January 16, 2007

January 16, 2007, Testimony of Eileen Appelbaum before the Committee on Health, Education, Labor, and Pensions

The Great American Disconnect

The U.S. economy has experienced tremendous growth in the last 30 years. American workers today produce 70 percent more goods and services than they did at the end of the 1970s. There has been a dramatic increase in women’s paid employment – especially in the employment of mothers of young children – as women have responded to both increased opportunities and increased financial pressures on families with greater attachment to the paid workforce. More women are working and working more hours than ever before. Workers have generated a huge increase in the size of the economic pie. As a country, America is much richer than it was a generation ago.

There is a problem with this picture, however. The overwhelming majority of American families haven’t shared fairly in this bounty. Workers’ pay and benefits have lagged far behind the increase in productivity. Families have struggled to make up the difference as wives’ hours of work increased – by about 500 hours since 1979 for middle income married couples with children.1 Family work hours have increased without benefit of affordable quality child care, paid sick days and family leave, or greater control over work schedules. The time squeeze on working families has grown sharper, especially now that baby boomers face the need to help aging parents as well as care for children. Despite working harder, America’s families face greater stress and economic insecurity. The challenges are especially severe for single parent families, which today account for a quarter of all families with children.

As America has grown richer, inequality has increased. In 1979, the average income of the richest 5 percent of families was 11 times that of families in the bottom 20 percent. Today, the richest 5 percent of families enjoys an average income nearly 22 times that of families in the lowest quintile. Together, the top 5 percent of families receives more income than all of the families in the bottom 40 percent combined – 21 percent of total family income compared with 14 percent. 2, 3

Americans know that this is unjust. They want their government and this Congress to do what’s right to make sure that their hard work is rewarded fairly, and that they and their families face a more secure economic future.

Left Out as the Good Times Roll

The growth of U.S. productivity (the output of goods and services per hour of work) over the last ten years has been remarkable. After being mired in the doldrums for decades, increasing at an annual rate of less than 1.5 percent a year from 1973 to 1995, productivity growth has rebounded. Between 1995 and 2005, productivity grew at 2 to 3 percent a year, comparable once again to its growth rate during the “golden age” of American prosperity that spanned the years from 1948 to 1973. 4, 5 In that earlier notable 25 year span, both productivity and real median family income doubled. Then, as productivity growth slowed, the connection between productivity and family income that created the great American middle class fell apart. Productivity continued to rise between 1973 and 1995, though at a slower pace, while real wages of many middle class workers stagnated or even fell. Families increased family hours of work just to stay even. Real median family income rose just 10.5 percent over the two decades.6

But then in 1995, as companies learned to use computer-based technologies effectively and the economy finally began to reap the fruits of the IT revolution, productivity growth recovered, rising once again at a 2 to 3 percent annual rate.7 In the boom years between 1995 and 2000, the cumulative increase in productivity was 13.2 percent. For the first time in more than two decades, real median family income increased apace, rising by 11.3 percent over that half decade and narrowing inequality ever so slightly as unemployment fell to 4 percent and labor markets tightened.8

Optimism that the U.S. was returning to shared prosperity began to take hold, but these hopes were soon dashed. Productivity continued to rise strongly, growing at 3 percent a year between 2000 and 2005, but real median family income, which fell in the recession of 2001, failed to keep up. By 2005, real median family income still had not recovered to its pre-recession level.9, 10 Despite strong GDP growth, low unemployment, and rising productivity, real wages have been flat for the typical worker since 2001, and wage growth is once again falling sharply behind productivity growth. Working families supported consumption growth in the first half of the 2000s by spending faster than income rose as the bubble in the housing market expanded and housing prices surged. Personal saving fell from 2.9 percent of disposable income in the first half of 1999 to -0.9 percent in the first half of 2006.11 In contrast, corporate profits have been strong as the economy has expanded in the five years since the recession ended, rising rapidly since 2001 and squeezing total labor compensation.12 And the gap between the very richest families and the rest of American families is widening once again.

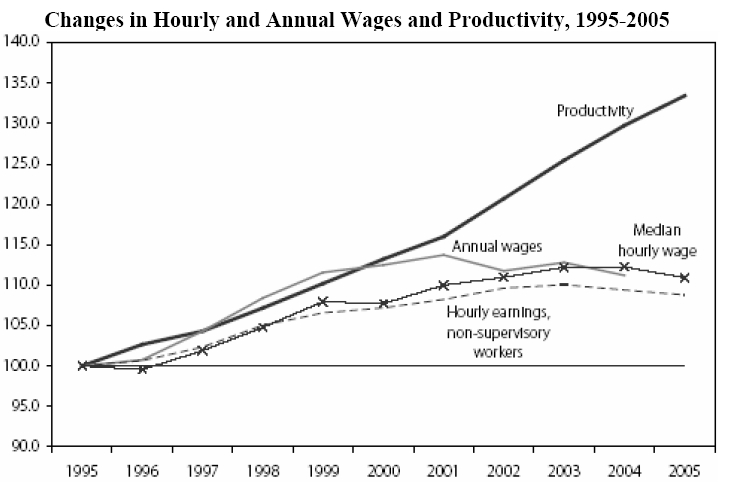

Since 2001, a yawning gap has once again opened up between productivity and real wages or compensation (see figure below). The gap between hourly productivity and hourly compensation is at an all-time high since these figures began to be tracked in 1947. At the same time, labor’s share of GDP is at an all-time low.13

The main reasons for this disconnect between wages and productivity, despite strong productivity growth, are not difficult to identify or to understand. The decline in the real value of the minimum wage, which has not increased in nearly10 years, has undermined the floor supporting workers’ wages while de-unionization left middle income Americans with no bulwark against greed in the new “winner-take-all” economy. Labor markets, once described as the arena in which employers and employees negotiated the distribution of a growing economic pie, is today viewed as a tournament, with few winners and many losers. This winner-take-all economy is symbolized for Americans by the unseemly increase in CEO pay – now 262 times the earnings of the average worker.14 The countervailing forces that can defend the interests of the many against the labor market power of the few are weak. The consensus politics of the Keynesian model has broken down as the interests of today’s large multinationals no longer coincide with the national interest in rising incomes, a growing middle class, and a competitive domestic economy.

Changes in Hourly and Annual Wages and Productivity, 1995-2005

Source: Economic Policy Institute

Unions are hard pressed to defend the wages and working conditions of American workers. Less than 13 percent of workers (8 percent of private sector workers) belong to unions today, down from 20 percent in 1983, the first year for which we have comparable union data.15 The difficulties workers face in organizing unions, and the barriers unions face in achieving a first contract even after winning a union election, have left many workers without effective representation or voice in the workplace. Since the 1980s it has become increasingly common for employers to fire workers who are involved in organizing drives. The penalties for engaging in this type of illegal behavior are sufficiently small that employers who want to keep a union out can chalk them up as a cost of doing business. The practice of hiring replacement workers to take the place of workers on strike, rare before President Reagan replaced the striking air traffic controllers in 1981, has also become increasingly common. As a result, it has become extremely difficult for unions to organize new workplaces or to protect the wages, benefits and working conditions of their members.

This does not bode well for many workers who are working hard and striving to achieve the American dream of economic independence, a secure future, and a good life for their children. Many of the occupations projected to experience large increases in the number of employees over the next ten years – retail sales persons, food prep and serving workers, cashiers, janitors and cleaners, waiters and waitresses, nursing aides and orderlies, office clerks, teacher assistants, home health aides, personal and home care aides, and landscape workers16 – are not footloose and cannot be outsourced. Yet despite high demand for workers in these occupations, many of these jobs pay low or very low wages. The reason for this lies, in large part, in the lack of a countervailing force to companies’ blind, and often counterproductive, pursuit of profit. Low membership density makes it difficult for unions to provide effective resistance as employers shift the burdens and the risks of an uncertain marketplace onto their most vulnerable employees while claiming any payoffs in the marketplace for themselves.

The disdain for manufacturing over the last decade and the accelerated erosion of America’s manufacturing capacity in the past five years have also had deleterious effects on union membership and employee earnings – as well as on America’s national competitiveness. U.S. multinationals dominate the global economy, but our nation’s ability to compete in world markets has been seriously eroded. Demand for manufactured goods remains strong in the U.S., but the share of demand met by domestic manufacturing has fallen sharply, from about 90 percent a decade ago to about 75 percent today.17 Our negative trade balance in goods and services has grown so large that even the IMF is concerned that it now threatens the stability of the world economy.

No one should have any illusions that manufacturing employment can increase dramatically – strong productivity growth in this sector is a large part of the argument for maintaining manufacturing capacity in the U.S. Nevertheless, the steady loss of American competitiveness in manufacturing over the last decade and our ballooning trade deficit in manufactured goods since 2000 have resulted in the loss of many more manufacturing jobs than would be dictated by productivity growth. A third of the drop in manufacturing employment is due to the increase in the share of domestic demand for manufactured goods filled by imports.18

Thus for nonsupervisory workers (production workers and non-managers in services), strong GDP and productivity growth in the U.S. following the recession and the tragic events of 2001 have not translated into higher earnings or greater family economic security. Instead, inequality has increased, and the benefits of growth have gone overwhelmingly to the richest families. Productivity grew by 2.3 percent during 2005, but the real median earnings of both men and women who worked full-time, year-round declined, by 1.8 percent for men and 1.3 percent for women.19 The increase in real median income of all family households was just 0.2 percent ($99 increase in real annual income) and of married-couple households was also 0.2 percent ($121 increase in real annual income).20 The economic prosperity enjoyed by American corporations and wealthy families during the first half of the current decade passed most Americans by.

For the middle class, it is only in the past few months that the good times finally seemed to begin to roll. Hourly real wages of nonsupervisory workers began, at last, to increase in 2006, rising 4.2 percent in nominal terms or more than 2 percent in real terms. Family income figures are not yet available for 2006, but it is likely that real median family income may finally, five years after the end of the recession, recover to its pre-recession level.

Yet this increase in middle class wages and family income is likely to be short lived. The 2.3 percent productivity growth in 2005 represents a sharp fall off from the 3.1 percent growth experienced in 2004 – almost entirely the result of the sharp slowdown in productivity growth that began in the fourth quarter of 2005 and continued through 2006. Final productivity growth figures for 2006 are not yet available, but they are likely to be quite weak – about 1.5 percent.21 This creates a more difficult situation in which to sustain real wage and income growth for the middle class workers and families.

Clouds Gathering on the Horizon

Decelerating growth in GDP and an even sharper slowdown in the rate of productivity growth has raised the specter of a slowdown in the economy in 2007. Indeed, the U.S. economy faces two major economic challenges that threaten the economic security of American workers. The recent slowdown in the housing market and the turnaround in the rapid run-up of home equity values have already taken a percent or more off GDP growth in 2006, and will be even more of a drag in 2007. The correction to our ballooning trade deficit, when it comes, will result in rising prices at Wal-Mart and elsewhere and declining real wages for American workers. It may even lead to rising unemployment and a return to high readings on the misery index, which measures the impact of inflation and unemployment on the lives of ordinary people.

The current economic expansion has been fueled to a large extent by the housing bubble. Housing prices, which historically have tracked the overall rate of inflation, rose by more than 50 percent above the rate of inflation between 1997 and 2006. The housing bubble contributed directly to economic growth through its direct effect on home construction and the housing sector.22, 23 The run-up in housing prices also increased housing wealth, and contributed to indirectly to a growing GDP through the impact of housing wealth on consumption. The Congressional Budget Office estimates that the rise in home prices above the rate of inflation added $6.5 trillion to consumer wealth between mid-1997 and mid-2006, adding between $130 billion and $460 billion a year to consumer spending over that period.24 The notion that home owners have used the equity in their homes as their personal ATM machines is borne out by the data on borrowing by homeowners against the equity in their homes. Withdrawal of mortgage equity rose from 3 to 4 percent of disposable personal income before 1997 to a peak of 11 percent at the start of 2005.25 Homeowners were borrowing more than $600 billion annually against their home equity by 2005.26

Two groups of workers will feel the shock of lower home prices more severely than most. Workers approaching retirement with inadequate savings, who planned to use the equity in their homes to finance their retirements, now face financial insecurity. Homeowners will also be hit by the resetting of more than $2 trillion in adjustable rate mortgages (ARMs) in 2006 and 2007.27 Some will be able to refinance their homes at favorable rates. But those who borrowed in the subprime mortgage market and purchased homes at inflated prices now stand to lose everything if they are unable to make the higher mortgage payments and unable to sell their homes at prices that cover their outstanding mortgage.

The decline in housing values has already begun to be felt. Consumption growth slowed in the second and third quarters of 2006 reducing the overall growth rate of GDP. This negative effect on GDP is likely to become more important for the economy in 2007, slowing economic growth and perhaps even leading to recession.

The second challenge to continued American prosperity comes from the rapid and accelerating growth in the trade deficit in the past five years, which is becoming unsustainable and threatens to lead to a disorderly decline in the exchange value of the dollar.28 The U.S. is consuming substantially more than it produces, borrowing abroad to finance this spending, and amassing a very large level of debt in the process. A disorderly return to balance has the potential to inflict significant damage on the U.S. economy and on America’s working families. Grave dangers for American workers are lurking in a trade deficit that, at well over $700 billion, is now nearly three times the size of the federal budget deficit and growing. With the trade deficit now above 6% of GDP, the risks of a drastic and unruly decline in the exchange value of the dollar have increased.

Reducing the trade deficit to a more manageable 2 to 3% of GDP won’t be easy.

The hard landing scenario is one in which there is a sudden plunge in the dollar29 against foreign currencies. In the absence of any steps to increase manufacturing output and exports, the drop in the dollar would have to be quite steep – at least 20% and perhaps as much as 40% — to improve the trade balance to the point of sustainability. A rapid drop of that magnitude will create serious inflation and reduce workers’ living standards. Interest rates and prices will rise and workers’ real wages will fall, lowering consumption and investment, and reducing imports.30 The likely result of ignoring the ballooning trade deficit is a decade of lost jobs, bankrupted businesses, and reduced living standards.

The situation will be made even worse if the Federal Reserve responds by raising interest rates in a misguided effort to reduce inflation. The Fed’s anti-inflation policies lead to rising unemployment and falling wages, and hit low and middle income workers hardest.

The soft landing scenario is one in which the U.S. finds a way to increase exports without a drastic plunge in the dollar. While the dollar will have to fall and U.S. workers are likely to experience some decline in living standards, the effects can be mitigated if we negotiate an orderly decline in the exchange value of the dollar against these currencies, and especially with China. Equally necessary are domestic policies to rebuild U.S. manufacturing capacity via domestic investment in the production of innovative or high value-added products sooner rather than later. An increase in the production and export of manufactured products would accomplish the rebalancing of trade with a smaller depreciation of the dollar, and without the loss of jobs and reduction in living standards that are the likely result of current policies.

Thinking about What America Can Be

As we have argued, America’s working families face a number of daunting challenges.

- Seventy percent of families are headed by dual earner couples or by a single parent; only 30 percent fit the Ozzie and Harriet mold today.31 Workers urgently need to be able to take care of their families – their aging parents and spouses as well as their children – while meeting their responsibilities as employees. Families need to take responsibility, but they can’t manage this alone. We need policies to create a workable balance for employers and employees.

- The gap between productivity growth and wage growth is wider today than ever. Even with the increase in the number of mothers who are working, and working more hours, real median family income has risen slowly. There has been a steady shift of income from wages to profit and from low to high income earners. Workers need a floor under wages in the labor market, and they need the right to form unions to represent their interests in negotiations over employment standards and the distribution of the rewards from productivity and GDP growth.

- Health care costs are rising rapidly, putting downward pressure on workers’ wages and burdening employers. Employer health insurance costs are about the same for high and low wage earners, but they are a much larger fraction of compensation for low and middle income earners than for high earners. Increasingly, employers find the soaring costs of health insurance unaffordable for these employees. Increasing numbers of workers find themselves shouldering the rising health care costs or denied employee-sponsored health insurance entirely. Sixteen percent of people in the U.S. (46.6 million people) are without health insurance.32

- The deflating housing bubble is likely to reduce consumption and increase economic insecurity among middle and lower income households. This is especially worrisome for workers in the pre-retirement years who may have been counting on the equity in their homes to provide retirement income security. It is equally disturbing that many lower income families were lured by banks and mortgage lenders into home ownership and subprime mortgages with the promise of a risk free path to wealth accumulation and a piece of the American dream. But it is not only homeowners who bought at the top of an inflated market or face a sudden increase in their monthly mortgage payment as their ARM expires who are at risk. The entire country faces slower economic growth, the threat of rising unemployment, and possibly recession.

- The country faces an accelerating run-up in the trade (and current account) deficits, on pace in 2006 to exceed the record $717 billion trade deficit of 2005 for a fifth record year and to surpass 6 percent of GDP.33 This is simply unsustainable. A reduction in the U.S. trade deficit will require a decline in the exchange value of the dollar against China and a host of low wage countries. While this is a necessary precondition for U.S. exports to increase rapidly, it has the unwanted side effect that it raises the price of imported goods, bringing inflation with it. This rise in prices reduces the real wages of workers, especially those in the middle and low end of the wage distribution. The larger danger is that the Fed will respond by raising interest rates in a misguided effort to control inflation, putting the jobs as well as the wages of less-educated workers at risk. Such policy carries the risk of turning a necessary adjustment in America’s trade position into a serious threat of recession and stagnation.

But these challenges can also provide opportunities to update the legal environment and put in place labor market policies for the 21st century. Despite the popularity with the public of many of the policies – policies that establish minimum employment standards, reduce the stresses on working families, and support their efforts to meet their care and work responsibilities – a work and family policy agenda has not gained the necessary traction with politicians and policy makers. In the context of a ballooning trade deficit and a deflating housing bubble, however, it has become clear that these are policies that can also provide a bulwark against the potential risks that threaten the stability of the economy itself and can sustain growth and prosperity.

Working families and the businesses that employ them need policies that support employees in their roles as worker and care giver; that make the domestic economy more competitive, and that sustain growth and prosperity. There is more economic risk, fewer economic buffers, and less economic security in our new, fast changing, and more global economy. We need policies for this new economy that enable all of us to thrive and prosper.

The 110th Congress is off to a great start in its first 100 hours. The House has already passed the Fair Minimum Wage bill to increase the minimum wage to a more realistic $7.25 an hour by 2009. The Senate must do the same and more. The minimum wage should be indexed to the average wage of workers, so that it doesn’t take an act of Congress for low wage workers to get a raise.

Workers need a greater voice at work and the right to form unions if they so desire. For all practical purposes, employers today face no restraint on their ability to fire workers for organizing a union. The Employee Free Choice Act would enable workers to form unions by requiring employers to recognize a union once a majority of workers sign cards authorizing union representation. It would also provide for mediation and arbitration of first contract disputes and would impose stronger penalties on unlawful behavior by employers.

Businesses and workers both need a better and more cost effective way of providing health insurance to everyone in America. Health care costs as a share of GDP are higher in the U.S. than in other countries, yet we cannot boast of superior health outcomes. Too much of our health spending is tied up in administrative costs, too many people in America lack health insurance, and too many companies are struggling to compete while bearing high employee health costs. As our population ages, we need to improve access to affordable quality services that allow the elderly to live in dignity in their own homes or to be cared for in assisted living or nursing homes.

Working families need time to care for loved ones without risking their jobs. Most families are squeezed for time, and workers need greater control over work hours and work schedules. All employees need a minimum number of paid sick days so they can stay home when they or their child has the flu, and not infect co-workers or school mates. They need a minimum number of hours of paid time off for small necessities – a visit with a child’s teacher, to take an elderly parent to a doctor’s appointment. They need temporary disability insurance and family leave insurance so they can draw partial wage replacement when they need to take time off for their own serious illness, to care for a seriously ill family member, or to bond with a new child. No one should ever have to face the impossible choice between a paycheck and caring for a seriously ill family member.

Preparing our children to grow up as healthy, happy individuals and to succeed as workers in the new 21st century economy means we must pay more attention to their needs. Children (and their parents, whether working or not) need access to affordable, quality child care; universal pre-K; and for older children, exciting and stimulating after-school care, sports, arts and summer programs. We need to invest more in K-12 education, and provide young people with multiple opportunities for post-secondary education or training.

Enacting a working families’ agenda will better equip workers to shoulder the risks of a dynamic and rapidly changing economy. It will also buffer all workers against the worst effects of the bursting of the housing bubble or a disorderly decline in the dollar as global payments imbalances adjust. The American economy holds great promise for a prosperous 21st century. We need 21st century policies to assure that all workers will share in that prosperity.

1 Lawrence Mishel, Jared Bernstein, and Sylvia Allegretto, The State of Working America 2006-2007, Chapter 1, Washington DC: Economic Policy Institute Advance Copy, September 2006, Chapter 1.

2 Ibid.

3 U.S. Census Bureau, Income, Poverty, and Health Insurance Coverage in the United States: 2005, accessed at http://www.census.gov/prod/2006pubs/p60-231.pdf on January 10, 2007.

4 William Nordhaus, The Sources of the Productivity Rebound and the Manufacturing Employment Puzzle, NBER Working Paper 11354, Cambridge, MA: NBER, November 2005

5 Bureau of Labor Statistics, Productivity news release, December 5, 2006, accessed at http://www.bls.gov/news.release/pdf/prod2.pdf on January 11, 2007.

6 Mishel et al., op. cit.

7 Eileen Appelbaum, Thomas Bailey, Peter Berg, Arne Kalleberg, Manufacturing Advantage: Why High Performance Systems Pay Off, Ithaca, NY: Cornell University ILR Press, 2000.

8 Mishel et al., op. cit.

9 Bureau of Labor Statistics, Productivity news release, December 5, 2006, accessed at http://www.bls.gov/news.release/pdf/prod2.pdf on January 11, 2007.

10 U.S. Census Bureau, Income, Poverty, and Health Insurance Coverage in the United States: 2005, accessed at http://www.census.gov/prod/2006pubs/p60-231.pdf on January 10, 2007.

11 Dean Baker, Recession Looms for the U.S. Economy in 2007, Washington, DC: Center for Economic and Policy Research, November 2006.

12 A. Sum, P. Harrington, P. Tobar, I. Khatiwada, The Unprecedented Rising Tide of Corporate Profits and the Simultaneous Ebbing of Labor Compensation in 2002 and 2003, Boston: Northeastern University Center for Labor Market Studies, 2004.

13 Arindrajit Dube and Dave Graham-Squire, Where Have All the Wages Gone? Jobs and Wages in 2006, Berkeley, CA: UC Berkeley Institute of Industrial Relations, August 2006.

14 Economic Policy Institute, “Facts and Figures: Wages.” Washington, DC: EPI, 2006.

15 Bureau of Labor Statistics, “Union Members Summary,” January 20, 2006, accessed at http://www.bls.gov/news.release/union2.nr0.htm on January 10, 2007.

16 D. E. Hecker, “Occupational Employment Projections to 2012,” Monthly Labor Review, February 2004, pp. 80-105.

17 L. Josh Bivens, Shifting Blame for Manufacturing Job Loss, Washington, DC: Economic Policy Institute, 2004.

18 Bivens, op. cit.

19 U.S. Census Bureau, Income, Poverty, and Health Insurance Coverage in the United States: 2005, accessed at http://www.census.gov/prod/2006pubs/p60-231.pdf on January 10, 2007, Table A2.

20 U.S. Census Bureau, Income, Poverty, and Health Insurance Coverage in the United States: 2005, accessed at http://www.census.gov/prod/2006pubs/p60-231.pdf on January 10, 2007, Table 1.

21 Bureau of Labor Statistics, Productivity news release, December 5, 2006, accessed at http://www.bls.gov/news.release/pdf/prod2.pdf on January 11, 2007.

22 Baker, op. cit.

23 Congressional Budget Office, Housing Wealth and Consumer Spending, Washington, DC: CBO, January 2007.

24 Congressional Budget Office, op. cit., p. 7.

25 Ibid., Figure 3, p. 10.

26 Baker, op. cit., p.2.

27 Ibid.

28 Catherine L. Mann, “Breaking Up Is Hard To Do: Global Co-Dependence, Collective Action, and the Challenges of Global Adjustment.” Focus. CESifo Forum: 1/2005, accessed at www.petersoninstitute.org/publications/papers/mann0105b.pdf

29 C. Fred Bergsten, “The Risks Ahead for the World Economy,” op. cit.

30 Ibid.

31 Mishel et al., op. cit.

32 U.S. Census Bureau, Income, Poverty, and Health Insurance Coverage in the United States: 2005, accessed at http://www.census.gov/prod/2006pubs/p60-231.pdf on January 10, 2007, Table A2.

33 U.S. Census Bureau, International Trade in Goods and Services, Highlights, January 10, 2007, accessed at http://www.census.gov/indicator/www/ustrade.html on January 12, 2007.

Eileen Appelbaum is a Professor at School of Management and Labor Relations and Director of the Center for Women and Work, Rutgers University, and on CEPR’s Advisory Board of Economists.