The coverage of the new law in New York state, which would prohibit the short-term renting of whole apartments in New York City, has been difficult to understand. It presents as competing claims that it would increase the supply of affordable housing in New York City and that it will allow hotels to raise their fees. (This Washington Post piece is an excellent example.) Actually, it will likely do both.

The basic story is that the city has a large number of units that are subject to some form of rent control. The purpose is to keep these units affordable for people who don’t work on Wall Street. This purpose is defeated if it is possible for either the landlord or tenant to rent out the unit through a service like Airbnb. If the landord is going the Airbnb route then it removes a unit of otherwise affordable housing from the market. If the tenant is going the Airbnb route then they are taking advantage of rent control to make a profit on arbitrage.

This is also bad news for the hotel industry, since people who might have otherwise stayed in hotels will instead stay in Airbnb units, thereby lowering occupancy rates and putting downward pressure on hotel prices. Therefore, there is absolutely nothing contradictory about the argument this measure will both increase the supply of affordable housing and benefit the hotel industry.

The long-run story may be somewhat different. In the long-run the construction of hotels is responsive to demand. If there is a high vacancy rate in the city’s hotels, there will be fewer hotels built in future years. This will leave more land for the construction of apartments and other uses. In that case, the restriction on Airbnb rentals may not ultimately lead to an increase in the number of affordable housing units in the city (a financial transactions tax would be more effective), but is perfectly reasonable to believe that in the short-term this restriction on Airbnb rentals will both increase the supply of affordable housing units and benefit the hotel industry.

The coverage of the new law in New York state, which would prohibit the short-term renting of whole apartments in New York City, has been difficult to understand. It presents as competing claims that it would increase the supply of affordable housing in New York City and that it will allow hotels to raise their fees. (This Washington Post piece is an excellent example.) Actually, it will likely do both.

The basic story is that the city has a large number of units that are subject to some form of rent control. The purpose is to keep these units affordable for people who don’t work on Wall Street. This purpose is defeated if it is possible for either the landlord or tenant to rent out the unit through a service like Airbnb. If the landord is going the Airbnb route then it removes a unit of otherwise affordable housing from the market. If the tenant is going the Airbnb route then they are taking advantage of rent control to make a profit on arbitrage.

This is also bad news for the hotel industry, since people who might have otherwise stayed in hotels will instead stay in Airbnb units, thereby lowering occupancy rates and putting downward pressure on hotel prices. Therefore, there is absolutely nothing contradictory about the argument this measure will both increase the supply of affordable housing and benefit the hotel industry.

The long-run story may be somewhat different. In the long-run the construction of hotels is responsive to demand. If there is a high vacancy rate in the city’s hotels, there will be fewer hotels built in future years. This will leave more land for the construction of apartments and other uses. In that case, the restriction on Airbnb rentals may not ultimately lead to an increase in the number of affordable housing units in the city (a financial transactions tax would be more effective), but is perfectly reasonable to believe that in the short-term this restriction on Airbnb rentals will both increase the supply of affordable housing units and benefit the hotel industry.

Read More Leer más Join the discussion Participa en la discusión

The New York Times had a major adventure in fantasy land when it ran a front page article asserting that the problem with the health care exchanges under the Affordable Care Act is that the penalties have not been large enough to coerce people into getting health care insurance. The begins by telling readers:

“The architects of the Affordable Care Act thought they had a blunt instrument to force people — even young and healthy ones — to buy insurance through the law’s online marketplaces: a tax penalty for those who remain uninsured.

“It has not worked all that well, and that is at least partly to blame for soaring premiums next year on some of the health law’s insurance exchanges.”

The piece then explains that many people are opting not to buy insurance and instead pay the penalty.

The problem with this line of argument for fans of reality is that the number of uninsured has actually fallen by more than had been projected at the time the law was passed. This is in spite of the fact that many states were allowed to opt out of the Medicare expansion by a 2012 Supreme Court decision making expansion optional. (It was mandatory in the law passed by Congress.)

It is not difficult to find the evidence that the number of uninsured has fallen more than projected. In March of 2012, the Congressional Budget Office and the Joint Tax Committee projected that there would be 32 million uninsured non-elderly people in 2015. Estimates from the Kaiser Family Foundation put the actual number at just under 29 million. In other words, three million more people were getting insured as of last year (our most recent data) than had been projected before most of the ACA took effect.

So, if more people are getting insured than had been expected, how could the penalties have been a failure? I leave that one for the folks at the NYT responsible for this front page story.

I will add one other item in this story worth correcting. The piece includes a quote from Joseph J. Thorndike, the director of the tax history project at Tax Analysts, telling readers:

“If it [the mandate] were effective, we would have higher enrollment, and the population buying policies in the insurance exchange would be healthier and younger.”

While we do care whether the people in the exchanges are healthy, it doesn’t matter if they are young. In fact, healthy older people are far more profitable to insurers than healthy young people since their premiums are on average three times as high. There is a slight skewing against the young in the structure of premiums, but this has little consequence for the costs of the system.

As a practical matter, the people signing up on the exchanges are probably somewhat less healthy than had been expected, but this is largely because more people are getting insurance through employers than had been expected. The people who get insurance through their employers are more healthy than the population as a whole, since for the most part they are healthy enough to be working full-time jobs.

The New York Times had a major adventure in fantasy land when it ran a front page article asserting that the problem with the health care exchanges under the Affordable Care Act is that the penalties have not been large enough to coerce people into getting health care insurance. The begins by telling readers:

“The architects of the Affordable Care Act thought they had a blunt instrument to force people — even young and healthy ones — to buy insurance through the law’s online marketplaces: a tax penalty for those who remain uninsured.

“It has not worked all that well, and that is at least partly to blame for soaring premiums next year on some of the health law’s insurance exchanges.”

The piece then explains that many people are opting not to buy insurance and instead pay the penalty.

The problem with this line of argument for fans of reality is that the number of uninsured has actually fallen by more than had been projected at the time the law was passed. This is in spite of the fact that many states were allowed to opt out of the Medicare expansion by a 2012 Supreme Court decision making expansion optional. (It was mandatory in the law passed by Congress.)

It is not difficult to find the evidence that the number of uninsured has fallen more than projected. In March of 2012, the Congressional Budget Office and the Joint Tax Committee projected that there would be 32 million uninsured non-elderly people in 2015. Estimates from the Kaiser Family Foundation put the actual number at just under 29 million. In other words, three million more people were getting insured as of last year (our most recent data) than had been projected before most of the ACA took effect.

So, if more people are getting insured than had been expected, how could the penalties have been a failure? I leave that one for the folks at the NYT responsible for this front page story.

I will add one other item in this story worth correcting. The piece includes a quote from Joseph J. Thorndike, the director of the tax history project at Tax Analysts, telling readers:

“If it [the mandate] were effective, we would have higher enrollment, and the population buying policies in the insurance exchange would be healthier and younger.”

While we do care whether the people in the exchanges are healthy, it doesn’t matter if they are young. In fact, healthy older people are far more profitable to insurers than healthy young people since their premiums are on average three times as high. There is a slight skewing against the young in the structure of premiums, but this has little consequence for the costs of the system.

As a practical matter, the people signing up on the exchanges are probably somewhat less healthy than had been expected, but this is largely because more people are getting insurance through employers than had been expected. The people who get insurance through their employers are more healthy than the population as a whole, since for the most part they are healthy enough to be working full-time jobs.

Read More Leer más Join the discussion Participa en la discusión

The Social Security scare story is a long established Washington ritual. Bloomberg news decided to bring it out again in time for Halloween. The basic story is that the Social Security trust fund is projected to face a shortfall in less than two decades. This means that unless Congress appropriates additional revenue, the program is projected to only be able to pay a bit more than 80 percent of scheduled benefits.

This much is not really in dispute. The question is how much should we be worried about this projected shortfall and what should we do about it. Bloomberg’s answer to the first question is that we should be very worried. It goes through the list of potential fixes and implies that all would be difficult or impossible.

I will just take one potential fix, which is raising the payroll tax by 2.58 percentage points to cover the projected shortfall. Bloomberg tells us:

“…it’s doubtful that the American public would accept such jarring changes.”

That’s an interesting political assessment. It would be worth knowing the basis for this assertion. We had comparably jarring changes in the form of Social Security tax increases in the decades of 40s, 50s, 60s, 70s, and 80s. There was no massive tax revolt against any of these tax increases; what has convinced Bloomberg that we can never again have a comparable increase in the payroll tax?

A piece of evidence suggesting that tax increases necessary to support Social Security might be politically viable is the fact that few people even noticed the 2.0 percentage point increase in the payroll tax at the start of 2013 when the payroll tax holiday ended. This was at a time when the labor market was still very weak from the recession and wages had been stagnant for more than a decade. (A survey conducted for the National Academy for Social Insurance also found that people were willing to pay higher taxes to support the scheduled level of Social Security benefits.)

Given this history and evidence, Bloomberg’s claim that the public won’t tolerate the sort of tax increases necessary to fully fund Social Security looks like an unsupported assertion.

The other point on this topic is that economists usually believe that workers care first and foremost about their after-tax wage, not the tax rate. The Social Security trustees project that real before-tax wages will rise on average by more than 50 percent over the next three decades. By comparison, the tax increase needed to fully fund Social Security seems relatively small, as shown below.

Source: Social Security trustees report, 2015 and author’s calculations.

Most workers have not seen their wages increase as much as the average wage over the last four decades since a disproportionate share went to those at top. These are people like CEOs, Wall Street traders, and doctors and other highly paid professionals. Workers stand to lose much more in terms of after-tax income if this upward redistribution continues over the next three decades than they would from the “jarring” Social Security tax increase that Bloomberg feels the need to warn us about.

So, of course people could get really worried about Social Security, as Bloomberg wants, or they can focus on the upward redistribution which will have far more impact on their well-being and that of their children. (Yes, this is the topic of my new book, Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer, which can be downloaded for free.)

The Social Security scare story is a long established Washington ritual. Bloomberg news decided to bring it out again in time for Halloween. The basic story is that the Social Security trust fund is projected to face a shortfall in less than two decades. This means that unless Congress appropriates additional revenue, the program is projected to only be able to pay a bit more than 80 percent of scheduled benefits.

This much is not really in dispute. The question is how much should we be worried about this projected shortfall and what should we do about it. Bloomberg’s answer to the first question is that we should be very worried. It goes through the list of potential fixes and implies that all would be difficult or impossible.

I will just take one potential fix, which is raising the payroll tax by 2.58 percentage points to cover the projected shortfall. Bloomberg tells us:

“…it’s doubtful that the American public would accept such jarring changes.”

That’s an interesting political assessment. It would be worth knowing the basis for this assertion. We had comparably jarring changes in the form of Social Security tax increases in the decades of 40s, 50s, 60s, 70s, and 80s. There was no massive tax revolt against any of these tax increases; what has convinced Bloomberg that we can never again have a comparable increase in the payroll tax?

A piece of evidence suggesting that tax increases necessary to support Social Security might be politically viable is the fact that few people even noticed the 2.0 percentage point increase in the payroll tax at the start of 2013 when the payroll tax holiday ended. This was at a time when the labor market was still very weak from the recession and wages had been stagnant for more than a decade. (A survey conducted for the National Academy for Social Insurance also found that people were willing to pay higher taxes to support the scheduled level of Social Security benefits.)

Given this history and evidence, Bloomberg’s claim that the public won’t tolerate the sort of tax increases necessary to fully fund Social Security looks like an unsupported assertion.

The other point on this topic is that economists usually believe that workers care first and foremost about their after-tax wage, not the tax rate. The Social Security trustees project that real before-tax wages will rise on average by more than 50 percent over the next three decades. By comparison, the tax increase needed to fully fund Social Security seems relatively small, as shown below.

Source: Social Security trustees report, 2015 and author’s calculations.

Most workers have not seen their wages increase as much as the average wage over the last four decades since a disproportionate share went to those at top. These are people like CEOs, Wall Street traders, and doctors and other highly paid professionals. Workers stand to lose much more in terms of after-tax income if this upward redistribution continues over the next three decades than they would from the “jarring” Social Security tax increase that Bloomberg feels the need to warn us about.

So, of course people could get really worried about Social Security, as Bloomberg wants, or they can focus on the upward redistribution which will have far more impact on their well-being and that of their children. (Yes, this is the topic of my new book, Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer, which can be downloaded for free.)

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Just kidding. Actually, insurance costs have slowed sharply in the years since the Affordable Care Act was passed, but it is unlikely many readers of the NYT would know this. Instead, it has focused on the large increase (not levels) in premium costs for the relatively small segment of the population insured on the exchanges. In keeping with this pattern, it gives us a front page piece telling readers about the 25 percent average increase in premiums facing people on the exchange this year. There are two points to keep in mind on this issue.

First, the focus on premiums is exclusively on the relatively small segment of the population getting insurance through the exchanges and specifically through the exchanges managed through the federal government. According to the latest numbers, 12.7 million people are now getting insurance through the exchanges (roughly 4.0 percent of the total population). This article refers to the premiums being paid by the 9.6 million people insured through the federally managed exchange (3.0 percent of the total population). Many states, such as California, have well run exchanges that have been more successful in keeping cost increases down.

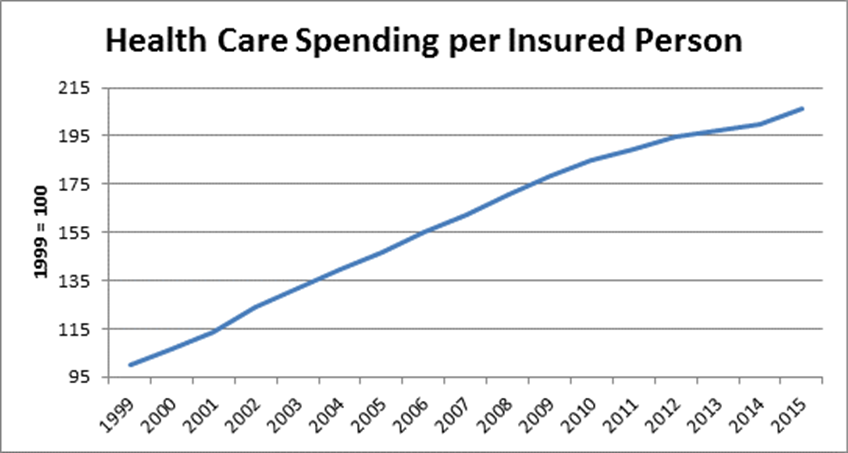

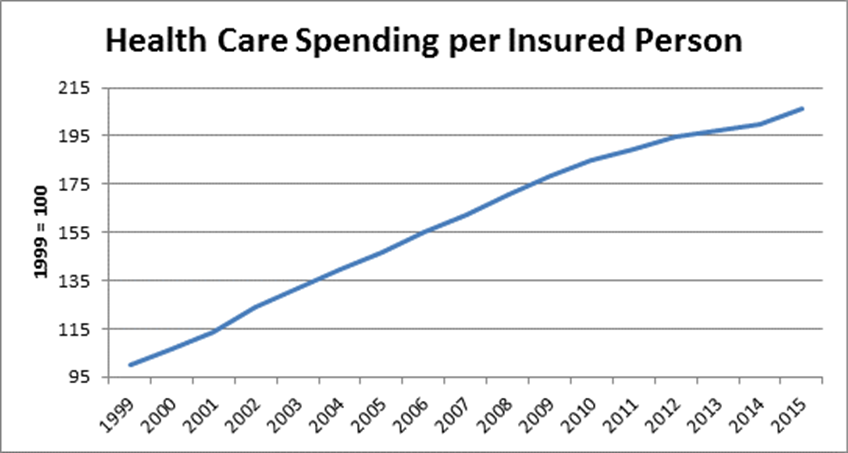

There are two reasons that costs on the exchanges have been rising rapidly. The first is that insurers probably priced their policies too low initially. Even with the increases this year premium prices are still lower than had been expected in 2010 when the law was passed. In fact, there has been a sharp slowing in the pace of health care cost growth in the last six years. While not all of this was due to the ACA, it was undoubtedly a factor in this slowdown. In the years from 1999 to 2010, health care costs per insured person rose at an average annual rate of 5.7 percent. In the years from 2010 to 2015 costs per insured person rose at an average rate of just 2.3 percent.

Source: Bureau of Economic Analysis and author’s calculations.

The other reason that premiums on the exchanges have risen rapidly is that more people are stiill getting insurance through employers than had been expected. The people who get insurance through employers tend to be healthier on average than the population as a whole. The Obama administration expected that more employers would stop providing insurance, sending their workers to get insurance on the exchanges. Since they have continued to provide insurance, the mix of people getting insurance through the exchanges is less healthy than had been expected.

Note that this has nothing to do with the “young invincible” story that had been widely touted in the years leading up to the ACA. The problem is not that healthy young people are not signing up. The problem is simply that healthy people of all ages are getting their insurance elsewhere. The overall percentage of the population getting insured is higher than projected, not lower as the young invincible silliness would imply.

Addendum

Robert Salzberg reminds me that the vast majority of people buying insurance in the exchanges get subsidies. For most people these subsidies will fully cover these cost increases. Even after the increases noted in this NYT article, almost 80 percent of the people buying insurance in the exchanges will be able to get a plan for less than $100 per month.

Just kidding. Actually, insurance costs have slowed sharply in the years since the Affordable Care Act was passed, but it is unlikely many readers of the NYT would know this. Instead, it has focused on the large increase (not levels) in premium costs for the relatively small segment of the population insured on the exchanges. In keeping with this pattern, it gives us a front page piece telling readers about the 25 percent average increase in premiums facing people on the exchange this year. There are two points to keep in mind on this issue.

First, the focus on premiums is exclusively on the relatively small segment of the population getting insurance through the exchanges and specifically through the exchanges managed through the federal government. According to the latest numbers, 12.7 million people are now getting insurance through the exchanges (roughly 4.0 percent of the total population). This article refers to the premiums being paid by the 9.6 million people insured through the federally managed exchange (3.0 percent of the total population). Many states, such as California, have well run exchanges that have been more successful in keeping cost increases down.

There are two reasons that costs on the exchanges have been rising rapidly. The first is that insurers probably priced their policies too low initially. Even with the increases this year premium prices are still lower than had been expected in 2010 when the law was passed. In fact, there has been a sharp slowing in the pace of health care cost growth in the last six years. While not all of this was due to the ACA, it was undoubtedly a factor in this slowdown. In the years from 1999 to 2010, health care costs per insured person rose at an average annual rate of 5.7 percent. In the years from 2010 to 2015 costs per insured person rose at an average rate of just 2.3 percent.

Source: Bureau of Economic Analysis and author’s calculations.

The other reason that premiums on the exchanges have risen rapidly is that more people are stiill getting insurance through employers than had been expected. The people who get insurance through employers tend to be healthier on average than the population as a whole. The Obama administration expected that more employers would stop providing insurance, sending their workers to get insurance on the exchanges. Since they have continued to provide insurance, the mix of people getting insurance through the exchanges is less healthy than had been expected.

Note that this has nothing to do with the “young invincible” story that had been widely touted in the years leading up to the ACA. The problem is not that healthy young people are not signing up. The problem is simply that healthy people of all ages are getting their insurance elsewhere. The overall percentage of the population getting insured is higher than projected, not lower as the young invincible silliness would imply.

Addendum

Robert Salzberg reminds me that the vast majority of people buying insurance in the exchanges get subsidies. For most people these subsidies will fully cover these cost increases. Even after the increases noted in this NYT article, almost 80 percent of the people buying insurance in the exchanges will be able to get a plan for less than $100 per month.

Read More Leer más Join the discussion Participa en la discusión

Yes, that is what he advocated in this column calling on people to vote for Hillary Clinton and Republican members of Congress. The Republicans are a party of climate deniers. Perhaps Samuelson doesn’t know this, but who cares. He urged the readers of his column to support a party that denies well-established science on climate change.

Yes, that is what he advocated in this column calling on people to vote for Hillary Clinton and Republican members of Congress. The Republicans are a party of climate deniers. Perhaps Samuelson doesn’t know this, but who cares. He urged the readers of his column to support a party that denies well-established science on climate change.

Read More Leer más Join the discussion Participa en la discusión

We continue to see a steady drumbeat of news stories and opinion pieces about the problem of men, and especially less-educated men, in the modern economy. The pieces always start with the fact that large numbers of prime-age men (ages 25–54) have dropped out of the labor force. The latest entry is a NYT column by Susan Chira that highlighted recent research showing that a large percentage of men who are not in the labor force are in poor health and frequent users of pain medication.

While this is interesting and useful research, it is unlikely that it explains the decline in employment among prime-age men. The reason, as I (along with Jared Bernstein) continually point out, is that there has been a similar drop in the employment rates of prime-age women since 2000.

The issue here should be straightforward. If we see drops in employment rates for both prime-age men and women, then it is not likely that they will be explained by problems that are unique to men. More likely, the problems stem from the overall state of the economy. In other words, the problem is with the people who design policy, not with the men who have dropped out of the workforce.

This doesn’t mean that non-employed men are not facing real problems. Undoubtedly many are, although the extent to which these problems are the result of their unemployment or a cause will often not be clear. Nonetheless, steps that can improve public health will be a good thing, but the better place to look to solve the problem of unemployment is Washington.

We continue to see a steady drumbeat of news stories and opinion pieces about the problem of men, and especially less-educated men, in the modern economy. The pieces always start with the fact that large numbers of prime-age men (ages 25–54) have dropped out of the labor force. The latest entry is a NYT column by Susan Chira that highlighted recent research showing that a large percentage of men who are not in the labor force are in poor health and frequent users of pain medication.

While this is interesting and useful research, it is unlikely that it explains the decline in employment among prime-age men. The reason, as I (along with Jared Bernstein) continually point out, is that there has been a similar drop in the employment rates of prime-age women since 2000.

The issue here should be straightforward. If we see drops in employment rates for both prime-age men and women, then it is not likely that they will be explained by problems that are unique to men. More likely, the problems stem from the overall state of the economy. In other words, the problem is with the people who design policy, not with the men who have dropped out of the workforce.

This doesn’t mean that non-employed men are not facing real problems. Undoubtedly many are, although the extent to which these problems are the result of their unemployment or a cause will often not be clear. Nonetheless, steps that can improve public health will be a good thing, but the better place to look to solve the problem of unemployment is Washington.

Read More Leer más Join the discussion Participa en la discusión

By Lara Merling and Dean Baker

The Peter Peterson-Washington Post deficit hawk gang keep trying to scare us in cutting Social Security and Medicare. If we don’t cut these programs now, then at some point in the future we might have to cut these program or RAISE TAXES.

There are many good reasons not to take the advice of the deficit hawks, but the most immediate one is that our economy is suffering from a deficit that is too small, not too large. The point is straight forward, the economy needs more demand, which we could get from larger budget deficits. More demand would lead to more output and employment. It would also cause firms to invest more, which would make us richer in the future.

The flip side in this story is that because we have not been investing as much as we would in a fully employed economy, our potential level of output is lower today than if we had remained near full employment since the downturn in 2008. The Congressional Budget Office estimates that potential GDP in 2016 is down by 10.5 percent (almost $2.0 trillion) from the level it had projected for 2016 back in 2008, before the downturn.

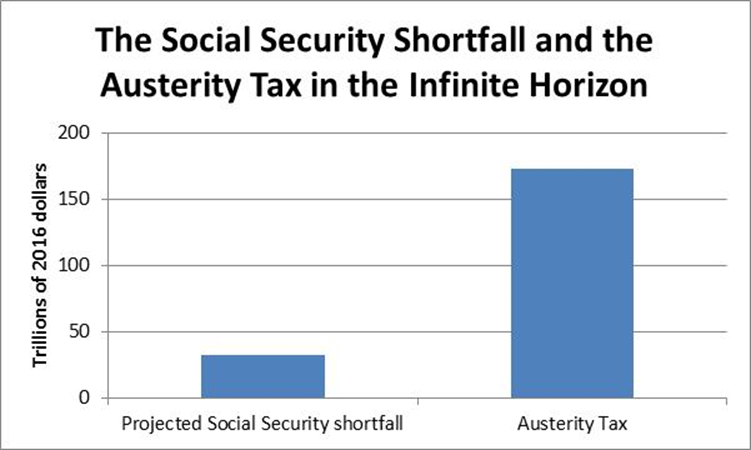

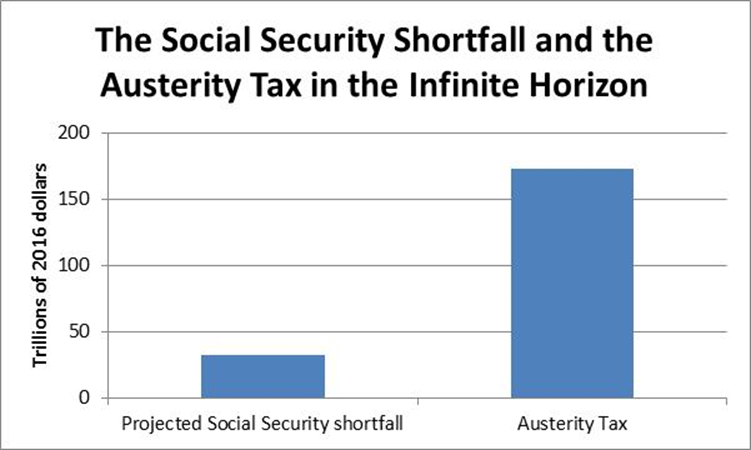

This is real money, over $6,200 per person. But if we want to have a little fun, we can use a tactic developed by the deficit hawks. We can calculate the cost of austerity over the infinite horizon. This is a simple story. We just assume that we will never get back the potential GDP lost as a result of the weak growth of the last eight years. Carrying this the lost 10.5 percent of GDP out to the infinite future and using a 2.9 percent real discount rate gives us $172.94 trillion in lost output. This is the size of the austerity tax for all future time. It comes to more than $500,000 for every person in the country.

By comparison, we can look at the projected Social Security shortfall for the infinite horizon. According to the most recent Social Security Trustees Report, this comes to $32.1 trillion. (Almost two thirds of this occurs after the 75-year projection period.) Undoubtedly, many deficit hawks hope that people would be scared by this number. But compared to the austerity tax imposed by the deficit hawks, it doesn’t look like a big deal.

Source: Social Security Trustees Report and Author’s Calculations.

By Lara Merling and Dean Baker

The Peter Peterson-Washington Post deficit hawk gang keep trying to scare us in cutting Social Security and Medicare. If we don’t cut these programs now, then at some point in the future we might have to cut these program or RAISE TAXES.

There are many good reasons not to take the advice of the deficit hawks, but the most immediate one is that our economy is suffering from a deficit that is too small, not too large. The point is straight forward, the economy needs more demand, which we could get from larger budget deficits. More demand would lead to more output and employment. It would also cause firms to invest more, which would make us richer in the future.

The flip side in this story is that because we have not been investing as much as we would in a fully employed economy, our potential level of output is lower today than if we had remained near full employment since the downturn in 2008. The Congressional Budget Office estimates that potential GDP in 2016 is down by 10.5 percent (almost $2.0 trillion) from the level it had projected for 2016 back in 2008, before the downturn.

This is real money, over $6,200 per person. But if we want to have a little fun, we can use a tactic developed by the deficit hawks. We can calculate the cost of austerity over the infinite horizon. This is a simple story. We just assume that we will never get back the potential GDP lost as a result of the weak growth of the last eight years. Carrying this the lost 10.5 percent of GDP out to the infinite future and using a 2.9 percent real discount rate gives us $172.94 trillion in lost output. This is the size of the austerity tax for all future time. It comes to more than $500,000 for every person in the country.

By comparison, we can look at the projected Social Security shortfall for the infinite horizon. According to the most recent Social Security Trustees Report, this comes to $32.1 trillion. (Almost two thirds of this occurs after the 75-year projection period.) Undoubtedly, many deficit hawks hope that people would be scared by this number. But compared to the austerity tax imposed by the deficit hawks, it doesn’t look like a big deal.

Source: Social Security Trustees Report and Author’s Calculations.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The Washington Post had an interesting piece about Iclusig, a cancer drug that now sells for almost $200,000 a year. The piece discussed the pricing pattern for cancer drugs. It noted that the pricing of Iclusig did not follow the normal pattern, with the price soaring as its range of approved uses was limited by the Food and Drug Administration.

While it presented this as evidence of this not being a normal market, the piece never made the obvious point: the drug market is certainly not normal because the government grants patent monopolies and other forms of protection. Without these government granted monopolies almost all drugs would be cheap. Certainly none would sell for anything close to $200,000. While it is necessary to pay for research, they are other mechanisms that would almost certainly be more efficient and less prone to corruption than patent monopolies.

The Washington Post had an interesting piece about Iclusig, a cancer drug that now sells for almost $200,000 a year. The piece discussed the pricing pattern for cancer drugs. It noted that the pricing of Iclusig did not follow the normal pattern, with the price soaring as its range of approved uses was limited by the Food and Drug Administration.

While it presented this as evidence of this not being a normal market, the piece never made the obvious point: the drug market is certainly not normal because the government grants patent monopolies and other forms of protection. Without these government granted monopolies almost all drugs would be cheap. Certainly none would sell for anything close to $200,000. While it is necessary to pay for research, they are other mechanisms that would almost certainly be more efficient and less prone to corruption than patent monopolies.

Read More Leer más Join the discussion Participa en la discusión