December 02, 2015

On Friday, the Bureau of Labor Statistics will release its latest jobs report. This month’s report is of special significance given that the Federal Reserve may raise interest rates in mid-December.

News reports typically cite three numbers from each jobs report: the unemployment rate, the number of jobs created, and the number of private-sector jobs created. By themselves, these figures provide an incomplete picture of the labor market. Here are five additional measures worth watching. Hyperlinks have been included so that anyone wishing to check these figures can do so easily on Friday.

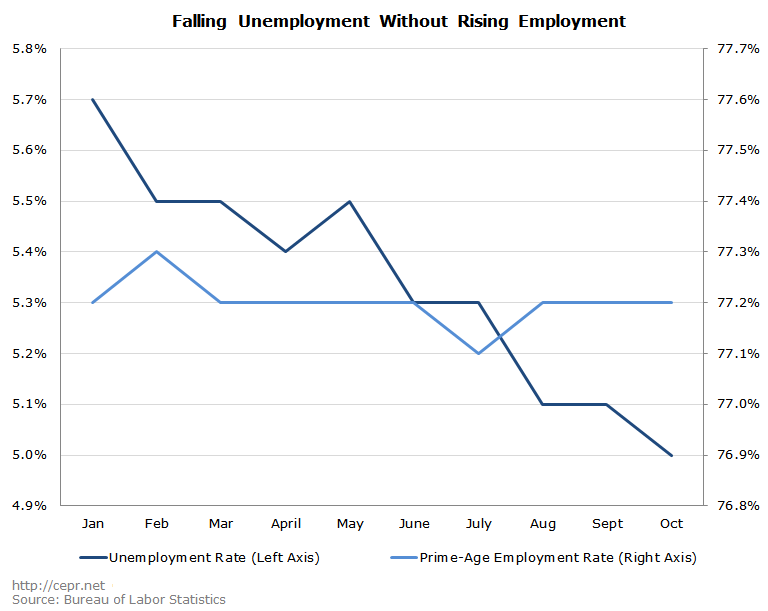

1. The Prime-Age Employment Rate: The prime-age employment rate measures the percentage of the population aged 25 to 54 which is employed. This is a better measure than the unemployment rate, which only counts workers as unemployed if they have “actively looked for work in the prior 4 weeks.” If prospective workers become discouraged over their job prospects and stop looking for work, the unemployment rate falls. A better measure of the labor market wouldn’t show the economy gaining strength due to the fact that workers were becoming depressed with their job prospects. Since the beginning of the year, the unemployment rate has fallen 0.7 percentage points, while the prime-age employment rate has been flat:

A good jobs report would include an increase in the prime-age employment rate. Since there is some random error in the data, to be meaningful an increase should be at least 0.2 percentage points.

2. Involuntary Part-Time Employment: “Involuntary part-time workers” are people who seek full-time jobs but are employed less than 35 hours per week. In general, involuntary part-time workers are employed about half as many hours as full-time workers, meaning that they are effectively “half unemployed.” Involuntary Part-Time Employment (IPTE) has been relatively high over the past eight years. However, there has been a substantial decline in IPTE from 6.5 million workers to 5.8 million over the past two months. One important question for this upcoming jobs report is: will this decline continue? Do the last two months represent the beginning of a positive downward trend in IPTE, or are they just an anomalous blip?

3. Wages and Prices: The primary impetus for raising interest rates is to hold back inflation. However, inflation (the rate of price increases) has been incredibly low since the recession; it has consistently fallen well below the Federal Reserve’s target rate. If inflation doesn’t show any sign of accelerating, there is little argument for raising interest rates.

Sometimes significant wage growth is a precursor to accelerating inflation. Monthly wage data are erratic, but if there is little evidence of an upward trend in wage growth, the Fed has no reason to be concerned about inflation.

4. The Search for Work: The Bureau of Labor Statistics (BLS) classifies non-employed persons who want a job into one of two categories. Non-employed persons who want a job, are available to work, and have searched for a job within the past four weeks are classified as unemployed. Non-employed persons who want a job and are available to work but haven’t searched within the past four weeks are classified as job wanters. There is an abnormally high ratio of job wanters to unemployed in today’s labor market. When non-employed workers begin feeling better about their job prospects, we’ll see some number of people shift from job wanter status to unemployed as they start to search for work.

5. The Average Duration of Unemployment: As of last October, unemployed Americans had been out of work an average of 28 weeks. From 2005 to 2008, the average duration of unemployment was consistently below 20 weeks. This indicates that unemployed workers are still having trouble finding jobs. A good jobs report would feature a decrease in the average duration of unemployment. (A complementary measure is the median duration of unemployment, which is also relatively high.)

Although the number of jobs created is an important figure, it’s best to examine a broader set of measures when evaluating the monthly jobs report.