May 31, 2017

Housing rent has been outpacing the overall rate of inflation in recent years. This is worth noting both because it is a large portion of the consumption basket and rents do not tend to follow other prices. Rent is primarily a function of the shortage of available units. It does not respond in any immediate way to wage pressures, like other components in the consumption basket. Rental inflation will also not be slowed by higher interest rates. In fact, by reducing construction, higher interest rates may further tighten the supply of housing, leading to higher rental inflation.

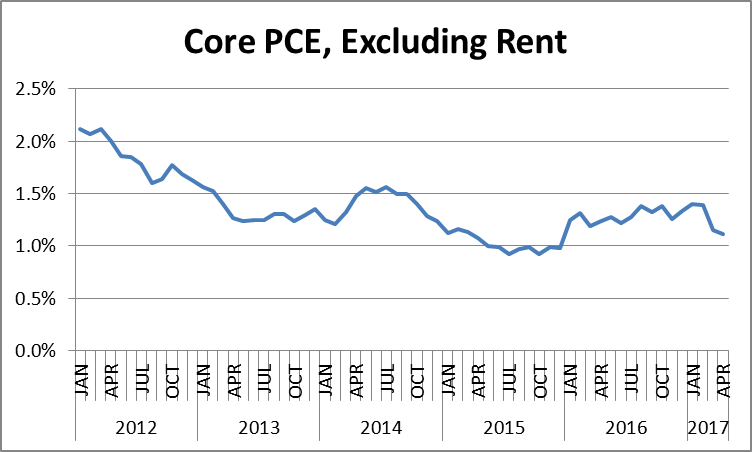

If we look at the core personal consumption expenditure deflator excluding rent, it is both well below the Fed’s 2.0 percent target and, if anything, is trending lower over the last few years.

Source: Bureau of Economic Analysis.

This raises the question millions are asking: why is the Fed raising interest rates? We know this keeps people from getting jobs and workers, especially those at the bottom of the wage distribution, from getting pay increases. With no problems with inflation on the horizon, this looks like lots of pain for no obvious gain.

Note: An earlier version had the months improperly labeled.

Comments