February 02, 2012

The Morning Edition piece on President Obama’s new mortgage refinancing proposal implied that the housing market is a major drag on the economy. This is misleading.

The housing bubble was the motor of the economy during the last business cycle. It did this both by leading to a construction boom and by propelling consumption through the creation of $8 trillion of ephemeral equity. Now that the bubble has burst it can no longer play this role, however it is inaccurate to describe it as a drag on the economy.

Addendum:

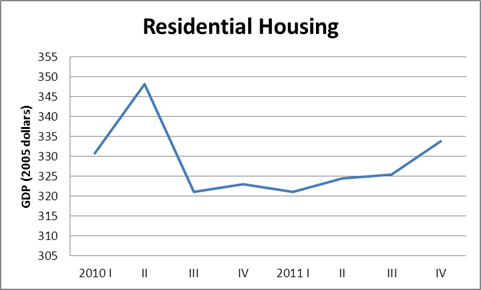

Since the comments suggest some confusion, let me be clear on what I mean by housing is not a drag on the recovery. The graph below shows real expenditures on residential construction over the last two years.

Source: Bureau of Economic Analysis.

Note the direction that spending on residential construction (sorry, mislabeled the graph) has been going. That’s right, it has been going up! This is why some of us say that housing is not a drag on the recovery.

Now will housing be the force that leads out of the recovery? No, and it would be extremely foolish to expect otherwise, as I have written about endlessly. We got into this downturn because of the housing bubble. This led to a huge amount of overbuilding of housing. It will take years to wind this down to a more normal level.

This is exact opposite of a typical recovery which is led by housing. That is because a typical recession is caused by the Fed raising rates to slow the economy. That has the effect of slowing housing construction. When the Fed decides to take its foot off the break and lower interest rates to boost the economy, there is major pent up demand, which leads to a boom in housing. That is not the story here.

The wealth created by the housing bubble also led to a consumption boom. This is the long-known and widely forgotten housing wealth effect. This consumption boom is also not coming back for the simple reason that the housing bubble is not coming back.

Okay, so the collapse of the housing bubble caused the recession, which I probably have said more than any other person on the planet. But, at the moment housing is not a drag on the economy, it is adding to growth, even if it is not adding as much as we might like.

Comments