January 28, 2012

When the Mets were an expansion team in 1962 and on their way to losing a record 120 games, their manager Casey Stengel reportedly cried out in frustration after a Mets error, “can’t anybody here play this game?” Readers of the coverage of the 4th quarter GDP report must have felt the same way.

Most of the coverage was along the same lines as the Washington Post headline, “U.S. Economic Recovery Picks Up Pace.” At the most basic level, this is true. GDP grew at a 2.8 percent annual rate, up from 1.8 percent in the third quarter and its strongest showing since the second quarter of 2010. However a closer examination of the data indicated that there was little cause for celebration.

There are always a number of random factors that will affect measured GDP in any given quarter. Often they average out so that the measured GDP is pretty much in line with what we may view as the underlying rate of growth. Sometimes they don’t average out so that the headline number might be notably better or worse than the economy’s underlying growth rate. This is the situation for the last two quarters.

The most obvious wildcard in GDP numbers is inventory changes. These are erratic. Sometimes they reflect conscious decisions of firms to build-up or run-down inventories. Sometimes firms accumulate inventories because they didn’t sell as much as expected. Sometimes it is just the timing of when items get counted in stock.

Whatever the cause, inventory fluctuations often have a very large impact on GDP growth. And, this impact is often reversed in the following quarter. (The impact on growth is the change in the change. If inventories grow by $50 billion in both the third and fourth quarters then inventories add zero to growth. The $50 billion growth in inventories only boosts growth in the fourth quarter if we added less than $50 billion in the third quarter.)

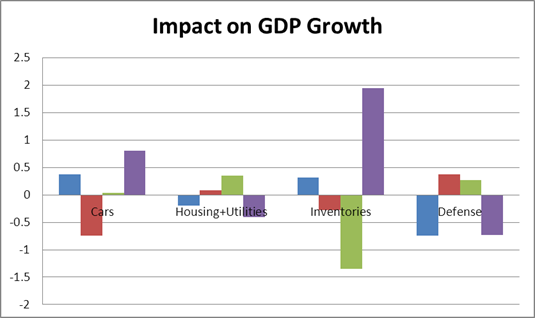

This is worth noting because more than the entire difference between the third quarter growth rate and the fourth quarter growth rate can be explained by the movement in inventories. Inventories subtracted 1.35 percentage points from growth in the third quarter, when they rose at just a $5.5 billion annual rate. They added 1.95 percentage points to growth in the fourth quarter when they rose at a strong $63.6 billion annual rate.

Needless to say, this speedup in the rate of inventory accumulation will not continue. In future quarters inventories are likely to grow at a somewhat slower pace. In the absence of this inventory growth we would have been looking at 0.9 percent growth rate in the fourth quarter.

Fortunately, there were a couple of items on the other side which will certainly not be repeated. Defense spending fell at a 12.5 percent annual rate, lopping 0.73 percentage points off growth for the quarter. Defense spending is heading downward with the winding down of the wars in Iraq and Afghanistan, but certainly not at 12.5 percent annual rate. This just reflects the erratic timing of defense expenditures.

Similarly the category of housing and utilities showed a sharp drop in the quarter, reducing growth by 0.4 percentage points. This is a measure of the rental value of housing, it can only fall if fewer homes are occupied. The likely cause of the sharp drop was better than usual weather, which means less spending on utilities. This drop will almost certainly be reversed in the first quarter of 2012.

However, there is one more negative in the picture. Car sales grew at a 48.1 percent annual rate, adding 0.81 percentage points to growth in the quarter. This was largely a reversal of a decline earlier in the year that resulted from shortages due to the earthquake in Japan. It is not going to be repeated. Car sales will add much less to growth in 2012.

Source: Bureau of Economic Analysis.

The long and short is that there was likely little change in the underlying rate of growth from the third quarter to the fourth quarter. The winding down of the stimulus, coupled with the negative impact from the Japan earthquake brought growth to a near halt in the first half of the year.

Now that the stimulus has almost fully unwound we are back on a growth path of around 2.5 percent — pretty much the economy’s trend rate of growth. This means that we are making up little or none of the ground lost during the recession. That is a really bad story.

Comments