September 06, 2012

The Democrats’ discussion of the loss of the Clinton budget surpluses is a tale of paradise lost. Unfortunately, it was an illusory paradise that serious people should not concern themselves with. That is why it is disappointing to see Ezra Klein give us more tales of the evaporating budget surplus.

The huge surpluses of the last Clinton years were the result of a boom that was driven by a stock bubble. The boom was great. Millions of people got jobs who would not have otherwise. We also saw real wage gains up and down the income distribution for the first time since the early 70s.

The greatest minds in the economics profession had assured us that the unemployment rate could not get below 6.0 percent without touching off accelerating inflation. However the boom pushed the unemployment rate down to 4.0 percent as a year-round average in 2000. Guess what? There was no story of accelerating inflation. (Fortunately for economists, continued employment, and even standing in the profession, does not depend on performance.)

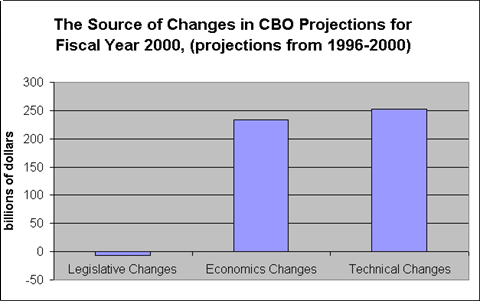

But the key point is that the surplus came from a boom that was not sustainable. Here’s the key chart that shows you how we went from the deficit of 2.7 percent of GDP that the Congressional Budget Office had projected in 1996 for 2000 to the surplus of 2.4 percent of GDP that we actually saw in 2000.

Source: Congressional Budget Office and author’s calculations.

This was not a story of tax increases and budget cuts, those had already been on the books by 1996. This was pure and simple a story of the bubble-based boom pushing the economy much further than CBO had expected. (Greenspan deserves a huge amount of credit for allowing the unemployment rate to fall. His Clinton appointed colleagues, Lawrence Meyer and Janet Yellen, wanted to raise interest rates in 1996 to keep unemployment from falling much below 6.0 percent.)

Anyhow, when the bubble burst, the surplus was destined to vanish. The Bush tax cuts and even the wars helped to stimulate the economy and maintain employment. There were much better ways to boost the economy, but it is absurd to imagine that the economy somehow would have been better off without this spending.

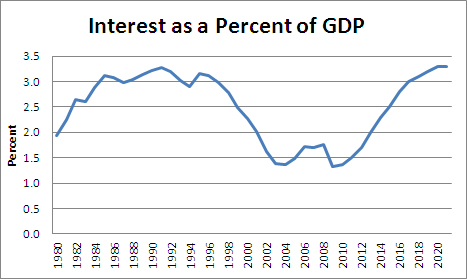

To repeat a post from last week, the real tragedy of both conventions is that policy is so obsessed with the deficit. No one apart from a few policy wonks in DC even has a clue as to the size of the deficit. (Quick, give it to me to the nearest hundred billion.) Contrary to the scare stories, the burden of the debt (a.k.a. interest payments) are near a post-war low as a share of GDP, not a record high.

Source: Congressional Budget Office.

Topics one, two, and three should be jobs, jobs, and jobs. The deficit is a distraction. And the tale of the vanishing Clinton era budget surpluses, well that’s something for retired budget wonks to reminisce over in their golden years.

Addendum:

Many good questions are raised below. I’ll just address a few points. First, I have zero interest in getting into debates on the budget deficit. I don’t care whether the government runs a budget surplus, so the particular accounting is of no interest to me apart from the fact that it needs to be consistent through time. I suppose we can have some good make work jobs having people design new budget methodologies, but I don’t intend to get involved myself.

In terms of the causes of the deficits/debt, a lot depends on the baseline. My baseline was 1996 since I wanted to show that Clinton did not give us a balanced budget/surplus, the stock market bubble did. The spending/tax cuts that followed the recession were needed to boost the economy. Unless you like to see people out of work, you should be happy for the deficit. Of course the tax cuts and money spent on the war could have been much better directed, but if the choice was no tax cuts and no additional military spending versus what we got, there can be little doubt that the latter created more jobs.

Comments