January 31, 2012

January 31, 2012

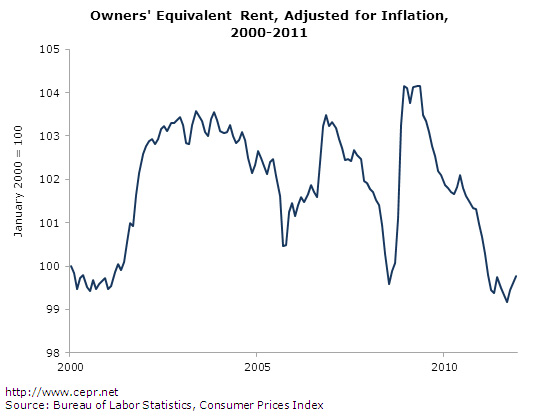

It is interesting to compare the path of house prices with the owners’ equivalent rent (OER) index in the CPI to get an assessment of underlying conditions in the housing market. (OER excludes utilities and therefore provides a better comparison than the rental index with sales prices as a measure of the value of housing.) The real value of this index largely peaked with a 4 percent rise in 2002. It then remained flat through the peak bubble years and has since fallen back to its pre-bubble level. This suggests that there is zero evidence of any upward pressure on prices coming from the rental segment of the market as some have claimed.

For more, check out the latest Housing Market Monitor.