September 12, 2014

When countries went into recessions in the past they usually came out with a year or two of rapid growth that more than made up the ground lost in the recession and then resumed a normal growth path until the next recession. That hasn’t been the case in any major wealthy country following the 2008 downturn, although some countries, notably those in the euro zone, have done markedly worse than others.

Perhaps it is this comparison to the weak performance of the euro zone countries that led a piece in the NYT Dealbook section to tell readers:

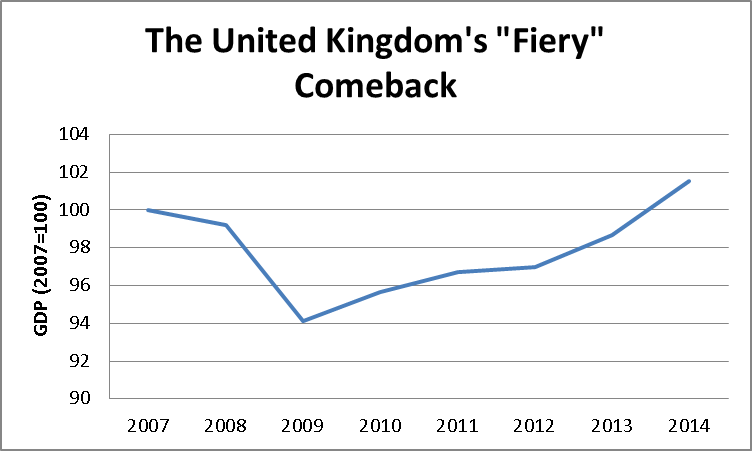

“Britons also see a Continent that is plagued by deflation and stagnation while their economy has staged a fiery comeback from the financial crisis.”

According to the I.M.F. the U.K. economy will be 1.5 percent larger in 2014 than it was in 2007. This would be equal to a bit more than a half year of growth in normal times.

Source: International Monetary Fund.

It is also worth noting that this piece seems to imply that the loss of part of its financial sector would be a big hit to the U.K. economy. This is not clear. Economists usually assume that economies tend to be at their full employment level of output in the long-run. If this is the case, then the loss of banks in the U.K. and/or Scotland would lead the people currently employed in finance to move to other sectors where their labor could be employed productively.

Comments