November 11, 2012

Former Federal Reserve Board Chairman Paul Volcker is a hero to the inside Washington crowd for having brought down inflation from its double-digit levels of the late 1970s. Never mind that this drop in the inflation rate occurred in every other country in the world also. We still must praise Volcker.

We also should not be bothered by the fact that his policy pushed the unemployment rate to almost 11 percent. This was necessary pain that those outside the elite just had to endure for the good of the country as a whole. We also are not supposed to be bothered by what his high interest policies did to heavily indebted developing countries.

But putting all this aside, the Volcker worshippers should at least be able to get the basic facts right. Steven Pearlstein flunks the test in a WAPO book review when he tells readers:

“By the time he stepped down as Fed chairman in 1987, Volcker had managed to wring inflation out of the American psyche and bring the country’s trade account and the government’s budget much closer toward balance.”

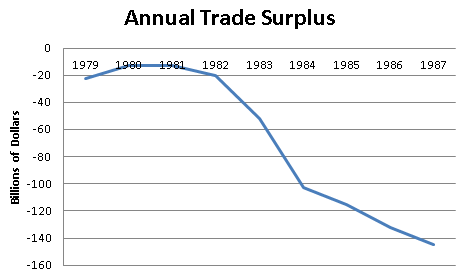

This is not true, the trade deficit in fact soared during the Volcker years as shown below.

Source: Bureau of Economic Analysis.

Expressed as a share of GDP, the trade deficit went from 0.8 percent in 1979 to 3.0 percent in 1987. It really shouldn’t be hard to get this one right.

Addendum:

In response to several comments below I have corrected the graph to show the “surplus” not deficit becoming more negative under Volcker. This was arguably the direct result of his Fed policy, since a predicted result of higher interest rates is a rise in the value of the dollar which makes U.S. goods less competitive internationally.

Comments