June 28, 2018

For folks who can remember all the way back to last fall, the promise was that a huge boom in investment would lead to more rapid productivity growth. Higher productivity would mean pay would be close to 10 percent higher than in the baseline scenario after a decade.

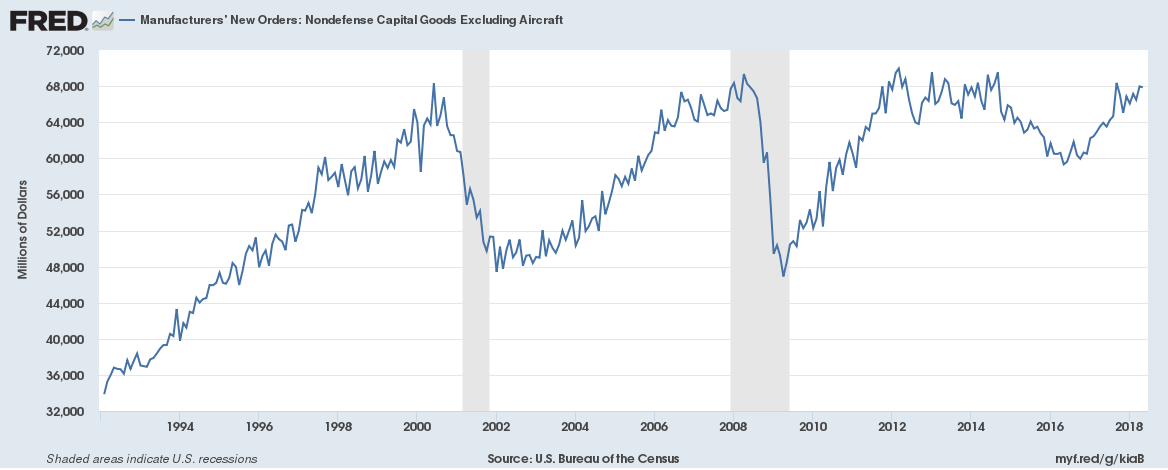

Well, the data disagree. We got new data on capital goods orders yesterday. Here’s the picture.

If you see a boom here since the tax cut, you may want to get the prescription on your glasses checked. It’s not a terrible story, but we’re still below the pre-recession peaks and even the levels reached during the horrible Obama years. Oh well, at least rich people got lots of money out of the deal.

By the way, the drop in capital goods orders in 2015 and 2016 was due to the plunge in world oil prices from $100 a barrel to $40 a barrel. Much of the increase in the last year and a half has been attributable to the partial recovery to $70 a barrel. I am not inclined to give the Trump administration the blame for higher gas prices, but I suppose if they insist, we can yell at them over $3 per gallon gas.

Comments