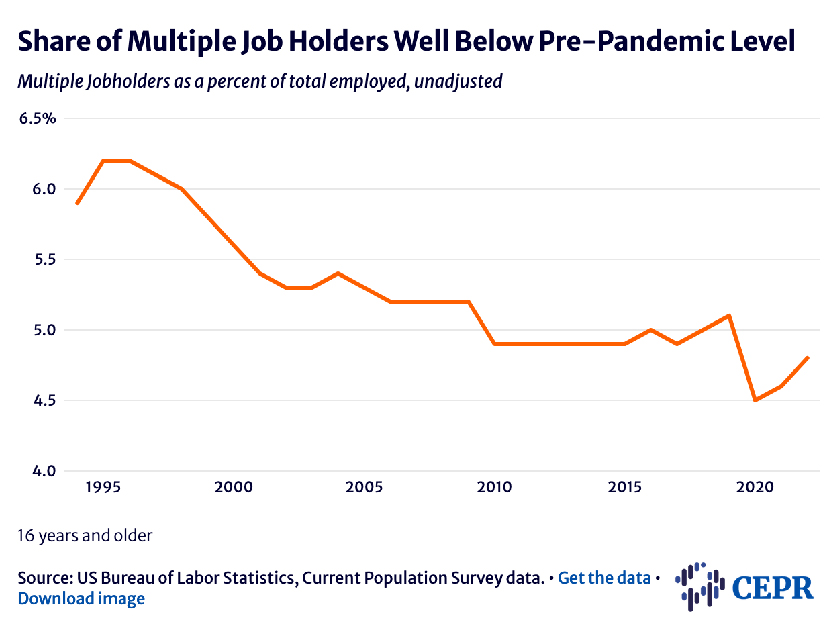

There had been a substantial gap in the job growth reported in the establishment survey and employment growth in the household survey. The establishment survey is much larger and has a much higher response rate (around 94.0 percent after the second revision), compared to less than 50 percent for the household survey, so it is usually reasonable to assume the establishment survey is closer to the mark. Also, the big gap in the reported numbers was largely due to differences in concept, since the self-employed don’t count in the establishment survey and multiple-job holders only appear once in the household survey. Nonetheless, it is reassuring that the two surveys are now giving us pretty much the same picture of a strong labor market.

Household Data Almost All Solid

Just about every measure in the household survey looked solid in November. In addition to the jump in employment and drop in unemployment, the number of workers involuntarily working part-time fell by 295,000. The share of unemployment due to voluntary quits rose by 0.5 pp to 13.1 percent. This is a reasonable share for a strong labor market, but well below the peak of 15.8 percent hit last fall. The share of long-term unemployed (more than 26 weeks) fell to 18.3 percent, the lowest level since February. The average duration of unemployment fell by 2.2 weeks to 19.4 weeks, although the median edged up slightly.

Unemployment Rate for Asian Americans Rises to 3.5 Percent

One disturbing item in the household survey was a 0.4 pp rise in the unemployment rate for Asian Americans to 3.5 percent. The unemployment rate for Asian Americans is typically slightly below the unemployment rate for whites, but the November figure is 0.2 pp above the 3.3 percent rate reported for whites.

The monthly data are erratic, but this is a substantial increase from the 2.3 percent low reported for July. That is a large enough rise that it could reflect something real in the world.

Black Teen Unemployment Falls Sharply

The unemployment rate for Black teens dropped 6.6 pp to 12.2 percent, the third lowest on record, and a rate lower than any pre-pandemic level. This number is highly erratic, but this drop is large enough that it likely reflects a reality of better labor market prospects.

The overall Black unemployment rate was unchanged at 5.8 percent. There was a rise in the unemployment rate for Black men of 1.1 percent to 6.4 percent, but this was associated with a sharp jump in the employment rate and labor force participation rate. The unemployment rate for Black women fell 0.5 pp to 4.8 percent.

Wage Growth Remains Moderate

The average hourly wage grew at a 3.4 percent annual rate over the last three months, which indicates the moderation in wage growth seen throughout the year is continuing. This pace is very much consistent with the Fed’s 2.0 percent inflation target. It should also allow a decent pace of real wage growth if inflation is close to 2.0 percent.

We continue to see some evidence of wage compression, with the average hourly wage of production and non-supervisory workers rising at a 4.2 percent annual rate over the last three years months. Over the last year, it has risen by 4.3 percent compared to a 4.0 percent increase for all workers.

Hours Reverse Decline in October

There was a modest increase in the length of the average workweek in November, reversing the drop reported for October. As a result, the index of aggregate weekly hours rose 0.4 percent, after October’s 0.2 percent drop. Still, it looks like another quarter of relatively weak hours growth, which should translate into another good productivity figure, although nowhere near as strong as the 5.2 percent rate reported for the third quarter.

Employment Growth Concentrated in Healthcare and Government

One disconcerting aspect to this report is that employment growth was again highly concentrated in just two sectors. The healthcare sector added 76,800 jobs while the government sector (all state and local) added 49,000 jobs. If we pull out the roughly 30,000 jobs due to returning UAW strikers and 15,000 due to the end of the SAG strike, it means that these two sectors accounted for roughly 78 percent of employment growth in November. It is a bit worrying when job growth is so highly concentrated.

Construction added just 2,000 jobs in November. Employment is still up by 200,000 from the year-ago level, but interest rates seem to be finally having an effect. Manufacturing employment added 28,000 jobs, meaning employment would have been essentially flat if not for the ending of the UAW strike. Non-durable manufacturing lost 8,000 jobs.

The retail sector lost 38,400 jobs, although this may be partly a seasonal adjustment story with retailers adding fewer workers than normal for the holiday season. (Unadjusted employment rose by 264,000.) Professional and technical services added 16,500 jobs, somewhat below its average of 22,600 a month over the last year. Employment services lost 24,600 jobs.

Restaurants added 38,300 workers, but hotels added just 1,100. While restaurant employment is above its pre-pandemic level, hotel employment is still 218,000 (10.3 percent) below the pre-pandemic level. The 17,000 jobs added by state governments put employment above its pre-pandemic level, but local government employment is still down by 19,000 (0.1 percent) from the pre-pandemic level.

Very Positive Report, with Some Caution

The biggest concern for the November report was that we would see a further rise in unemployment and may, indeed, be on an upward track of unemployment. The drop in the unemployment rate, coupled with the large rise in employment in the household survey, should alleviate this concern. The moderate wage growth is close to ideal. This is consistent with the Fed’s inflation target, while still allowing for healthy real wage growth.

The cause for concern is the concentration of job growth in the healthcare and government sectors. This, coupled with the weakness in manufacturing and construction, the most cyclically sensitive industries, should keep us on the alert for further evidence of a weakening economy.