The grant of copyright monopolies is a mechanism the government uses to support creative work. It is far from the only mechanism. The government funds creative work through agencies like the National Endowments for the Arts and Humanities, the Corporation for Public Broadcasting, and indirectly through its support of colleges and universities. It also provides support through the charitable contribution tax deduction, which subsidizes contributions that wealthy people choose to make to organizations that support creative work at the rate of almost 40 cents on the dollar.

The fact that copyright is just one of many tools for supporting creative work should be a central part of any discussion about ramping up in enforcement rules. Incredibly, this simple fact is altogether absent from a Washington Post column, by T Bone Burnett and Jonathan Taplin, arguing for the need for enhanced enforcement measures in the era of artificial intelligence (AI).

Copyright, AI and the Internet Age

Burnett and Taplin are concerned that AI programs will be able to freely surf the web, grabbing and recycling copyrighted material, without making any payments to the people who created the material. This is a very realistic concern.

As Burnett and Taplin point out, file sharing over the web has already cut sales of recorded music almost in half. (Actually, as a percent of GDP, the decline would be close to 70 percent.) The spread of AI programs is virtually certain to lead to even further declines in the future. Their response to this threat is to call for “new laws and regulations governing AI and safeguarding the human core of creative artistry.”

It’s important to realize that we already have created new laws and regulations to protect copyright in the Internet Age. Specifically, Congress passed the Digital Millennial Copyright Act (DMCA) in 1998 to establish rules for enforcing copyright on the Internet.

The DMCA requires website owners and Internet platforms to promptly remove infringing material after they have been notified by the person claiming infringement in order to protect themselves from an infringement suit. This threat is taken very seriously, since the law provides for statutory damages, and also legal fees.

This is a big deal. The actual damages resulting from most alleged acts of infringement would be trivial. Spotify compensates performing artists at an average rate of 0.4 cents per stream. That means that if the unauthorized posting of a copyrighted song allowed for 10,000 people to play the piece, the actual damages would be in the neighborhood of $40.

No one would pursue a lawsuit for such a small amount of money. However, the statutory damages allowed under the law can run into the thousands of dollars for even minor acts of infringement. In addition, a successful lawsuit can mean the defendant also has to pay several thousand dollars in legal fees.

As a result of these large potential damages, websites and platforms take removal notices very seriously. In fact, there is evidence that we see over-removal, with websites and platforms removing material where the notice may not properly represent someone with a legitimate copyright claim, or the material may reasonably qualify as “fair use.”

Whether or not we actually see over-removal, it is clear that copyright enforcement on the web imposes a substantial cost on society. Not only does it prevent direct acts of infringement, it also requires that third parties (the website or platform) police items that others post.

This cost is important to keep in mind when we consider Burnett and Taplin’s call for “new laws and regulations” to protect copyrighted material from AI. Almost by definition this means still larger costs for a mechanism that is providing relatively little revenue for creative workers.

An Alternative to Copyright

Rather than developing new laws and enforcement mechanisms to protect the relatively small revenue stream produced by copyright monopolies, we might look to alternative mechanisms for supporting creative work. We could go the route of increased funding for agencies like the National Endowments for the Art and Humanities, but this would raise political issues over who gets to decide what work is funded.

An alternative would be to build on the mechanism we already have in place with the charitable contribution tax deduction. As currently structured, this contribution benefits a small share of the population, since the vast majority of taxpayers take the standard deduction, which means they are not able to benefit from the charitable contribution tax deduction at all.

The deduction is also regressive, with higher income taxpayers effectively able to get a far larger subsidy for their contributions than middle income households. And of course, most of the contributions are not going for creative work.

But we could build on the basic logic of the charitable deduction where we give a public subsidy for individuals’ support of what very broadly are considered socially desirable ends. However, instead of making it a deduction, we could make it a refundable tax credit, and specify that the money go to support creative workers. (I outline this system in somewhat more detail in chapter 5 of Rigged [it’s free].)

On the first point, if some billionaire decides to give $100 million to their favorite church, the taxpayers are on the hook for $37 million of this payment, which is the reduction in their tax liability. Under a tax credit system, we would give every person the same amount, say $100 to $200, to contribute to whatever creative worker, or organization supporting creative workers, they want.

This would provide an enormous amount of money to support creative work. If we assume 70 percent of adults decide to use this free money, it would mean $17.5 billion to $35 billion a year, roughly 0.07 percent to 0.14 percent of GDP. The latter figure is more than twice as much as what is now paid for recorded music.

The condition for being eligible to get the money is that a creative worker or organization has to register with the I.R.S., or other designated agency, saying what it is they do. This is similar to what tax-exempt organizations must do now. They must say they are a church, a research organization, or charity providing food to the poor. The I.R.S. does not evaluate whether they are a good church or a good charity; its only obligation is to ensure that the organization is not committing fraud and is in fact what it claims.

In this case, a person would say they are a musician, singer, or some other type of creative worker (the law would have to specify how broadly this would be defined). If they are getting money as an organization, they would have to say that they support country music, mystery writers, or some other type of creative work. Just as is the case with tax-exempt organizations now, the government would not evaluate the quality of the work, just that the person or organization does what they claim.

There would also be another condition. If you get money through the tax credit system, you are not also eligible for copyright monopolies. The government gives you one subsidy, not two.

The neat part about this aspect of the system is that it is self-enforcing. There would be a public record of everyone getting money through the tax credit system. If any of these people subsequently tried to claim copyright infringement, their case would be immediately dismissed, since they were not eligible to get copyrights. This sort of subsidy would generate an enormous amount of material that could be freely distributed over the web, with no concerns about copyright.

It’s true that this system would lead to public support for work that people didn’t like. Virtually everyone would likely be able to identify something supported through the tax credit system that they found objectionable, and perhaps highly objectionable.

But this is also the case with the current system with the charitable deduction. Many of us find the activities of some organizations that get millions, or even billions, of tax subsidized dollars highly objectionable. We would have the same story here, but an organization that got a large amount of money would need to have a large number of people who supported it, not just a single billionaire.

There are issues that need to be addressed in constructing this sort of tax credit system. It can be sliced and diced in thousands of different ways. Should we make the dollar amount larger or smaller? Perhaps we should also allow a match, where if a person decides to contribute $100 of their own money, the government throws in another $100 or even $200.

We also have to decide which work qualifies. Presumably music and writing are obvious (how about journalism – seems very important), but what about movies or television shows? How about video games? I would argue for making the boundaries as large as plausible, which would presumably make a case for a larger credit, but this is the sort of thing that would need to be debated.

The key point is that we have options other than trying to revive a 500-year-old copyright system that is already on life support. Our creative workers may not be very creative when it comes to designing mechanisms to support their work, but the rest of us have to be.

The grant of copyright monopolies is a mechanism the government uses to support creative work. It is far from the only mechanism. The government funds creative work through agencies like the National Endowments for the Arts and Humanities, the Corporation for Public Broadcasting, and indirectly through its support of colleges and universities. It also provides support through the charitable contribution tax deduction, which subsidizes contributions that wealthy people choose to make to organizations that support creative work at the rate of almost 40 cents on the dollar.

The fact that copyright is just one of many tools for supporting creative work should be a central part of any discussion about ramping up in enforcement rules. Incredibly, this simple fact is altogether absent from a Washington Post column, by T Bone Burnett and Jonathan Taplin, arguing for the need for enhanced enforcement measures in the era of artificial intelligence (AI).

Copyright, AI and the Internet Age

Burnett and Taplin are concerned that AI programs will be able to freely surf the web, grabbing and recycling copyrighted material, without making any payments to the people who created the material. This is a very realistic concern.

As Burnett and Taplin point out, file sharing over the web has already cut sales of recorded music almost in half. (Actually, as a percent of GDP, the decline would be close to 70 percent.) The spread of AI programs is virtually certain to lead to even further declines in the future. Their response to this threat is to call for “new laws and regulations governing AI and safeguarding the human core of creative artistry.”

It’s important to realize that we already have created new laws and regulations to protect copyright in the Internet Age. Specifically, Congress passed the Digital Millennial Copyright Act (DMCA) in 1998 to establish rules for enforcing copyright on the Internet.

The DMCA requires website owners and Internet platforms to promptly remove infringing material after they have been notified by the person claiming infringement in order to protect themselves from an infringement suit. This threat is taken very seriously, since the law provides for statutory damages, and also legal fees.

This is a big deal. The actual damages resulting from most alleged acts of infringement would be trivial. Spotify compensates performing artists at an average rate of 0.4 cents per stream. That means that if the unauthorized posting of a copyrighted song allowed for 10,000 people to play the piece, the actual damages would be in the neighborhood of $40.

No one would pursue a lawsuit for such a small amount of money. However, the statutory damages allowed under the law can run into the thousands of dollars for even minor acts of infringement. In addition, a successful lawsuit can mean the defendant also has to pay several thousand dollars in legal fees.

As a result of these large potential damages, websites and platforms take removal notices very seriously. In fact, there is evidence that we see over-removal, with websites and platforms removing material where the notice may not properly represent someone with a legitimate copyright claim, or the material may reasonably qualify as “fair use.”

Whether or not we actually see over-removal, it is clear that copyright enforcement on the web imposes a substantial cost on society. Not only does it prevent direct acts of infringement, it also requires that third parties (the website or platform) police items that others post.

This cost is important to keep in mind when we consider Burnett and Taplin’s call for “new laws and regulations” to protect copyrighted material from AI. Almost by definition this means still larger costs for a mechanism that is providing relatively little revenue for creative workers.

An Alternative to Copyright

Rather than developing new laws and enforcement mechanisms to protect the relatively small revenue stream produced by copyright monopolies, we might look to alternative mechanisms for supporting creative work. We could go the route of increased funding for agencies like the National Endowments for the Art and Humanities, but this would raise political issues over who gets to decide what work is funded.

An alternative would be to build on the mechanism we already have in place with the charitable contribution tax deduction. As currently structured, this contribution benefits a small share of the population, since the vast majority of taxpayers take the standard deduction, which means they are not able to benefit from the charitable contribution tax deduction at all.

The deduction is also regressive, with higher income taxpayers effectively able to get a far larger subsidy for their contributions than middle income households. And of course, most of the contributions are not going for creative work.

But we could build on the basic logic of the charitable deduction where we give a public subsidy for individuals’ support of what very broadly are considered socially desirable ends. However, instead of making it a deduction, we could make it a refundable tax credit, and specify that the money go to support creative workers. (I outline this system in somewhat more detail in chapter 5 of Rigged [it’s free].)

On the first point, if some billionaire decides to give $100 million to their favorite church, the taxpayers are on the hook for $37 million of this payment, which is the reduction in their tax liability. Under a tax credit system, we would give every person the same amount, say $100 to $200, to contribute to whatever creative worker, or organization supporting creative workers, they want.

This would provide an enormous amount of money to support creative work. If we assume 70 percent of adults decide to use this free money, it would mean $17.5 billion to $35 billion a year, roughly 0.07 percent to 0.14 percent of GDP. The latter figure is more than twice as much as what is now paid for recorded music.

The condition for being eligible to get the money is that a creative worker or organization has to register with the I.R.S., or other designated agency, saying what it is they do. This is similar to what tax-exempt organizations must do now. They must say they are a church, a research organization, or charity providing food to the poor. The I.R.S. does not evaluate whether they are a good church or a good charity; its only obligation is to ensure that the organization is not committing fraud and is in fact what it claims.

In this case, a person would say they are a musician, singer, or some other type of creative worker (the law would have to specify how broadly this would be defined). If they are getting money as an organization, they would have to say that they support country music, mystery writers, or some other type of creative work. Just as is the case with tax-exempt organizations now, the government would not evaluate the quality of the work, just that the person or organization does what they claim.

There would also be another condition. If you get money through the tax credit system, you are not also eligible for copyright monopolies. The government gives you one subsidy, not two.

The neat part about this aspect of the system is that it is self-enforcing. There would be a public record of everyone getting money through the tax credit system. If any of these people subsequently tried to claim copyright infringement, their case would be immediately dismissed, since they were not eligible to get copyrights. This sort of subsidy would generate an enormous amount of material that could be freely distributed over the web, with no concerns about copyright.

It’s true that this system would lead to public support for work that people didn’t like. Virtually everyone would likely be able to identify something supported through the tax credit system that they found objectionable, and perhaps highly objectionable.

But this is also the case with the current system with the charitable deduction. Many of us find the activities of some organizations that get millions, or even billions, of tax subsidized dollars highly objectionable. We would have the same story here, but an organization that got a large amount of money would need to have a large number of people who supported it, not just a single billionaire.

There are issues that need to be addressed in constructing this sort of tax credit system. It can be sliced and diced in thousands of different ways. Should we make the dollar amount larger or smaller? Perhaps we should also allow a match, where if a person decides to contribute $100 of their own money, the government throws in another $100 or even $200.

We also have to decide which work qualifies. Presumably music and writing are obvious (how about journalism – seems very important), but what about movies or television shows? How about video games? I would argue for making the boundaries as large as plausible, which would presumably make a case for a larger credit, but this is the sort of thing that would need to be debated.

The key point is that we have options other than trying to revive a 500-year-old copyright system that is already on life support. Our creative workers may not be very creative when it comes to designing mechanisms to support their work, but the rest of us have to be.

Read More Leer más Join the discussion Participa en la discusión

An item in Ezra Klein’s NYT column yesterday really grabbed by attention. Ezra cited a Wall Street Journal column that claimed that the Federal Reserve Board’s stress tests would not have detected Silicon Valley Bank’s (SVB) problems, because its stress tests did not consider interest rate risk.

This struck me as close to crazy. How could a stress test not consider interest rate risk? I recalled the stress tests that the Fed and Treasury performed very publicly in March of 2009, in the middle of the financial crisis. These tests did not consider interest rate risk for the simple reason that, at that point in time, soaring interest rates seemed about as likely as a Martian invasion.

I had not been following the Fed’s stress tests since that time, but I assumed that they did adjust them for circumstances. I recall back in 2002, when I first became concerned about the housing bubble, being on a radio show with the chief economist from Fannie Mae. He assured me that they could not have serious problems with a decline in housing prices, since they regularly stress test their assets. Their tests included a large rise in interest rates. (When the bubble finally burst, Fannie Mae, along with Freddie Mac, collapsed in the summer of 2008 and have been in conservatorship ever since.)

Anyhow, this exchange led me to believe that regulators applied some common sense to their stress test exercises and examined how bank assets would fare in all bad, but plausible, circumstances. In the years 2020-21, when 10-year Treasury rates were at times flirting with 1.0 percent, a sharp rise in interest rates had to be seen as a plausible, even if unlikely, possibility.

Incredibly, the Fed stress tests did not consider this scenario. This means that the Fed’s stress tests would not have detected the vulnerability of SVB to the sort of jump in interest rates that we have seen over the last year. That means that it is possible that, even if Dodd-Frank had not been weakened in 2018 to reduce the regulation to which SVB was subject, the Fed still would not have detected its problems.

I said “possible,” rather than asserting that the Fed would not have caught the bank’s vulnerabilities, because even without a stress test some items should have been apparent to anyone giving the bank careful scrutiny, as would have been required before the 2018 law weakening Dodd-Frank.

First and foremost, the bank had well over 90 percent of its liabilities in uninsured deposits. That has to be a red flag to any bank regulator. These are the deposits that are more likely to run in a crisis, since insured deposits have no reason to flee. Also, most banks have more of their liabilities in the form of bonds or other fixed term debt that cannot run.

The fact that the bank’s customers were highly concentrated in a single industry, the tech sector, also should have been a red flag. This is especially the case because tech has a long history as being a boom-bust industry.

Third, the bank’s assets had nearly tripled in size from the fourth quarter of 2019 to the fourth quarter of 2021. Again, any regulator with some clear eyes should have been asking if SVB was doing anything risky to bring about such extraordinary growth. As an old line goes, they should use their University of Chicago common sense: “If what we’re doing is not risky, why is the good lord being so nice to us?”

Anyhow, I mention these points since it still seems likely to me that if the Fed was applying the strict scrutiny to SVB, that had been required before the passage of the 2018 law weakening Dodd-Frank, it would have caught the bank’s vulnerabilities and required measures to shore up its capital and/or reduce its deposits. However, the stress tests the Fed was using would have been utterly worthless in detecting its problems.

This should be an important reminder that regulation does not necessarily solve market problems. Sometimes liberals seem to work from the assumption that if the market outcomes are getting things wrong, somehow bringing in the government will set things right.

This is often not the case. When I think back to my exchange with Fannie Mae’s chief economist, he insisted that a nationwide plunge in house prices was not even a possibility, since the country had never seen anything like that. While that was partly true (they did fall sharply in the Great Depression), we also had never seen the sort of nationwide run-up in house prices we were experiencing at the time.

But the key point was that he could not even consider the possibility that we were seeing a housing bubble, where house prices were being driven by irrational exuberance, rather than the fundamentals of the market. That was true of almost all the economists I encountered in those years. Even my friends largely did not buy the story, although they might politely nod when I made the case.

Anyhow, if we had more thoroughgoing regulation of the financial system in the years when the housing bubble was growing, there is little reason to think the regulators necessarily would have caught the financial system’s problems. After all, if the house price growth we saw in the bubble years made sense, then the banks’ behavior would not have been especially risky.

To my view, while we need government regulators in many circumstances, the most important part of the story is to structure the market to get the incentives right. That is why I have argued for a system where the Fed gives everyone an account which they can use for getting their paychecks, paying their bills, and other transactions.

This would be enormously more efficient than the current system, eliminating tens of billions in fees paid annually to the banks. The amount saved could be two or three times the price of Biden’s student loan debt forgiveness. It would also eliminate the problem of bankers sitting on huge pots of money where they can make great fortunes by taking big risks.

This is also the story with the pharmaceutical industry. If we paid for the development costs upfront, as we already do with more than $50 billion a year going to the National Institutes of Health, we would not only make drugs cheap (all drugs would be available as generics the day they are approved), we would also eliminate the incentive for drug companies to lie about their safety and effectiveness.

I have my longer tirade on this topic in chapter 5 of Rigged [it’s free], along with a discussion of other sectors. (See also here.) But the key point is that we can’t count on government regulation to right the wrongs of a badly structured market. Regulators can both make mistakes and also be corrupted by the industry they are regulating.

The most important reform is to structure the markets right in the first place, so that we can minimize the need for regulatory oversight. We need regulation in many circumstances, but even the best regulation will not correct the problems of a badly structured market.

An item in Ezra Klein’s NYT column yesterday really grabbed by attention. Ezra cited a Wall Street Journal column that claimed that the Federal Reserve Board’s stress tests would not have detected Silicon Valley Bank’s (SVB) problems, because its stress tests did not consider interest rate risk.

This struck me as close to crazy. How could a stress test not consider interest rate risk? I recalled the stress tests that the Fed and Treasury performed very publicly in March of 2009, in the middle of the financial crisis. These tests did not consider interest rate risk for the simple reason that, at that point in time, soaring interest rates seemed about as likely as a Martian invasion.

I had not been following the Fed’s stress tests since that time, but I assumed that they did adjust them for circumstances. I recall back in 2002, when I first became concerned about the housing bubble, being on a radio show with the chief economist from Fannie Mae. He assured me that they could not have serious problems with a decline in housing prices, since they regularly stress test their assets. Their tests included a large rise in interest rates. (When the bubble finally burst, Fannie Mae, along with Freddie Mac, collapsed in the summer of 2008 and have been in conservatorship ever since.)

Anyhow, this exchange led me to believe that regulators applied some common sense to their stress test exercises and examined how bank assets would fare in all bad, but plausible, circumstances. In the years 2020-21, when 10-year Treasury rates were at times flirting with 1.0 percent, a sharp rise in interest rates had to be seen as a plausible, even if unlikely, possibility.

Incredibly, the Fed stress tests did not consider this scenario. This means that the Fed’s stress tests would not have detected the vulnerability of SVB to the sort of jump in interest rates that we have seen over the last year. That means that it is possible that, even if Dodd-Frank had not been weakened in 2018 to reduce the regulation to which SVB was subject, the Fed still would not have detected its problems.

I said “possible,” rather than asserting that the Fed would not have caught the bank’s vulnerabilities, because even without a stress test some items should have been apparent to anyone giving the bank careful scrutiny, as would have been required before the 2018 law weakening Dodd-Frank.

First and foremost, the bank had well over 90 percent of its liabilities in uninsured deposits. That has to be a red flag to any bank regulator. These are the deposits that are more likely to run in a crisis, since insured deposits have no reason to flee. Also, most banks have more of their liabilities in the form of bonds or other fixed term debt that cannot run.

The fact that the bank’s customers were highly concentrated in a single industry, the tech sector, also should have been a red flag. This is especially the case because tech has a long history as being a boom-bust industry.

Third, the bank’s assets had nearly tripled in size from the fourth quarter of 2019 to the fourth quarter of 2021. Again, any regulator with some clear eyes should have been asking if SVB was doing anything risky to bring about such extraordinary growth. As an old line goes, they should use their University of Chicago common sense: “If what we’re doing is not risky, why is the good lord being so nice to us?”

Anyhow, I mention these points since it still seems likely to me that if the Fed was applying the strict scrutiny to SVB, that had been required before the passage of the 2018 law weakening Dodd-Frank, it would have caught the bank’s vulnerabilities and required measures to shore up its capital and/or reduce its deposits. However, the stress tests the Fed was using would have been utterly worthless in detecting its problems.

This should be an important reminder that regulation does not necessarily solve market problems. Sometimes liberals seem to work from the assumption that if the market outcomes are getting things wrong, somehow bringing in the government will set things right.

This is often not the case. When I think back to my exchange with Fannie Mae’s chief economist, he insisted that a nationwide plunge in house prices was not even a possibility, since the country had never seen anything like that. While that was partly true (they did fall sharply in the Great Depression), we also had never seen the sort of nationwide run-up in house prices we were experiencing at the time.

But the key point was that he could not even consider the possibility that we were seeing a housing bubble, where house prices were being driven by irrational exuberance, rather than the fundamentals of the market. That was true of almost all the economists I encountered in those years. Even my friends largely did not buy the story, although they might politely nod when I made the case.

Anyhow, if we had more thoroughgoing regulation of the financial system in the years when the housing bubble was growing, there is little reason to think the regulators necessarily would have caught the financial system’s problems. After all, if the house price growth we saw in the bubble years made sense, then the banks’ behavior would not have been especially risky.

To my view, while we need government regulators in many circumstances, the most important part of the story is to structure the market to get the incentives right. That is why I have argued for a system where the Fed gives everyone an account which they can use for getting their paychecks, paying their bills, and other transactions.

This would be enormously more efficient than the current system, eliminating tens of billions in fees paid annually to the banks. The amount saved could be two or three times the price of Biden’s student loan debt forgiveness. It would also eliminate the problem of bankers sitting on huge pots of money where they can make great fortunes by taking big risks.

This is also the story with the pharmaceutical industry. If we paid for the development costs upfront, as we already do with more than $50 billion a year going to the National Institutes of Health, we would not only make drugs cheap (all drugs would be available as generics the day they are approved), we would also eliminate the incentive for drug companies to lie about their safety and effectiveness.

I have my longer tirade on this topic in chapter 5 of Rigged [it’s free], along with a discussion of other sectors. (See also here.) But the key point is that we can’t count on government regulation to right the wrongs of a badly structured market. Regulators can both make mistakes and also be corrupted by the industry they are regulating.

The most important reform is to structure the markets right in the first place, so that we can minimize the need for regulatory oversight. We need regulation in many circumstances, but even the best regulation will not correct the problems of a badly structured market.

Read More Leer más Join the discussion Participa en la discusión

The New York Times seems to think it is a newspaper’s job to promote bank panics wherever possible. It would be difficult to explain its reporting on the Silicon Valley Bank’s (SVB) collapse any other way.

Last week it ran a piece implying that Silicon Valley’s tech sector was going to be seriously crippled by the collapse of the bank. The crippling would occur both, because they would lose a large chunk of their assets, which were in uninsured accounts at SVB, and also because they would lose access to a bank which was a major source of credit.

The first point was not plausibly true even at the time the NYT posted the story. When it seized the bank a week ago Friday, the FDIC issued a notice that it would give depositors an advance payment against the uninsured funds in their account the next week. It also said that it would give them a certificate for the remaining funds, the value of which would depend on how much it was able to collect by selling the bank’s assets.

The advance payment would almost certainly have been an amount equal to at least 50 percent of the uninsured deposits and quite possibly over 70 percent. The certificate would cover some fraction of the remaining amount.

While the depositors would have to wait for the FDIC to complete its resolution process to know how much they would ultimately get from their certificates, they would almost certainly be able to sell them to investors the day they were issued. This would likely mean a loss to these depositors, but we are almost certainly talking about less than 15 percent, and quite likely something close 5.0 percent. (The bonds of the bank were still selling for 30 cents on the dollar after the FDIC seizure was announced. No bond holder will collect a penny on their bonds, unless the depositors are paid in full.)

In short, the idea that Silicon Valley businesses would see their accounts zeroed out was always nonsense. Losing 5-15 percent of holdings above $250k would surely be a blow, but it is hard to believe this would devastate an otherwise thriving business.

On the second point, while other banks may not give quite the same service to Silicon Valley business people as SVB, banks are generally happy to make loans to thriving businesses. Also, part of the loss is personal to these people, not about their businesses.

“SVB’s home loans were significantly better than those from traditional banks, four people who received them said. The loans were $2.5 million to $6 million, with interest rates under 2.6 percent. Other banks had turned them down or, when given quotes for interest rates, offered over 3 percent, the people said.”

Anyhow, in a follow up today, the NYT gave us the timeline for Sara Mauskopf, a small business owner who had an account at SVB. The timeline goes over her experiences from first hearing about the bank’s troubles through the announcement on Sunday afternoon that everyone would have immediate access to the full amount in their accounts.

Incredibly, the piece never once mentions the FDIC’s statement when it took over the bank, that it would issue an advance payment within days and a certificate for the rest of the money. It is possible that Ms. Mauskopf did not know about this statement and the promise that most of the funds in her account would be available almost immediately.

If that is true, that would be a great story for a serious news outlet to pursue. Was Ms. Mauskopf typical among SVB depositors in not knowing that most of her account would be available to her the week after the bank had been seized?

If so, why were depositors not better informed about this fact? It could be because news outlets like the New York Times were more interested in promoting panic than in providing information, but that would just be speculation.

The New York Times seems to think it is a newspaper’s job to promote bank panics wherever possible. It would be difficult to explain its reporting on the Silicon Valley Bank’s (SVB) collapse any other way.

Last week it ran a piece implying that Silicon Valley’s tech sector was going to be seriously crippled by the collapse of the bank. The crippling would occur both, because they would lose a large chunk of their assets, which were in uninsured accounts at SVB, and also because they would lose access to a bank which was a major source of credit.

The first point was not plausibly true even at the time the NYT posted the story. When it seized the bank a week ago Friday, the FDIC issued a notice that it would give depositors an advance payment against the uninsured funds in their account the next week. It also said that it would give them a certificate for the remaining funds, the value of which would depend on how much it was able to collect by selling the bank’s assets.

The advance payment would almost certainly have been an amount equal to at least 50 percent of the uninsured deposits and quite possibly over 70 percent. The certificate would cover some fraction of the remaining amount.

While the depositors would have to wait for the FDIC to complete its resolution process to know how much they would ultimately get from their certificates, they would almost certainly be able to sell them to investors the day they were issued. This would likely mean a loss to these depositors, but we are almost certainly talking about less than 15 percent, and quite likely something close 5.0 percent. (The bonds of the bank were still selling for 30 cents on the dollar after the FDIC seizure was announced. No bond holder will collect a penny on their bonds, unless the depositors are paid in full.)

In short, the idea that Silicon Valley businesses would see their accounts zeroed out was always nonsense. Losing 5-15 percent of holdings above $250k would surely be a blow, but it is hard to believe this would devastate an otherwise thriving business.

On the second point, while other banks may not give quite the same service to Silicon Valley business people as SVB, banks are generally happy to make loans to thriving businesses. Also, part of the loss is personal to these people, not about their businesses.

“SVB’s home loans were significantly better than those from traditional banks, four people who received them said. The loans were $2.5 million to $6 million, with interest rates under 2.6 percent. Other banks had turned them down or, when given quotes for interest rates, offered over 3 percent, the people said.”

Anyhow, in a follow up today, the NYT gave us the timeline for Sara Mauskopf, a small business owner who had an account at SVB. The timeline goes over her experiences from first hearing about the bank’s troubles through the announcement on Sunday afternoon that everyone would have immediate access to the full amount in their accounts.

Incredibly, the piece never once mentions the FDIC’s statement when it took over the bank, that it would issue an advance payment within days and a certificate for the rest of the money. It is possible that Ms. Mauskopf did not know about this statement and the promise that most of the funds in her account would be available almost immediately.

If that is true, that would be a great story for a serious news outlet to pursue. Was Ms. Mauskopf typical among SVB depositors in not knowing that most of her account would be available to her the week after the bank had been seized?

If so, why were depositors not better informed about this fact? It could be because news outlets like the New York Times were more interested in promoting panic than in providing information, but that would just be speculation.

Read More Leer más Join the discussion Participa en la discusión

David Wallace-Wells just wrote a column describing measures being passed in state legislatures controlled by Republicans, which will make it more difficult for governments to implement measures like temporary business closures or mask and vaccine mandates, all as tools to contain a deadly pandemic. While these laws may seem like an exercise in ungodly stupidity, the New York Times would not allow mention in its paper of restrictions that are likely to pose an even greater risk to public health in the next pandemic.

Of course, I am talking about intellectual property rules. Yes, I have been hitting this one hard in the last few days, but that is just because I find the arrogant ignorance on this issue so infuriating. And it matters.

We don’t know what the next deadly pandemic will look like, and with luck it will be many decades in the future. But we can envision what might have been different about the course of this pandemic if we went the open-source route, where all the science and technology was freely available for others to build on and to use to manufacture vaccines, tests, and treatments.

And, to be clear, this doesn’t mean that companies would not be compensated for their investments in developing the needed technology. The compensation would just take a different form, as a check from the government, rather than charging monopoly prices on vaccines or other products. Of course, companies could sue in court if they considered the compensation inadequate.

If we had gone down this route, all the information for making all vaccines, tests, and treatments would have been available for any manufacturer in the world. Governments interested in slowing the spread of the pandemic would also pay to produce and stockpile these products, especially vaccines, in advance of their approval by the FDA and other countries regulatory agencies.

This would be a very low risk proposition, since the vaccines were cheap to manufacture, less than $2 a shot in most cases. The potential loss from having to throw out 200 million vaccines that proved to be ineffective is trivial compared to the incredible benefits of having 200 million vaccines that could be quickly put into people’s arms once a vaccine was approved.

By pooling technology, we could ensure that people have a choice of vaccines. If people had refused to get vaccinated due to fears of mRNA vaccines (rational or otherwise), there were a number of vaccines based on well-established technologies that could have been made available as an alternative. (The FDA did approve non-mRNA vaccines manufactured by Johnson and Johnson and Novavax, but there were also non-mRNA vaccines widely used in other countries that in principle could have been available here.)

If a range of vaccines had been produced and stockpiled in vast quantities in 2020, when they were being tested for approval, we would have begun large-scale world-wide vaccination campaigns in late 2020 and the first months of 2021. This would have rapidly slowed the spread of the virus, almost certainly preventing the development of the omicron strain and quite possibly the delta strain.

That would have saved millions of lives and avoided trillions of dollars in economic damage. If we adopted the same approach to tests and treatments, this would both further reduce the spread and also the likelihood of death or serious illness among people who got infected.

But, any discussion of suspending intellectual property rules is strictly verboten in the New York Times. They only have space for trashing the Trumpers doing theatrics over banning pandemic mitigation measures. While these Trumpers do certainly deserve the criticism Wallace-Wells directs towards them, it would be great if we could have a discussion of the policies that do far more serious damage to public health, even if they mean big profits to the drug industry.

David Wallace-Wells just wrote a column describing measures being passed in state legislatures controlled by Republicans, which will make it more difficult for governments to implement measures like temporary business closures or mask and vaccine mandates, all as tools to contain a deadly pandemic. While these laws may seem like an exercise in ungodly stupidity, the New York Times would not allow mention in its paper of restrictions that are likely to pose an even greater risk to public health in the next pandemic.

Of course, I am talking about intellectual property rules. Yes, I have been hitting this one hard in the last few days, but that is just because I find the arrogant ignorance on this issue so infuriating. And it matters.

We don’t know what the next deadly pandemic will look like, and with luck it will be many decades in the future. But we can envision what might have been different about the course of this pandemic if we went the open-source route, where all the science and technology was freely available for others to build on and to use to manufacture vaccines, tests, and treatments.

And, to be clear, this doesn’t mean that companies would not be compensated for their investments in developing the needed technology. The compensation would just take a different form, as a check from the government, rather than charging monopoly prices on vaccines or other products. Of course, companies could sue in court if they considered the compensation inadequate.

If we had gone down this route, all the information for making all vaccines, tests, and treatments would have been available for any manufacturer in the world. Governments interested in slowing the spread of the pandemic would also pay to produce and stockpile these products, especially vaccines, in advance of their approval by the FDA and other countries regulatory agencies.

This would be a very low risk proposition, since the vaccines were cheap to manufacture, less than $2 a shot in most cases. The potential loss from having to throw out 200 million vaccines that proved to be ineffective is trivial compared to the incredible benefits of having 200 million vaccines that could be quickly put into people’s arms once a vaccine was approved.

By pooling technology, we could ensure that people have a choice of vaccines. If people had refused to get vaccinated due to fears of mRNA vaccines (rational or otherwise), there were a number of vaccines based on well-established technologies that could have been made available as an alternative. (The FDA did approve non-mRNA vaccines manufactured by Johnson and Johnson and Novavax, but there were also non-mRNA vaccines widely used in other countries that in principle could have been available here.)

If a range of vaccines had been produced and stockpiled in vast quantities in 2020, when they were being tested for approval, we would have begun large-scale world-wide vaccination campaigns in late 2020 and the first months of 2021. This would have rapidly slowed the spread of the virus, almost certainly preventing the development of the omicron strain and quite possibly the delta strain.

That would have saved millions of lives and avoided trillions of dollars in economic damage. If we adopted the same approach to tests and treatments, this would both further reduce the spread and also the likelihood of death or serious illness among people who got infected.

But, any discussion of suspending intellectual property rules is strictly verboten in the New York Times. They only have space for trashing the Trumpers doing theatrics over banning pandemic mitigation measures. While these Trumpers do certainly deserve the criticism Wallace-Wells directs towards them, it would be great if we could have a discussion of the policies that do far more serious damage to public health, even if they mean big profits to the drug industry.

Read More Leer más Join the discussion Participa en la discusión

• Economic Crisis and RecoveryCrisis económica y recuperación

Read More Leer más Join the discussion Participa en la discusión

It really is bizarre how elite policy types have such a hard time thinking clearly about intellectual property. Earlier this week, I was beating up on the NYT for having two columns on preparing for the next pandemic, neither of which mentioned even once the issue of intellectual property.

This issue of intellectual property in a pandemic should not seem like an obscure topic. In the fall of 2020, India and South Africa proposed a resolution at the WTO that all intellectual property claims on vaccines, tests, and treatments be suspended for the duration of the pandemic.

More than 100 countries eventually signed on to the resolution. The United States and other wealthy countries subsequently filibustered the resolution to the point of irrelevance.

However, the idea that questions of intellectual property might be important in the next pandemic should not seem far-fetched. If we had eliminated all IP barriers (this would include both suspending patent monopolies and other forms of exclusivity, as well as not enforcing non-disclosure agreements), we quite likely could have had enough people around the world vaccinated quickly enough to have prevented the development of the Omicron strain of the coronavirus. It is even possible that we could have slowed the spread enough to prevent the Delta strain.

Imagine the millions of lives that could have been saved and the trillions of dollars of economic losses that would have been averted if these mutations had not developed. You might think this would be sufficient to interest the great minds that write about pandemics for the New York Times.

Just to be clear — suspending IP doesn’t mean that companies forego their profits from these claims. The idea is that the suspension would allow for the free flow of knowledge and technology to address the pandemic. After the fact, the companies would receive compensation from the government, and of course they would have every right to sue in court if they felt the compensation was inadequate. The point is that all effort should be focused on stopping the pandemic, and the money issues can be dealt with later.

Okay, it was pretty amazing to see this extraordinary neglect in the NYT, but Planet Money on NPR arguably went one better. It actually had a very interesting piece on drug costs and innovation, but then walked away from the big question it raised.

The piece pointed out that the United States pays more than any other country in the world because we grant drug companies patent monopolies and then let them charge whatever they want for their drugs. It then discussed President Biden’s plan to negotiate drug prices in Medicare, which the Congressional Budget Office (CBO) projected would save $25 billion a year.

It also noted that CBO projected that the reduction in drug company profits would result in a reduction of one percent in the number of drugs being developed. Since we develop roughly 45 new drugs a year, this would mean one less drug every two years. If that lost drug was an important treatment for cancer, diabetes, or some other serious illness, that would be a big loss.

But then the NPR piece cites another CBO study that calculates that we could offset the reduction in drug company research spending by increasing spending on NIH research by $1 billion. The piece then comments:

“So the policies together would save the government billions of dollars overall with minimal harm to innovation,” and then moves on.

Okay folks, let’s slow down and look at what NPR just told us. They said that $1 billion in government spending on research would offset the impact of a $25 billion reduction in drug prices. That is a 25 to 1 return on investment. In cost-benefit analyses, this would be off-the-charts crazy. A ratio of 1.1 is considered good, and 1.5 to 1 is great. If you can get to 2 to 1, that’s really fantastic. This is 25 to 1.

Maybe we should be asking if we can push this further and have the government pick up the whole tab for the research that is currently supported by patent monopolies (a bit over $100 billion a year at present), and let all new drugs be sold as cheap generics as soon as they are approved by the FDA. This could easily save us over $400 billion a year in spending on prescription drugs.

And, not only would drugs be cheap, we would also have removed the enormous incentive to be dishonest about the safety and effectiveness of drugs which results from patent monopoly pricing. We would also radically reduce the amount of money spent researching copycat drugs, and could instead direct more money into exploring cures and treatments that may not involve patentable products.

I wouldn’t necessarily expect this piece to go all the way down this road, but it is more than a bit incredible that they tell us that increased spending on NIH research can have a 2500 percent return on investment, and then just walk away from the issue. Is it not possible for people to think clearly about alternatives to patent monopolies for supporting the development of new drugs?

There is a lot of money, as well as peoples’ lives and health, at issue. It should be possible for our leading news outlets to think about the problem seriously and not let prejudices about intellectual property get in the way.

It really is bizarre how elite policy types have such a hard time thinking clearly about intellectual property. Earlier this week, I was beating up on the NYT for having two columns on preparing for the next pandemic, neither of which mentioned even once the issue of intellectual property.

This issue of intellectual property in a pandemic should not seem like an obscure topic. In the fall of 2020, India and South Africa proposed a resolution at the WTO that all intellectual property claims on vaccines, tests, and treatments be suspended for the duration of the pandemic.

More than 100 countries eventually signed on to the resolution. The United States and other wealthy countries subsequently filibustered the resolution to the point of irrelevance.

However, the idea that questions of intellectual property might be important in the next pandemic should not seem far-fetched. If we had eliminated all IP barriers (this would include both suspending patent monopolies and other forms of exclusivity, as well as not enforcing non-disclosure agreements), we quite likely could have had enough people around the world vaccinated quickly enough to have prevented the development of the Omicron strain of the coronavirus. It is even possible that we could have slowed the spread enough to prevent the Delta strain.

Imagine the millions of lives that could have been saved and the trillions of dollars of economic losses that would have been averted if these mutations had not developed. You might think this would be sufficient to interest the great minds that write about pandemics for the New York Times.

Just to be clear — suspending IP doesn’t mean that companies forego their profits from these claims. The idea is that the suspension would allow for the free flow of knowledge and technology to address the pandemic. After the fact, the companies would receive compensation from the government, and of course they would have every right to sue in court if they felt the compensation was inadequate. The point is that all effort should be focused on stopping the pandemic, and the money issues can be dealt with later.

Okay, it was pretty amazing to see this extraordinary neglect in the NYT, but Planet Money on NPR arguably went one better. It actually had a very interesting piece on drug costs and innovation, but then walked away from the big question it raised.

The piece pointed out that the United States pays more than any other country in the world because we grant drug companies patent monopolies and then let them charge whatever they want for their drugs. It then discussed President Biden’s plan to negotiate drug prices in Medicare, which the Congressional Budget Office (CBO) projected would save $25 billion a year.

It also noted that CBO projected that the reduction in drug company profits would result in a reduction of one percent in the number of drugs being developed. Since we develop roughly 45 new drugs a year, this would mean one less drug every two years. If that lost drug was an important treatment for cancer, diabetes, or some other serious illness, that would be a big loss.

But then the NPR piece cites another CBO study that calculates that we could offset the reduction in drug company research spending by increasing spending on NIH research by $1 billion. The piece then comments:

“So the policies together would save the government billions of dollars overall with minimal harm to innovation,” and then moves on.

Okay folks, let’s slow down and look at what NPR just told us. They said that $1 billion in government spending on research would offset the impact of a $25 billion reduction in drug prices. That is a 25 to 1 return on investment. In cost-benefit analyses, this would be off-the-charts crazy. A ratio of 1.1 is considered good, and 1.5 to 1 is great. If you can get to 2 to 1, that’s really fantastic. This is 25 to 1.

Maybe we should be asking if we can push this further and have the government pick up the whole tab for the research that is currently supported by patent monopolies (a bit over $100 billion a year at present), and let all new drugs be sold as cheap generics as soon as they are approved by the FDA. This could easily save us over $400 billion a year in spending on prescription drugs.

And, not only would drugs be cheap, we would also have removed the enormous incentive to be dishonest about the safety and effectiveness of drugs which results from patent monopoly pricing. We would also radically reduce the amount of money spent researching copycat drugs, and could instead direct more money into exploring cures and treatments that may not involve patentable products.

I wouldn’t necessarily expect this piece to go all the way down this road, but it is more than a bit incredible that they tell us that increased spending on NIH research can have a 2500 percent return on investment, and then just walk away from the issue. Is it not possible for people to think clearly about alternatives to patent monopolies for supporting the development of new drugs?

There is a lot of money, as well as peoples’ lives and health, at issue. It should be possible for our leading news outlets to think about the problem seriously and not let prejudices about intellectual property get in the way.

Read More Leer más Join the discussion Participa en la discusión

There are two key points that people should recognize about the decision to guarantee all the deposits at Silicon Valley Bank (SVB):

The first point is straightforward. We gave a government guarantee of great value to people who had not paid for it.

We will get a lot of silly game playing on this issue, just like we did back in 2008-09. The game players will tell us that this guarantee didn’t cost the government a penny, which will very likely end up being true. But that doesn’t mean we didn’t give the bank’s large depositors something of great value.

If the government offers to guarantee a loan, it makes it far more likely that the beneficiary will be able to get the loan and that they will pay a lower interest rate for this loan. In this case, the people who held large uninsured deposits at SVB apparently decided that it was better, for whatever reason, to expose themselves to the risk by keeping these deposits at SVB, rather than adjusting their finances in a way that would have kept their money better protected.

This would have meant either parking their deposits at a larger bank that was subject to more careful scrutiny by regulators, or adjusting their assets so that they were not so exposed to a single bank. They also could have taken ten minutes to examine SVB’s financial situation, which was mostly a matter of public record.

For whatever reason, the bank’s large depositors chose to expose themselves to serious risk. When their bet turned out badly, they in effect wanted the government to provide the insurance that they did not pay for.

This brings us to the second point; this is Donald Trump’s bailout. The reason this is a bailout is that the government is providing a benefit that the depositors did not pay for. It also is, in effect, a subsidy to other mid-sized banks, since it tells their depositors that they can count on the government covering their deposits, even though they are not insured and the bank is not subject to the same scrutiny as the largest banks.

This is where the fault lies with Donald Trump. It was his decision to stop scrutinizing banks with assets between $50 billion and $250 billion that led to the problems at SVB.

Prior to the passage of this bill, a bank the size of SVB would have been subject to stricter rules and regular stress tests. A stress test means projecting how a bank would fare in various bad situations, like the rise in interest rates that apparently sank SVB. The 2018 changes exempted banks with assets under $100 billion from undergoing stress tests (SVB had been in this category until 2021), and said that banks with assets between $100 billion and $250 billion had to undergo “periodic” stress tests.

If regulators had subjected to SVB to a stress test, they would have almost surely recognized its problems. They then would have required it to raise more capital and/or shed deposits.

But Trump pulled the regulators off the job. This is wrongly described as “deregulation.” It isn’t.

Deregulation would mean both eliminating the scrutiny of SVB and ending insurance for the bank. (In principle that would mean ending all deposit insurance, not the just the insurance for large accounts that is at issue here.)

What happened in 2018 was effectively allowing SVB to still benefit from insurance without having to pay for it. It is comparable to telling drivers that they don’t have to buy auto insurance, but will still be covered if they are in an accident. Or, perhaps a better example would be telling a restaurant that it is covered by fire insurance, but it doesn’t have to adhere to safety standards.

It is dishonest to describe this as “deregulation.” It is the government giving a subsidy to the banks in question. It is understandable that the banks prefer to describe their subsidy as deregulation, but it is not accurate.

Anyhow, this bailout is the Donald Trump bailout. He touted the 2018 bill when he signed it. We are now seeing the fruits of his action.

Note: An earlier version said that the 2018 changes would have exempted SVB from stress tests altogether.

There are two key points that people should recognize about the decision to guarantee all the deposits at Silicon Valley Bank (SVB):

The first point is straightforward. We gave a government guarantee of great value to people who had not paid for it.

We will get a lot of silly game playing on this issue, just like we did back in 2008-09. The game players will tell us that this guarantee didn’t cost the government a penny, which will very likely end up being true. But that doesn’t mean we didn’t give the bank’s large depositors something of great value.

If the government offers to guarantee a loan, it makes it far more likely that the beneficiary will be able to get the loan and that they will pay a lower interest rate for this loan. In this case, the people who held large uninsured deposits at SVB apparently decided that it was better, for whatever reason, to expose themselves to the risk by keeping these deposits at SVB, rather than adjusting their finances in a way that would have kept their money better protected.

This would have meant either parking their deposits at a larger bank that was subject to more careful scrutiny by regulators, or adjusting their assets so that they were not so exposed to a single bank. They also could have taken ten minutes to examine SVB’s financial situation, which was mostly a matter of public record.

For whatever reason, the bank’s large depositors chose to expose themselves to serious risk. When their bet turned out badly, they in effect wanted the government to provide the insurance that they did not pay for.

This brings us to the second point; this is Donald Trump’s bailout. The reason this is a bailout is that the government is providing a benefit that the depositors did not pay for. It also is, in effect, a subsidy to other mid-sized banks, since it tells their depositors that they can count on the government covering their deposits, even though they are not insured and the bank is not subject to the same scrutiny as the largest banks.

This is where the fault lies with Donald Trump. It was his decision to stop scrutinizing banks with assets between $50 billion and $250 billion that led to the problems at SVB.

Prior to the passage of this bill, a bank the size of SVB would have been subject to stricter rules and regular stress tests. A stress test means projecting how a bank would fare in various bad situations, like the rise in interest rates that apparently sank SVB. The 2018 changes exempted banks with assets under $100 billion from undergoing stress tests (SVB had been in this category until 2021), and said that banks with assets between $100 billion and $250 billion had to undergo “periodic” stress tests.

If regulators had subjected to SVB to a stress test, they would have almost surely recognized its problems. They then would have required it to raise more capital and/or shed deposits.

But Trump pulled the regulators off the job. This is wrongly described as “deregulation.” It isn’t.

Deregulation would mean both eliminating the scrutiny of SVB and ending insurance for the bank. (In principle that would mean ending all deposit insurance, not the just the insurance for large accounts that is at issue here.)

What happened in 2018 was effectively allowing SVB to still benefit from insurance without having to pay for it. It is comparable to telling drivers that they don’t have to buy auto insurance, but will still be covered if they are in an accident. Or, perhaps a better example would be telling a restaurant that it is covered by fire insurance, but it doesn’t have to adhere to safety standards.

It is dishonest to describe this as “deregulation.” It is the government giving a subsidy to the banks in question. It is understandable that the banks prefer to describe their subsidy as deregulation, but it is not accurate.

Anyhow, this bailout is the Donald Trump bailout. He touted the 2018 bill when he signed it. We are now seeing the fruits of his action.

Note: An earlier version said that the 2018 changes would have exempted SVB from stress tests altogether.

Read More Leer más Join the discussion Participa en la discusión

Word from the grapevine is that the risk of contagion may cause the Fed or the FDIC to engineer some sort of bailout of uninsured deposits, where they get paid back in full, instead of being forced to accept a partial loss on deposits over $250k. That would be unfortunate, since the people who run these companies that have large deposits are supposed to be brilliant whizzes, who should be able to understand things like FDIC deposit insurance limits.

Their incessant whining, that losing 10-20 percent of their deposits, would shut down Silicon Valley and the country’s tech sector, made for good laughs. However, the risk of a nationwide series of bank runs is a high price to pay to teach these people about the limits on deposit insurance.

We know that the view of most of our policy elites (the politicians who make policy, their staff, and the people who write about it in major news outlets) is that the purpose of government is to make the rich richer. But, there are alternative ways to structure the financial system for people who care about fairness and efficiency.

The most obvious solution would be to have the Federal Reserve Board give every person and corporation in the country a digital bank account. The idea is that this would be a largely costless way for people to carry on their normal transactions. They could have their paychecks deposited there every two weeks or month. They could have their mortgage or rent, electric bill, credit card bill, and other bills paid directly from their accounts.

This sort of system could be operated at minimal cost, with the overwhelming majority of transactions handled electronically, requiring no human intervention. There could be modest charge for overdrafts, that would be structured to cover the cost of actually dealing with the problem, not gouging people to make big profits.

Former Fed economist (now at Dartmouth), Andy Levin, has been etching the outlines of this sort of system for a number of years. The idea would be to effectively separate out the banking system we use for carrying on transactions from the system we use for saving and financing investment.

We would have the Fed run system to carry out the vast majority of normal financial transactions, replacing the banks that we use now. However, we would continue to have investment banks, like Goldman Sachs and Morgan Stanley, that would borrow on financial markets and lend money to businesses, as well as underwriting stock and bond issues. While investment banks still require regulation to prevent abuses, we don’t have to worry about their failure shutting down the financial system.

Not only would the shift to Fed banking radically reduce the risk the financial sector poses to the economy, it would also make it hugely more efficient. We waste tens of billions of dollars every year maintaining the structure of a financial system that technology has made obsolete.

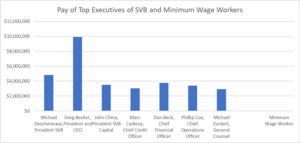

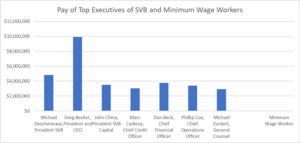

It is easy to see why this waste persists. The financial system as currently structured offers enormous rewards for people who get to the top. The Silicon Valley Bank (SVB) makes this case very clearly. The graph below shows the pay of the top seven executives at SVB alongside the pay of a minimum wage worker putting in 40 hours a week for 50 weeks. (It’s really there.)

Source: SVB and author’s calculations.

Greg Becker, the President and Chief Executive Officer, gets top pay among this group, pulling down 9,922,000 in SVB’s 2021 fiscal year (the most recent year for which I could find the data). That would be roughly 684 times what a minimum wage worker would earn for a full year’s work. (Top execs at the largest banks can earn three or four times this amount.) If we think that a worker has a 45-year working lifetime, then Mr. Becker pulls down more in a year than what a minimum wage worker would get in 15 working lifetimes. Yes, but we know the argument, how many minimum wage workers could threaten major financial upheaval, even in 15 working lifetimes?

We can go down the list, but the point should be clear. We maintain an enormously wasteful financial system because a relatively small number of people get very rich from it. And, these people use their money to lobby members of Congress to make sure no one talks about modernizing the system in a way that would take away the big bucks. (For those wondering about public sector comparisons, Fed Chair Jerome Powell gets $226,000 a year, just over 2.2 percent of Mr. Becker’s paycheck.)

And, our rich bankers have plenty of allies in the media and academic circles. Some of this is due to the fact that they can finance the voices of people who will tout their wisdom, but part of it is likely ideological bias. Plenty of neoliberal types, who will go on the warpath over a policy that helps workers or low-income people that they claim to be wasteful, can manage to completely ignore the massive waste in our financial system that is a major contributor to inequality.

Anyhow, we are not about to overturn the massive power of the rich in the financial system and the enormous network of elite opinion makers that supports them, but perhaps we can at least make the failure of SVB a teaching moment.

The rich are ripping us off big time. They are not lucky winners in a market competition due to their intelligence and hard work. They are people who have managed to rig the game to put big bucks in their pocket. That is the reality. We just have to find ways to change it. A key place to start is to stop pretending that their great wealth has anything to do with a free market.

Word from the grapevine is that the risk of contagion may cause the Fed or the FDIC to engineer some sort of bailout of uninsured deposits, where they get paid back in full, instead of being forced to accept a partial loss on deposits over $250k. That would be unfortunate, since the people who run these companies that have large deposits are supposed to be brilliant whizzes, who should be able to understand things like FDIC deposit insurance limits.

Their incessant whining, that losing 10-20 percent of their deposits, would shut down Silicon Valley and the country’s tech sector, made for good laughs. However, the risk of a nationwide series of bank runs is a high price to pay to teach these people about the limits on deposit insurance.

We know that the view of most of our policy elites (the politicians who make policy, their staff, and the people who write about it in major news outlets) is that the purpose of government is to make the rich richer. But, there are alternative ways to structure the financial system for people who care about fairness and efficiency.

The most obvious solution would be to have the Federal Reserve Board give every person and corporation in the country a digital bank account. The idea is that this would be a largely costless way for people to carry on their normal transactions. They could have their paychecks deposited there every two weeks or month. They could have their mortgage or rent, electric bill, credit card bill, and other bills paid directly from their accounts.

This sort of system could be operated at minimal cost, with the overwhelming majority of transactions handled electronically, requiring no human intervention. There could be modest charge for overdrafts, that would be structured to cover the cost of actually dealing with the problem, not gouging people to make big profits.

Former Fed economist (now at Dartmouth), Andy Levin, has been etching the outlines of this sort of system for a number of years. The idea would be to effectively separate out the banking system we use for carrying on transactions from the system we use for saving and financing investment.

We would have the Fed run system to carry out the vast majority of normal financial transactions, replacing the banks that we use now. However, we would continue to have investment banks, like Goldman Sachs and Morgan Stanley, that would borrow on financial markets and lend money to businesses, as well as underwriting stock and bond issues. While investment banks still require regulation to prevent abuses, we don’t have to worry about their failure shutting down the financial system.

Not only would the shift to Fed banking radically reduce the risk the financial sector poses to the economy, it would also make it hugely more efficient. We waste tens of billions of dollars every year maintaining the structure of a financial system that technology has made obsolete.

It is easy to see why this waste persists. The financial system as currently structured offers enormous rewards for people who get to the top. The Silicon Valley Bank (SVB) makes this case very clearly. The graph below shows the pay of the top seven executives at SVB alongside the pay of a minimum wage worker putting in 40 hours a week for 50 weeks. (It’s really there.)

Source: SVB and author’s calculations.

Greg Becker, the President and Chief Executive Officer, gets top pay among this group, pulling down 9,922,000 in SVB’s 2021 fiscal year (the most recent year for which I could find the data). That would be roughly 684 times what a minimum wage worker would earn for a full year’s work. (Top execs at the largest banks can earn three or four times this amount.) If we think that a worker has a 45-year working lifetime, then Mr. Becker pulls down more in a year than what a minimum wage worker would get in 15 working lifetimes. Yes, but we know the argument, how many minimum wage workers could threaten major financial upheaval, even in 15 working lifetimes?

We can go down the list, but the point should be clear. We maintain an enormously wasteful financial system because a relatively small number of people get very rich from it. And, these people use their money to lobby members of Congress to make sure no one talks about modernizing the system in a way that would take away the big bucks. (For those wondering about public sector comparisons, Fed Chair Jerome Powell gets $226,000 a year, just over 2.2 percent of Mr. Becker’s paycheck.)

And, our rich bankers have plenty of allies in the media and academic circles. Some of this is due to the fact that they can finance the voices of people who will tout their wisdom, but part of it is likely ideological bias. Plenty of neoliberal types, who will go on the warpath over a policy that helps workers or low-income people that they claim to be wasteful, can manage to completely ignore the massive waste in our financial system that is a major contributor to inequality.

Anyhow, we are not about to overturn the massive power of the rich in the financial system and the enormous network of elite opinion makers that supports them, but perhaps we can at least make the failure of SVB a teaching moment.

The rich are ripping us off big time. They are not lucky winners in a market competition due to their intelligence and hard work. They are people who have managed to rig the game to put big bucks in their pocket. That is the reality. We just have to find ways to change it. A key place to start is to stop pretending that their great wealth has anything to do with a free market.

Read More Leer más Join the discussion Participa en la discusión

The New York Times had two pieces on Sunday talking about what we should do the next time we face a pandemic. Incredibly, neither said one word about waiving patents and other forms of intellectual property.