July 01, 2014

Neil Irwin has a piece noting housing’s importance in the downturn, which gets things half right. First, housing is typically important in economic cycles, as he says, but the picture is quite different than Irwin implies.

In a typical recession housing construction falls because it is very sensitive to interest rates. Most recessions are brought on by the Fed raising interest rates to slow the economy. In these cases the decline in housing is a deliberate outcome of Fed policy, not an accidental outcome to be avoided.

In contrast, the most recent downturn was brought on by a collapse of a housing bubble. This made it qualitatively different from most prior downturns (the 2001 recession was also bubble induced) in several different ways.

First, construction was proceeding at an extraordinary rate of more than 6.0 percent of GDP before the collapse, compared to an average rate of just over 4.0 percent of GDP. This meant that housing contracted far more than it would in a typical downturn. Furthermore, because of the overbuilding of the bubble years, housing fell further than normal, hitting levels just above 2.0 percent of GDP. And, because the downturn was not brought on by a rise of interest rates it could not be reversed by a drop in interest rates.

There really should not have been much mystery about housing being in a bubble. There was a huge unprecedented run-up in house prices that broke with a century long trend in which nationwide house prices had just kept pace with the overall rate of inflation. There was no plausible basis in the fundamentals of the housing market for this run-up, with income and population growth both relatively weak. And, rent just kept pace with inflation during the bubble years.

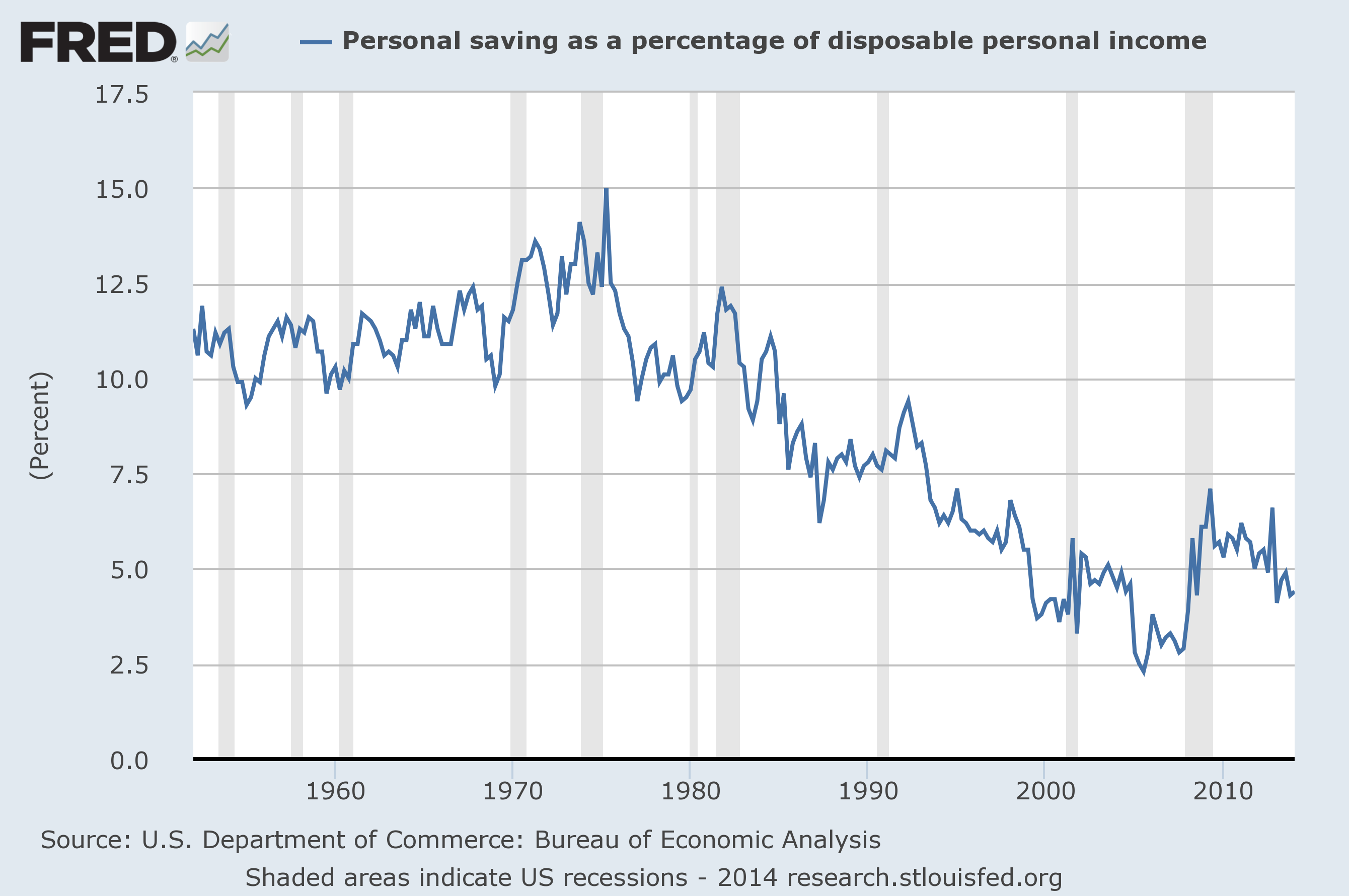

The effect of the bubble on consumption was also predictable. The bubble created trillions of dollars of ephemeral housing wealth. This led to a surge in consumption due to the housing wealth effect, pushing the savings rate to record lows. When the bubble burst, consumption fell as the housing wealth disappeared, but the saving rate is in fact still relatively low, contrary to what is often asserted in the media. There is no reason that we should expect people to be consuming a larger share of their income than is currently the case. The only mystery about the current state of the economy is why anyone would see any mystery

Comments