July 10, 2012

Folks in Washington like to think that their silly dramas have much more impact on the world than they in fact do. The battle over extending the debt ceiling last year is a case in point, with its sequel, the 2013 Fiscal Cliff, providing another example.

Ezra Klein traced a slowdown in the economy last year to the uncertainty resulting from the battle over the debt ceiling. He tells readers:

“Early in the year, the recovery seemed to be proceeding smoothly. In February, the economy added 220,000 jobs. In March, it added 246,000 jobs. And in April, 251,000 jobs. But as summer approached, and as markets shuddered over the Republican threat to breach the debt ceiling, the economy sputtered. Between May and August, the nation never added more than 100,000 jobs a month. And then, in September, the month after the debt ceiling was resolved, the economy sped back up and added more than 200,000 jobs.”

He then goes on to give data on consumer confidence showing a fall in the months where consumers were supposed to be concerned about the debt ceiling. While this might sound as though it supports the case that concerns about the debt ceiling cratered the economy, the data on what people actually did (not what they said) indicates otherwise.

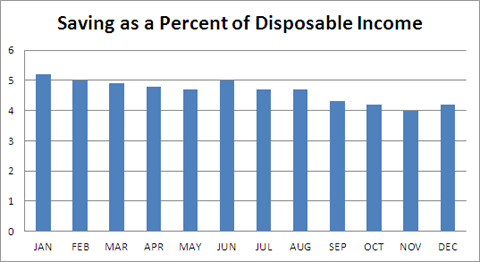

The chart below shows saving as a percent of disposable income. See the surge in the saving rate as the debt ceiling battle reached its crescendo in June and July? Me neither.

Source: Bureau of Economic Analysis.

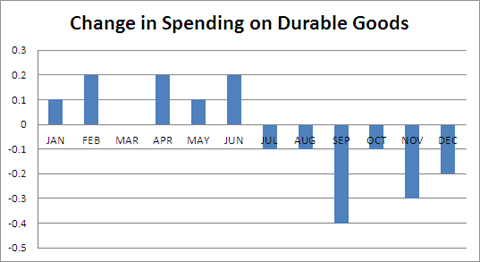

Suppose we look at the trend in spending on durable goods. These are big ticket items like cars and refrigerators, certainly not the sort of expenditure that worried consumers are likely to make if they could avoid it. Here we do see a falloff in July as people saw catastrophe about to hit, but durable good spending continues to fall after people got the all clear in early August. This one doesn’t seem to quite fit the worried consumer story either. (The data here are nominal, which is appropriate in this context since it reflects what people are willing to spend. It is unlikely that consumers are very aware of monthly price changes, especially in durable goods, since these will often be dominated by quality adjustments. The latter are calculated by the Bureau of Labor Statistics and may not be entirely apparent to consumers at the time.)

Source: Bureau of Economic Analysis.

So if consumer spending didn’t fall through the floor what explains the dropoff in job creation? Typically there is some lag between GDP growth and job creation. GDP grew 2.5 percent in the third quarter and 2.3 percent in the fourth quarter. That fell to 0.4 percent in the first quarter, followed by 1.3 percent growth in the second quarter.

And why did GDP growth slow? Try the end of the stimulus. Government spending shrank at an annual rate of 2.8 in the fourth quarter of 2010, followed by drops of 5.9 percent in the first quarter and 0.9 percent in the second quarter. After being a boost to growth in the second half of 2009 and the first half of 2010, the government sector became a major drag on growth in the first half of 2011.

As I have argued elsewhere, consumer confidence measures largely reflect what people in the media are saying about the economy. They often have little to do with what consumers are doing.

Comments