May 11, 2011

Alan Greenspan, the central banker who gained international notoriety for being unable to see the largest asset bubble in the history of the world, is again giving advice on the economy. Bloomberg News tells us that:

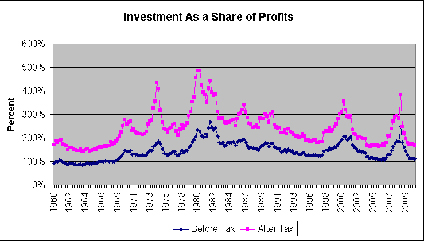

“Greenspan said the deficit is one reason that corporate investment as a share of profits is lower than historical patterns, in an interview on CNBC’s Squawk Box on Dec. 3, 2010.

‘Approximately one-third of the decline in capital investment as a share of cash flow is directly attributable to” the “crowding out by U.S. Treasury borrowing.'”

Greenspan is right that investment as a share of profits is below its historic average, but this was also true for most of his tenure as Federal Reserve Board chairman.

Click for a Larger Version

Source: Bureau of Economic Analysis.

It is also worth noting that investment is depressed right now in part because of the bubble in non-residential real estate. This led to enormous overbuilding in most areas of non-residential construction leading to very high vacancy rates. As a result, non-residential construction is at extraordinarily low levels. Apparently Mr. Greenspan is still unaware of this bubble.

Comments