November 24, 2012

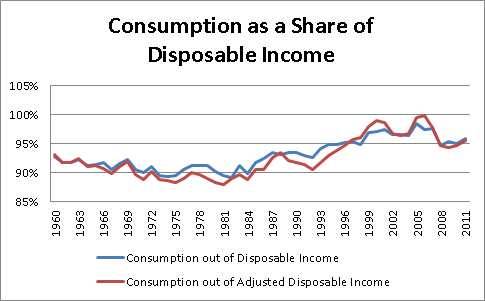

People who are familiar with the Commerce Department’s National Income and Product Accounts know that consumption as a share of disposable income is high by historic standards, not low, as shown in the beautiful graph below.

Source: Bureau of Economic Analysis and author’s calculations.

As can be seen, consumption as a share of disposable income is higher than at any point in the 60s, 70s, 80s, and even most of the 90s until the stock bubble generated a consumption boom. It is lower than at the peak of the housing bubble, but that’s what happens when you lose $8 trillion in housing wealth. (Adjusted disposable income has to do with the treatment of the statistical discrepancy in the national accounts.)

Given the actual path of consumption over the post-war years, readers of the Post editorial were undoubtedly shocked to see its conclusion:

“Housing is healing, albeit slowly, as are household balance sheets. Deutsche Bank economist Joseph LaVorgna estimates that households are on course to wipe out the excessive leverage of the bubble years within 15 months. This sets the stage for renewed consumer spending.”

The Post seems to be expecting bubble levels of consumption without bubble levels of wealth. That would truly be surprising, especially in a political environment in which all the serious people in Washington are openly plotting to cut Social Security and Medicare. What economic theory would tell us that we should see saving rates fall to levels that are far below normal in such an environment?

The other bizarre part of this story is that the Post seems to think that consumption is an on/off switch, telling us that households reaching some ill-described threshold of paying down of debt:

“sets the stage for renewed consumer spending.”

That makes no sense. The paying down of debt is a process in which tens of millions of households are paying down debt, while tens of millions are acquiring more. We reduce aggregate debt when the former exceeds the latter. We don’t hit some magic threshold and suddenly get a burst of consumption, rather we should be a seeing a continuing rise in the ratio of consumption to disposable income if the debt paydown is having the predicted effect (we haven’t).

Access to the Internet could help to address the Post’s misunderstanding about current consumption levels. I’m afraid that they will need some additional training in economics or logic to clear up the confusion about how debt could affect consumption.

Comments