April 07, 2023

Okay, maybe it’s a Good Friday or Ramadan miracle, but we should be celebrating the Fed’s victory in the war on inflation. If you missed it, you probably have been following the news — which hasn’t widely reported on this.

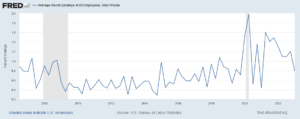

But, if instead, you looked at the data, you would have noticed that the annual rate of wage growth has slowed to 3.2 percent over the last three months.

The reason why this is such a big deal is that we typically expect the inflation rate to be roughly equal to the rate of wage growth, minus the rate of productivity growth. The annual rate of productivity growth has averaged 1.4 percent since the pandemic, roughly the same as its pre-pandemic pace.

If we take the 3.2 percent rate of wage growth over the last quarter and subtract the 1.4 percent trend rate of productivity growth, we get 1.8 percent inflation. This is below the Fed’s 2.0 target; therefore, we get victory!

There are a few points worth adding. First, the relationship is not immediate. Inflation has been growing at considerably more than a 2.0 percent rate. Many items, most notably rent, have considerable inertia. We know that rent, as measured in the Consumer Price Index and Personal Consumption Expenditure Deflator, will be slowing sharply in the next several months due to a sharp reduction in the rental inflation rate shown by a number of private indexes measuring the rent of marketed units. These indexes lead the government data by six to twelve months.

There are also some remaining supply chain issues, most notably with cars, that might keep prices high for several more months. However, over the course of 2023, we should see slower inflation, and often even deflation in many of these items. For these reasons, given the current pace of wage growth, we can be confident that inflation will slow to the Fed’s target in the not-distant future.

Of course, it is possible that we will see a continuing shift to profits, as we saw in the first year and a half of the pandemic. That can’t be ruled out, but that is not what is generally predicted. Furthermore, an effort to tackle profit-driven inflation, by further depressing wage growth, would be a rather perverse policy. It’s not likely it would enjoy much public support if people were aware that this was the Fed’s strategy.

Finally, wage data are erratic and subject to large revisions. The picture may look different when we get the data for April. But based on the data we have today, we can say the Fed won its battle against inflation. You can include this in the celebration for the religious or non-religious holiday of your choice. It is great news.

Comments